The pair rose to a excessive of 148.54 because the BOJ left coverage unchanged, earlier than steadily slipping to close 148.00 now – buying and selling flattish on the day. Within the greater image, the 100-day shifting common at 147.50 is the important thing technical stage to observe. Maintain above that and patrons are nonetheless in it with a shout for the week.

Going again to the BOJ coverage choice itself, there have been a few issues to select up on. They don’t seem to be something substantial nevertheless it continues to assist the concept of a coverage pivot probably in March or April. The primary of which is the delicate addition to the outlook abstract for costs. In October final 12 months, the central financial institution said:

“CPI inflation is prone to

enhance steadily towards attaining the worth stability goal..”

At this time, they famous that:

“CPI inflation is prone to enhance steadily towards

attaining the worth stability goal.. The chance of realizing this

outlook has continued to steadily rise, though there stay excessive uncertainties over

future developments.”

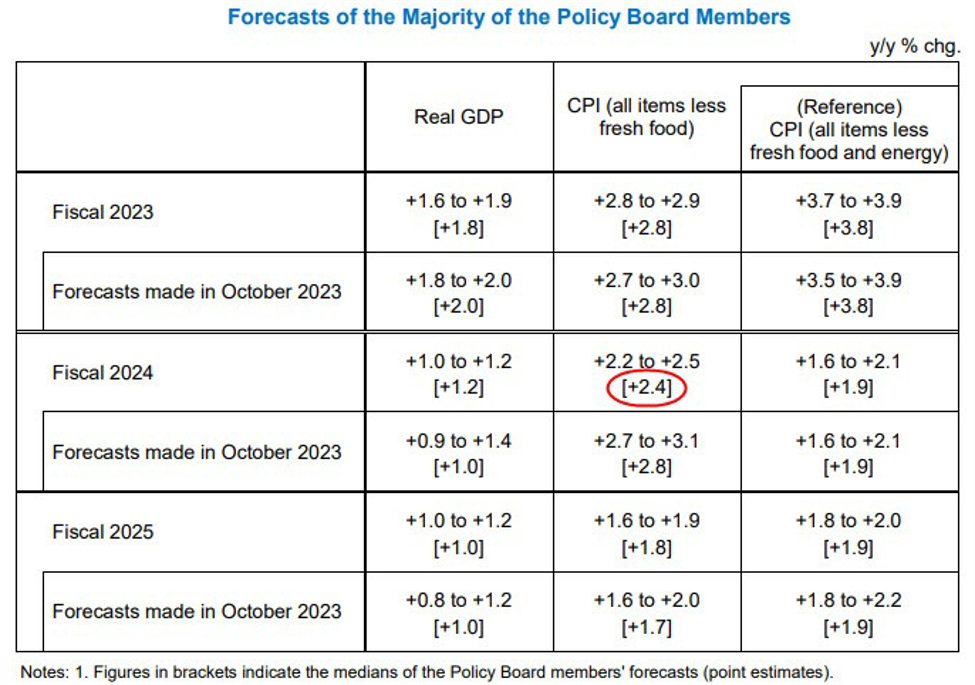

Besides that, they did revise their inflation projections a little with the most notable being a downgrade to the forecast for fiscal year 2024:

That being said, the 2.4% forecast is still higher than the 2% price target and continues to support a likely policy pivot to come in the months ahead.

To summarise, the BOJ continues to preach patience before we get to the spring wage negotiations. They are still laying the groundwork for a potential change in the spring but it is still no guarantee that they will do so.

So, this is not fairly the frustration that we’ve been accustomed to with most BOJ coverage choices from final 12 months. Stick with it as you’ll.