matejmo

Pricey Companions,

In This fall 2023, the Voss Worth Fund, LP and the Voss Worth Offshore Fund, Ltd., returned 19.4% and 18.6% to traders internet of charges and bills, respectively, in comparison with 14.0% whole return for the Russell 2000 (RTY), 15.3% whole return for the Russell 2000 Worth, and 11.7% whole return for the S&P 500 (SP500,SPX). As of December 31 st, 2023, the Voss Worth Grasp Fund’s whole gross publicity stood at 177.8% and the online lengthy publicity was 80.4%.

The highest 10 longs had a weight of 90.8%, and our prime 10 shorts had a weight of 39.0%. Voss Worth Grasp Fund belongings underneath administration stood at roughly $275.1 million and Agency belongings stood at roughly $889.3 million as of December thirty first, 2023.

Voss Worth Grasp Fund Advanced: NET MONTHLY PERFORMANCE | 2023

|

PERIOD |

Voss Worth Fund, LP |

Voss Worth Offshore Fund, Ltd. |

Russell 2000 TR |

Russell 2000 Worth Index |

S&P 500 TR |

|

JANUARY |

9.2% |

9.2% |

9.7% |

9.5% |

6.3% |

|

FEBRUARY |

-1.7% |

-1.7% |

-1.7% |

-2.3% |

-2.4% |

|

MARCH |

-5.5% |

-5.5% |

-4.8% |

-7.2% |

3.7% |

|

1st QUARTER |

1.5% |

1.5% |

2.7% |

-0.7% |

7.5% |

|

APRIL |

-1.9% |

-1.9% |

-1.8% |

-2.5% |

1.6% |

|

MAY |

0.5% |

0.1% |

-0.9% |

-2.0% |

0.4% |

|

JUNE |

8.8% |

8.8% |

8.1% |

7.9% |

6.6% |

|

2nd QUARTER |

7.2% |

6.8% |

5.2% |

3.2% |

8.7% |

|

JULY |

0.2% |

0.2% |

6.1% |

7.5% |

3.2% |

|

AUGUST |

-2.1% |

-2.4% |

-5.0% |

-4.8% |

-1.6% |

|

SEPTEMBER |

-6.5% |

-6.8% |

-5.9% |

-5.2% |

-4.8% |

|

third QUARTER |

-8.3% |

-8.9% |

-5.1% |

-3.0% |

-3.3% |

|

OCTOBER |

-5.8% |

-5.9% |

-7.7% |

-6.0% |

-2.1% |

|

NOVEMBER |

10.1% |

9.5% |

10.0% |

9.0% |

9.1% |

|

DECEMBER |

15.2% |

15.1% |

12.2% |

12.4% |

4.5% |

|

4th QUARTER |

19.4% |

18.6% |

14.0% |

15.3% |

11.7% |

|

YEAR TO DATE |

19.2% |

17.1% |

16.9% |

14.6% |

26.3% |

The desk beneath reveals the Voss Worth feeder fund returns in comparison with among the related indices:

|

Internet Return Comparability as of December thirty first, 2023 |

||||||||

|

1 Month |

3 Month |

YTD |

1-Yr |

Compound Annual Progress Fee |

||||

|

3-Yr |

5-Yr |

10-Yr |

ITD(1) |

|||||

|

Voss Worth Fund, LP |

15.2% |

19.4% |

19.2% |

19.2% |

18.7% |

20.2% |

16.6% |

18.1% |

|

Voss Worth Offshore Fund, Ltd. |

15.1% |

18.6% |

17.1% |

17.1% |

17.4% |

– |

– |

18.8% |

|

S&P 500 |

4.5% |

11.7% |

26.3% |

26.3% |

10.0% |

15.7% |

12.0% |

14.7% |

|

Russell 2000 |

12.2% |

14.0% |

16.9% |

16.9% |

2.2% |

10.0% |

7.2% |

11.3% |

|

Russell 2000 Worth |

12.4% |

15.3% |

14.6% |

14.6% |

7.9% |

10.0% |

6.8% |

10.9% |

|

Russell 2000 Progress |

12.0% |

12.7% |

18.7% |

18.7% |

-3.5% |

9.3% |

7.2% |

11.5% |

|

HFRX Fairness Hedge Index |

1.6% |

3.6% |

6.9% |

6.9% |

5.1% |

6.3% |

3.0% |

3.6% |

|

(1) Inception to Date measures the time interval from Voss Worth Fund, LP’s inception date of October 1st, 2011, and from Voss Worth Offshore Fund, Ltd’s inception date of January 1st, 2020. |

