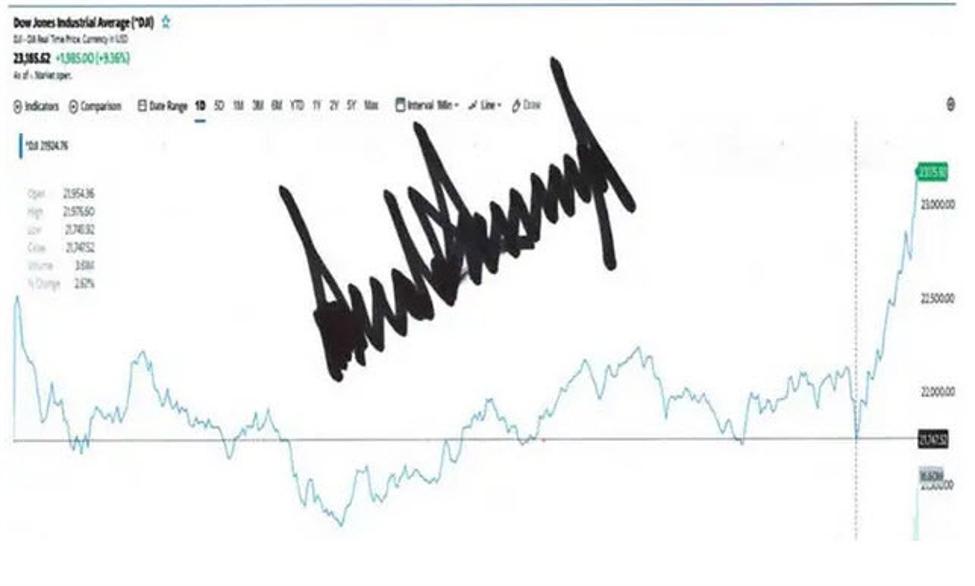

USDCAD day by day chart

The climate is cooling off in Canada however the forex has heated up.

USD/CAD fell to a four-month low right this moment regardless of some US greenback energy elsewhere. Financial institution of Canada governor Tiff Macklem helped alongside the transfer as he pushed again in opposition to charge minimize discuss.

“We have not started having that discussion (about cutting rates), because it’s too early to have that discussion. We’re still discussing whether we raised interest rates enough and how long they need to stay where they are,” he stated.

He did provide a nod that “conditions increasingly appear to be in place to get us (to 2% inflation” however the loonie stayed robust.

Housing is a giant danger to the Canadian financial system within the months forward as mortgages proceed to resume however market-driven charges are down considerably and that diminishes the chances of a tough touchdown whereas additionally placing some a refund in Canadians’ pockets.

This week, RBC released its month-to-month spending tracker that confirmed Black Friday vacation spending was

up 7% from year-ago

ranges. In November as an entire, they famous robust gross sales at clothes shops and a rise in retail gross sales total, even after adjusting for inflation.

A possible tailwind for the loonie subsequent 12 months can be a comfortable touchdown mixed with stimulus from China. That would meaningfully push up commodity costs and enhance Canada’s phrases of commerce.

For now, I do not suppose you possibly can struggle the momentum within the Canadian greenback. It rose on Friday regardless of softness in equities and a basic ‘danger off’ commerce. Flows are going to dominate into 12 months finish however financial sentiment is enhancing and that ought to ship USD/CAD right down to 1.32.