Tim Platt/DigitalVision via Getty Images

Thesis

Viking Therapeutics (NASDAQ:VKTX) is a biotechnology company in the clinical stage focused on the discovery and development of novel treatments for metabolic and endocrinology disorders. Viking’s most promising program is VK2735, a dual agonist (activator) of glucagon-like peptide 1 (GLP-1) and glucose-dependent insulinotropic polypeptide (GIP) receptors.

VK2735 is aimed for the treatment of obesity, and it accounts for two formulations currently being tested in the clinic. The first one is a subcutaneous weekly injection (the company is also planning to test it as a once a month treatment), which is on the verge of finishing Phase II clinical trials and planning to start Phase III, once they receive the FDA clearance after the end of Phase II meeting scheduled in Q4 2024. The second formulation is a daily tablet (oral), which has recently delivered good tolerance and safety results in its Phase I clinical trials, and it is expected to start Phase II in Q4 2024. If/when it achieves FDA approval, VK2735 would become the first oral GLP-1/GIP dual agonist treatment for obesity. In my opinion, the companies that succeed in the development and commercialisation of oral incretin-based anti-obesity drugs, are likely to become very strong players in the weight loss drug sector.

In this sense, Global Data highlighted that given the advanced clinical stage of VK2735, the drug is likely to become the first addition to the obesity drug market after the “miracle drugs” commercialised by Eli Lilly (LLY) and Novo Nordisk (NVO). The news negatively impacted LLY’s and NOVO’s shares to fall by 3%. However, the most recent projections of the obesity drug market still forecast LLY and NVO to dominate the market even after the approval of potential competitors. Furthermore, Eli Lilly’s decision to reduce the price of Zepbound by 50% when acquired through the LillyDirect platform, caused the sell-off of several stocks including Viking, which temporarily fell 9%, while showing a small recovery towards the end of the day, closing at $61.41.

Despite Lilly’s announcement, and NVO/LLY’s dominance of the obesity market, I believe Viking is still a strong contender given the clinical performance of their product candidates so far. It would be very naive from my side to expect Viking to match the revenue performance of LLY/NVO’s drugs, given the advantage of being the first ones in the market. However, I believe the potential revenues driven by VK2735 would be transformative to Viking, and thus to VKTX’s investors.

In my opinion, Viking Therapeutics seems to be a strong candidate in the race for the development of drugs for the treatment of obesity and its comorbidities. Nonetheless, there are many more companies pursuing this indication, such as Amgen (AMGN), Altimmune (ALT), AstraZeneca (AZN), Roche Holding (OTCQX:RHHBY), Structure Therapeutics (GPCR), Pfizer (PFE), among others. Thus, the competition is fierce. Viking is a relatively small biotech company with only 29 employees, and a market cap in the range of $7 billion, aiming to profit from an obesity market whose size is estimated to reach up to $144 billion by 2030. Hence, there are numerous analysts pointing to Viking as a target for M&A. Although, that is a very likely option, I think that given the positive clinical performance of VK2735, so far, as well as the potential to become the first GLP-1/GIP receptor agonist oral formulation in the market, Viking Therapeutics has a larger upside potential if it was to remain independent, perhaps allowing for strategic partnerships in order to facilitate a successful penetration in the market.

Overall, this article will be analysing Viking Therapeutics’ updates, including the most recent clinical developments associated with VK2735, as well as its comparison against other drugs under development in Phase II clinical trials. As well as a view into VKTX’s H1 financials and valuation. In order to provide readers with my view on Viking Therapeutics, and to empower them to make an informed decision on whether VKTX suits their portfolio or not.

Scientific Overview

Before diving into VK2735 development, clinical performance and competitive landscape, I think it could be useful to provide some background information about GLP-1 and GIP receptors as therapeutic targets for the treatment of obesity. So, feel free to skip this section and continue to the next if this one is not of your interest.

