USD

- The Fed left interest rates unchanged as

anticipated whereas dropping the tightening bias within the assertion however including a

slight pushback towards a March price

lower. - Fed Chair Powell harassed

that they need to see extra proof of inflation falling again to focus on and

{that a} price lower in March will not be their base case. - The most recent US GDP beat

expectations by an enormous margin. - The US PCE got here

largely consistent with expectations with the Core 3-month and 6-month annualised

charges falling under the Fed’s 2% goal. - The US NFP report

beat expectations throughout the board by an enormous margin. - The ISM Manufacturing

PMI

shocked to the upside with the brand new orders index, which is taken into account a

main indicator, leaping again into enlargement. Equally, the ISM Services PMI beat

expectations throughout the board with the employment sub-index erasing the prior

drop and costs paid leaping above 60. - The US Consumer

Confidence report got here consistent with expectations however

the labour market particulars improved significantly. - The market now expects the primary price lower in Might.

CAD

- The BoC left interest rates unchanged at

5.00% as anticipated and dropped the language about being ready to hike if

wanted. - The most recent Canadian CPI beat expectations throughout the board with

the underlying inflation measures remaining elevated, which ought to give the BoC

a motive to attend for extra knowledge earlier than contemplating price cuts. - On the labour market facet, the newest report missed

expectations though wage development spiked to the best degree since 2021. - The Canadian PMIs improved in

January though they continue to be each in contractionary territory. - The market expects the BoC to begin

reducing charges in Might.

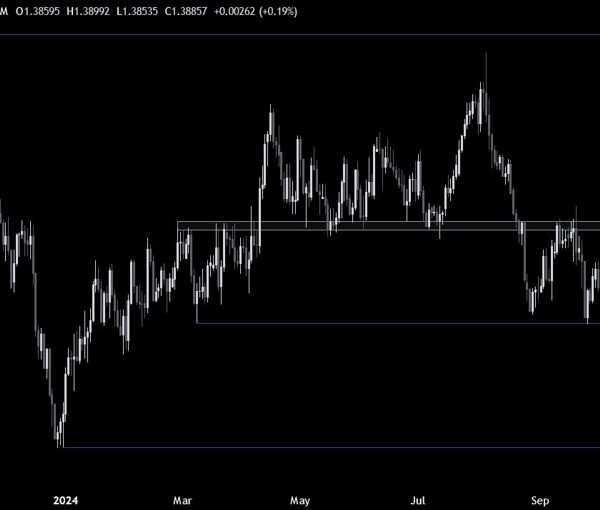

USDCAD Technical Evaluation –

Day by day Timeframe

USDCAD Day by day

On the each day chart, we will see that USDCAD bounced

on the 50% Fibonacci retracement degree

and rallied all the best way as much as the latest excessive following the sturdy US NFP

report. The sellers stepped in across the excessive with an outlined threat above it to

place for a drop into new lows. The consumers, however, will need to

see the worth breaking increased to extend the bullish bets into the following resistance at

1.3620.

USDCAD Technical Evaluation –

4 hour Timeframe

USDCAD 4 hour

On the 4 hour chart, we will see that from a threat

administration perspective, the consumers can have a greater threat to reward setup

across the 1.3460 degree the place we will discover the confluence with the

50% Fibonacci retracement degree and the 21 moving average. The

sellers, however, will need to see the worth breaking under the

help zone to extend the bearish bets into the 1.3360 degree.

USDCAD Technical Evaluation –

1 hour Timeframe

USDCAD 1 hour

On the 1 hour chart, we will see that the

worth is now proper on the resistance. Will probably be attention-grabbing to see what

occurs right here within the US session as a break above the extent ought to see the rally extending

to new highs whereas a powerful rejection is prone to take us again to the 1.3460

degree.

Upcoming Occasions

This week is mainly empty on the info entrance with simply

a few key financial releases on the agenda. On Thursday, we are going to see the

newest US Jobless Claims figures whereas on Friday we get the Canadian labour

market report.