The Nice Humiliator has sprung forth from beneath an avalanche of nebulous repudiations heaped upon it this time final yr. Because the yr wore on, Voss highlighted that market strategists and individuals appeared overly centered on more and more much less reliable survey knowledge, the weak manufacturing knowledge (which includes solely ~1/seventh of the full financial output as Companies), and overestimating the influence of upper short-term charges on client spending-while underestimating a bevy of positives corresponding to authorities fiscal stimulus and strong job development. Actual financial development was within the 96th percentile in Q3 and 72nd percentile in This fall, relative to the final 20 years, excluding the wackiness of 2020 and 2021. Our constructive view of financial development performed a think about our determination to stay closely internet lengthy small cap cyclicals together with areas like homebuilders, development supplies, and heavy development gear.

Our portfolio was nicely positioned late within the yr though arguably for the incorrect causes. On the finish of October 2023, the Russell 2000 started considered one of its finest two-month rallies in lots of many years on the again of a drop in ahead price expectations, versus rallying from traders instantly realizing how good financial development had change into and earnings had remained.

Is it any marvel then that with WSJ headlines like “Data Show the Economy is Booming” to kick off 2024, small cap worth has as soon as once more been lubricated with molasses within the relative return race? With a swift ~9% correction in small caps to begin the yr, price reduce expectations clearly obtained too far forward of themselves and charges are nonetheless within the driver’s seat.1 The primacy of mega cap tech shares has been largely justified by earnings revisions. “Winners win things,” is an adage that involves thoughts and has been strengthened by the “momentum” issue inside Tech experiencing a 26% vertical rally to begin 2024.2 We would favor some breathers, choppier issue efficiency, and extra frequent bouts of imply reversion.

After such a historic market rally, atypical market ideas like bullish or bearish are a lot too inflexible to be helpful descriptions of our present views. The reason is that underneath the floor, the market nonetheless appears break up between two ghosts of previous extremes: the bubbly euphoria of 2021 and the extra distant despondency of say, 2009 maybe – or another period that had comparatively little in widespread with a backyard selection financial downturn. Whereas there are massive pockets of the market exhibiting late-stage bull market conduct with nosebleed valuations, one additionally needn’t delve deep into the distant nooks and crannies of the market to seek out compelling worth, thus we resist the reductionism of the statements that the market is “all Mag-7” and nothing else. It’s exactly this return dispersion on the extremes that makes this a terrific inventory selecting surroundings in idea.

The median forecast of 53 market forecasters that printed a 2024 S&P 500 value goal was 1.4%, the bottom assumed return in not less than 20+ years (observe: the S&P 500 is already up ~7% YTD). Valuations begin from an undeniably elevated perch so solely two courageous souls had been undaunted by an innate acrophobia and predicted a return of larger than 10%.3 Certainly the surly sentiment from final yr is not one other early presentiment?*

