USD

- The Fed left interest rates unchanged as anticipated on the final assembly with a shift in

the assertion that indicated the top of the tightening cycle. - The Abstract of Financial Projections confirmed a

downward revision to Progress and Core PCE in 2024 whereas the Unemployment Price

was left unchanged. Furthermore, the Dot Plot was revised to indicate three charge cuts

in 2024 in comparison with simply two within the final projection. - Fed Chair Powell did not push again in opposition to the robust dovish pricing

and even stated that they’re targeted on not making the error of holding charges

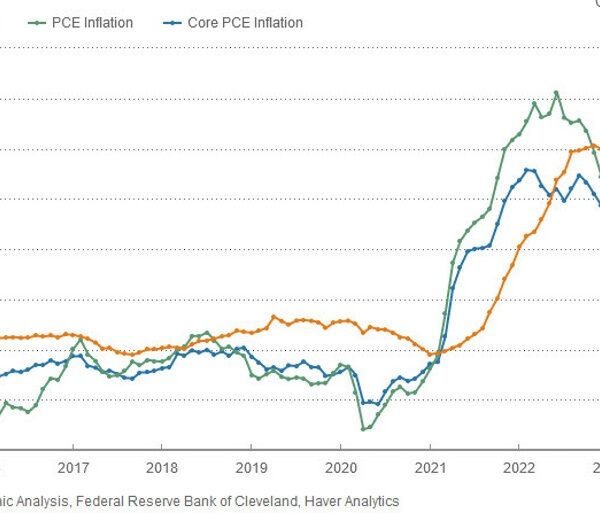

excessive for too lengthy. - The most recent US PCE missed expectations throughout the board with

the Core 6-month annualised charge falling beneath the Fed’s goal at 1.9%. - The NFP report beat

expectations though there was extra weak spot underneath the hood. - The most recent ISM Manufacturing PMI beat expectations, whereas the ISM Services PMI missed by a giant margin.

- The hawkish Fed members have been leaning

on a extra impartial aspect these days. - The market expects the Fed to begin reducing charges

in Q1 2024.

CAD

- The BoC kept the interest rate steady at

5.00% as anticipated on the final assembly with

the same old caveat that it’s ready to lift the coverage charge additional if wanted. - BoC Governor Macklem lately has been leaning on a extra

impartial aspect and even began to speak about charge cuts though he stays

unsure on the timing. - The most recent Canadian CPI beat expectations throughout the board with

the underlying inflation measures remaining elevated, which ought to give the BoC

a purpose to attend for extra knowledge earlier than contemplating charge cuts. - On the labour market aspect, the newest report missed

expectations though wage development spiked to the best degree since 2021. - The Canadian PMIs proceed to fall

additional into contraction because the economic system retains on weakening amid restrictive

financial coverage. - The market expects the BoC to begin

reducing charges in Q2 2024.

USDCAD Technical Evaluation –

Each day Timeframe

USDCAD Each day

On the each day chart, we are able to see that USDCAD rallied

all the way in which again to the important thing trendline round

the 1.34 deal with the place we are able to additionally discover the confluence with the

pink 21 moving average and the

50% Fibonacci retracement degree.

That is the place the sellers are piling in with an outlined threat above the trendline

to place for a drop into new lows. The consumers, alternatively, will need

to see the worth breaking greater to invalidate the bearish setup and place

for a rally into the 1.36 deal with.

USDCAD Technical Evaluation –

4 hour Timeframe

USDCAD 4 hour

On the 4 hour chart, we are able to see that the newest leg

greater into the trendline diverged with the

MACD, which

is mostly an indication of weakening momentum typically adopted by pullbacks or

reversals. On this case, it’s one other layer of confluence for the sellers and

will increase the possibilities of seeing one other drop from these ranges. If the worth

breaks beneath the upward counter-trendline, we are able to anticipate the sellers to

enhance their bearish bets into new lows.

USDCAD Technical Evaluation –

1 hour Timeframe

USDCAD 1 hour

On the 1 hour chart, we are able to see extra

carefully the present worth motion with the pair now compressed between the

downward and upward trendlines. This provides us a transparent setup:

- A break above the 1.34 deal with ought to lead

to a rally into the 1.36 deal with subsequent. - A break beneath the downward trendline is

more likely to set off a selloff into new lows.

Upcoming Occasions

This week is mainly empty on the information entrance with the

solely two notable releases scheduled for Thursday after we will get the US CPI

report and the US Jobless Claims figures, after which we conclude the week with

the US PPI knowledge on Friday.