Andrew Toth/Getty Pictures Leisure

Since Vita Coco (NASDAQ:COCO) I final covered three quarters in the past in Might 2023 with a Maintain score, the inventory has dipped round 2% whereas the S&P 500 rose 23%. Since that article, there seems to be no materials change to the corporate’s fundamentals which for my part stay intact; COCO nonetheless has ample runway for worthwhile development and the corporate seems nicely positioned to revenue as a market chief with aggressive benefits to defend market share. Prospects nevertheless seem absolutely baked into the inventory value and at this stage, stay a maintain.

Overview

Vita Coco is a practical beverage firm, primarily working within the coconut water phase (with their flagship model Vita Coco together with non-public label clients), revenues of which accounted for over 90% of complete web gross sales for the fiscal 12 months ended December 2023. The remaining revenues have been generated by different manufacturers together with protein-infused sports activities beverage PWR LIFT, and water model Ever & Ever.

FY2023 efficiency

In line with Vita Coco’s This fall 2023 and FY2023 outcomes, launched on February 28, This fall 2023 revenues rose 15.4% YoY with web earnings of $7 million in comparison with a lack of $3 million the identical quarter the prior 12 months. FY2023 revenues rose 15.5% YoY to $493.6 million pushed by coconut water which grew 14% YoY. Gross revenue elevated 75% YoY to $181 million and gross margin improved to 36.6%, up from 24.2% the earlier 12 months, primarily resulting from a lower in transport prices. This in flip helped enhance the corporate’s backside line with web earnings leaping to $49 million in FY2023, from $8 million the earlier 12 months.

Close to time period, administration tasks revenues of $495 million and $505 million for FY2024, translating right into a low single digit development on the midpoint of their steering largely due to non permanent headwinds of their non-public label coconut oil enterprise and value/combine results offsetting development of their core coconut water enterprise. Full 12 months gross margin is projected at 36%-38%.