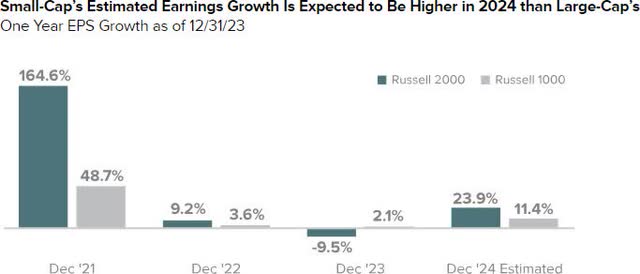

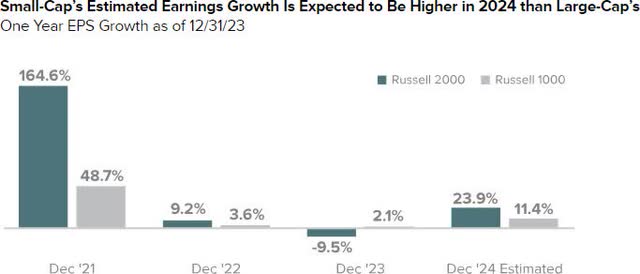

Talking of being early, we’re nonetheless calling for the scales of the “weighing machine” to tip in favor of small cap worth relative returns going ahead, as they continue to be at a low percentile of historic valuations in comparison with massive caps based mostly on ahead earnings yields. Small caps are additionally anticipated to develop earnings a lot quicker this yr, with ~24% EPS development estimated in 2024 for the Russell 2000 versus 11.4% for the Russell 1000.4 Judging from previous cycles, we expect small caps must also profit disproportionately if shoppers take their cash out of cash market funds (MMF) on the again of Fed funds price cuts and shift additional into FOMO mode.5 Nonetheless, with larger than 50% of all fairness belongings in passive ETFs now, it’s doable that MMF outflows simply additional exacerbate the present record-wide massive/small unfold.

After sturdy actual development for 3 quarters in a row, skepticism stays wholesome, and it appears traders are nonetheless not but extrapolating it or believing it despite the fact that high-frequency industrial knowledge factors are turning up globally. For instance, freight demand is at a 17-month excessive, and the change in forward-looking indicators such because the US ISM Manufacturing New Orders element are seeing their largest will increase in a number of years. With such a long-running anticipation of recession within the US, the build-up of extra capability has doubtless been restricted and probably resulted in deferred capex that can additional enhance financial development all through this yr.

Inflation

US CPI ex-shelter has been beneath 2% year-over-year for seven months in a row and 46% of the 74 CPI elements are already beneath 2%. The Manheim Used Automotive Value Index reveals a decline of that key element is perhaps within the bag, and extra importantly, the shelter element is poised to plunge from its lofty 6%+ as evidenced by asking rents on Condo Listing & Zillow (Z). With this disinflation during the last a number of months, the breadth of actual wage development has hit a stage not witnessed within the US because the late Nineteen Nineties. In Q2 2022, 54% of working Individuals had wage development that was not preserving tempo with inflation. As of November 2023, this had fallen to 43%.6 When adjusting the CPI price for almost all of Individuals who personal their house and have a hard and fast (or no) month-to-month fee, the proportion of inflation-laggards drops much more precipitously. Total, actual disposable earnings development accelerated to +4.1% y/y in December, additional enhancing client shopping for energy whereas steadiness sheets stay wholesome by historic requirements.7 Recall final quarter we predicted strategists might start to explain the financial backdrop as “Goldilocks” and this more and more is the case.

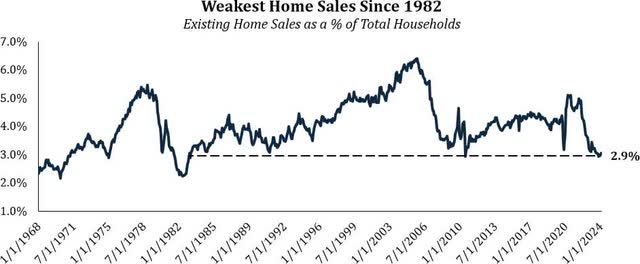

US Housing

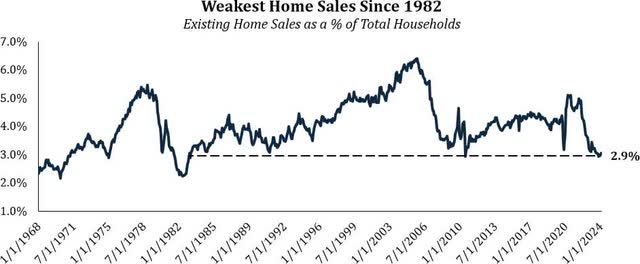

One other latest theme that we imagine will carry over this yr is the continued scarcity of accessible inexpensive US housing stock. The speed of transactions of current houses, measured as a p.c of whole households, has been hitting 40-year lows due to the lock-in impact of low mortgage charges and the general inexpensive housing stock disaster. We expect housing costs and new development begins will stay resilient in 2024 and turnover will enhance. Thus, related typical massive ticket discretionary purchases (e.g., furnishings, constructing merchandise for R&R, and many others.) may very well be an space of constructive shock relative to expectations.

