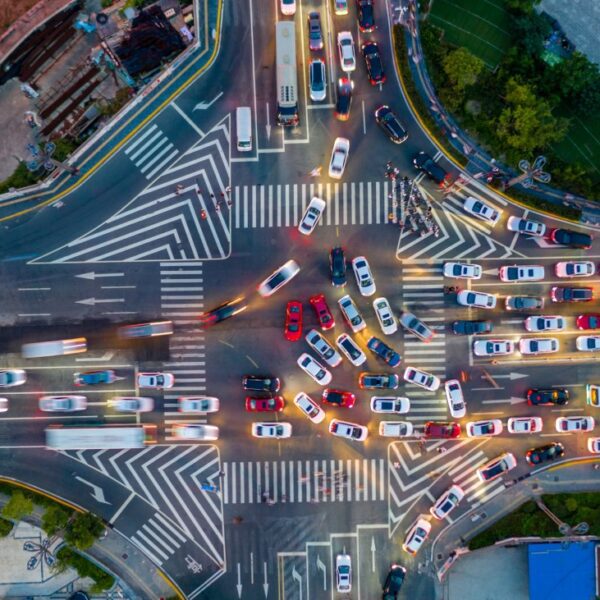

USD/JPY vs US Treasury 10-year yields (%) every day chart

The post-BOJ bounce certain didn’t final lengthy because the pair fails to push above the 145.00 mark earlier than the most recent retreat. The drop now sees the pair fall to 142.90 and closes in on the 200-day transferring common (blue line) at 142.70. A drop under the important thing technical stage will see sellers resume a extra bearish bias in seek for additional draw back momentum.

The Japanese authorities has made it fairly express that they’re aligned with the BOJ in ready on subsequent 12 months’s spring wage negotiations earlier than a possible coverage pivot. The current headlines have confirmed that and there’s yet another at this time as nicely here. As such, it is now actually simply a race against the clock for the Japanese central bank.

Including to the macro image is decrease Treasury yields, as seen with the chart above. 10-year yields are down to three.86% and that’s weighing additional on USD/JPY on the whole as nicely. Taking that into consideration, it is powerful to see the development in USD/JPY reverse drastically except there’s purpose for a squeeze again to the opposite facet for bonds.

The opposite factor to notice now could be that we’re within the dwelling stretch for buying and selling in 2023. It is onerous to essentially learn a lot into any of the strikes amid thinner liquidity situations, particularly now in any case the key occasions having handed. The technicals will proceed to supply a little bit of a information however actually, that is no time to over-analsyse any market strikes.