The big news on the weekend was from Japan as Sanae Takaichi won the LDP leadership race to become the country’s first female prime minister. She is known as a fiscal dove and markets are reacting accordingly to start the new week, though by quite some margins in the opening stages for now.

USD/JPY has opened with a gap up and has now raced higher to test the 150.00 level. That as the Nikkei soars by over 4% gains to jump up above the 47,000 level today. Big, big wins all around. Circling back to USD/JPY, the pair is once again seeking a breakout after the failed attempt two weeks ago:

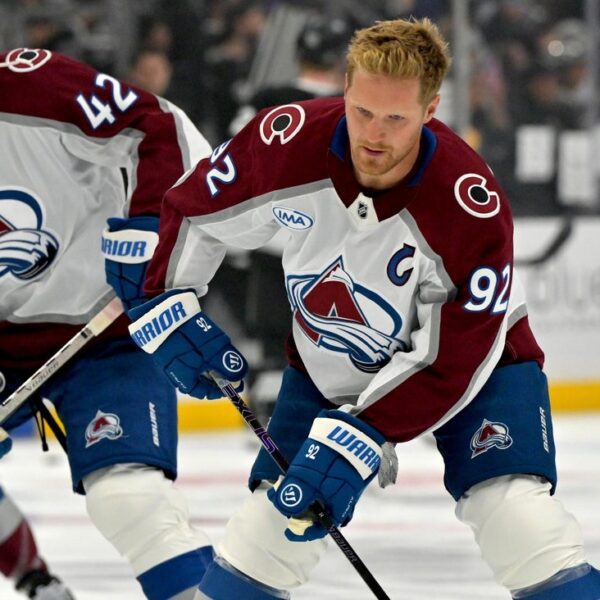

USD/JPY daily chart

The 100-week moving average is seen at 149.65 and that’s also another key level to be mindful of on the week. That as the pair is now trying to contest a firmer break above the pivotal 150.00 level.

The drop in the Japanese yen comes amid a repricing in BOJ odds as we look towards the October decision. Market players were positioned for at least one more rate hike this year with odds of a move this month being around a little more than 60% previously. However, Takaichi’s win now sees those odds flip drastically with only a ~22% probability of a rate hike priced in now for October.

All of this of course is tied to Takaichi’s inherent views on fiscal and monetary policy. We are yet to officially see what her actions will be in her new capacity as prime minister and how she will balance all of that out.

I would argue it is definitely a case that the BOJ will find it tougher to push for tighter policy from hereon. But to say that rate hikes going into next year will be completely off the table is a little premature, at least for now.

I mean it wouldn’t be the first time where a politician once elected, has to find a different way to balance out their election “promise”. That being said, I would expect Takaichi to be firm on a lot of matters as she is after all Shinzo Abe’s protégé.

Anyway, USD/JPY is now basically up against a key technical test to start the week. Holding a break above 150.00 will do buyers a world of good in keeping with the gap to the upside to start the week. But on the week itself, that 100-week moving average at 149.65 will be one to be aware of in determining buyers’ stranglehold on the pair.

I’d be inclined to fade this upside jump but only if the pair continues to keep below 150.00 on the daily front. That’s the key line in the sand at the moment.