Supply: Nationwide Affiliation of Realtors, St. Louis Fed

Housing begins exceeded expectations for 2023 nevertheless it was a story of two halves. 1H noticed a 15% decline in begins y/y development and 2H noticed 2% improve y/y. Whereas housing begins marginally exceeded family formations for 9 years in a row from 2003-2011, they’ve now lagged family formations by a a lot larger magnitude yearly for the final 10 years (2013-2023).8 Ages 33-35 are the height first-time homebuying years and round 4.2 million Individuals turned 33 final yr versus solely 3 million in 2008. Along with favorable demographics for housing demand, the prevailing inventory of houses has grown older than ever which is able to proceed to drive structurally elevated R&R spend. R&R spend has already gone by a little bit of an Armageddon situation on account of increased charges and the 40+ yr low in housing turnover but remained pretty resilient and traditionally has most extremely correlated to actual disposable earnings development and residential value appreciation, each of that are exhibiting strong development charges as soon as once more.

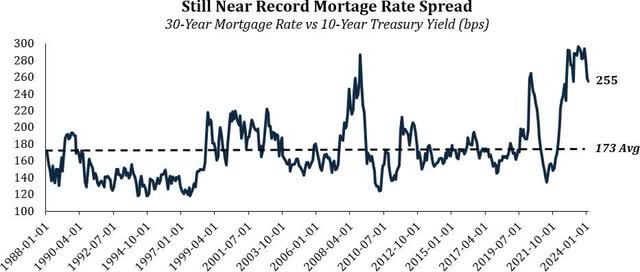

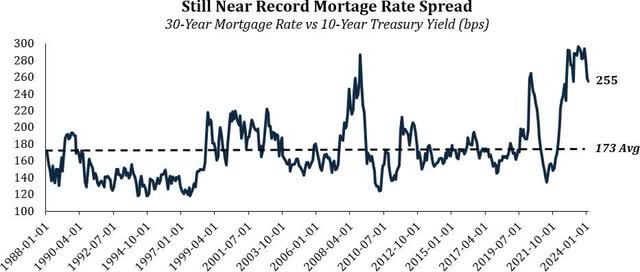

One other potential constructive for housing simply across the nook is the tip of the Fed’s QT, which can have contributed to the unusually outsized unfold between the 30-year fastened price mortgage price and the 10-year treasury yield. If this unfold reverted to its historic common it could present a boon to housing even when the Fed doesn’t trim short-term charges from right here (common unfold 173 bps since 1988 versus 255 bps right now).

Supply: Bankrate.com, US Treasury

One further theme we expect is already rising for markets in 2024 is a surge in pent-up M&A as personal fairness unleashes its ~$4 trillion of dry powder and company boards get assured in price stability as soon as once more. By means of mid-February, M&A within the US is already up about 55% year-over-year with the CEO of funding financial institution Moelis stating their deal pipeline is “at the highest level ever.”9 Given the character of our portfolio comprised of what we imagine are undervalued corporations, lots of that are strategically essential companies, we hope to sufficiently capitalize on this development and on the very least imagine it ought to crank up the animal spirits in small cap land.

Replace on Griffon Corp. (GFF)

We lately bought simply over half of our outsized place in Griffon Corp. for portfolio threat administration functions. Along with stepping off the Board, the corporate purchased 1.5 million shares from Voss, which we imagine is a win/win for our traders and GFF shareholders. Throughout our holding interval and time partaking with the corporate, one non-core phase was bought at a excessive a number of, a radical strategic assessment for the remainder of the enterprise was performed, company governance improved on the margin, administration bonus metrics had been modified to incentivize ROI, and the corporate purchased again over 14% of the shares excellent whereas additionally paying $4 of particular dividends. The whole shareholder return has exceeded 200% since we first wrote a public letter in November 2021 whereas the Russell 2000 has had a unfavorable return over that point. The market is waking as much as the unrivaled high quality of GFF’s storage door phase because it has change into one of many highest EBITDA margin constructing merchandise corporations within the public market.

