The offshore yuan has fallen to its lowest level since July, driven by concerns over potential tariffs from the Trump administration. If such tariffs are imposed on Chinese goods, a weaker yuan could offset some of the impact by making Chinese exports more competitive internationally. This dynamic is shaping up as a key theme as markets adjust to the evolving trade landscape.

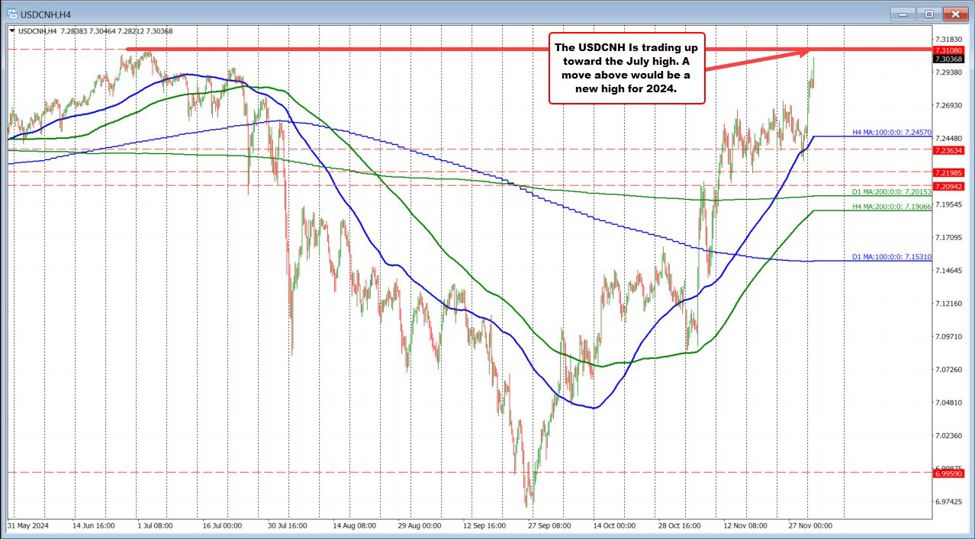

On the technical front, the USDCNH surged sharply higher yesterday, followed by a period of consolidation, and is now making another push higher today. The pair is approaching the July high of 7.3108, with the most recent peak reaching 7.3046. A breakout above the July high would mark the highest level for the pair since November 2023, setting the stage for further upside momentum.

Looking ahead, the next major target is the October 2022 high at 7.3744, a level that could come into focus if the pair successfully breaks above the 2024 high. Breaching this resistance would signal the potential for a larger move upward, putting the long-term highs firmly back in play.

The market’s attention now turns to whether the pair can sustain its upward momentum and clear key resistance levels. A move above the July peak would solidify the bullish bias, while failure to do so may signal a pause or reversal in the recent rally.