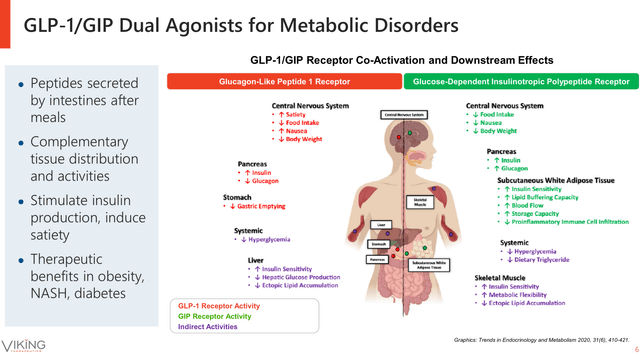

The first thing that I consider relevant to clarify it is that both GLP-1 and GIP are the two most important incretin hormones in our system. Incretins are hormones produced by cells located in our small intestine and are released to the bloodstream after eating. Once in the bloodstream, the incretins travel towards the targeted cells, where the hormones bind to its receptors (GLP-1R and GIPR are the receptors for GLP-1 and GIP hormones respectively).

The GLP-1R and GIPR expression have been identified in the insulin-producing pancreatic cells, adipocytes (fat cells), and brain cells located in the hypothalamus. Among other functions, the hypothalamus is the part of the brain controlling our appetite. Interestingly, some cells have shown dual expression of GLP-1R and GIPR. In the case of GLP-1, once it binds to its receptor, it results in a reduction of the appetite, increases the sensation of satiety, increases insulin production, reduces the hepatic lipid content (hepatic steatosis), reduces gut motility and gastric emptying, and reduces insulin resistance.

On the other hand, GIP-GIPR binding has been associated with appetite reduction, increased lipid formation, and reduced gastric emptying. Meanwhile, the dual binding of GLP-1 and GIP to their receptors (see image below), has been linked to a synergistic effect that induces an increased weight loss and further reduction of appetite when compared against single GLP-1 or GIP alone. In addition, the combined activity of GLP-1 and GIP hormones increases insulin production, reduces lipid formation, and increases insulin sensitivity in the muscles. Thus, suggesting that the dual treatment targeting GLP-1 and GIP receptors might be a more efficient therapeutic approach against obesity and its comorbidities than treatments based on GLP-1 alone.

Dual GLP-1 and GIP receptor agonist systemic effects (Viking Therapeutics June Corporate Presentation)

VK2735

Viking therapeutics’ most advanced program is VK2735, which is a dual GLP-1 and GIP receptors agonist. In biochemistry, an “agonist” is a small molecule that binds to a receptor and mimics the effects of the native substance that usually binds to the receptor. So, in the case of GLP-1R and GIPR, an agonist would mimic the effects of the native GLP-1 and GIP hormones. Hence, VK2735 is a dual activator of GLP-1R and GIPR, likewise Tirzepatide (commercialised as Mounjaro and Zepbound by Eli Lilly).

VK2735 Subcutaneous

To date, the company has two formulations of VK2735 in clinical trials. The first one is a subcutaneous injection, which is in Phase 2 clinical trials as a once a week treatment. However, in the Q2 2024 earnings call, Brian Lian Viking’s President and CEO commented the following when referring to the Phase II top line clinical trial results, VENTURE, released last February:

Following completion of dosing in the VENTURE study, patients returned to their respective clinical sites at various time points for follow-up assessments, including pharmacokinetic measurements. We believe the resulting PK data merit the development of less frequent dosing regimens. To this end, we expect to explore monthly dosing of VK2735 in a future study.

In this sense, Viking is expecting to test the effects of VK2735 as a once a month subcutaneous treatment. However, the details of this test are yet to be disclosed. I believe the company is likely to provide more details after the end of Phase II meeting with the FDA in Q4 2024.

