USD/JPY each day chart

The promote the actual fact play is constant as merchants are nonetheless digesting the BOJ financial coverage resolution earlier here. However fairly frankly, we have had loads of time to take all of it in after the quite a few leaks over the previous week. And that kind of explains what we’re seeing right now.

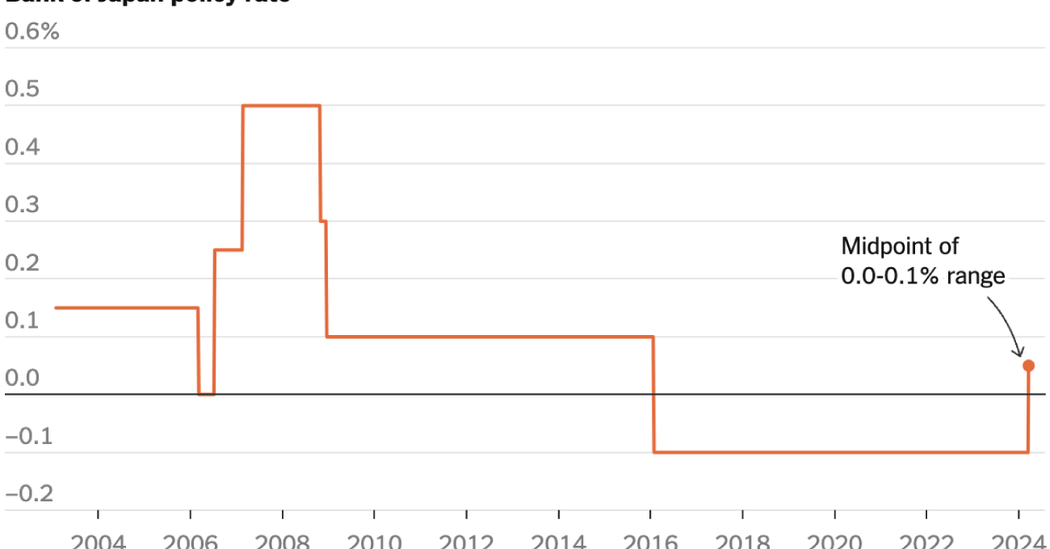

Sure, the BOJ has determined to finish unfavorable charges. Nonetheless, it’s merely shifting short-term charges from -0.10% to between the 0.00% to 0.10% vary. Sure, the BOJ has determined to scrap yield curve management. Nonetheless, they’re nonetheless sustaining JGB purchases and can step in the place essential if yields run too excessive, too quick.

Moreover that, additionally they did not supply any ahead steering about future coverage steps and the tempo of normalisation. That is a crimson flag to me and smells like they will method it very, very slowly.

In the meantime, with Treasury yields persevering with to hold on the highs for the yr, it’s making it tough to find a compelling reason for USD/JPY to assemble a lot draw back momentum presently.

For now, consumers are in management because the pair runs into resistance and presents across the 150.00 mark. Thereafter, key resistance lies on the February highs across the 150.84-88 area earlier than probably revisiting the November excessive at 151.90. These will likely be key upside ranges to observe in the mean time for USD/JPY.