Erik Isakson

Investment Thesis

Vicor’s (NASDAQ:VICR) shares have been in the trading range between $30 and $48 since last October. Now that the price is above its 200-day Moving Average at $39, it is poised to begin a new long-term uptrend. Volume has fallen to its lowest levels in the past several years. With the positive catalysts ahead and a tight float, Vicor could have an explosive break out on any positive news.

Vicor’s share price rocketed to $164 in November of 2021 as the result of Nvidia (NVDA) using Vicor’s power converters on their A100 GPU. Vicor was selected because of its superior and enabling power supply converters. You can see the Vicor power converters, the gold bars on the Nvidia A100 here.

Vicor’s stock fell from that peak when Nvidia selected a competing product from Monolithic Power (MPWR) for their H100 GPU. Vicor lost the business because they did not have the manufacturing capacity needed to deliver the large quantity of products that Nvidia required. Vicor had the same problem with several other AI manufacturers as Vicor was capacity constrained.

Vicor had anticipated this customer ramp and was building a new “ChiP Fab”, Converter Housed in a Package Fabrication facility. However, the ChiP Fab was over two years late because of supply chain issues during Covid, especially from the machine manufacturers.

With the stock price at $39 a share, it is a strong buy as the shares are poised for a turnaround. With the ChiP Fab completed, the company has $1,000,000,000 in capacity, which is enough to provide products for Nvidia, other AI processor manufacturers, auto, defense/aerospace, and their industrial customers.

The recent insider buys from Dr. Patrizio Vinciarelli, CEO, Michael McNamara, corporate VP and GM of operations, Phil Davies, Corporate VP of Global Sales and Marketing, and the company announcing in their 2nd Q 10Q a new $100,000,000 share buyback program are very positive signs of good things to come.

Vicor has only 45,000,000 shares outstanding, and the CEO owns 21,000,000 shares, leaving approximately 24,000,000 shares of float. As history has shown, this exceptionally low share count is a catalyst for a very volatile share price. With the ChiP Fab complete, it is only a matter of time before Vicor recovers some or all of the AI processor designs they lost. As soon as that happens, the demand for the shares will quickly exceed the supply, and the share price will appreciate rapidly.

The rise of the share price to $164 was a preview of things to come. The company demonstrated that with its superior enabling technology, its leveraged business model, and the low share float what the stock is capable of. In time, I expect a similar and sustained run in stock.

Background

Vicor has a long history of innovation in the power converter market since they invented the Brick in 1984. They invest heavily in R&D, almost 20% of their revenue in Q2, to produce leading-edge products that convert AC electricity to DC and DC to DC, from over four hundred volts to sub 1 Volt at the point of load. They do this by using a scalable modular building block approach. This approach facilitates faster design cycles with proven designs and frees up valuable customer engineering resources.

Vicor has two divisions: their brick business and their advanced products. While the brick business is their legacy, it is important to note that it is still profitable and sustainable. Vicor’s brick business sells into the defense and aerospace, industrial, test and instrumentations, and transportation (rail) markets with a focus on lower volume highly customized products.

Their advanced products initially target very high-volume applications like AI processors and auto, and this is where accelerated growth is expected. Vicor has invested well over half a billion dollars in developing the advanced products technology, along with a state-of-the-art ChiP Fab. These investments have set the stage for dramatic growth, as Vicor now has the superior products and the manufacturing capacity necessary to fulfill their customer’s demands.

ChiP Fab

Vicor now has a fully functional end-to-end vertically integrated ChiP Fab. At the annual meeting, I talked to the CEO about the ChiP Fab and he explained how it lowers costs and streamlines manufacturing as it was designed for efficiency and scalability.

The Fab has a novel manufacturing approach where they make PCB wafers analogous to the way semiconductors are made, and they cut them up into parts. “The original Vicor VI Chip® was an over-molded package that was manufactured using individual‑cavity construction. In contrast, the new ChiP™ is made and cut from a standard‑size panel and it makes full use of both sides of the module’s internal PCB for active and passive components.”

The video at the annual meeting showed the Fab fully automated and vertically integrated. One meaningful change was bringing the plating process in-house. Before, they had a subcontractor perform the plating, and a couple of years ago, that sub upped the price by over five times and had issues meeting demand, and these issues cut into Vicor’s margins and limited their ability to ship.