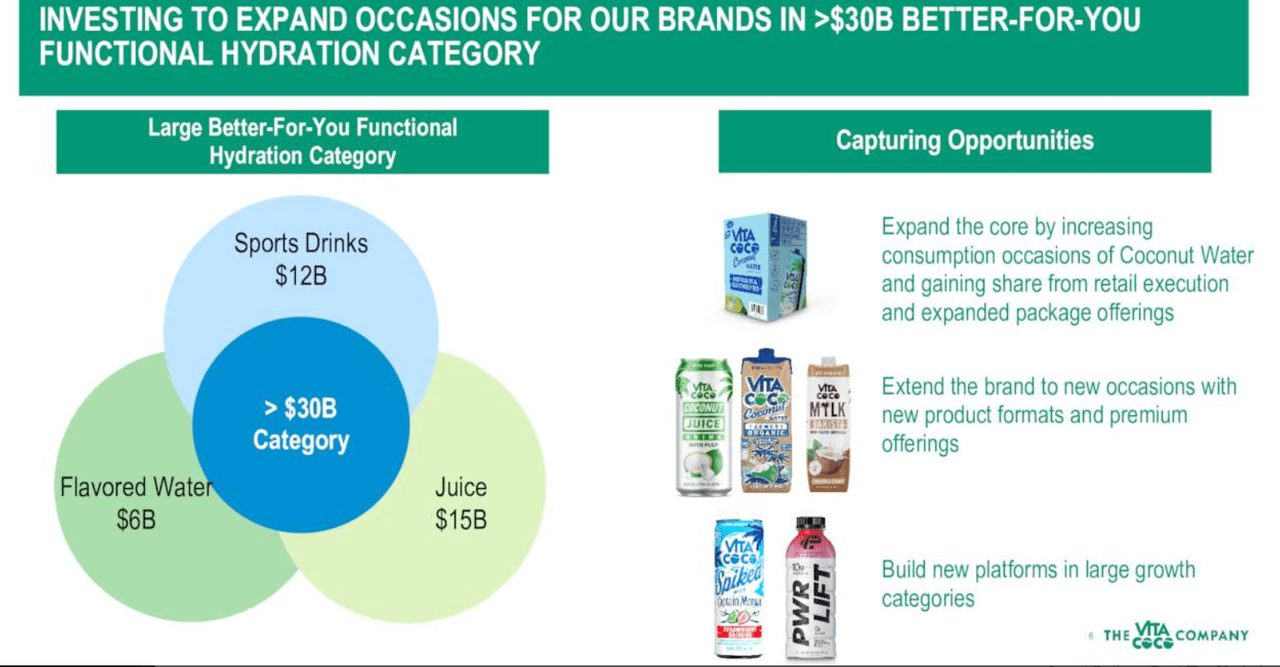

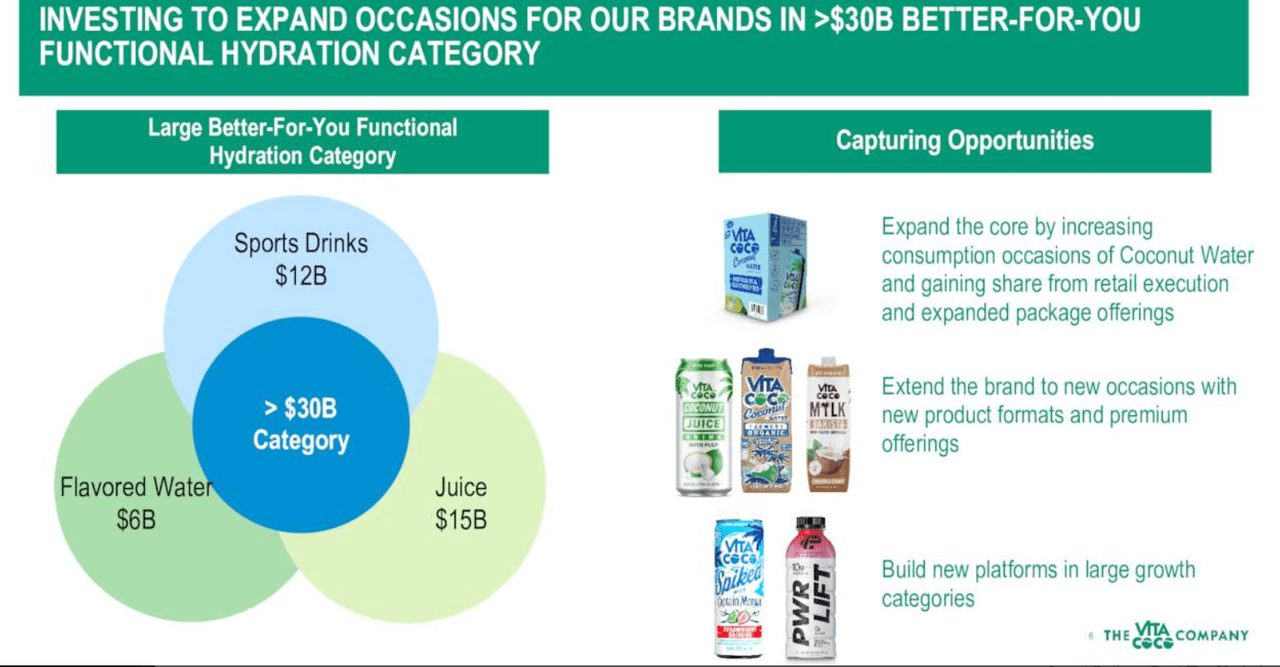

Long term prospects nevertheless stay optimistic. Development is anticipated to return in 2025 and past helped by continued power of their core branded coconut water enterprise with administration focusing on web gross sales development within the mid teens medium time period. The corporate has a number of development drivers to help this ambition. Of their greatest market, the U.S. (the Americas area accounts for 87% of revenues), coconut water represents simply 3% of water gross sales and the market is projected to develop at over 11% CAGR over the approaching years. The corporate intends to proceed investing in innovation and advertising to extend family penetration (which the corporate stated is simply round 11%) and coconut water consumption events within the better-for-you practical hydration market which is estimated to be price over $30 billion.

