gladassfanny/E+ via Getty Images

Investment Overview

Ski resort operator Vail Resorts (NYSE:MTN) made headlines this year after hitting a multi-year low. Underwhelming quarterly performances of late were to blame, driven by unfavorable skiing conditions across North America and Australia. It’s now trading at levels last seen during the pandemic while boasting an enticing dividend yield, well above its historical averages. Also, based on multiple scenarios, its fair value computation points to a sizeable margin of safety.

Company Snapshot & Competitive Landscape

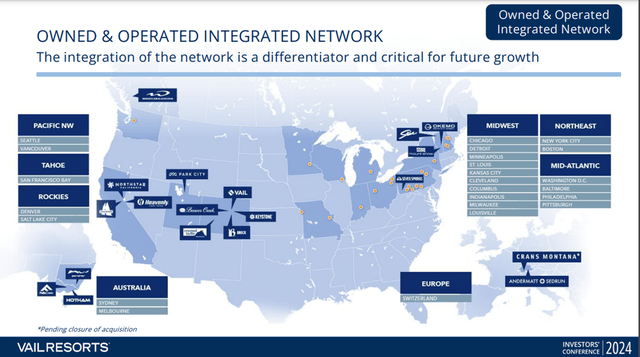

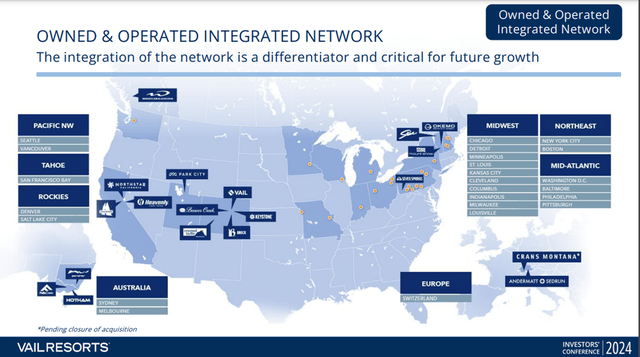

Vail Resorts shines as a bellwether among mountain resort operators, with an impressive portfolio of 40 resorts spread across key territories, including North America, Australia, and Europe.

The company operates through three unique segments, including Mountain, Lodging, and Real Estate, to deliver an unmatched experience for its clientele. Moreover, these segments cover everything from world-class ski schools and dining to premium retail offerings and luxury accommodations. Based on results from last year, its Mountain segment led the charge, contributing almost 88% of total sales, followed by Lodging and Real Estate.

Vail Resorts Integrated Network (Investor Conference March 2024)

Furthermore, Vail benefits from strong customer engagement with a subscriber base of upwards of 2.4 million and 75% of skier visits committed before the season opener. Additionally, the firm leverages cutting-edge technology to build on guest experiences while improving its bottom-line metrics. With a market cap exceeding $7.04 billion and 7,200 employees, Vail Resorts remains dominant in its niche.

Vail Resorts has effectively leveraged its juggernaut-like position in its niche to acquire many of its competitors over the past few years. Perhaps the most notable of its acquisitions was of Peak Resorts for $264 million in 2019, adding multiple ski areas across the Midwest and Northeast to its massive portfolio. Furthermore, most of Vail’s competitors haven’t gone public and lack the financial muscle to go toe-to-toe with its market supremacy.

Alterra Mountain Company, owner of the popular Ikon Pass, is perhaps Vail’s closest competitor; it operates multiple high-profile resorts across North America. Similarly, Boyne Resorts and Power Corporation are privately owned and manage several ski areas.

As mentioned earlier, the consolidation trend, marked by Vail’s acquisition of Peak Resorts and the prior merger of Intrawest into Alterra, has considerably reduced the number of mid-sized operators in the industry. Vail will benefit from economies of scale, stronger pricing power, and increased brand loyalty as that trend blossoms.

Latest Financial Insights and Performance Highlights

Vail Resorts has had it rough over the past year, grappling with unprecedented conditions that weighed down its performance across key markets.