Vicor’s new equipment produces higher quality plating at a lower cost than they could get from their subcontractor. Additionally, significant savings are now incurred because instead of boxing up parts, putting them in a truck, shipping them to the sub, who unpacks them, plates them and re-boxes them and ships them back, everything is done inhouse in a vertically integrated and automated fashion.

The market does not appreciate the advantages the factory offers, as all it can see is that it was two years late. The new factory saves considerable manufacturing time, reduces the cost of goods, increases turns, and increases margins. In addition, it allows for the building of the densest and most efficient power modules that are available. The improvements in density and efficiency enable Vicor to solve the most challenging power delivery problems.

Vicor’s manufacturing process is unique and patented. Vicor procured customized manufacturing equipment designed with their input to ensure the best possible manufacturing. Vicor will reap significant benefits to their production process with these specialized machines.

Years ago, on a conference call, an analyst asked the CEO why he didn’t make his products overseas. The CEO responded that he did not need to because he could make his products of better quality and as cost-effective in the United States. The CEO knows how to build products. He designed his company to be automated and streamlined from the minute they receive a purchase order until a unit ships.

Now, Vicor needs to fill that factory with products and to do that, they need orders. The orders will come; it is just a matter of time.

Vicor’s ChiP Fab (Vicor website)

Patents and royalty income

Vicor’s has a portfolio of patents on all aspects of their power converters. The CEO has often said that the patents present a land mine for unscrupulous competitors. This has proven to be true, as Vicor has several wins in recent court cases. The first case they won was against Delta Electronics when Delta challenged the validity of Vicor’s patents. Then, Vicor won a preliminary injunction against Foxconn subsidiaries.

Another important trial at the International Trade Commission, ITC, is over, and a decision is expected in October. The CEO said this about that trial, “Our first case is complete. It’s with the administrative law judge. We expect the decision at the beginning of October, and we expect that to be a favorable decision that should before too long result in an exclusion order. And we’ll see where it goes from there.”

According to Vicor’s Q2 10Q, Vicor has seen its royalty revenue grow considerably. For the 2nd Q of 2024, Vicor had royalty income of $9,271,000 vs. $2,456,000 for Q2 2023, a 377% increase. When The CEO was asked about the future of royalty income on the Q2 conference call, he responded, “So generally, we expect the royalty contribution to our revenues and bottom line to continue to expand as far as we can see.”

The license agreements provide multiple sources for Vicor’s NBM converters. During the annual meeting and the last conference call, it was apparent that Vicor was aware of the need for a second source for their current multipliers. With the success of the NBM agreements, Vicor has a roadmap for additional agreements.

After the legal expenses of protecting their patterns are reduced, a significant portion of the royalty income will fall to the bottom line.

Gen 5 & Vertical Power Delivery, VPD, for AI

The trend for AI processors is and continues to be that they draw more power. As I have listed below, Nvidia’s GPUs and their power draw illustrate this point as the Nvidia V100 requires three hundred Watts, and the GH200 can demand up to 2,000 Watts! The trend to higher power favors Vicor and its superior technology.

V100 SXM2, 300 Watts

A100 SXM, 400 Watts

H100 SXM, 700 Watts

GH 200 up to 1,000 Watts

Dual GH 200 up to 2,000 Watts

To address the higher power GPU’s, Vicor is on its second generation VPD with Gen 5 parts, and they claim to be the only viable solution for processors that require over 1,000 Watts. VPD is the most efficient way to power a processor with minimal voltage drop and heat, as is necessary to reliably deliver electricity at low voltages.

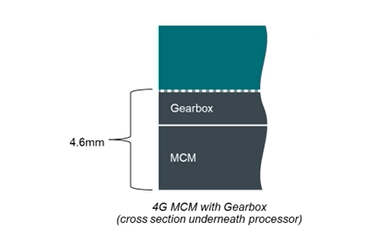

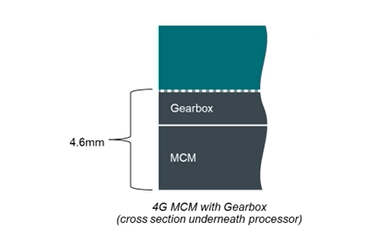

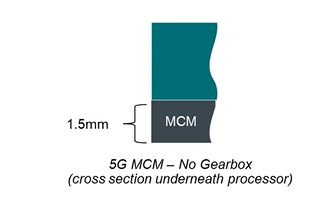

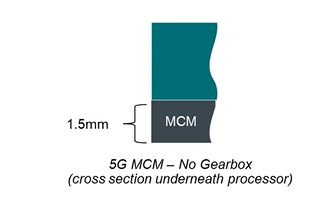

Because of the small size of Vicor’s 5th gen current multipliers, Vicor’s second-generation VPD, eliminates the stacked capacitator layer (Gearbox) that existed on their first generation. This configuration significantly simplified the design and reduced the complexity, heat, and cost. The pictures below illustrate that point.