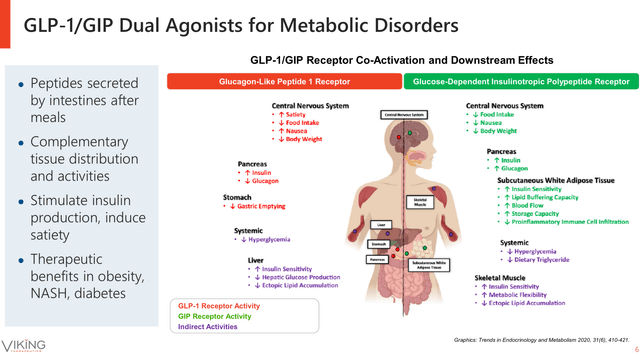

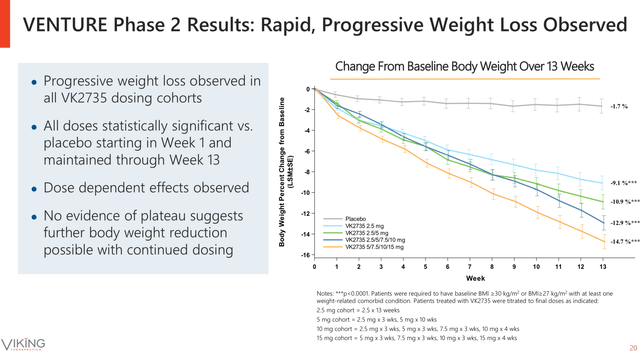

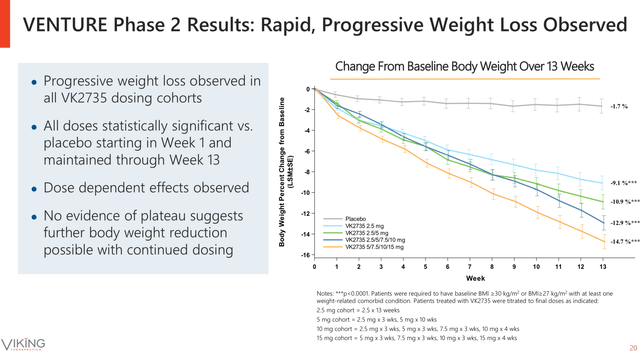

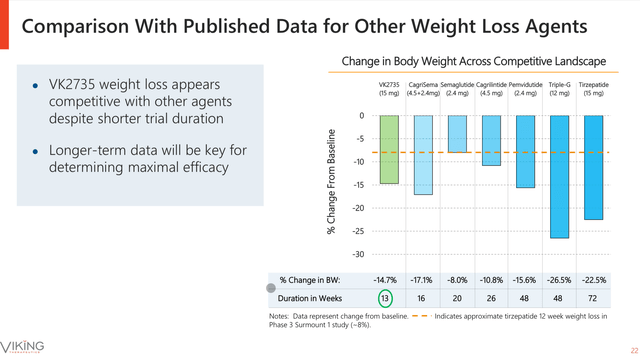

VENTURE’s latest data demonstrated that VK2735 once a week subcutaneous injection induced a weight loss up to a 14.7% from baseline and 13.1% when normalised against the placebo in only 13 weeks of treatment. In addition, VK2735 continued to exhibit relatively low severity of treatment emergent adverse events (TEAEs), with no severe events reported at any dose and the majority of TEAEs observed at the first week of treatment. Moreover, the data showed that higher doses of VK2735 induced higher weight loss, dose-dependent response, with a rapid effect from the first week of treatment onwards and no sign of slowing during the 13 weeks (see image below). Then, suggesting that higher doses of the drug and/or a longer treatment period might induce higher weight loss.

Week by week effects of subcutaneous VK2735 weekly injections on body weight reduction (Viking Therapeutics June Corporate Presentation)

VENTURE’s promising results sent the share price 145% up on February 27th when it reached its all-time-high ($99.41). Since then, the share price has observed approximately a 35% decline amid the pressures exerted by the data released by numerous competitors, as well as the Global Data projections mentioned in the first section of this article.

VENTURE’s end of trial meeting with the FDA is expected to end in Q4 2024. However, given the written feedback obtained from the Type C meeting with the FDA, the company announced that they are progressing the development of VK2735 subcutaneous formulation into Phase III. In this sense, the company committed to share details related to the Phase III experimental design after the end of Phase II meeting with the FDA.

