Summary:

-

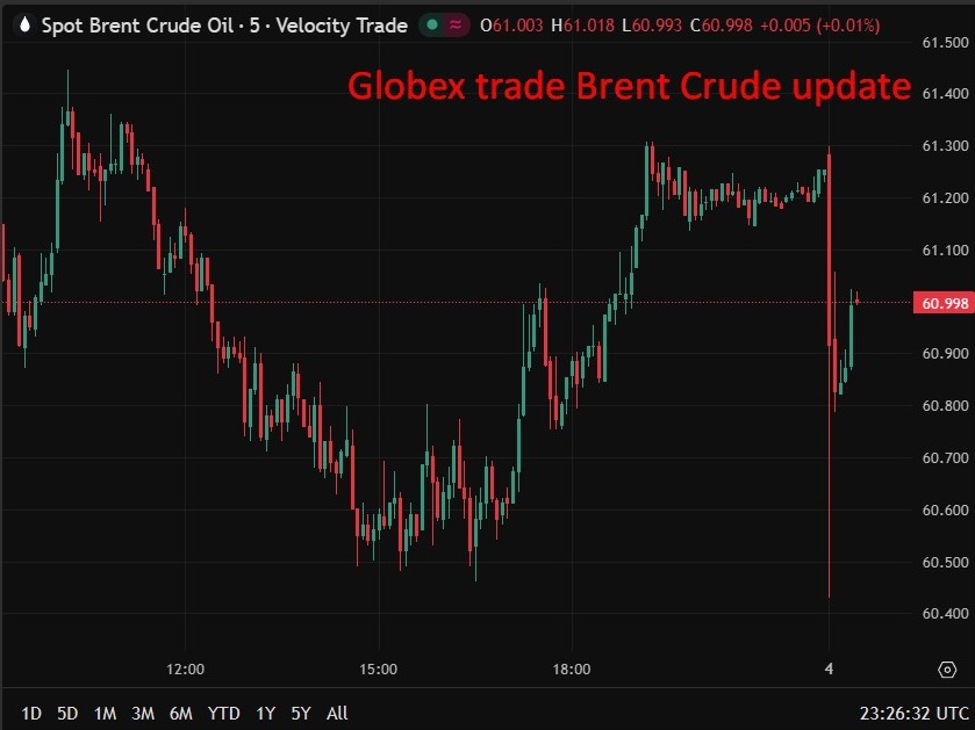

Goldman Sachs left its near-term price forecasts unchanged, projecting average prices of $56 per barrel for Brent crude and $52 for West Texas Intermediate this year.

-

Goldman sees limited near-term impact from Venezuela on oil prices

-

Any production recovery likely to be gradual and partial

-

Infrastructure damage and underinvestment remain major constraints

-

Near-term Brent and WTI price forecasts unchanged

-

Long-run downside risks increase from added global supply

Prospects for a longer-term recovery in Venezuelan oil production could add to downward pressure on crude prices beyond the near-term horizon, according to Goldman Sachs, even as the bank cautions that any rebound would be slow, uneven and highly dependent on sustained investment.

In a research note dated January 4 (via Bloomberg, gated), Goldman analysts said that while the recent US intervention in Venezuela has reshaped the country’s political outlook, it does not immediately alter oil market fundamentals. The bank expects any meaningful recovery in Venezuelan output to unfold only gradually, citing severely degraded infrastructure and years of underinvestment across the upstream sector. Analysts added that strong financial and policy incentives would be required to attract the scale of capital necessary to restore production capacity.

Goldman emphasised that Venezuela’s oil industry has been in long-term decline, with output collapsing over the past two decades due to mismanagement, sanctions and infrastructure decay. As a result, Venezuela now accounts for less than 1% of global oil supply, significantly limiting its ability to influence prices in the short run. The bank therefore left its near-term price forecasts unchanged, projecting average prices of $56 per barrel for Brent crude and $52 for West Texas Intermediate this year.

The assessment follows a dramatic escalation in geopolitical risk over the weekend, when the United States captured Venezuelan President Nicolás Maduro in a military operation that stunned global markets. While the political shock initially raised concerns about potential supply disruptions, Goldman noted that the intervention itself has not materially affected Venezuelan production or exports.

Looking further ahead, however, the bank warned that a gradual return of Venezuelan barrels could add to a growing list of downside risks for oil prices in the latter part of the decade. Goldman pointed to stronger-than-expected production growth in both Russia and the United States, arguing that additional supply from Venezuela would further loosen balances in the outer years of its forecast horizon.

Taken together, the analysts said these dynamics increase the risk that oil prices could face sustained pressure from 2027 onwards, particularly if global demand growth softens and investment elsewhere continues to surprise to the upside. While Venezuelan supply is unlikely to be a decisive factor in the near term, Goldman concluded that it reinforces a structurally more bearish long-run outlook for crude markets.