VPD with Vicor’s 4th gen gearbox (Vicor’s Annual Meeting replay) Vicor’s 2nd gen VPD with 5th gen MCM (Vicor’s Annual Meeting replay)

The small size and placement of the Vicor converters allow the converters to be placed closer and directly under the GPU, enabling VPD. This placement is the optimal location for the power converters, as it provides the most efficient power delivery with minimal power loss and the least amount of heat (thanks to Ohm’s Law). If all AI processors used the Vicor parts, Vicor estimates an aggregate saving of terawatts of power, equivalent to billions of dollars of electrical energy costs and millions of tons of carbon-dioxide reductions annually, depending on the renewable-energy mix.

Data centers are looking for ways to reduce their carbon footprint, and AI processing is putting a strain on our electrical grid. The power and carbon emission savings, along with reduced cooling requirements of the Vicor converters, make their solution extremely attractive.

With their ChiP Fab’s new manufacturing capabilities, and 5th generation technology, the CEO has repeatedly said that they will cut the cost of their converters, and they will be price competitive in applications where processors draw as little as 300 watts. Before, Vicor was only competitive in the highest power processors. With this reduced cost, Vicor will compete in a significantly larger market, including the general-purpose CPU server market.

While Vicor’s fifth-generation products appear to be game changers, they are new and not yet proven. The CEO said this on their Q2 conference call on the status of Gen 5. “We are on track to deliver complete evaluation systems and power module samples in Q2 and Q3 respectively. There is one notable customer that may well be in production come at the very beginning of next year. And for that customer, the hardware is due to be delivered in the summer months.”

The notable customer is likely Cerebras, as Vicor has mentioned them many times, and they have extraordinary power requirements because of the size of their AI processor. Vicor’s products enable Cerebras to have the largest and fastest GPU available by providing VPD. I found the following quote on Cerebras’s website, which describes Vicor’s VPD System.

“A first innovation concerns the physical placement of the power supplies. They are mounted on the PCB, so that the power flows in the through-PCB direction, rather than laterally across the PCB from the side, which is conventional. The 3D arrangement makes for a shorter, low resistance path, which curtails resistive heating and power loss in the power supply and distribution network. And there simply isn’t enough room and enough copper in the PCB to handle longer, lateral paths anyway.”

Cerebras has filed for an IPO. Additional attention will be directed at Vicor when they go public. As the CEO said, “once others see that we are enabling higher performance with lower power, the other GPU manufacturers will be forced to respond.”

In addition to the GPU manufacturers, Vicor is engaged with the hyperscalers who are building their own GPUs. The CEO stated, “But we have some very good interest from the accounts that are building really big investments into AI and developing their own processor chips, and they are the people that you would expect, and we have great engagements with them right now.”

He elaborated, “So, we are involved in one important development with a major OEM at the 2,000 Amp level. At that level, fundamentally, you need VPD, and you need an advanced form of VPD such as what we call second gen VPD. Yes, you could try to do it with the first gen VPD that has been covered to a high degree by competitors, but what you would be stuck with is a system, a power system that evolves modules very heavy, very thick thermally inadept, difficult to scale with very poor yields in assembly and reliability issues, not to mention the IP issues I alluded to earlier. So, we see the market in AI, in particular, quickly getting past the 1,000 Amp level and fundamentally left with VPD-only solution.”

Vicor’s 5th gen MCM (My picture at the annual meeting)

Above is a picture of the Vicor point of load current multiplier. Phil Davies, Vice President of Global Sales and Marketing, brought this sample to the annual meeting where I took this picture. This current multiplier is 28mm X 8mm and rated at 800 amps. For VPD, you need a very small, quiet, and thermally adept converter that will fit under the AI processor. The Vicor current multiplier fits that bill, as the specifications are truly amazing.

ChiP, Converter housed in a Package

What is a ChiP? It’s a converter housed in a package. The module is the equivalent of the brick converter of yesteryear, but it is smaller, more efficient, and more power-dense. So, instead of an isolated semiconductor component, the ChiP is a complete module with numerous individual semiconductors and passives.

