US Core PCE Key Factors:

MOST READ: Oil Value Forecast: WTI Faces Technical Hurdles as OPEC+ Rumors Swirl

Elevate your buying and selling abilities and acquire a aggressive edge. Get your arms on the Information Buying and selling Information right this moment for unique insights on how you can navigate information occasions.

Beneficial by Zain Vawda

Buying and selling Foreign exchange Information: The Technique

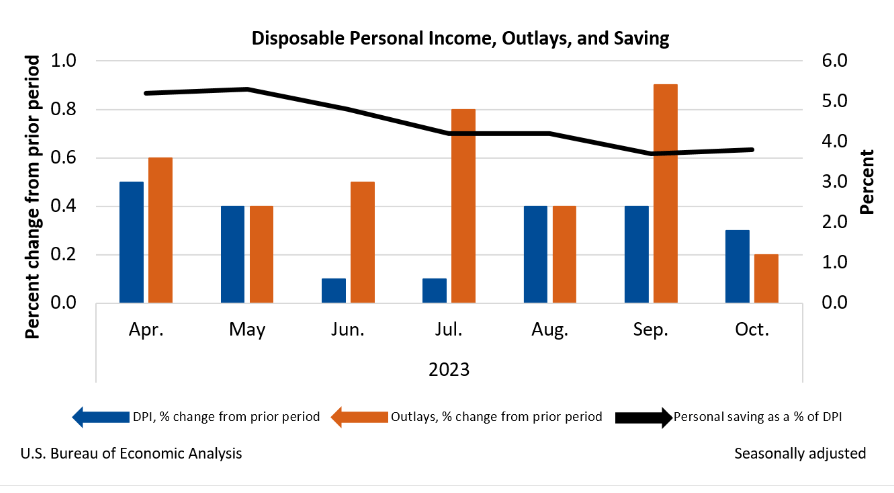

Core PCE costs MoM slowed in October following two successive months of 0.4% will increase. The October print of 0.2%, according to estimates was the weakest studying since July 2022. ThePCE value indexincreased lower than 0.1 p.c. Excluding meals and vitality, the PCE value index elevated 0.2 p.c.

The annual price cooled to three% from 3.4%, a low stage not seen since March 2021, matching forecasts. In the meantime, annual core PCE inflation which excludes meals and vitality, slowed to three.5% from 3.7%, a contemporary low since mid-2021.

Customise and filter reside financial information by way of our DailyFX financial calendar

The rise incurrent-dollar private incomein October primarily mirrored will increase in private earnings receipts on property and compensation that have been partly offset by a lower in private present switch receipts.

Supply: US Bureau of Financial Evaluation

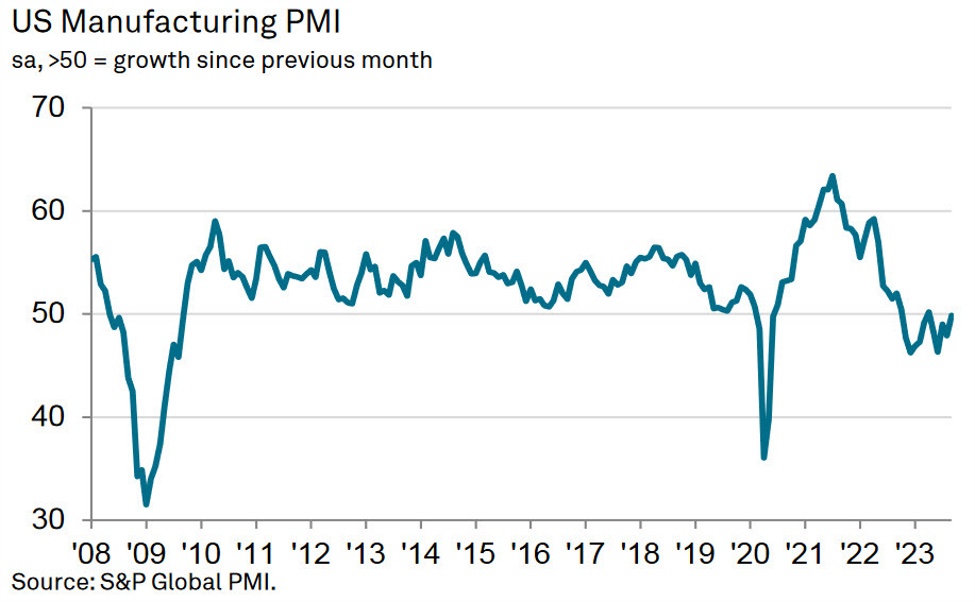

US ECONOMY AHEAD OF THE FOMC MEETING

The current batch of information releases proceed to point a slowdown with the US displaying comparable indicators regardless of the sturdy labor market and companies inflation. Market members have been buoyed by the current batch of information growing bets for price cuts in 2024.