We imagine there stays substantial upside within the inventory as any of the next play out:

- the HBP phase garners an EBITDA a number of that’s merely consistent with a lot decrease margin constructing product friends, within the 11.5-12.0x vary

- the CPP initiative to maneuver to a extra versatile contract manufacturing base bears fruit in 2025 and past, and

- ongoing aggressive returns of capital to shareholders.

As said above, we stay as optimistic as ever on restore and reworking spending, which incorporates storage doorways.

New core sized lengthy: R1 (RCM)

R1 is a prime participant in outsourced Income Cycle Administration for big hospitals and doctor teams. Outsourced income cycle administration continues to be within the early innings with solely about 30% penetration, and we imagine R1 has essentially the most full and scalable unbiased (i.e., not affiliated with an insurance coverage firm) resolution within the market, in what may show to be a “winner take most” business. With hospital profitability underneath strain and coding and regulatory complexity ever rising, R1 affords substantial financial savings by way of regional labor arbitrage and automation expertise to prospects by extra environment friendly income assortment.

The present administration staff got here from Cloudmed, which R1 acquired very lately in June of 2022, and has undertaken the difficult activity of cultural and technological integration whereas being relative public market newcomers underneath immense scrutiny. Cloudmed affords modular or single-point RCM options versus a full end-to-end providing, and it counts 95 out of the highest 100 hospitals within the US as prospects. Cloudmed is a strong enterprise with upwards of 40% EBITDA margins and 117% internet income retention, and we expect they’ll obtain a mid-teens income CAGR over the following few years whereas opening the door to upselling R1’s extra strong service providing throughout the broader buyer base.

We imagine with Cloudmed’s technological focus and huge entry to knowledge (they contact over $900 billion of Internet Affected person Income throughout all hospital EMRs), a little bit of a community impact is prone to take maintain, as R1’s military of engineers (most of their $100 million+ in capex is directed in the direction of software program growth) are using Machine Studying and, sure, AI, to automate processes to drive additional effectivity of economics to be shared with prospects. The corporate lately introduced a collaboration with Microsoft to enhance billing coding productiveness. We imagine there’s a vital alternative to each increase margins and increase their technological management. The CEO has a technology-oriented background and has been very constant and outspoken since turning into CEO in regards to the long-term margin enhancing alternatives that Machine Studying and AI may generate for the corporate.

R1 presently has horrible unfavorable sentiment as evidenced by an enormous a number of de-rating and 18% brief curiosity. It’s getting hit by each stylistic (floating debt, healthcare IT, SMID) and idiosyncratic elements (accounting considerations, buyer loss/chapter, unfavorable estimate revisions). Whereas we can’t dismiss all these negatives as “nothing,” it’s our variant view that underneath the covers issues on the firm are a lot better than they seem at first look and many of the bearish arguments miss the forest for the bushes.

The extent of threat of an funding is partly a operate of the valuation paid relative to many outcomes. Ready for excellent near-term readability on a scenario like RCM can be pricey and will negate any probability at outsized alpha. The place we’ve got had huge winners is just not the place we prioritize near-term readability, however quite exact draw back valuation safety underneath a wide range of regular financial outcomes. R1 definitely matches the invoice right here, with traders overly centered on steerage for the following three months whereas we’re centered on getting snug with the money circulate dynamics three years out. We imagine there may be restricted draw back over the following few years as there may be nonetheless latent profitability constructing that can present up from maturing prospects and ongoing Modular (Cloudmed) development.

Twelve months from now, we expect the funding narrative may have reworked considerably as administration indicators new prospects with out “paying to play”, earnings high quality improves considerably, deleveraging begins in earnest, and hospitals change into incrementally more healthy, resulting in what might be seen as a scarce, top quality healthcare IT asset that may very well be buying and selling nearer to truthful worth which we peg at 15x 2026 FCF, ~100% increased over the following two years. Though that is definitely an execution story, these numbers don’t require a lot new enterprise to be gained as many of the FCF in our Base Case comes from ramping up already signed prospects, together with some margin enlargement from their AI/Machine studying initiatives. If the “network effect” we’re predicting takes maintain, we imagine the Bull Case beneath is achievable.