Earnings History (Seeking Alpha)

A snapshot of Vail Resorts’ recent earnings reveals a grim outlook, marked by consistent underperformance and year-over-year (YOY) declines across both lines. The company has struggled on the revenue front, missing estimates for five consecutive quarters, though it managed to perform better on earnings, beating expectations in a couple of those quarters.

Poor ski conditions across North American resorts have weighed down results over the past year, marked by lower skier visitation. In its most recent quarterly showing in the third quarter (Q3) with a $19.27 million top-line miss, posting $1.28 billion. Additionally, there was a 5.7% drop in non-pass lift sales. Additionally, the Lodging segment saw a decline in sales due to lower condominium inventory and decreased demand. Also, Vail Resorts’ Australian business took a major hit in Q3, with Epic pass subscription sales dropping 22% due to a remarkably weak ski season down under.

Nonetheless, Vail Resorts is positioned for a potential turnaround next year. The firm will benefit from improving ski conditions in the U.S. and Australia, as La Niña is expected to bring cooler temperatures and higher snowfall.

The La Niña is essentially a climate phenomenon that brings cooler temperatures and increased snowfall to regions including the U.S. and Australia. According to the National Oceanic and Atmospheric Administration (NOAA), there’s a 66% chance of La Niña developing, with above-average snowfall anticipated in key regions. With expectations of more snow in the Northern Rockies and Australian Alps and an extended ski season, the company will be looking to bounce back to historical performance levels and reverse recent losses.

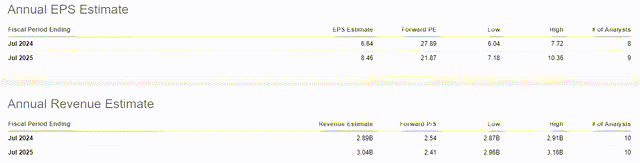

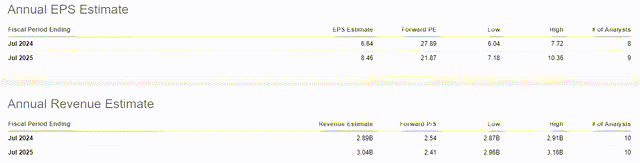

Vail Resorts Annual EPS and Revenue Estimates (Seeking Alpha)

The snippet shows a superb turnaround for Vail Resorts in 2025. Analysts forecast a noticeable improvement across both lines, with its 2025 EPS expected to rise significantly to $8.46, up from $6.64 in 2024. Moreover, based on 2025 estimates, the stock trades at 21.87 times forward earnings from 27.89 in 2024.

On the revenue front, Vail Resorts is expected to rake in $3.04 billion in 2025, roughly a 5.2% increase from the $2.89 billion estimate for 2024. The improvement moves it closer in line with its 5-year revenue growth rate of 7.75%, in contrast to its current YOY revenue growth of just 0.10%.

Dividend Yield Now Significantly More Attractive

With the sluggishness in MTN stock over the past year, its dividend yield has become remarkably more attractive.

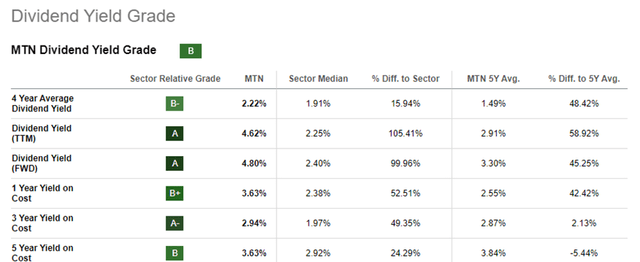

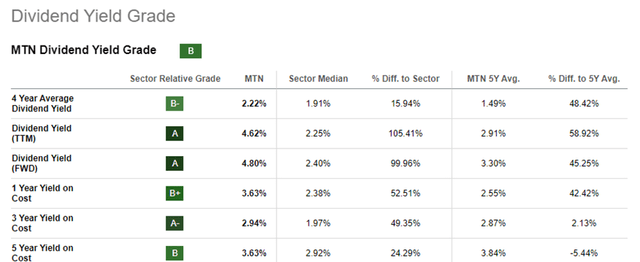

Vail Resorts Dividend Yield Card (Seeking Alpha)

We can see that MTN’s current dividend yield stands at an attractive 4.62%, trouncing the sector median by 105%. Additionally, it is 59% higher than its 5-year average of roughly 2.91%. Furthermore, judging from initial payments this year, its investors are set for a bigger payout despite the headwinds.