VK2735 Oral

The second VK2735 formulation is a daily oral tablet, which is expected to start Phase II clinical trials in Q4 2024. Regarding this oral formulation, the company stated in its Q2 2024 earnings press release the following:

The company believes a tablet formulation could represent an attractive treatment option for patients who are hesitant to initiate injection-based therapy, or for those seeking to maintain the weight loss they have already achieved. A key advantage in this regard is the potential to transition patients from the subcutaneous formulation to an oral formulation which utilizes the same molecule. Viking believes this may reduce the risk of unexpected safety or tolerability challenges, and could be an attractive option for both patients and clinicians.

Given that NVO’s Rybelsus is already in the market, an oral formulation of Semaglutide, VK2735 wouldn’t be the first incretin agonist in oral therapy. However, if VK2735 obtains regulatory approval, it might become the first GLP-1R and GIPR dual agonist in oral formulation. Interestingly, despite the practical advantages that oral formulations have against injectables, Novo Nordisk reported sales-revenue from Rybelsus to be DKK 10,931 million in H1 2024, versus DKK 61,086 million from the injectable formulations in the same period of time.

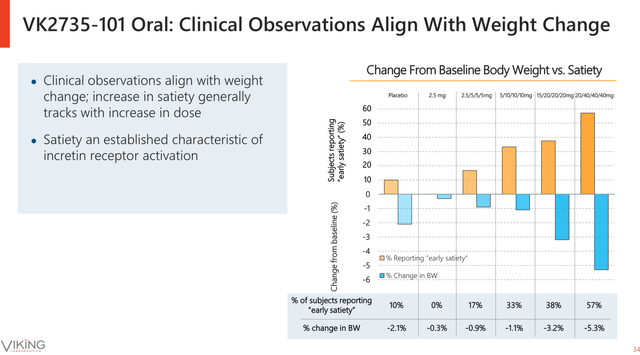

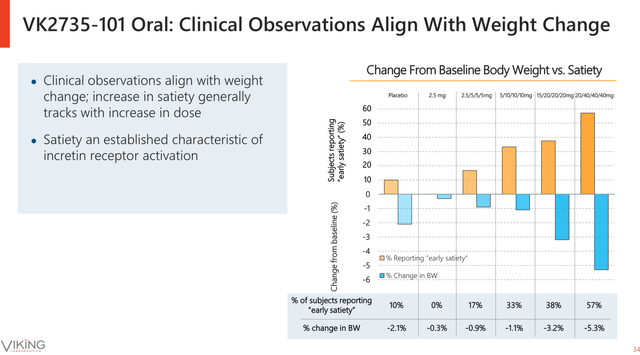

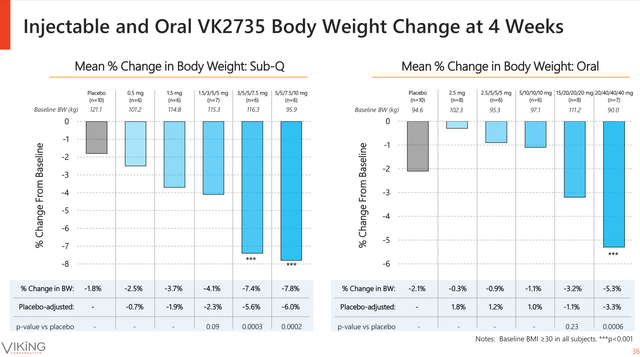

In March, the company released top-line results from the Phase I clinical trial associated with the VK2735 oral formulation. The study revealed encouraging data, in which the once daily VK2735 tablet induced up to 5.3% weight loss from baseline, with 57% of the people treated with the tablet achieving weight loss of 5% or greater at four weeks of treatment. Importantly, the tolerability results showed that the once a daily tablet, ranging from 2.5 mg to 40 mg, did not cause clinically meaningful gastrointestinal TEAEs. Suggesting that the oral tablet is well tolerated and safe at the concentrations tested.