2026 Estimates

|

Case Abstract |

EBITDA-Capex |

FCF |

A number of |

Value |

Up/Down |

Implied EBITDA- Capex |

|

Bear |

$725 |

$475 |

10x |

$9.63 |

-10% |

8.5x |

|

Base |

$949 |

$666 |

15x |

$21.05 |

97% |

12.2x |

|

Bull |

$1,155 |

$821 |

20x |

$34.58 |

224% |

15.6x |

Conclusion

If a map detailed each little landmark and trivial wiggle within the path alongside the best way, its customers would get slowed down, confused, and stray from the supposed route and by no means make it to their vacation spot. A map is normally useful as a result of it doesn’t include an excessive amount of data. Equally, a lways succumbing to the nagging compulsion to build up incremental data won’t essentially result in extra alpha and might be detrimental to optimum portfolio-level determination making. We should incessantly zoom out on our funding journey and watch out to not lose the forest for the bushes of the noisy market in actual time. A sturdy course of of data gathering to achieve conviction in our concepts should be balanced with a cautious research of historical past and an uncomfortable look again at our personal laundry listing of losers- an aide-memoire assured to stave off illusions of certainty within the current.

As is the case usually, 2023’s most important problem was remaining optimistic and steadfast in our internet lengthy positioning amidst pervasive negativity. This yr’s denouement stays TBD, however as we proceed navigating by the Nice Humiliator’s limitless corridor of mirrors, we are going to proceed thoughtfully as we all the time have by tactically adapting inside a strict principled framework and focusing our consideration on discovering enticing value-oriented particular conditions that embed a margin of uncertainty.

Sincerely, Voss Crew

|

Appendix: 1WSJ: https://www.wsj.com/economy/united-states-economy-data-experts-soft-landing-1f23b1a5 2Bloomberg, Goldman Sachs Momentum Index GSTMTMOM 3Fisher Investments Analysis *https:// www.youtube.com/watch?v=ixljWVyPby0 4Supply: Factset   5The S&P 600 small cap index has the best unfavorable correlation of main indices to y/y adjustments in MMF balances as a proportion of family internet value 6DallasFed.org | More workers find their wages falling even further behind inflation – Dallasfed.org 7Goldman Sachs fairness analysis 8Nationwide Affiliation of Realtors 9Bloomberg: https://www.bloomberg.com/news/articles/2023-12-06/moelis-sees-huge-backlog-of-deals-after-fed-s-rate- hike-regime Widespread Phrases:

Disclosures and Notices: Starting January 1, 2020, all funding exercise is performed by the Voss Worth Grasp Fund, LP (the “Master Fund”), which has two feeder funds, and subsequently efficiency figures from January 1, 2020, onward are calculated based mostly on the Grasp Fund. All restricted companions spend money on the Fund by a number of of the next feeder funds: Voss Worth Offshore Fund, Ltd. (the “Offshore Fund”) and Voss Worth Fund, LP (the “Predecessor Fund”), every a “Feeder Fund”. Efficiency figures for the Predecessor Fund are contributable to Travis Cocke as sole portfolio supervisor. Mr. Cocke maintains the identical the place with the Fund and the Fund will make use of an identical technique because the Predecessor Fund. Precise returns are particular to every investor investing by a Feeder Fund. Every Feeder Fund was established at completely different occasions and has various subsets of traders who might have had completely different payment buildings than these presently being provided. Because of differing payment buildings, differing tax influence on onshore and offshore traders, the timing of subscriptions and redemptions, and different elements, the precise efficiency skilled by an investor might differ materially from the efficiency reported above. Portfolio statistics proven are inclusive of the Predecessor Fund and the Offshore Fund. Internet outcomes are offered after deduction of all operational bills (together with brokerage commissions), 1% each year administration payment, and 20% efficiency allocation. Previous to Q1 2023, 2022, and 2023 internet outcomes had been offered on the Fund/feeder stage however had been subsequently up to date to match the strategy of presentation used for the Fund’s 2022 Audited Monetary Statements. A full chart is out there upon request. This letter is supplied by Voss Capital, LLC (“Voss”, “the Firm”, “the Voss Team”, and “our team”) for informational functions solely and doesn’t represent a proposal or a solicitation to purchase, maintain, or promote an curiosity within the Voss Worth Fund, LP (the “Fund”) or another safety. An funding within the Fund is speculative and entails substantial dangers. Extra data relating to the Fund, together with charges, bills and dangers of funding, is contained within the providing memorandum and associated paperwork, and ought to be rigorously reviewed. A suggestion or solicitation of an funding within the Fund will solely be made pursuant to an providing memorandum. This communication is confidential and will not be reproduced or distributed with out prior written permission from Voss. This confidential report is just supposed for the recipient and will not be redistributed with out the prior written consent of Voss. The data contained herein displays the opinions and projections of Voss as of the date of publication, that are topic to alter with out discover at any time subsequent to the date of problem. All data supplied is for informational functions solely and shouldn’t be deemed as funding recommendation or a advice to buy or promote any particular safety. Information included on this letter comes from firm filings and displays, analyst reviews and Voss’ estimates. Whereas the data offered herein is believed to be dependable, no illustration or guarantee is made regarding the accuracy of any knowledge offered. Sure data contained on this letter constitutes “forward-looking statements” which might be recognized by means of forward-looking terminology corresponding to “may,” will,” “ought to,” “anticipate,” “try,” “anticipate,” “venture,” “estimate, or “seek” or the negatives thereof or different variations thereon or comparable terminology. As a result of varied dangers and uncertainties, precise occasions or ends in the precise efficiency of the Fund might differ materially from these mirrored or contemplated in such forward-looking statements. There might be no assure that the Fund will obtain its funding aims and Voss doesn’t symbolize that any opinion or projection might be realized. The securities contained inside the benchmark indices highlighted herein don’t essentially correspond to investments and exposures that might be held by the Fund and are subsequently of restricted use in predicting future efficiency of the fund. Indexes are unmanaged and don’t have any charges or bills. An funding can’t be made immediately in an index. The Fund consists of securities which fluctuate considerably from these within the benchmark indexes listed beneath. Accordingly, evaluating outcomes proven to these of such indexes could also be of restricted use. The S&P 500 Complete Return Index is a market cap weighted index of 500 broadly held shares usually used as a proxy for the general U.S. fairness market. The Russell 2000 index is an index measuring the efficiency roughly 2,000 small-cap corporations within the Russell 3000 Index. The Russell 2000 serves as a benchmark for small-cap shares in the US. The Russell 2000 Progress Index measures the efficiency of these Russell 2000 corporations with increased value/guide ratios and better predicted and historic development charges. The Russell 2000 Worth Index measures the efficiency of the small-cap worth phase of the U.S. fairness universe. It consists of these Russell 2000 corporations with decrease price-to-book ratios and decrease anticipated and historic development values. HFRX Fairness Hedge Index encompass Fairness Hedge methods which keep positions each lengthy and brief in primarily fairness and fairness spinoff securities. All kinds of funding processes might be employed to reach at an funding determination, together with each quantitative and elementary strategies; methods might be broadly diversified or narrowly centered on particular sectors and might vary broadly when it comes to ranges of internet publicity, leverage employed, holding interval, concentrations of market capitalizations and valuation ranges of typical portfolios. The technique utilized by Voss has a excessive tolerance for uncertainty. Several types of investments contain various levels of threat. Due to this fact, it shouldn’t be assumed that future efficiency of any particular funding or funding technique might be worthwhile. Asset allocation could also be utilized in an effort to handle threat and improve returns. It doesn’t, nevertheless, assure a revenue or shield towards loss. Previous efficiency doesn’t assure future outcomes. |

Editor’s Be aware: The abstract bullets for this text had been chosen by Looking for Alpha editors.