Vicor sees the five areas listed below that are essential to their leadership and success with this product line.

High power and current density

Vicor has the densest, smallest and most efficient converters on the market. High power and current density are essential for VPD for AI processors, CPUs, GPUs, ASICs, and communication processors.

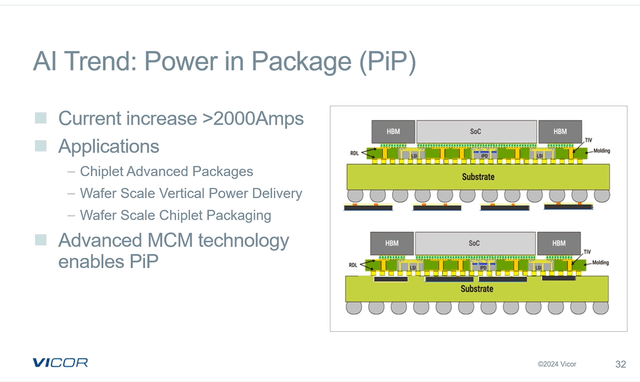

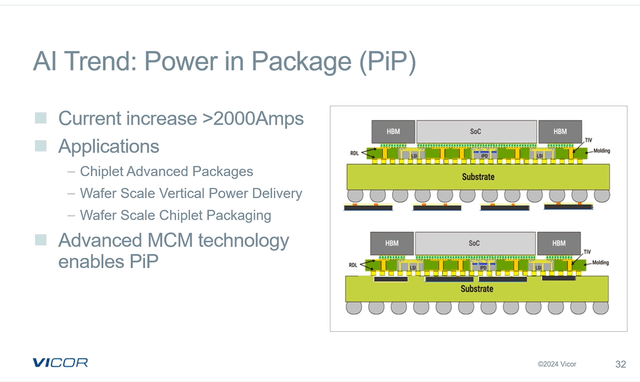

The holy grail of power delivery is to place the converters directly inside the processor’s package. This is called Power in Package or PiP. Vicor has claimed that 5th Gen products, because of their efficiency, packaging, and density make this possible. Vicor is collaborating with AI processor companies to develop solutions for PiP. When the Vicor PiP solution is productized, they will dominate the high current AI marketplace.

The four black rectangular figures in the first diagram below represent the Vicor current multipliers in a VPD configuration. The second diagram represents PiP where the four converters move from under the AI substrate to inside the package on the substrate. This placement is the most efficient way to deliver power to processors with the least amount of heat and power loss. PiP enables processor manufacturers the ability to produce higher power chips and chiplets, that otherwise would not be possible.

In order for the converter to reside inside the package of an AI processor, it must be incredibly dense, thermally adept, and designed so it doesn’t emit EMI. Vicor converters meet these requirements with their ChiP packaging.

Vicor’s Power in Package, PIP (Vicor’s Annual Meeting replay)

Thermal adept packaging

AI processors produce enormous amounts of heat, and the power supply can be a significant contributor. Nvidia’s customers are more than ever turning to water-cooling to help alleviate that problem. Vicor’s converters in a VPD system can save up to 120 Watts per GPU, and these Watts turn into heat that needs to be removed. In many cases, by using Vicor converters, water cooling is not necessary.

Here is what Vicor says about their packaging. “The power module package is where all the elements of innovation come together and where materials science and a great deal of ingenuity enable the critical performance metrics of density and efficiency. Thermal management of this package requires double‑sided cooling to maximize performance and power density.”

Integrated magnetics

Less than a year ago, there was a discussion about power converter magnetics in the Power Supply Design Center group on Facebook. The topic was how industry was not innovating around power supply magnetics. Here are a couple of comments from power supply engineers who see Vicor as leaders in magnetic innovation:

- “See Vicor. Then please tell me the complaint about magnetics again.”

- “But those Vicor guys are magicians. (Actually, just really really good!).”

Vicor says this about their integrated magnetics: “A key feature of the ChiP solution is that the converter’s magnetics are integrated into the device. The integrated planar magnetics in these devices have been optimized over 20 years and current multipliers now achieve current density levels of 2A/mm2 with even further advances planned for the near future.”

Compatibility with high‑volume PCB assembly techniques

Vicor’s patent-protected manufacturing techniques include compatibility with high-volume, automated PCB assembly techniques. These techniques are essential for high-volume, low-cost production.