Vail Resorts’ dividend payout is projected to rise by 7.77% this year compared to 2023. It made four quarterly payments of $2.06, totaling $8.24 for the year. However, so far in 2024, two payments of $2.22 have been made, and assuming the next couple of payments stay the same, the total payout would be $8.88.

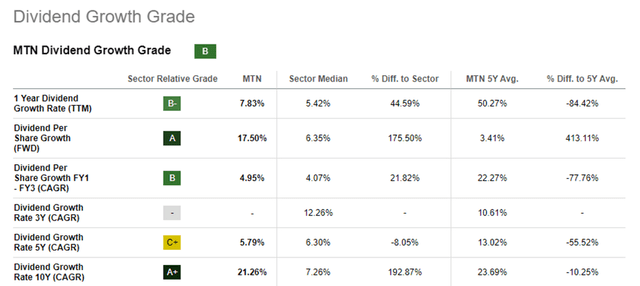

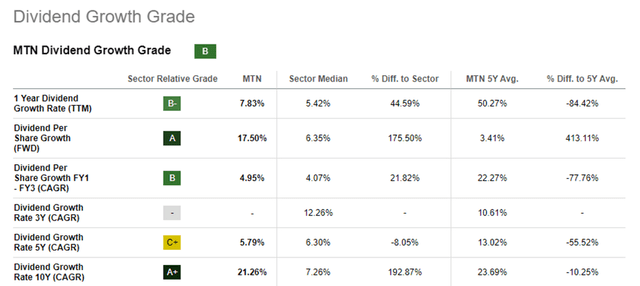

Vail Resorts Dividend Growth Card (Seeking Alpha)

Moreover, we can see that MTN’s dividend payout has grown by an impressive 7.83% increase in the past year, ahead of the sector median of 5.42%. Additionally, forward estimates for its dividend growth rate per share are at 17.50%, outpacing the sector median of 6.35%. Looking back over a 10-year horizon, Vail Resorts boasts a stellar growth rate of 21.2%, underscoring its exceptional long-term commitment to delivering shareholder value.

Current Valuation Presents Significant Upside Opportunity

Vail Resorts Stock Price Performance Vs S&P 500 (Seeking Alpha)

As discussed earlier, MTN stock has shed a ton of value, sliding 23.8% compared to the S&P 500’s 21.1% gain. The weaker-than-expected operating results weighed down investor sentiment throughout the year, pushing the stock near multi-year lows. Trading at around $185.10, the stock’s performance is reminiscent of the pandemic-era. Consequently, the stock is now trading attractively across multiple price metrics compared to sector medians and historical averages. To put things in perspective, it’s trading at around 11 times forward cash flows, 42% behind its 5-year average. Moreover, the stock is trading at just 2.44 times forward sales, a notable 41% discount compared to its 5-year average.

That said, to gauge the stock’s potential trajectory, let’s look at its fair value across three growth scenarios as we approach the anticipated recovery in the 2025 ski season.

