The USDJPY continues to run to the upside with the foreign money pair now up 1.32% on the day. That’s the largest improve because the finish of October when the pair moved up 1.75%.

It’s Golden Week subsequent week and markets are closed on Monday in Japan.

The Financial institution of Japan saved charges unchanged. It’s what was mentioned that has elevated the bullish bias for the pair (promoting of the JPY).

Throughout a press convention, Financial institution of Japan Governor Kazuo Ueda outlined the central financial institution’s present financial coverage stance and concerns for future changes. Ueda emphasised that the BOJ plans to keep up simple monetary circumstances in the meanwhile however indicated that the financial institution’s future financial coverage can be guided by the evolving financial and worth circumstances, fairly than being dictated by a single indicator. He acknowledged that whereas the Japanese economic system has proven average restoration, there are nonetheless some weaknesses, and highlighted the necessity to monitor monetary and international change market actions as a consequence of their potential influence on the economic system and costs.

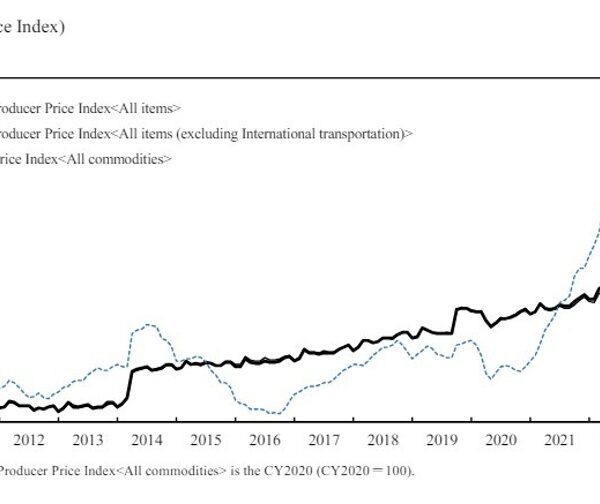

Governor Ueda clarified that the BOJ’s coverage is just not aimed toward instantly controlling the change charge however famous that they are going to proceed to look at the consequences of international change on the economic system and inflation. Regardless of the weak yen not considerably influencing development inflation up to now, it has contributed considerably to larger inflation forecasts. Ueda said that the chance of reaching the BOJ’s 2% inflation goal is progressively rising and that changes to the diploma of financial easing may be vital if underlying inflation rises. He additionally talked about that international change fluctuations may very well be a consider financial coverage selections in the event that they considerably have an effect on underlying inflation, although the influence of FX on inflation is mostly thought-about momentary.

“Continuing to observe” is just not all that scary. Additionally, the weak yen has not considerably influenced worth development inflation can be not scary.

That opened the door for the run to the upside. The 160.00 degree is getting nearer and nearer. The excessive swing degree from Could 1990 hit at 160.40