One of many 2024 predictions is the emergence of a minimum of one breakout blockchain sport that may surpass 1,000,000 day by day energetic customers as Web3 gaming continues to vie for mainstream adoption.

Asset supervisor VanEck has made 15 forecasts for the crypto trade in 2024. In what it phrases a “speculative expedition”, the New York-based agency touches many corners of the cryptoverse with mentions of the extremely anticipated Spot Bitcoin ETFs, peak NFT season, and KYC rules in DeFi.

A Comparatively Easy 4th Bitcoin Halving and a New BTC ATH in This autumn

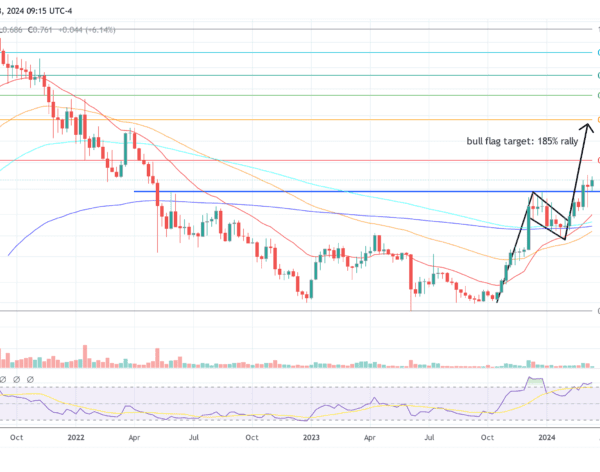

VanEck predicts that the fourth halving of the world’s main crypto will proceed “without a major fork or missed blocks.” The occasion, which is predicted to happen in April 2024, will probably be adopted by a consolidation interval that would vary from a number of days to a number of weeks. Put up-consolidation Bitcoin is projected to hit $48,000 whereas a minimum of one publicly traded miner is predicted to 10x by the tip of the 12 months.

One other Bitcoin-related prediction is that the cryptocurrency’s worth might attain a brand new all-time excessive (ATH) in the course of the 12 months’s fourth quarter off the “high volatility and the prospect of significant changes” introduced on by the November 5 US presidential election.

Binance to Lose High Place in Spot Buying and selling

On the heels of its $4 billion settlement with US regulators, international crypto trade Binance is predicted to succumb to competitors from well-funded rivals OKX, Bybit, Coinbase, and Bitget for the primary centralized trade by volumes place.

Coinbase’s worldwide futures market might probably surpass a day by day quantity of $1 billion, up from about $200 million per day in November 2023.

DeFi Reconciles with Know Your Buyer (KYC)

KYC-enabled apps like these utilizing Ethereum Attestation Service or Uniswap Hooks will achieve notable traction and will probably outperform their non-KYC counterparts when it comes to person base and costs. Based on the agency:

“The additional volume from KYC-gated hooks will significantly bolster protocol fees by allowing new entrants to participate in DeFi without the fear of interacting with OFAC-sanctioned entities.”

Bitcoin Staking, Solana’s Market Cap, and DePin Networks

One other 2024 prediction is the emergence of a minimum of one breakout blockchain sport that may surpass 1,000,000 day by day energetic customers as Web3 gaming continues to vie for mainstream adoption. In the meantime, the decentralized trade (DEX) market share of spot crypto buying and selling is projected to achieve an ATH “as high-throughput chains like Solana improve the on-chain trading experience for users.”

Solana is poised to turn into a prime 3 blockchain by market cap, Complete Worth Locked (TVL) and energetic customers. The blockchain might then probably be part of the spot ETF wars.

Remittances will catalyze a brand new Bitcoin yield alternative. “Bitcoin Staking” is predicted to stem from using the Bitcoin and layer 2 Lightning (LN) community by some remittance service suppliers.

In one other adoption prediction, a number of decentralized bodily infrastructure (DePin) networks will achieve traction. Hivemapper, the decentralized mapping protocol engaged on a community-owned competitor to Google Streetview, will map its “10 millionth unique KM, surpassing 15% of global roads capacity”. This may place the community a velocity and cost-of-capital benefit over Google.