grandriver

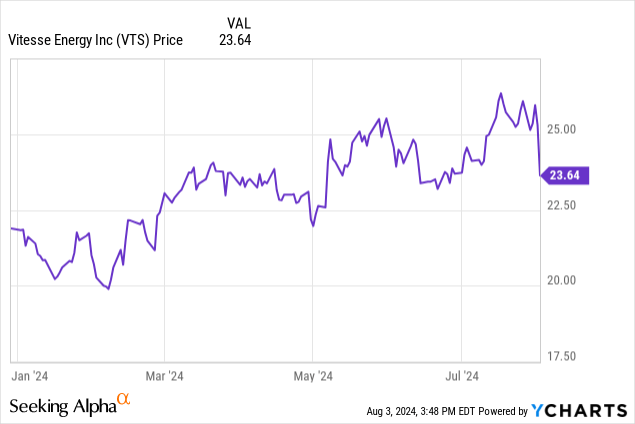

At the start of the year, I wrote an article about how Vitesse Energy (NYSE: VTS), a company which owns working interest in thousands of wells in Montana and North Dakota, is an interesting value play with a high dividend yield. I wrote that there was an opportunity for the already high-yielding company to increase its dividend going forward.

It turns out that came to pass, as in May the company increased the dividend per quarter from 50¢ to 52.5¢, an increase of 5%. The ability to keep increasing is somewhat limited by the company’s revolving credit facility, but as they continue to grow and pay down their debt, there will be room for more of a payout.

Today I want to take another look at the company and its dividends, and obviously its risks as well, as the company moves into fiscal year 2024.

Balance Sheet

|

Cash and Equivalents |

$1.4 million |

|

Total Current Assets |

$46 million |

|

Total Assets |

$750 million |

|

Total Current Liabilities |

$52 million |

|

Total Liabilities |

$227 million |

|

Total Shareholder Equity |

$523 million |

(source: most recent 10-Q from SEC)

The stock has been doing well, but the company is still trading at only a small premium to its book value at 1.33. The company has strong assets and not too much in the way of liability.

The only potential downside here is the relatively low cash on hand, which underscores that the company has been leveraging itself as strong as possible into the production of oil and gas in the Williston Basin.

The Risks

Things may be going well, but its important to keep in mind that there are a lot of risks to threaten Vitesse Energy in the future.

The company is substantially impacted by the unpredictable prices of oil and gas, and if the price ends up not holding strong, the company’s bottom line could really suffer.

Drilling is not always economical for the company, especially if they end up with a dry well. The company has to spend substantial amounts of its operating free cash flow to replace its proved reserves, and there’s no guarantee that the investment is going to pay off.

The company’s underlying value depends heavily on its proved reserves, but a lot of things could happen to effect what those reserves are ultimately worth. The price of oil and gas and the cost of recovering it could do a lot to effect what the company is practically worth.

Finally, why the company is investing in a few locations for its assets, materially all of its producing properties are in the Williston Basin. That means that what happens in the basin could be serious impacting the bottom line.

The Statement of Operations, 2023 and Beyond

|

2022 |

2023 |

2024 (Q1) |

|

|

Oil Revenue |

$242 million |

$218 million |

$57 million |

|

Gas Revenue |

$57 million |

$16 million |

$4 million |

|

Operating Income |

$154 million |

$35 million |

$13 million |

|

Diluted EPS |

26¢ |

(73¢) |

(7¢) |

(source: most recent 10-K and 10-Q from SEC)

Vitesse Energy has been a company producing a lot more oil revenue than gas revenue. Practically this improves margins, and the company is expected to grow substantially going forward.

Estimates are that in fiscal 2024 the company’s revenue will be $271 million, and $1.58 earnings. This puts the P/E ratio at just under 15. Things will continue to improve in 2025, with the revenue rising to $300 million and the earnings growing to $1.94. That gives us a forward P/E of 12.18.

The company’s P/E ratios, like its book value, are reasonable for one that grows like it is expected to, I feel this is more than a reasonable price.

Free Cash Flow

|

2022 |

2023 |

2024 (Q1) |

|

|

Operating FCF |

$147 million |

$142 million |

$39 million |

|

Investing FCF |

($84 million) |

($121 million) |

($32 million) |

|

Financing FCF |

($58 million) |

($31 million) |

($6 million) |

|

Net Cash |

$4.6 million |

($9.4 million) |

$825 thousand |

(source: most recent 10-K from SEC)

Vitesse Energy has a strong operating cash flow, and in addition to paying a nice dividend, the money goes into investments into growing proved reserves and output. This is a strong way to make use of the money, which I believe should remain strong going forward.

Dividend and Payout

The company is, as mentioned before, paying 52.5¢per quarter. That gives us a nice yield of 8.88%. Financial statements have made clear that the company is committed to paying the best dividends it can, and while even keeping the dividend flat would be a strong case for the company at its reasonable multiples, I would expect the dividend to grow with the company.

Conclusion

The last several months have been kind to the stock price of Vitesse Energy, but I feel that there is room left to grow at current levels.

I rated the company as a buy in January, and I’m standing by that rating, even at the higher prices. There are not a lot of really appealing dividend growth possibilities like Vitesse Energy, and what’s come from the last few months has only strengthened my beliefs.

I like the company in the low 20’s, and feel that it will continue to go up through the rest of the year.