Tippapatt

The healthcare industry is an important part of the economy, and one that has consistently demonstrated both growth and resilience in the face of broad economic downturns. Now, many factors appear to benefit continuing growth within healthcare, including advancements in medical technology and the aging of baby boomers. Further, many young individuals appear to be requiring care for serious issues, including cancer and heart disease, which creates further demand. For these reasons, long-term investing within healthcare appears sensible, and the Vanguard Health Care Index Fund ETF (NYSEARCA:VHT), is a highly reasonable method of gaining broad exposure to healthcare providers and insurers.

VHT tracks the MSCI US Investable Market Health Care 25/50 Index, and provides a diversified portfolio of healthcare companies. VHT invests in healthcare sectors that include pharmaceuticals, biotechnology, healthcare services, and medical devices. VHT also has a reasonable 0.10% expense ratio, making it one of the less expensive healthcare ETFs within the market.

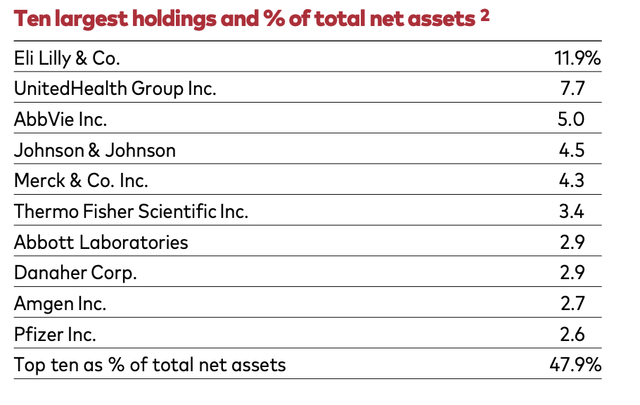

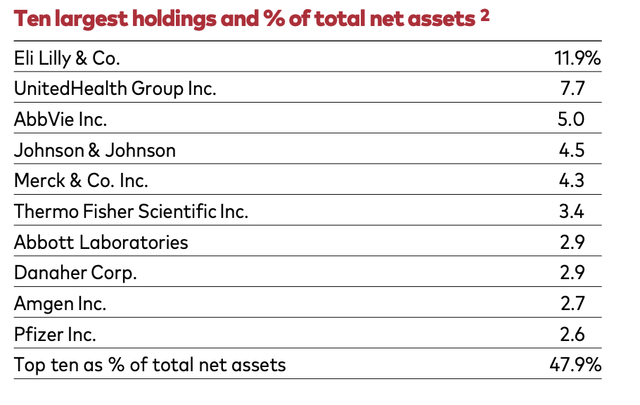

With approximately 423 holdings, VHT is highly diversified within the healthcare, but it is a little top-heavy. VHT is market weighted, and the more significant market capitalizations of its largest constituents make them dominate the index and ETF. As a result, the top ten holdings make up nearly half of the ETF, and Eli Lilly (LLY) is now approximately 12% of VHT, and UnitedHealth Group (UNH) is almost eight percent. Roughly 73% of VHT is composed of large cap stocks, while the remainder is made of small and medium-sized companies.

VHT top ten holdings (Vanguard’s VHT Fact Sheet)

A significant part of why its largest constituents are so dominant within the index is due to their market share and stock outperformance, and these factors may continue. As a result, VHT allows investors to allocate into these large players who have performed so well in the past, and which may continue to outperform into the future, while simultaneously diversifying into equities that may be lagging and presently undervalued, and which may hedge risk associated with market reversals.

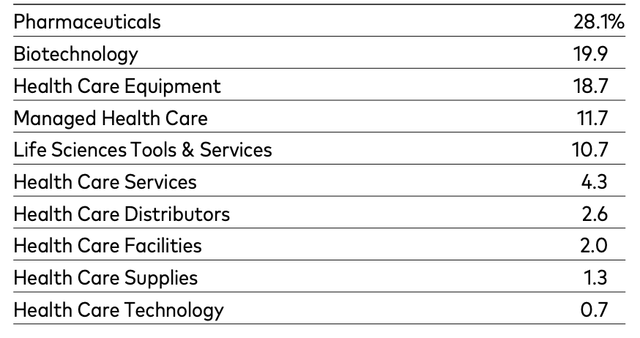

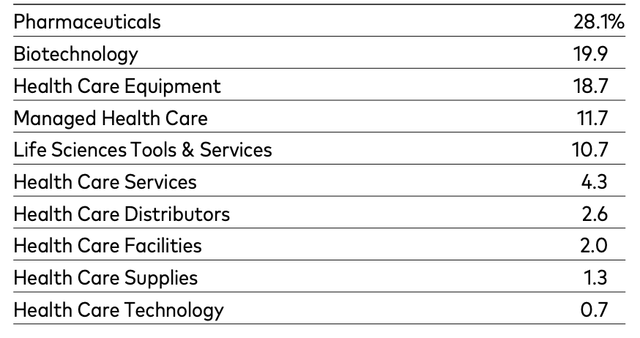

Another positive attribute of VHT is that with its sizable holdings comes broad exposure to biotechnology, including possible future market darlings and acquisition targets. Those higher risk investments are balanced out by the ETF’s more significant exposure to large cap Pharma, as well as the insurance and tools & services subindustries that tend to trade at lower valuations.