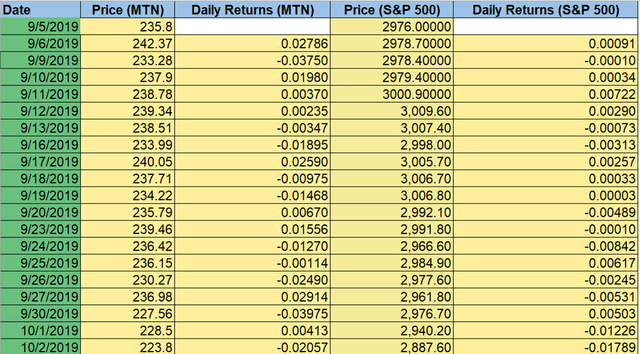

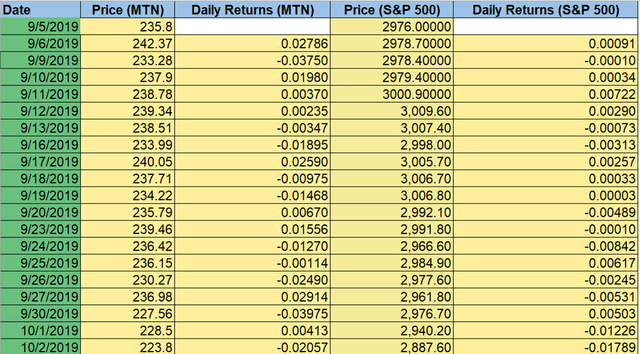

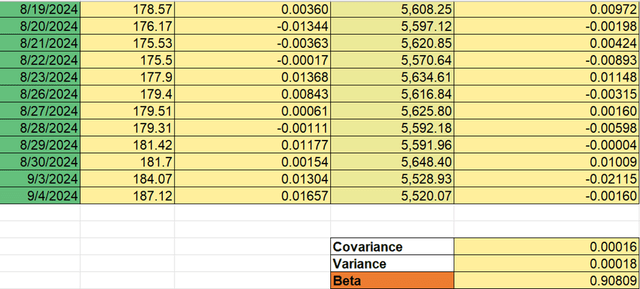

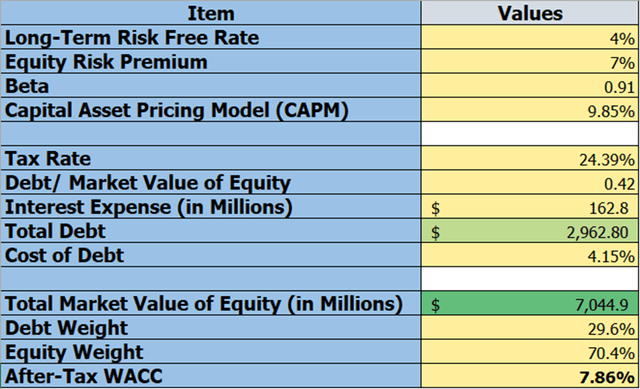

Perhaps the most important metric in evaluating MTN stock is its beta, which effectively measures its volatility relative to the market. Based on 5-year data against the S&P 500, the calculated beta stands at 0.908, which suggests that MTN is slightly less volatile than the broader market. This indicates that MTN stock’s price fluctuations are milder than the market, despite broader market movements.

Beta Calculation (Part 1) (Author Calculation based on historical price performance) Beta Calculation (Part 2) (Author Calculation based on historical price performance)

