USDJPY dipped on the BOJ charge resolution however bounced close to MAs

The USDJPY has continued its march the upside with a run to a brand new session excessive.

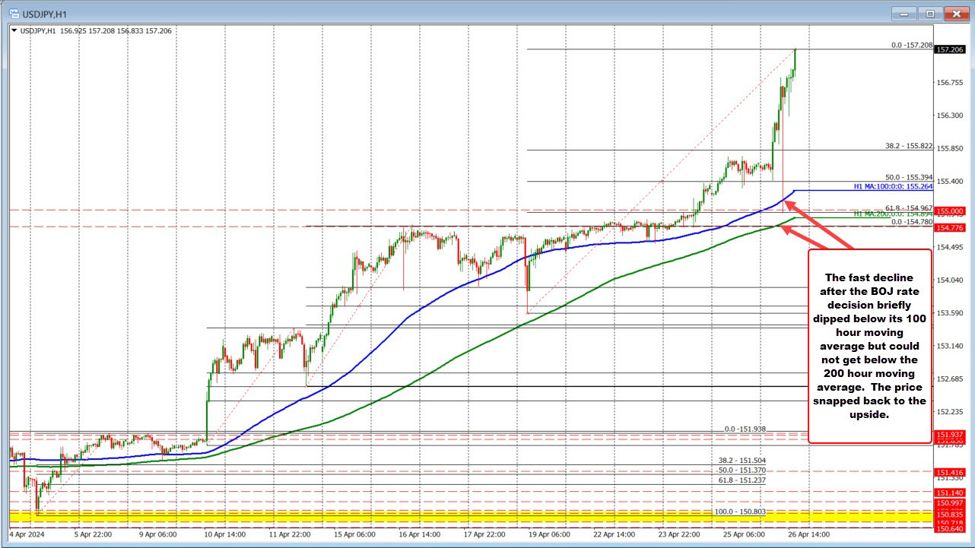

Earlier immediately, the Financial institution of Japan Coverage was unchanged. The preliminary response was a run to the draw back with the low worth reaching 154.96. That took the value slightly below its 100-hour shifting common however stalled forward of its 200-hour shifting common (blue and inexperienced traces on the chart above). Sellers had a shot. They missed. The consumers remained in management.

The next bounce-back rally as seen from suits of ups-and-downs however consumers nonetheless remained in management.

You may see that on the 5-minute chart beneath. There was a dip within the London morning session that took the value towards the 100-bar shifting common on a chart (blue line on the chart beneath). Consumers got here in and snapped the value again to the upside.

The opposite corrective strikes haven’t approached the rising 100 bar MA.

That 100-bar shifting common presently is available in 156.695. It will take a transfer beneath that shifting common (and it’s shifting larger) to present the sellers a victory technically. Absent that, and the consumers stay firmly in management.

When the value is trending, it’s best to let the value motion let you know when a prime could also be in place. Keep in mind that corrective strikes might also be restricted as traits are quick, directional and have a tendency to go additional than anticipated. It’s as much as the vendor to point out they’ll take management.

The worth is now as much as 157.25….