Cristian Martin

Introduction

Many investors may be aware of Argentina’s Vaca Muerta shale oil/gas discovery and unfulfilled potential, given the country’s dysfunctional political and economic environment. YPF Sociedad Anónima (YPF) the state-controlled oil company controls most of the acreage but has been hobbled by political interference from being able to fund full development. A handful of private companies have had greater success, such as Pampa Energia (PAM) and Tecpetrol, but the most successful has been Vista Energia (NYSE:VIST).

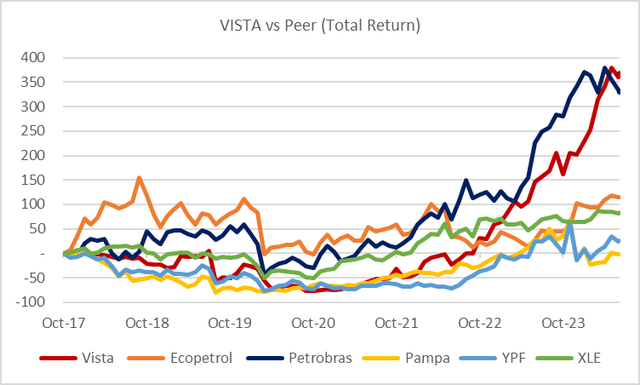

Performance

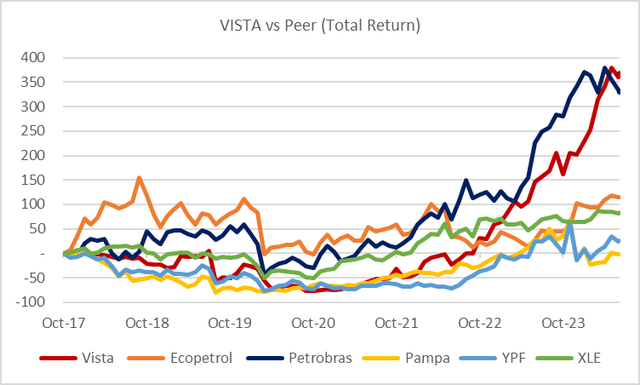

From its IPO in 2017 to Oct 2022, the stock severely underperformed driven by Argentina’s risk despite posting solid execution and growth. With the end of the last Kirchner/Peronist government, replaced by a business-friendly Milei administration, the stock has seen nearly 4x gains. Only Petróleo Brasileiro S.A. – Petrobras (PBR), including dividends, has fared as well.

Created by author with data from Capital IQ

What is Vista

While the company was incorporated in Mexico, it is an Argentine company whose main assets are in the Vaca Muerta basin. The executive team is mostly made up of former YPF executives led by Miguel Galuccio who worked most of his life in the Argentine oil sector, including as CEO of YPF from 2012-2016. The management team are experts on Vaca Muerta and dealing with Argentina’s political nuances.