According to data released by the company in its June 2024 Corp Presentation (see image below), the higher the VK2735 tablet dose, the larger the percentage of people reporting early satiety and the greater the weight loss percentage.

Early satiety and weight loss correlation after taking daily doses of oral VK2735 for four weeks (Viking Therapeutics June Corporate Presentation)

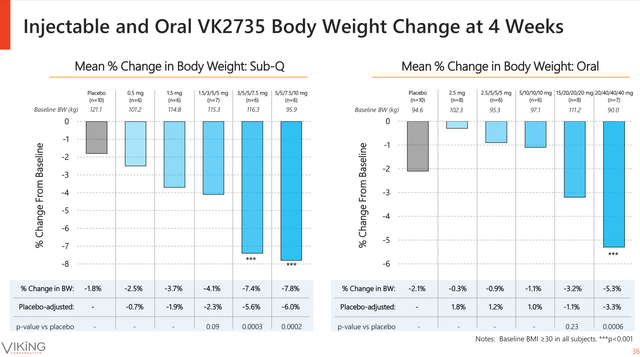

On the other hand, the oral formulation performs relatively well when compared against the subcutaneous formulation. The subcutaneous formulation induced up to 7.8% weight loss after 28 days of treatment, the daily tablet induced up to 5.3% weight loss in the same period of time. Nonetheless, the differences between both treatments become more significant when normalising against the placebo (see image below).

VK2735 Subcutaneous vs Oral at four weeks of treatment (Viking Therapeutics June Corporate Presentation)

In my opinion, the stronger performance of the subcutaneous versus the oral formulation is the reason why the company is partially focusing on the oral formulation as a maintenance treatment. However, in terms of body weight loss, the Phase I oral VK2735 results are already superior to Rybelsus’s. The once daily semaglutide oral formulation demonstrated to induce 3.7 Kg body weight reduction after 26 weeks of treatment with Rybelsus 14 mg.

On the other hand, it is important to remark that based on the oral VK2735’s safety and tolerability profile, and the progressive dose-dependent effect of the concentrations up to 40 mg, Viking announced during the Q2 2024 earnings call that they are already testing concentrations up to 100 mg, and that further details about the efficacy, safety and tolerability results from those doses will be shared later this year. Thus, it would be interesting if the high concentrations of VK2735 maintain the good tolerability results while significantly increasing the body weight loss. Moreover, I believe the results from those high concentrations will be very informative at the time of planning the experimental design for the Phase II clinical trial due to start in Q4 2024.

Weight Loss Competitive Landscape

Nowadays, Eli Lilly and Novo Nordisk are dominating the weight loss market, and more importantly the most recent projections by Global Data still forecasts the two companies to dominate the market in the foreseeable future, despite the potential entry to the market of several product candidates that are currently under development. Interestingly, a recent poll made by Seeking Alpha, revealed that SA readers believe Amgen’s MariTide is the most promising obesity product candidate, given its Phase I results, closely followed by AstraZeneca’s and Viking’s product candidates.

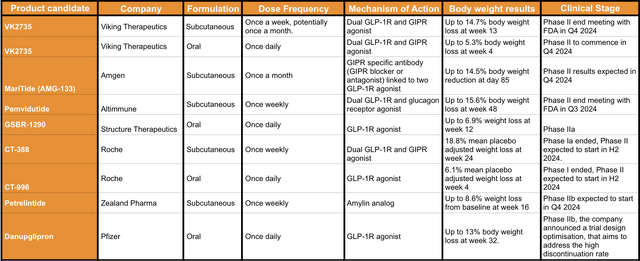

Hence, I think it might be in order to summarise the status of some of the major players in this weight loss race. In this sense, I would like to point out that given the increasing numbers of companies entering this race, I focused this section on product candidates in Phase II or above, as they are the closest candidates to joining Lilly/Novo’s duopoly.

The following table (see image below), summarises the weight loss product candidates that are either scheduled to start Phase II this year or are already ongoing Phase II clinical trials. Apologies in advance if I am missing some product candidates.

