Vertical Aerospace Ltd. stated it secured $50 million of recent funding from founder Stephen Fitzpatrick, a money injection that may forestall the flying taxi agency from working out of money later this 12 months.

Fitzpatrick will present a primary $25 million tranche of funding in March, which might worth the corporate at $10 per share, effectively above the present market worth. The rest would come by the top of July, with the pricing nonetheless to be determined and the quantity depending on how a lot outdoors capital the agency is ready to elevate.

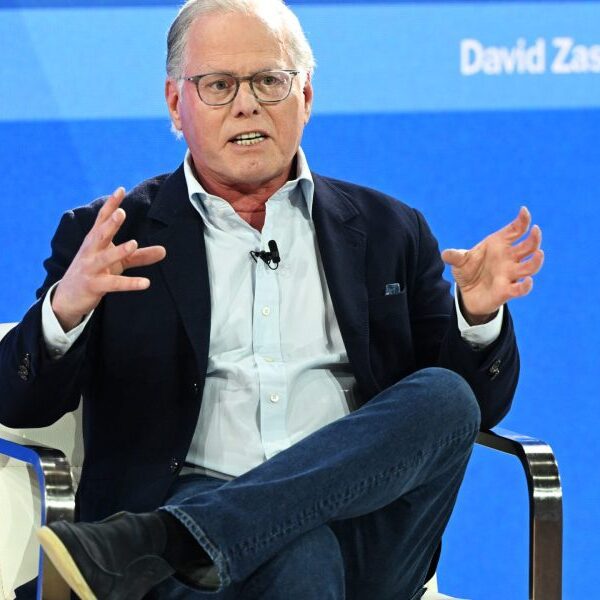

“I see a huge opportunity,” Fitzpatrick stated of his determination to double down on his funding within the flying taxi agency. “Of course, like every technological development, there are execution risks but, I really believe in the team that we’ve built. I believe in the progress that we’ve made, and I’m putting my money where my mouth is.”

With out extra funding, Vertical Aerospace projected last year it will burn via its money by September. Separate talks with traders on a recent financing spherical collapsed because of Fitzpatrick’s concern that his holding could be diluted an excessive amount of on the present share worth.

Vertical Aerospace is one in all a number of firms within the capital-intensive race to get an electrical vertical take-off and touchdown car, or eVTOL, licensed for passenger service. The corporate’s prototype VX4 plane crashed throughout an unmanned take a look at flight in August, and it missed a goal to lift recent funding by December.

The brand new funding by Fitzpatrick, who can also be founding father of Ovo Energy Ltd., ought to see the agency via till the second quarter of 2025, Vertical Aerospace stated. It must also enable it to hunt additional outdoors funding at a extra favorable valuation, folks accustomed to the matter stated.

Vertical Aerospace stated the settlement with Fitzpatrick comes at an necessary time, because it nears the completion of a second era, piloted VX4 prototype.

The corporate beforehand raised money from traders together with Mudrick Capital Management and Kouros SA and went public via a SPAC in 2021. Nevertheless it was late to listing and has since seen its shares plunge as traders soured on the SPAC growth and final 12 months’s crash of its prototype dented confidence.

Fitzpatrick stated he selected to speculate extra money as taking additional exterior funding on the present share worth could be too dilutive. “I didn’t want to accept the dilution,” he stated. “I really don’t believe the current market price reflects the value the company should have.”

Vertical Aerospace fell 80% final 12 months, closing Friday in New York at 58 cents and leaving the corporate with a market worth of about $130 million. The New York Inventory Trade warned Vertical Aerospace in December that it is going to be faraway from the trade unless the shares trade above $1 over a 30-day interval within the subsequent six months.

— With help from Siddharth Vikram Philip