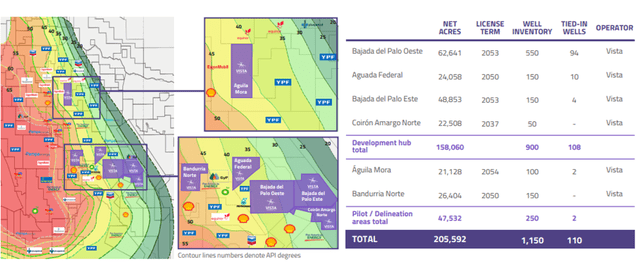

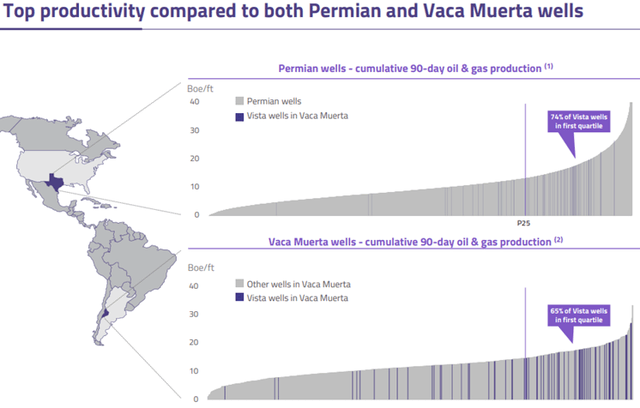

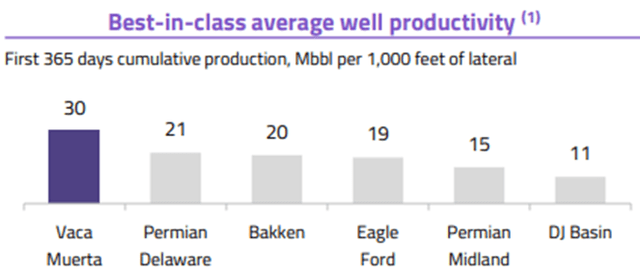

Vista has 6 blocks in Vaca Muerta for a total of 205k acres licensed to 2050 on which it has 108 producing wells with inventory to reach 900 wells most likely past 2030. Part of the company’s production and productivity success is due to the geological nature of the basin, where Vista has reached higher levels than the average US Shale wells.

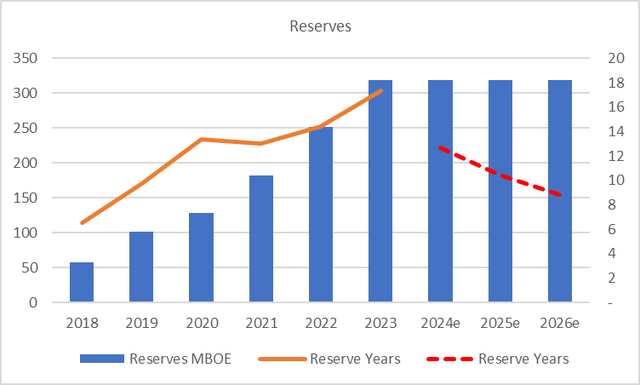

Reserves are vital for an oil & gas producer, with the norm around 7 years of production life (Reserves/Production). However, exploration and certification can be expensive, and thus many companies invest enough to maintain a steady state. Vista has grown reserves by 6x since 2018 with production life at 13 years for 2024 that could decline to 8 years on current plans if no new reserves are added.