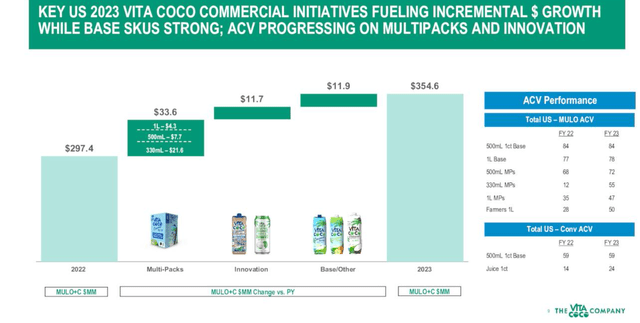

Vita Coco This fall 2023 earnings presentation

Investments in new packaging codecs have delivered good outcomes (their 300ml 12 and 18 multipack noticed retail scans enhance 45% in FY2023 with restricted cannibalization to their single models) and administration expects to proceed making additional investments on this space (as an example in cans) to help their long run gross sales goal.

Vita Coco This fall 2023 earnings presentation

Efforts to penetrate the premium phase (such because the natural phase by their natural model Vita Coco Farmers Natural which in keeping with administration of their This fall 2023 earnings name has appreciable runway for distribution enlargement), may additional drive gross sales. Worldwide markets which grew 17% YoY in FY 2023, current an additional alternative for Vita Coco, notably in markets such because the U.Okay. the place Vita Coco is the market chief with a market share of over 80%.

Administration is open to M&A alternatives which Vita Coco is nicely positioned to use with its sturdy stability sheet (debt to fairness of simply 0.82).

Plenty of elements may help profitability and margin enlargement medium time period together with continued productiveness enhancements (resembling provide chain optimization), scale economies, growing penetration in premium segments, in addition to administration’s effort to extend their branded share of gross sales versus their decrease margin non-public label enterprise. Moreover, administration is engaged on growing their share of coconut provide from Brazil which isn’t solely cheaper but in addition gives shorter cargo instances in comparison with Asia. Brazil at the moment accounts for roughly round a quarter of Vita Coco’s coconut provide (Asia accounts for the rest) and growing its share could possibly be probably margin accretive, thereby serving to enhance profitability (ROE = 27%).

Prone to stay market chief resulting from lack of significant competitors

Drinks is a extremely aggressive business however Vita Coco, the market chief with a market share of over 51% within the U.S. at this stage seems to be the fittest participant, and subsequently prone to stay in a dominant place for the foreseeable future. Vita Coco is already among the many extra competitively priced branded coconut waters in the marketplace, and far of their advertising communication highlights Vita Coco’s sustainability and social initiatives, help for small and native companies, and superstar endorsements amongst others, a positioning that resonates nicely with their millennial, Genz and multicultural viewers. Rivals like ZICO, C2O, Grace, Innocent Harvest and Goya amongst others are positioned otherwise in comparison with Vita Coco, and there may be little purpose to see a major change in positioning at this level; Vita Coco’s unmatched market share and dimension give them appreciable benefits when it comes to scale economies, advertising benefits, in addition to M&A benefits to defend market share towards smaller gamers. The fast U-turn of a significant coconut water non-public label buyer is an additional reflection of Vita Coco’s aggressive power.

Valuation

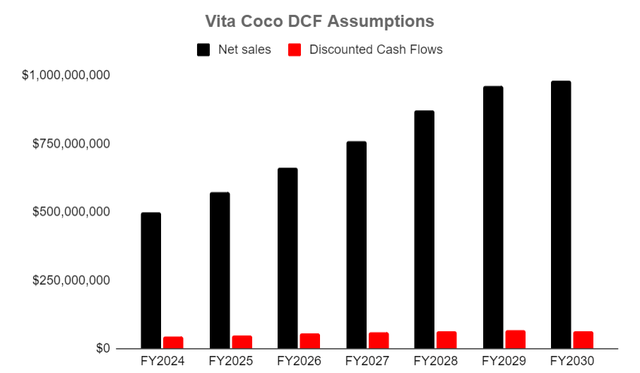

Taking the next assumptions suggests Vita Coco is price slightly below $1.3 billion ($1.28 billion), slightly below their $1.45 billion market worth at the moment.