Automated and scalable high-volume manufacturing

The Vicor ChiPs manufactured at the company’s Andover site are complete high-power modules manufactured in “panels” analogous to semiconductor wafers. According to Vicor, “The panels are then separated into individual “chip-scale” components much in the way of silicon chips. Making and cutting ChiPs from panels is very similar the way silicon chips are made and cut from wafers, but whatever the power level, current level or voltage level of the module, ChiPs are all cut from the same size panel, enabling a manufacturing operation that is streamlined, high‑volume and very scalable.”

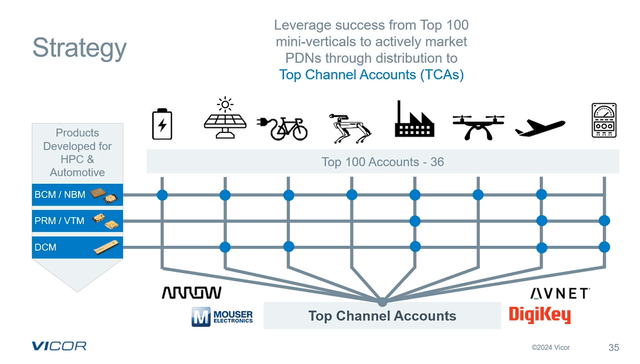

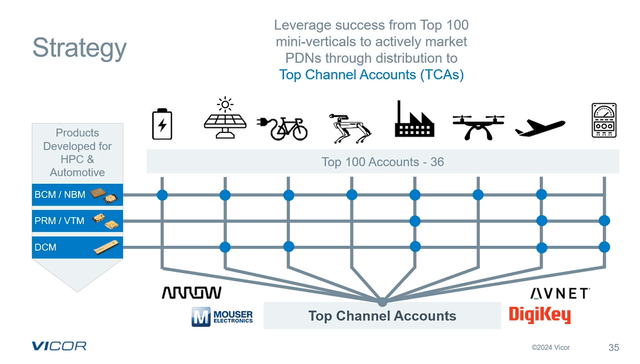

In response to a question from Alan Hicks’ on the Q2 conference call, The CEO emphasized that the same ChiP products can be used in different markets, allowing a quick succession of new products based on their core technology. Vicor’s plan, as illustrated in the slide below, is to develop very high-performance products for their HPC and Automotive customers. They will then map new products based on the same technology into their top 100 customers along with making those products available to their channel partners to further their penetration into the market.

New Product Strategy (Vicor’s Annual Meeting replay)

The ChiP is the future for Vicor, and they have invested and planned for success. Everything is in place, including the design, cost, size, efficiency, manufacturability, infrastructure, and patents. Now it is just a matter of time before the products regain traction in the GPU market and the sales and stock price start an upward trend.

Business Plan to get to $1,000,000,000

During the annual meeting, Vicor again reiterated that their ChiP Fab is capable of over $1,000,000,000 in yearly revenue, and their business plan supports getting there. Royalty income will be in addition to the $1B. Vicor has modeled for 65% gross margins and a 35% net. The CEO elaborated, “I think I can say that we do expect to fill our Fab.”

Diversification and Revenue Bridge

Investors are most interested in Vicor’s AI solutions. However, Vicor has a long history of providing products to the defense, industrial, and aerospace markets. Phil Davies spent a lot of time at the annual meeting addressing these markets. He commented that this year, they will release over twenty new high-power and dense products that leverage their new ChiP Fab capabilities.

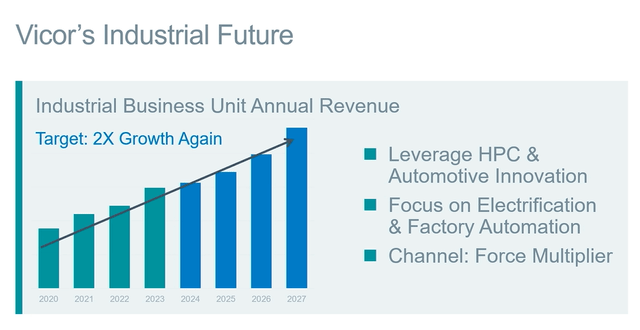

The products that are sold into the defense, aerospace, and industrial markets will supply a “revenue bridge” until Vicor gets back into high-volume GPU deliveries. Vicor had a 2X growth in their industrial markets over the last five years. Their plan is to again double the revenue in the next five years.