Summary table of the incretin-based weight loss product candidates in Phase II or Phase III clinical trials (Data collected by the author from press releases and 10Q reports provided by the companies listed in the table)

Although the comparison between the product candidates is not very straightforward, given the differences in the experimental designs and time of assessment. I would like to highlight a couple of trends, the first one is that the subcutaneous formulations seem to have a slight advantage in terms of body weight loss against the oral formulations. However, in my opinion, the practical advantages of tablets vs subcutaneous drugs makes the oral formulation more desirable, particularly for patients in the maintenance treatments.

On this, it is important to remark that to date, little is known about the long-term weight regain after stopping the incretin treatment. Indeed, based on the short-term data that most companies are releasing about weight dynamics a few weeks after ending the treatment, I would expect that unsupervised patients are likely to regain their baseline weight within a year of stopping the treatment. Thus, oral formulations combined with diet/exercise might facilitate weight maintenance long-term. Perhaps, slowly reducing the dose over time until complete withdrawal could be plausible for long-term maintenance. Interestingly, the majority of the oral formulations listed in the table above, have reported a fairly low percentage of TEAEs with the majority of the adverse events classified as mild or moderate, which in my opinion supports the use of this formulation as a long-term maintenance treatment.

The other aspect to be highlighted is that with the exception of the drug developed by Zealand Pharma (OTCPK:ZLDPF), all product candidates are based on GLP-1R agonists, with five out of nine product candidates combining GLP-1R agonism with the modulation of GIPR or Glucagon receptor agonism. In this sense, MariTide, developed by Amgen, is the only product candidate that aims to block GIPR while releasing two GLP-1R activators. This therapeutic strategy is very interesting given that GIPR agonism might lead to reduced sensitivity in long-term treatments, which is not a risk for antagonists/blockers. On the other hand, GIPR antagonists are associated with low lipid formation, increased muscle sensitivity to insulin, increased function of insulin producing cells in the pancreas and low triglyceride levels. Therefore, it will be very interesting to see MariTide’s complete results when released in Q4 2024.

Another strong candidate is Pemvidutide, from Altimmune, a dual agonist but in this case targeting GLP-1R and Glucagon receptors. Pemvidutide not only has released good results in body weight loss (up to 15.6% in 48 weeks) but also, to the best of my knowledge, it is the product candidate with the highest lean mass protection (21.9% lean loss index).

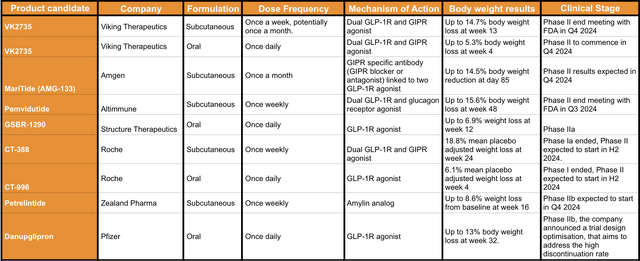

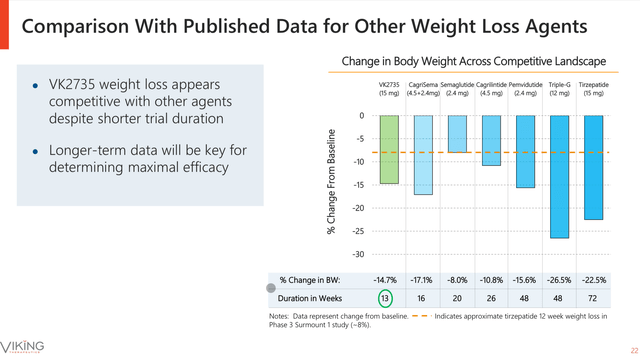

In terms of weight loss efficacy of subcutaneous drugs and drug candidates, Viking facilitated in its June Corporate presentation a comparative chart, depicting a comparison of VK2735 vs some of its competitors (see image below).