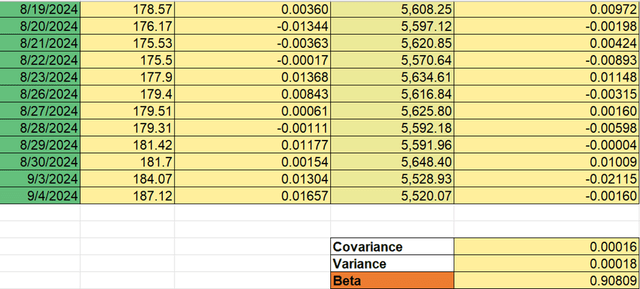

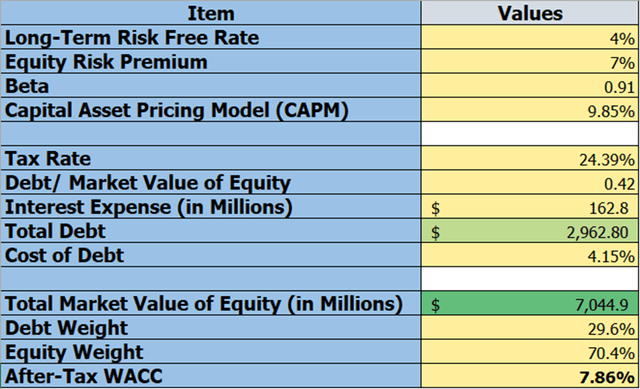

The Weighted Average Cost of Capital (WACC) for MTN stock is calculated at 7.86%, which blends the equity and debt financing costs. Moreover, we can see that equity accounts for the majority (70.4%) of the capital structure. Also, it’s important to note that MTN benefits from a relatively low cost of debt at 4.15%, with a debt weight of 29.6%.

WACC (Author Calculation based on historical data)

