- Excessive Yield: 4.423%

- WI degree because the time of the public sale: 4.415%

- Tail: +0.8 foundation factors. Earlier 1.5 bps, six-auction common -0.3 bps

- Bid-to-Cowl Ratio: 2.53X. Earlier 2.55x, six-auction common 2.58x

- Sellers: 17.33%. Earlier 12.9%, six-auction common 10.6%

- Directs (a measure of home demand): 20.51%. Earlier 20.7%, six-auction common 20.0%

- Indirects (a measure of worldwide demand): 62.21%. Earlier 66.4%, six-auction common 69.4%

Public sale Grade: D

Not a whole lot of good on this public sale. There was a 0.8 foundation level tail above the WI degree on the time of the public sale. The Bid to cowl was simply common, however the sellers had been saddled with extra each versus the final month public sale and the six month common. The reason being as a result of worldwide demand was nicely beneath the six month common of 69.4% (69.21%).

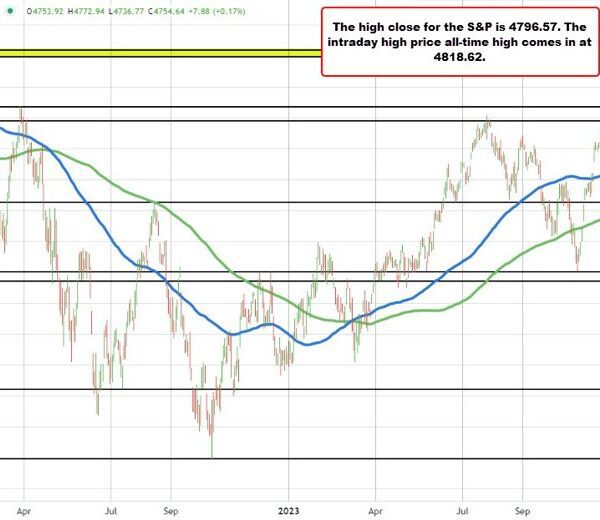

Trying on the US market:

- 2- yr yield 4.365% +13.7 foundation factors

- 10-year yield 4.100% +3.4 foundation factors

- 30-year yield 4.305% unchanged

US shares stay damaging:

- Dow Industrial Common minus 89.22.factors or -0.24%

- S&P index -31.98 factors or -0.67% at 4733.70

- NASDAQ -133.49 factors or -0.89% at 14811.

Rick Santelli on CNBC gave it a grade of D too.