VK2735 subcutaneous Phase II top line results vs competitors (Viking Therapeutics June Corporate Presentation)

Although, I would like to highlight that the studies from which the data presented above are not directly comparable, it is interesting to observe that VK2735 seems to induce the highest percentage of weight loss in the shortest period of time, being superior to Tirzepatide, which has the same mechanism of action than VK2735. Moreover, the company is expected to release the complete data associated with the VENTURE study in the Obesity Week Conference to be held in November.

Financials

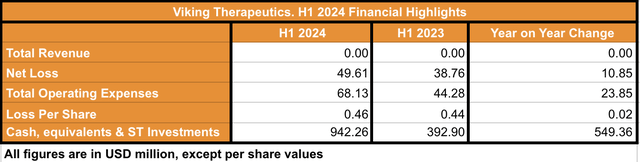

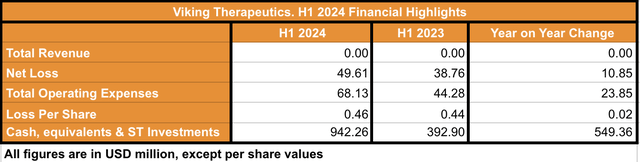

In terms of financial status, Viking reported, in its Q2 2024 financial results, to have $942 million in cash, equivalents and short-term investments by the end of June 2024 (see image below). The cash and equivalents held by the company at the end of H1 is 139.8% higher than the cash held at the end of H1 2023. The difference is a consequence of the $630 million in gross proceeds from the company’s public offering, closed in March 2024.

H1 2024 Financial Highlights (Data collected by the author from Viking’s Q2 2024 10Q report)

In contrast, Viking’s H1 net loss was $49.606 million, which accounts for a $10.85 million increase when compared against H1 2023. The company management commented in its latest earnings call that the ballpark cost of the Phase III trial associated with VK2735 will be approximately $300 million. Thus, considering that the H1 2024 operating expenses were $68 million (6-months cash burn rate), and adding the approximate cost of one Phase III trial, I believe the company holds enough cash and equivalents to fund operations (cash runway) for four years from June 2024. On the other hand, if the company moves two of its product candidates to Phase III, and assuming the same 6-month cash burn rate, Viking would have a cash runway of two years and a half from June 2024. Thus, despite the lack of revenue, the company seems financially stable, and able to fund operations for the foreseeable future, including to fund the scheduled clinical trials associated with its product candidates.

Valuation

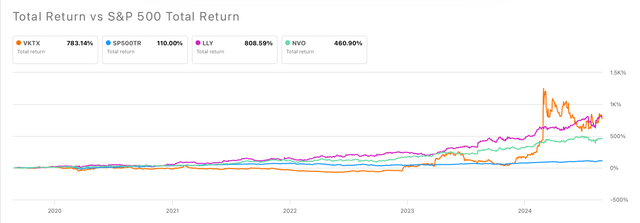

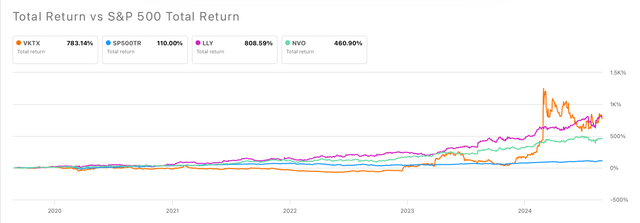

Viking’s shares have observed a 245% year-to-date increase. Furthermore, VKTX’s 5-years total returns largely outperformed the returns from the SP500 and NVO, and are a close second after LLY’s total returns (see image below).

VKTX’s 5-year total returns vs SP500 vs LLY vs NOVO (Seeking Alpha)

Today, VKTX shares are experiencing a bullish market, pricing the shares at approximately $63 or 3% increase when compared against the $61.16 at which the shares closed yesterday. Thus, showing signs of recovery after the share price tumble observed a couple of days ago when Lilly announced the Zepbound price reduction. In terms of technical indicators, the exponential moving average and the moving average convergence/divergence are currently signalling for a “buy” rating (see image below), while the relative strength index in the range of 50, indicates the stock is neither overbought nor oversold.