Created by author with data from Vista Energía

Growth and Profitability

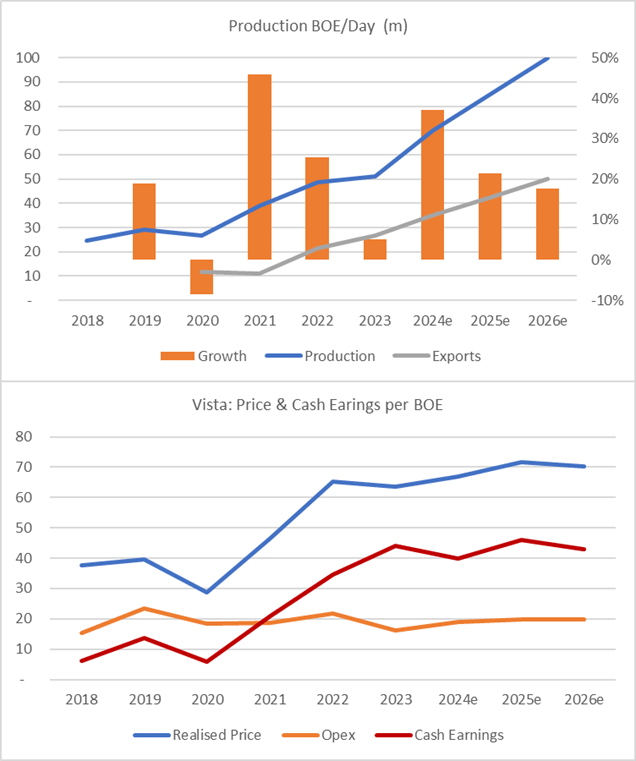

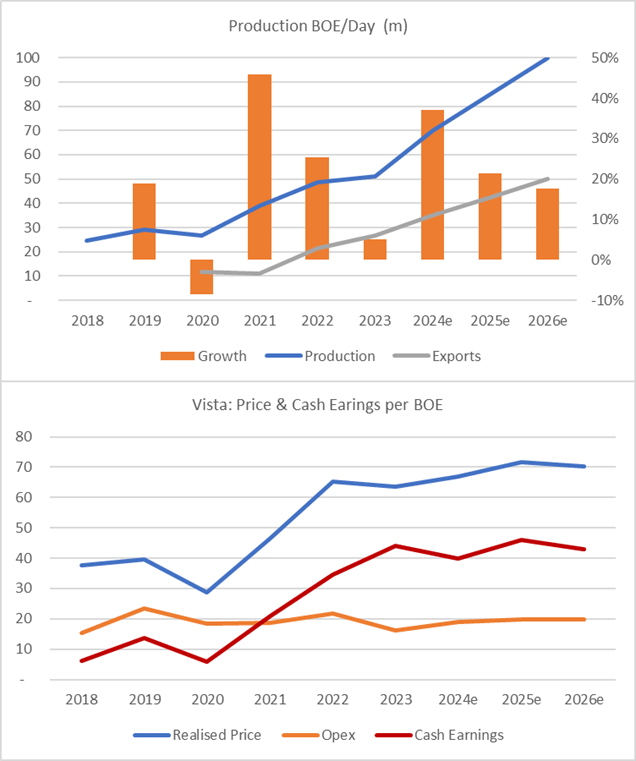

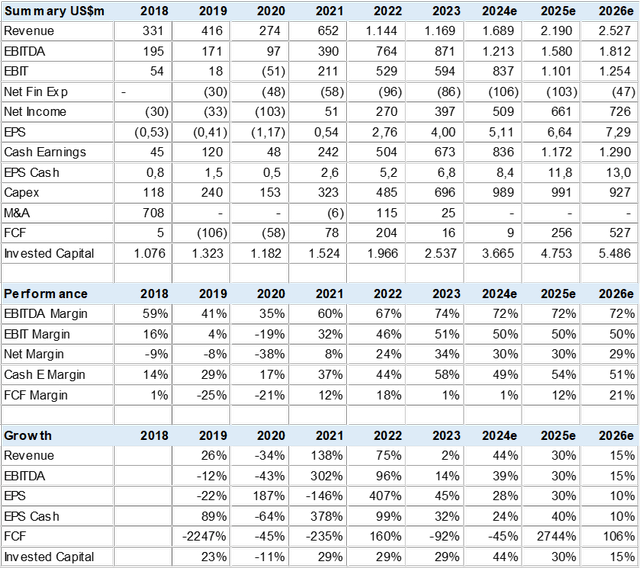

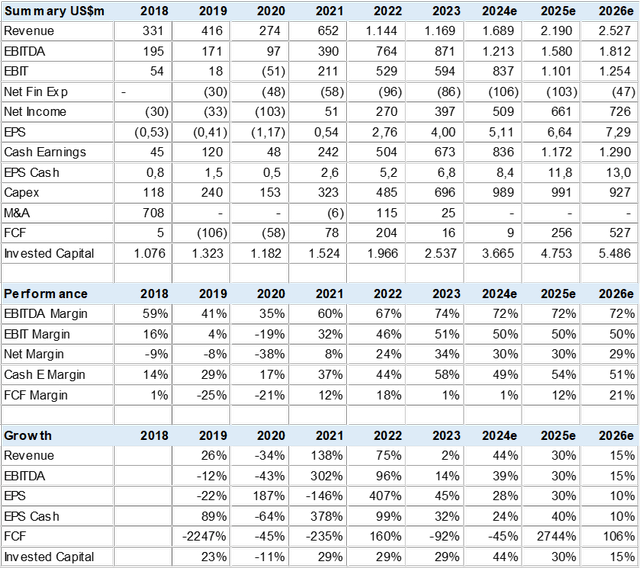

Vista has one of the highest growth rates in the Latam oil & gas sector with production targeted to increase by 40% in 2024 and 20% in 2025 and with a long-term CAGR of 17% to 2030 (150m BOE/D). The company has the cash flow, reserves, and distribution (pipelines) to reach 100mBOE/D in 2026 assuming realized oil prices stay in the US$70 range. This aggressive plan assumes that about 50% of production is exported and does not require added debt or capital funding.

Vista does not rely on subsidies and has been able to generate cash earnings with oil prices below US$30 due to improving costs and well productivity as mentioned earlier. The consensus estimates that Vista can post EBITDA margins of over 70% and fund its nearly US$1bn a year capex.

