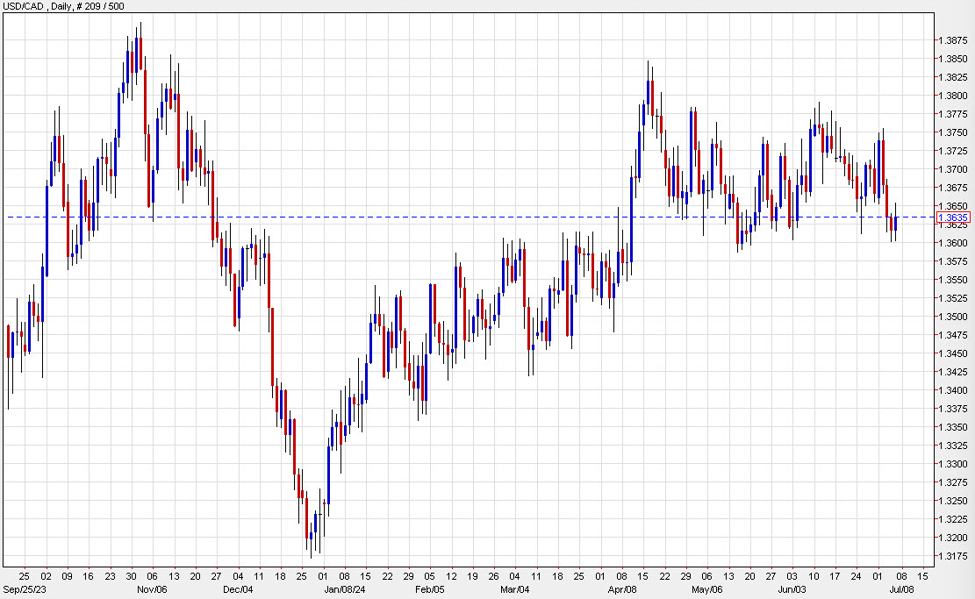

USD/CAD daily

The Canadian dollar softened following a rise in June unemployment to 6.4% from 6.2%. The market was expecting a tick higher to 6.3% but the economy shed 1400 jobs in the month and signs of weakness are mounting.

That’s why the recent drop in USD/CAD may present a buying opportunity. The pair has dipped on broad US dollar weakness as that economy also shows signs of slowing. Oil prices have also risen for four straight weeks.

Technically, there is support in the 1.3600-1.3587 zone, which is the bottom of the May-July range. That offers an opportunity to limit risk in a bet that Canada’s economy will deteriorate faster than the US and the Bank of Canada will cut rates quicker and lower.

The market is currently pricing in 55 bps more in BOC cuts this year and 50 bps of Fed cuts. A key moment will come July 24 when the Bank of Canada meets. Currently, the market is pricing in a 60% chance of a rate cut, which would mark the second consecutive meeting of lower rates. I believe that would also send a signal that rates will continue to be cut at each meeting, barring a surprise.

The housing sector is a massive part of the Canadian economy and GDP growth over the past decade. There were small signs of a resurgence in early spring but those have quickly reversed and the inventory of unsold homes is rising rapidly. There was hope that buyers would return at the first sign of rate cuts but, instead, it’s been sellers that are looking for an exit, particularly in new-build homes and condos.

That’s balanced somewhat by Canada’s incredible immigration rate (though there are signs it’s slowing, and I expect the next election will be fought over immigration policy).

On Wednesday, I spoke with BNNBloomberg about the difficulties in the Canadian dollar and the lay of the land elsewhere.