Year-to-date VKTX’s candle share price chart depicting EMA and MACD (Seeking Alpha/TradingView)

On the other hand, the Wall Street analyst’s consensus for the stock is a “Strong Buy” and a 77% upside potential in the next twelve months, while Seeking Alpha’s analysts rate the stock as a “Buy” and Seeking Alpha Quant as a “Strong Buy”. Considering those three ratings, my blended score is 8, which translates into a “Strong Buy” blended rating. However, Viking’s most advanced product candidates (VK2735 and VK2809), if successful, are expected to reach commercial stage by early 2027 in the best-case scenario, which explains the EPS growth consensus projecting 11% EPS growth by 2027.

Taking in consideration the strong financial status of the company, the upside potential driven by the good clinical performance of VK2735 oral and subcutaneous, balanced against the price/book value (7.36) which is significantly higher than the sector’s median (2.5), and a large short-interest of 15.2%. I rate VKTX shares as a “Buy” for long-term investors with a high-risk tolerance portfolio. Should investors consider starting a position in VKTX, they should also take into account the risks of such speculative investment based on clinical-stage product candidates.

Risks

Despite the encouraging clinical performance of VK2735, an investment in Viking Therapeutics is still speculative. Even if the product candidates have shown excellent performance in previous stages of clinical trials, it is not uncommon for some products to fail in the latest trials, or yield disappointing results when compared against the results from competitors, which may negatively impact the share price of the stock. A recent example of that, could be the recent crash of Neurocrine (NBIX), which is associated with the release of positive clinical results in Schizophrenia that were not impressive enough when compared against the results obtained by Bristol Myers Squibb’s (BMY) product candidate.

Additionally, Viking is a very small company in terms of workforce (only 29 employees). Which means that in the case of reaching the commercial stage, the company will need to exponentially increase its workforce or partner with a stronger/larger company that facilitates the manufacture and commercialisation of the products. Increasing the workforce, although necessary, is likely to lead to increasing operating expenses. While a partnership with a larger company might lead to giving up a large portion of the potential sale revenues. However, in both cases, the revenue reward should be able to compensate for the losses. Another option for Viking could be to merge with a larger company, although this should secure a significant payout to investors, I believe an M&A option might disappoint in the long term.

Finally, the most obvious and important risk is the number of competitors that are currently developing weight loss treatments based on similar mechanisms of action. In addition, to those I have mentioned in my competitive landscape section, it is important to remark that both Lilly and Novo are also developing their next-generation drugs, which are also showing very strong clinical results. Thus, remarking how important it might be for Viking to partner with another larger company in order to face the strong competition and secure a successful market penetration of its products.

Conclusion

In this article, I provided a deep overview of Viking’s obesity pipeline as well as its competitive landscape. In my opinion, the mechanism of action of VK2735 supports the strong clinical performance of the drug in terms of weight loss. However, it would be interesting to evaluate if VK2735 is able to also promote lean mass protection or have other positive health effects on other obesity comorbidities. With regard to the competitors, I think MariTide and Pemvidutide are very strong candidates against VK2735. While Roche’s and Structure’s oral product candidates might gain strength as potential competitors if the companies accelerate the development process.

Additionally, Viking holds another program in Phase II, such as VK2809, which is an agonist of the thyroid hormone receptor beta (TRB) in oral formulation aimed to treat non-alcoholic fatty liver (NAFL) and non-alcoholic steatohepatitis (NASH). Furthermore, recently the company shared promising preclinical results of its dual calcitonin and amylin receptor agonist, which in my opinion could become the next generation of obesity drugs if/when it obtains regulatory approvals.

In summary, I rate Viking Therapeutics as a “Buy” for long-term investors with high risk tolerant portfolios. My rating is based mostly on the upside potential driven from VK2735 oral and subcutaneous formulations. Meanwhile, VK2809 and the preclinical assets provide further upside potential to the company.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.