Income development assumptions are primarily based on administration’s medium time period steering earlier than slowing right down to 10% over an estimated five-year interval by which era revenues would have almost doubled to over $950 million. Administration’s prime line development steering is just not unrealistic primarily based on development prospects for COCO’s greatest enterprise i.e. coconut water within the U.S. alone; COCO’s roughly $400 million coconut water gross sales within the U.S. and estimated 51% market share suggests America’s coconut water market is price roughly $800 million, or underneath a tenth of the nation’s orange and apple juice markets which mixed are estimated to be price round $9.4 billion (the U.S. orange juice market is estimated at $5 billion, whereas the nation’s apple juice market is estimated at over $4 billion). Taking America’s inhabitants of round 300 million roughly suggests a per capita spend on coconut water of round $2.6 per individual yearly which interprets into underneath 500 ml per individual (as of this writing a Vita Coco 300ml tetrapak carton prices round $2.70 on Walmart). A doubling of per capita consumption doesn’t look unrealistic.

Furthermore, administration’s investments on advertising, innovation, and penetration into premium classes together with comparatively restricted significant competitors may assist the corporate outpace business development (which as talked about earlier, are forecast at over 10% in keeping with analysis projections) and develop market share.

|

Income development YoY % |

15% YoY over 4 years, dropping to 10% in 12 months 5 |

|

Terminal worth % |

2% |

|

Internet margin % |

Regularly bettering to 12.3% (because the world’s main pure-play coconut beverage participant there are not any corporations akin to COCO nevertheless for perspective, U.S. vitality drink participant Celsius whose revenues are about double that of Vita Coco reported a web margin of 17% of their most up-to-date FY) |

|

Depreciation & CAPEX |

Beneath 0.2% every (Vita Coco operates a set asset-light enterprise mannequin and this isn’t prone to change) |

|

Low cost charge % |

9% (primarily based on price of fairness utilizing figures as follows: Danger Free Charge (U.S. Treasury yield) = 4%, fairness threat premium = 5% primarily based on market return = 10%, and Beta = 0.8) |