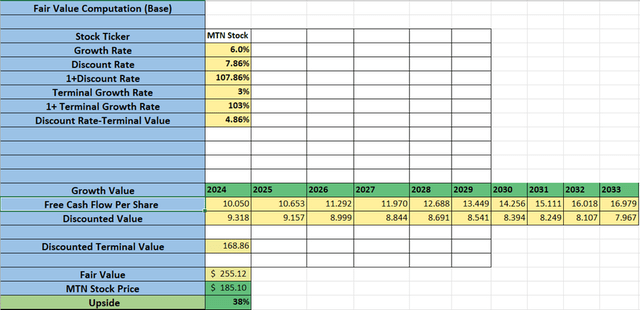

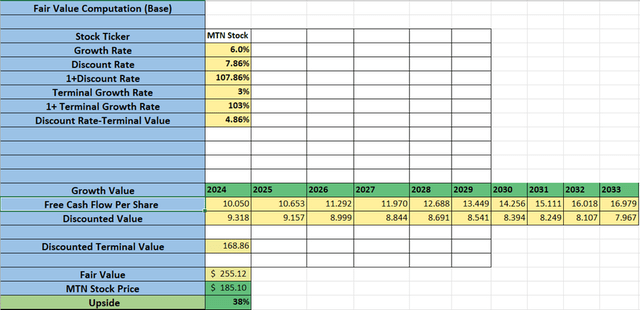

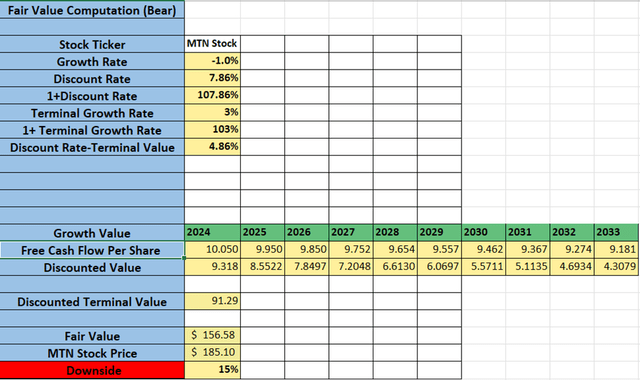

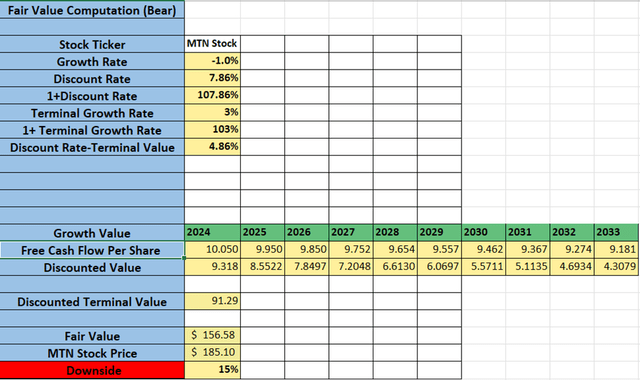

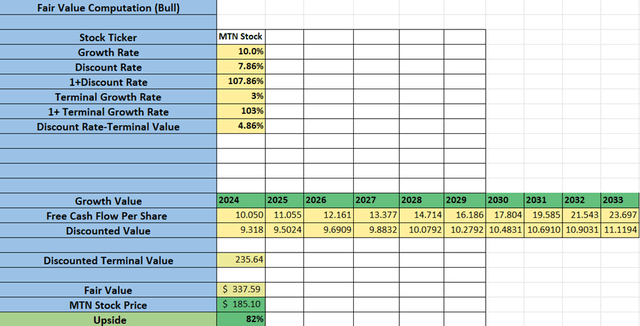

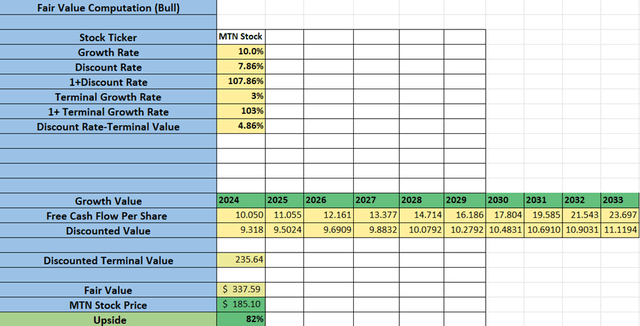

In calculating the firm’s fair value, I’ve utilized its trailing twelve-month (TTM) free cash flows as a key input. The Base Case assumes a 6% growth rate, reflecting sustainable growth based on historical trends while reflecting long-term stability, with macroeconomic factors supporting modest expansion. Additionally, the Bear Case projects a -1% growth rate, considering its shaky results of late. The Bull Case envisions 10% growth, driven by successful market expansion over the next few years, backed by improving skiing conditions.

Fair Value Calculation Base Case (Author calculations based on historical and estimated data) Fair Value Calculation Bear Case (Author calculations based on historical and estimated data) Fair Value Calculation Bull Case (Author calculations based on historical and estimated data)

Based on the calculations, MTN stock appears highly attractive across multiple scenarios. Despite conservative assumptions, MTN’s fair value significantly exceeds its current trading price of $185.10 by 38%. In the bullish scenario, with a 10% growth rate, the fair value is projected at $337.59, suggesting a massive upside of 82%. Finally, with a -1% growth rate, which seems highly unlikely in a turnaround situation, the stock trades at a 15% downside from current prices.

Risks To The Thesis

The bullish narrative around MTN stock hinges on a potential rebound next year, driven by favorable La Niña forecasts. However, it’s important to understand that weather patterns are unpredictable, which could significantly impact its optimistic outlook.

La Niña can fluctuate in intensity or not come to fruition as predicted, which leaves Vail vulnerable to suboptimal snowfall in key regions. Additionally, climate change poses a major long-term threat, with rising global temperatures leading to shorter and less reliable winter seasons. With temperatures rising, snowpack levels will accelerate melting, weighing down the time ski resorts can operate at full capacity. Moreover, a recent report found that by 2050, the average ski season in Australia could be 44 days shorter on average.

Hence, the unpredictability in the sector poses a major threat to Vail’s ability to deliver robust operational results consistently, which complicates things for its investors. It will be interesting to see how the comeback story pans out, and this would give investors much more certainty about Vail’s future trajectory.

Takeaway On Vail Resorts

In all likelihood, Vail Resorts is in an excellent position for a major rebound. The improved outlook in La Niña weather patterns could potentially lead to major improvements in ski conditions in both the U.S. and Australia. With a 66% chance of La Niña developing, there’s an excellent chance of above-average snowfall, benefitting key ski regions like the Northern Rockies and Australian Alps.

Moreover, following a forgettable ski season in the past year or so, MTN stock is now trading at pandemic-era levels, offering compelling value, especially considering an enticing 4.62% dividend yield. Analysts expect its 2025 earnings per share (EPS) to rise to $8.46, up from $6.64 in 2024, reflecting a robust potential recovery. Additionally, based on conservative base case estimates, MTN stock offers a sizeable upside from current prices. Hence, with an improved outlook and a solid foundation, I expect Vail Resorts to push the pace and end the year on a high.