Forecast for industrial market (Vicor’s Annual Meeting replay)

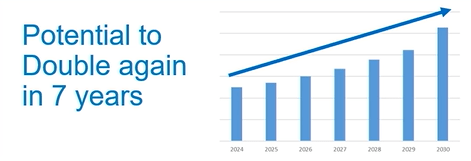

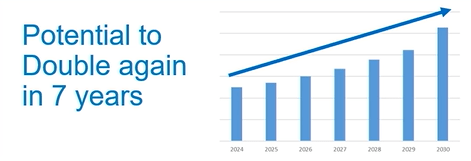

For defense and aerospace, they have grown 2X in the last 10 years, and their current plan is to double that business in 7 years.

Vicor’s Defense and Aerospace Future

Forecasted growth in defense market (Vicor’s Annual Meeting replay)

Auto

For years, Vicor has made significant investments in the automotive industry. They are engaged in onboard charging, 800/400 to 48-volt powertrain conversion systems, 48V zonal architecture, and they now have renewed interest in all classes of cars from the ICE to the BEV.

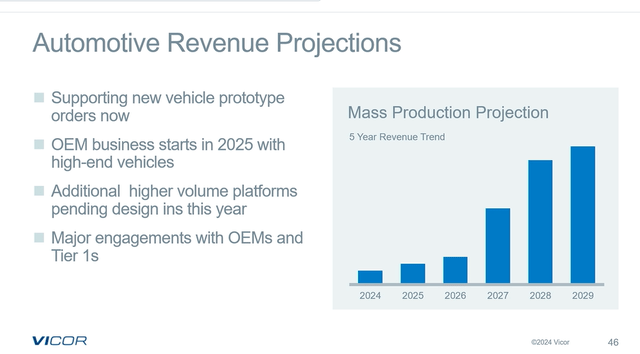

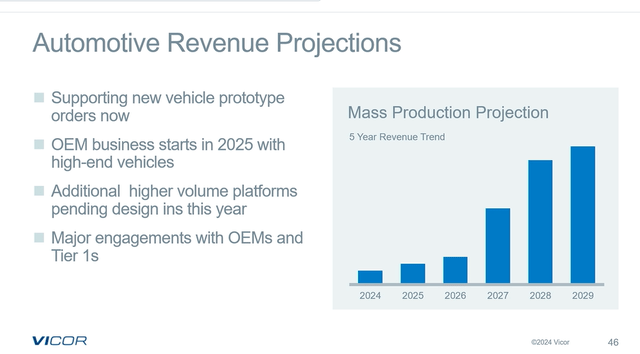

Two OEMs are going to start production ramps in 2025 with the Vicor parts. These are specialty high-performance automobile companies, like Ferrari. At the annual meeting, Vicor announced that they have four additional auto design wins that will go into production in later years. At the Q2 conference call, Vicor stated a new design win for 800V charging that is expected to produce revenue in 2026. Vicor can secure up to $2,000 of content per car.

Recently Vicor announced that licensing will enable more rapid scaling of their automotive market opportunity as they expand relationships with OEMs and automotive tier 1 suppliers.

Late this year, the two specialty automotive opportunities should provide the start of the revenue ramp, with 2025 and 2026 slowly increasing, and then Vicor expects a big jump in revenue in 2027. This ramp was highlighted in Vicor’s annual shareholders meeting, as you can see below.

Currently, Vicor basically gets no revenue from this market, so all auto revenue secured in the future will be incremental.

Automotive growth (Vicor’s Annual Meeting replay)

Competition

The power supply industry is fragmented with many competitors. Wolfspeed (WOLF), On Semiconductor (ON). Max Linear, (MXL), Monolithic Power Systems, STMicroelectronics (STM), Advanced Semiconductor Engineering (ASX), Infinion (OTCQX:IFNNY) are some of the notable competitors that Vicor faces.

Monolithic is Vicor’s main competitor in the AI space. While Monolithic’s converters are not as good as Vicor’s, Monolithic has done a great job executing, as they were able to guarantee the supply that Nvidia demanded, and they are the incumbent on the Nvidia H100.

