Fundamental

Overview

The USD continues to be under

pressure as the positive tariffs talks on Monday eased the trade war fears and

weighed on the greenback. In fact, trade war fears have been the only thing

keeping the bid under the USD as interest rate expectations and economic data

took the second place in importance.

As a reminder, the

repricing in rate cuts expectations reached the peak after the last US NFP

report and then the market returned into a dovish pricing following the benign

US inflation data (the market is still pricing roughly two rate cuts for 2025).

Today, we get the January

NFP and it could be another good report. That might lead to a short-term relief

rally for the US Dollar but as we’ve seen with the US Job Openings data, the

labour market continues to normalise and it’s not a source of inflationary

pressures anymore. So, the potential US Dollar rally might be faded.

That doesn’t mean that the

Fed will cut more than the two times projected for this year, but it also

doesn’t call for a more hawkish repricing yet. So, the path of least resistance

for the US Dollar (barring negative tariffs outcomes) might remain to the

downside as a more dovish path going forward looks more probable.

On the CAD side, the focus

has been entirely on the potential trade war with the US, so the data didn’t

matter much. Nonetheless, the positive talks on Monday and the pause in tariffs

gave the Loonie a strong boost with the pair falling back into the key 1.4280

support. The recent data from Canada has been pointing to gradual improvement

after the aggressive rate cuts which might now start to be reflected in the

exchange rate as the trade war fears abate.

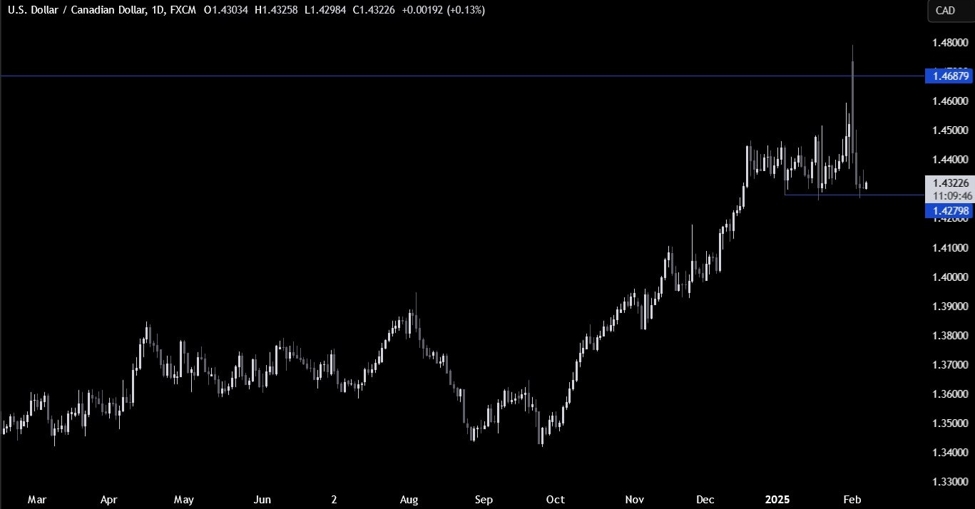

USDCAD

Technical Analysis – Daily Timeframe

USDCAD Daily

On the daily chart, we can

see that USDCAD dropped all the way back to the key support

around the 1.4280 level. This is where the buyers will likely step in with a

defined risk below the support to position for a rally back into the highs. The

sellers, on the other hand, will want to see the price breaking lower to increase

the bearish bets into new lows.

USDCAD Technical

Analysis – 4 hour Timeframe

USDCAD 4 hour

On the 4 hour chart, we can

see that we have a minor resistance zone around the middle of the range where

the price got rejected from a couple of times in the weeks. If we get a pullback

into that, we can expect the sellers to step in with a defined risk above the

level to position for a break below the key support. The buyers, on the other

hand, will look for a break higher to increase the bullish bets into the 1.4467

level next.

USDCAD Technical

Analysis – 1 hour Timeframe

USDCAD 1 hour

On the 1 hour chart, there’s

not much we can add here as we now have this mini-range between the 1.4280

support and the 1.4370 resistance. From a risk management perspective, it would

be much better to wait for the US NFP report as any technical setup can be

invalidated in a blink of an eye when the data gets released. The red lines

define the average daily range for today.

Upcoming Catalysts

Today we conclude the week with the Canadian

Employment data and the US NFP report.