Created by author with data from Vista Energía Consensus Estimates (Created by author with data from Capital IQ)

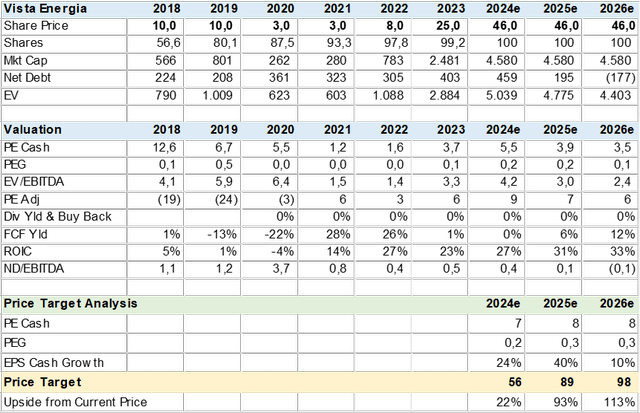

Valuation

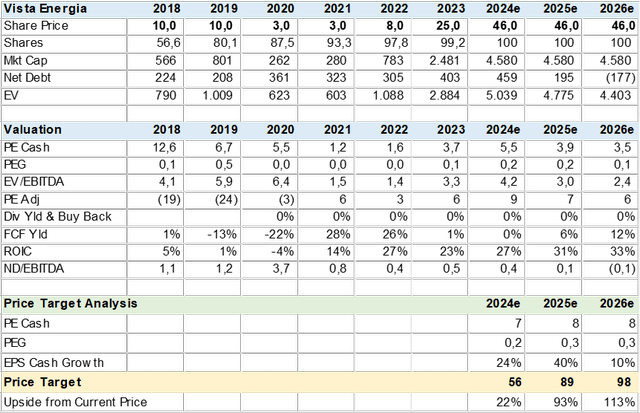

The market values the oil & gas sector at low multiples due to the dependence on volatile prices, high capital intensity, and decarbonization or peak oil outlook. This means that Vista should not expect higher multiples for its growth, and the upside is driven by production and earnings increases. The market has a YE24 price target of US$56 which backs into a P/CE of 7x (cash earnings = net income + depreciation) or 0.2 PEG, which in many other industries would be considered extremely cheap. For YE25 and YE26 I calculated a price target based on 0.3 PEG or 8x P/CE which provides for over 90% upside from current prices.

Consensus Valuation (Created by author with data from Capital IQ) Created by author with data from Capital IQ

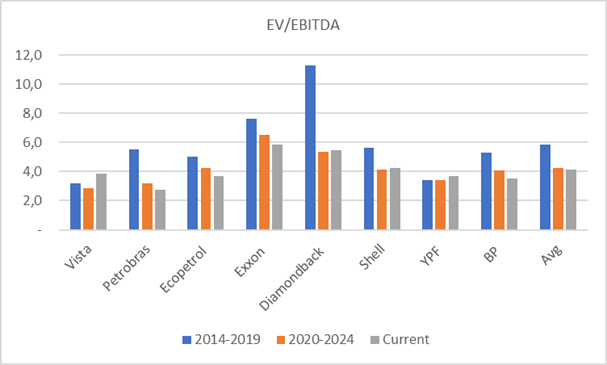

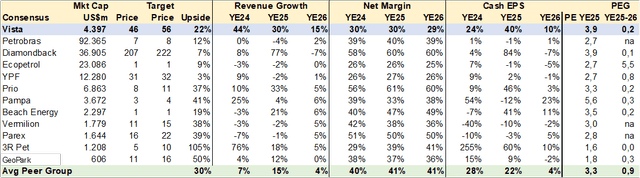

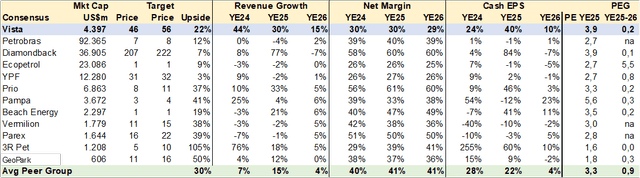

Peer Comps

Vista is a small-cap or junior oil company, and I compared its growth and valuation metrics vs. large and small peers in Latam and the US. As can be seen, valuations across the group are not expensive, but consistent growth is. The national champions, YPF, PBR, and Ecopetrol (EC), have no growth, according to the consensus. If Argentina can continue to de-risk the political/macro environment, Vista may turn into an attractive M&A target.

Created by author with data from Capital IQ

Risk

As a commodity-dependent sector, the risk of price volatility is inherent but generally accounted for in valuation. The Vista investment case has far more risk from changing government policies than operational execution. The main dilemma could be the inability to export production and the obligation to sell oil at artificial prices to local refineries. This Argentina-first type policy can severely damage cash flow and further expansion, as seen at YPF in the past.

Conclusion

I rate Vista a Strong Buy. The company has execution expertise with large and growing reserves that should provide for substantial production and earnings growth. At the same time, Argentina’s de-risking (at least for the next 4 years) should help Vista maintain valuations that could drive shares up 90% to YE25, in my view.