Infinion has good specs on their TDM22544D & TDM22545D dual-phase power modules which may compete with Vicor in the High-Performance Computing arena. However, while their specs are close to Vicor’s current Gen 4 solutions, they are not nearly as dense as the Vicor Gen 5 solution. The Infinion converter is 1A/mm2, while the Vicor Gen 5 is 3A/mm2. The other differences are the Infinion converters are still multiphase, and they use a two-step approach to get from 48V to sub 1V. Vicor uses current multiplication technology and has a one-step 48V to sub 1V solution.

ASE (ASX) has announced a VPD solution which resembles Vicor’s 1st generation VPD by using embedded capacitors. Their density does not compare to Vicor’s.

The power supply industry is very competitive while many of Vicor’s competitors are much larger with significantly greater resources. Vicor has a history of innovation, but they must execute to stay ahead.

The competition keeps nipping at Vicor’s heels, and everyone wants to win in the AI arena. Vertical power is needed for future generations of GPUs, and Vicor claims that they have a second-generation VPD while the competition is copying their patent protected 1st generation solution. Vicor elaborated that the 1st generation has problems with complexity, heat, and space, and they have eliminated these problems with their second generation.

I have heard many concerns that GaN and SiC based power supplies will perform better than the Vicor Si based converters. That is only one aspect of the power supply as the packaging, magnetics, design and density are as important or more so. I asked the CEO if they will switch to GaN or SiC, and he responded that when GaN and SiC can benefit our products, and are stable and cost-effective enough, we can switch.

Having a better product does not always win. Vicor needs to be competitive in cost and value and be able to produce production quantities in a timely manner.

Upcoming Catalyst

- A positive outcome from the ITC case could easily move the share price up $10, as infringing NBM modules could be banned from coming into the country. A decision is expected in October.

- New design wins from a major GPU manufacturer.

- Delivery of the initial Gen 5 current multipliers to Cerebras.

- Vicor buying back their stock from the new repurchase plan.

Forecast

Vicor failed to give guidance and Phil Davies explained that there could be a lot of variability either up or down, especially in the HPC arena. This makes forecasting very precarious for the next couple of years. With input from @aahicks and @shortybovine I have the following.

2024: $340,000,000 in revenues with $.45 EPS. (excludes the one-time litigation contingency)

2025: $415,000,000 in revenues a $1.15 EPS.

2028, or sooner: $1,000,000,000 in revenue with $6.00 EPS.

Risks

- With the limited number of shares outstanding, Vicor is a very volatile stock, and it is not for the faint of heart. Please do your due diligence.

- Vicor did not give guidance on their 2Q conference call, as their range of possibilities was very wide. We could have another rough quarter or two.

- Competing technology could improve and be as good or better than Vicor’s.

- Companies of much bigger size and resources compete against Vicor.

- Competitors don’t respect intellectual property, and the courts may not agree with Vicor’s patent position.

- Vicor is new to the automotive market and has yet to prove it can be successful.

- The vertical and fifth-generation products are new, and we could see delays.

- The new facility could experience setbacks.

- I don’t know what I don’t know.

- Vicor’s has a limited shareholder base, with the CEO owning almost ½ of all the shares. With this limited supply of shares, the stock price is subject to extreme price fluctuation, up and down.

- The CEO has full voting power and complete control over the company.

Conclusion

Vicor’s management is sending a strong message with their insider buys. They were selling at the top, and now they are buying at the bottom. The share buyback program that was put into place is very significant. The old program has been around since 2000, and the only reason they would put a new plan into place is if they were interested in buying shares. Vicor, and The CEO have a history of opportunistic buys.

Vicor shares sold for 23 times sales in 2021. It now trades at 4 times revenues with $252 million in cash and a history of strong cash flow. With any good news, investors will see that Vicor is significantly undervalued and will bid the shares higher. I expect Vicor will eventually get back into Nvidia. When that happens, the multiples will again expand significantly. For a point of reference, Vicor’s closest competitor Monolithic Power is now trading at 24 times revenues.

Vicor has leading-edge technology, and now they have a state-of-the-art ChiP Fab that has the capacity for over $1,000,000,000 a year in revenue, and as The CEO stated, we expect to fill the Fab. When they fill the Fab, the share price will be significantly higher.

The CEO is 77 years old. Someday, he will sell the company, and when he does, it will be for significantly more than the market price.

I cannot predict the short-term share price. Without guidance, Vicor still might have a rough Q or two; however, the share price will be much higher in a year, and I have a $50 price target. As AI and auto pick up, the share price will continue on an escalating upward trend.

Vicor is a strong buy.