Writer

Conclusion

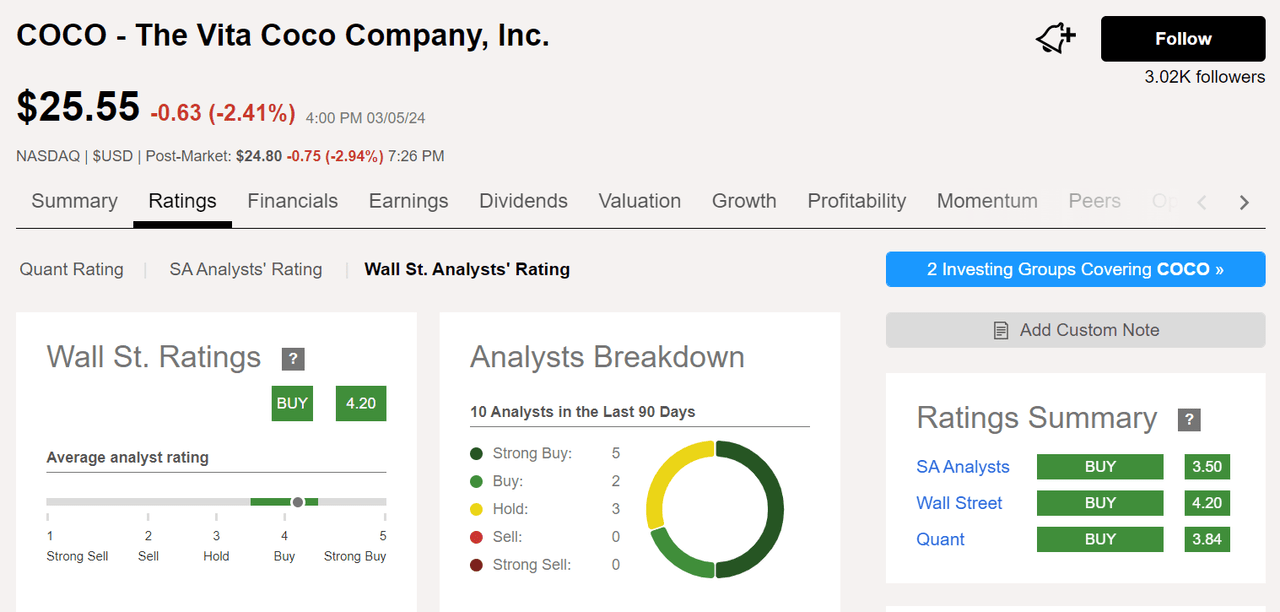

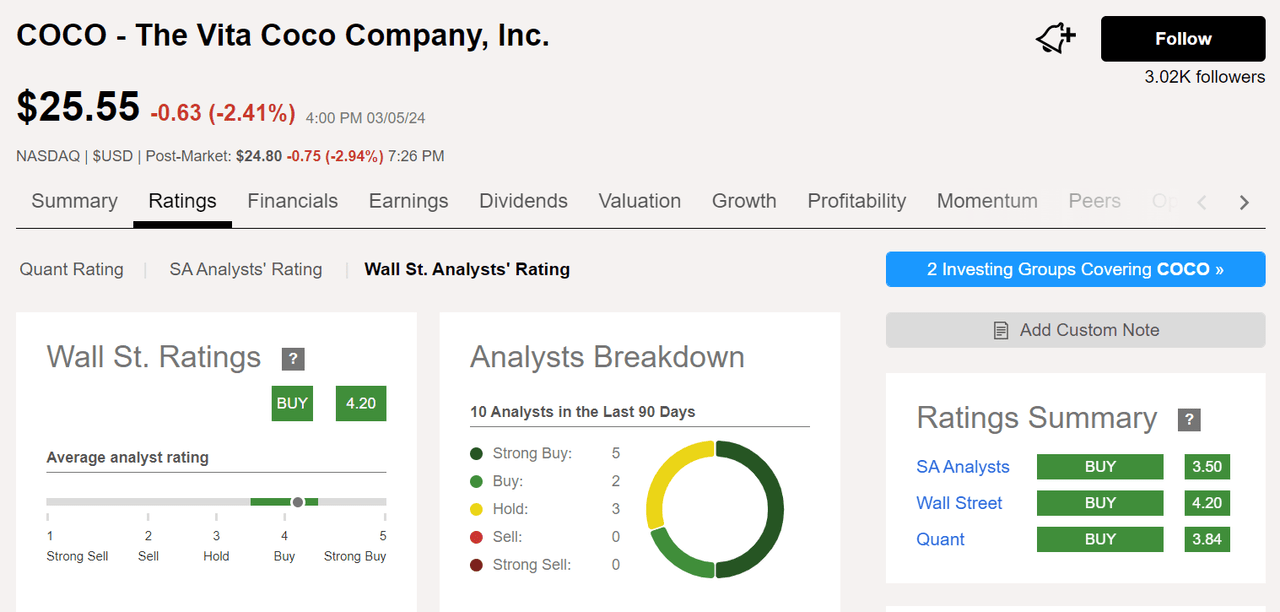

Vita Coco has a purchase analyst consensus score. Whereas some might view the inventory as a purchase given the corporate’s good fundamentals and optimistic prospects, the inventory is just not a cut price nevertheless with its market worth of $1.45 billion absolutely pricing of their future development prospects and leaving little margin for error. Subsequently, COCO is personally not a purchase at this level however could possibly be considered as a maintain.

In search of Alpha