VHT’s subindustry weighting (Vanguard’s VHT fact sheet)

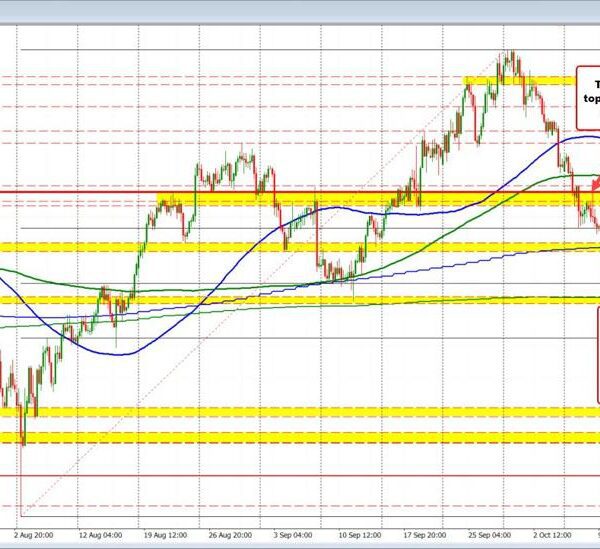

VHT has performed exceptionally well over the last several weeks, and recently broke out of its trading range. Shares had been rising in a fairly narrow channel since earlier this year, with the occasional test of both support and resistance. VHT appeared to be testing supply on nearly a monthly basis, and last did so around the start of August when market volatility spiked. After that test of support, VHT performed exceedingly well, making a clean break through upward resistance, which was at around $280. Since then, it has only continued to appreciate, in what appears to be a clean breakout that may have room to run further up the charts.

VHT daily candlestick chart (Finviz.com)

This apparent breakout does not merely take VHT through recent resistance, but actually out of a longer-term trading range where the ETF has remained stuck since 2022. This may be construed as a long term basing period that could now be followed by an extended breakout and appreciation.

VHT weekly candlestick chart (Finviz.com with red lines by Zvi Bar)

It is often the case that healthcare stocks experience a period of weakness in advance of presidential elections, as the industry is a frequent scapegoat due to its ever rising costs. While it may end up occurring this cycle too, it currently appears that the market is less concerned with such risks to healthcare than is often the case. This may be due to the recent change in nomination, and the possibility that neither candidate appears to present a greater future threat than the current administration.

Nonetheless, it is entirely possible that this circumstance will change between now and November. If that occurs, one might imagine that VHT could retest prior resistance at $280 and hopefully confirm it as support. Given current momentum and market expectations, it appears entirely possible that no such retest will occur in the near term, and that the more likely occurrence is continued appreciation.

One strong reason why VHT and healthcare in general may perform well in the coming weeks, months, and quarters is due to the forthcoming rate cut cycle. By reducing the risk-free rate of return available through short-term Treasuries, equities that have a well covered dividend are likely to become more valuable. This is especially the case for companies that have the potential to increase their payouts in the future, which is a feature many of the larger Pharma and insurance companies appear to have.

Risks

The healthcare sector is often volatile and influenced by factors such as regulatory changes, clinical trial outcomes, and external economic conditions that complicate the capacity to pay for care. Given we are currently rushing towards a national election, it is entirely possible and reasonably likely that either large cap Pharma or healthcare insurers could undergo increased political targeting.

This is a common concern, and therefore one that may be priced into the majority of equities, but such is no certainty. Therefore, there is the possibility that healthcare could become more volatile during the quarter and as we approach the election. Similarly, the large entities in this industry could undergo greater political scrutiny after the election, and be targeted due to their pricing and/or profitability.

Another possible concern is that of innovation, which could render existing profitable businesses obsolete. For example, the recent success of GLP-1 medications could curtail anticipated growth in the market for diabetes drugs and devices like continuous glucose monitors. To the extent such occurs, the success of one index constituent could come at the expense of another, and possibly result in a zero-sum game.

Conclusion

The healthcare industry appears to be breaking out of a multi-year base due to the strength of its market leaders, as well as the likelihood of high-quality dividend payers being valued higher. Because of this, VHT has performed exceedingly well recently, and that trend appears likely to continue in the near term. This trend may gain momentum as the Federal Reserve initiates the forthcoming rate cut cycle, and also accelerate after the election.