Right now’s PCE information will probably add additional gas to that fireplace because the slowdown continues. Subsequent week we have now the NFP report which may additional strengthen the case for the Federal Reserve heading into the December assembly. The query that may bug me if we do see a softer NFP print and signal that the labor market is cooling is whether or not the Fed will likely be ready to lastly sign that they’re accomplished with price hikes. December guarantees to be an intriguing month and the US Greenback specifically will likely be attention-grabbing to observe.

MARKET REACTION

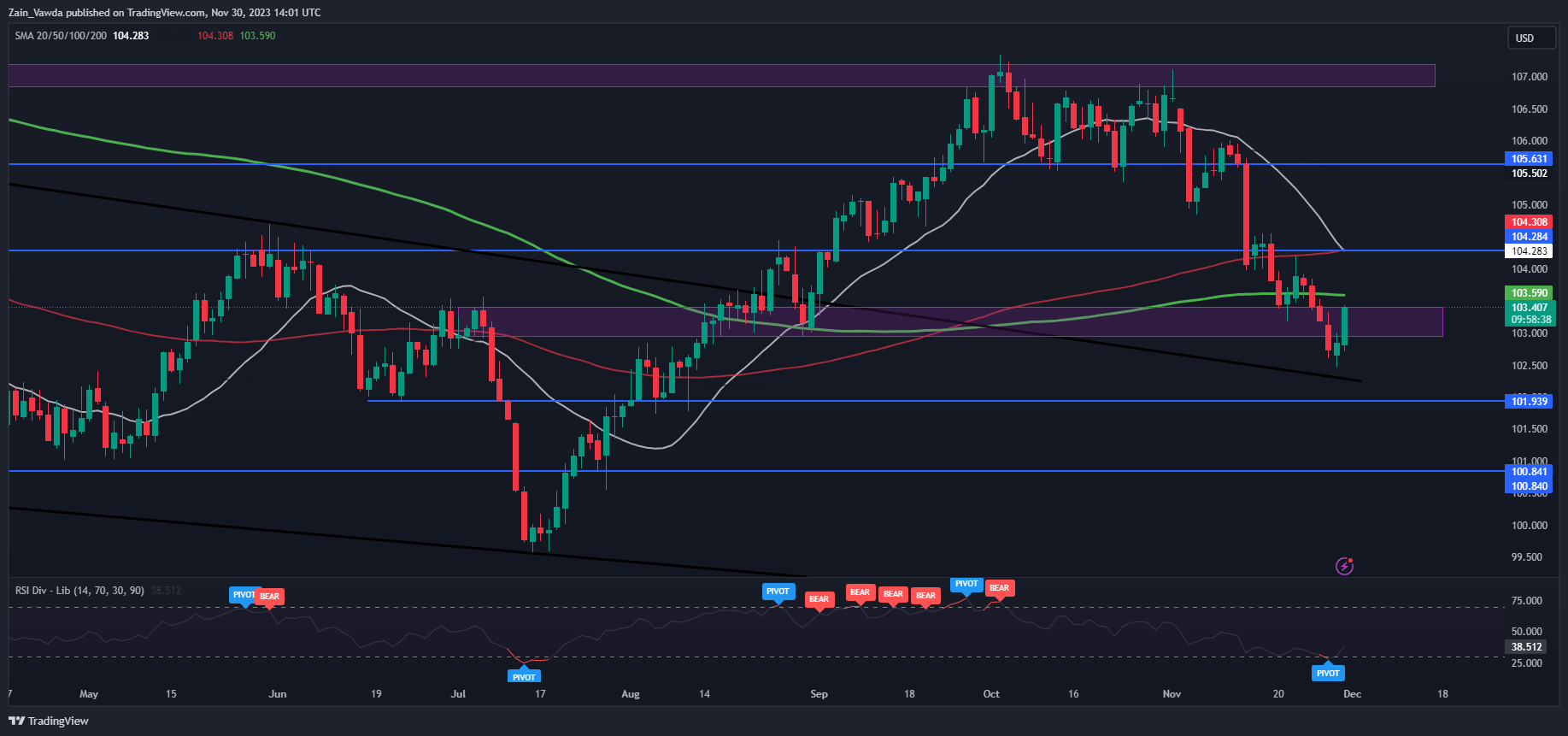

Following the info launch the greenback index surprisingly strengthened as we have now seen a number of USD pairs slide. That is attention-grabbing given the softness of the info and could possibly be right down to potential revenue taking by USD sellers as effectively.

The DXY is operating into some technical hurdles that lie simply forward with the 200-day MA resting on the 103.59 mark. The general construction of the DXY stays bearish till we see a each day candle shut above the swing excessive across the 104.00 deal with.

Key Ranges to Maintain an Eye On:

Help ranges:

Resistance ranges:

DXY Each day Chart- November 29, 2023

Supply: TradingView, ready by Zain Vawda

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX group

Subscribe to Publication

— Written by Zain Vawda for DailyFX.com

Contact and comply with Zain on Twitter: @zvawda