Tomwang112

WBA stock: my worst investment in 20+ years

If you have been following my writing, you would know that I have made a pretty bad call on Walgreens Boots Alliance, Inc. (NASDAQ:WBA). I have been betting on its turnaround in the past 1~2 years, as you can see from my rating history shown in the chart below. Take my most recent article as an example. That article was published on March 15, 2024, and titled “Walgreens Q2, Dow Exit, And Bet Against Wall Street.” In that article, I argued that:

Sentiment surrounding Walgreens Boots Alliance has reached a negative extreme among both Main Street and Wall Street analysts. The stock’s exit from the Dow may lead to temporary downsides, but long-term success depends on fundamentals and strategy. Despite the expected earnings drop in Q2, the stock’s compressed P/E ratio and projected profit recovery make it an interesting investment opportunity.

Since then, the stock has suffered a total loss of about 43%. All told, WBA is by far the worst investment I’ve made in more than 20 years. This update is my throw-in-the-towel moment. In the remainder of this article, I will elaborate on my thought process. In a nutshell, I’ve reevaluated the odds of its turnaround and concluded that the odds are much lower than I used to think.

As a contrarian investor, I’ve invested in many turnaround stocks – with winning success rates. The top three characteristics of successful turnarounds I’ve observed from these experiences are strong and effective leadership, fundamentally sound business economics, and plenty of financial resources. To limit the length of this article, I will only focus on the latter characteristics today and explain such a degree misjudged the underlying economics of WBA’s business model and B) why its profits have deteriorated to a degree that I begin to question if it has the financials to support a potential turnaround.

WBA stock: underlying economics

Warren Buffett accurately observed that

“When a management with a reputation for brilliance tackles a business with a reputation for poor fundamental economics, it is the reputation of the business that remains intact.”

This could not be more fitting in the case of WBA.

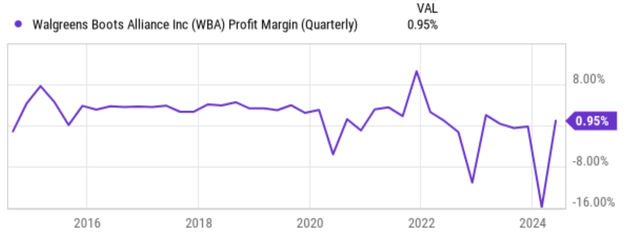

I severely underestimated the pressure that the retail pharmacy model has been facing recently. I knew that WBA’s margins (see the chart below) were pressured due to pharmacy reimbursement headwinds. But I badly misjudged the extent. To make things worse, the weakness in front-store sales continued and intensified due to the rise of online pharmacies and direct distributors.

All told, its profitability has been experiencing significant volatility since 2020 as seen, and I see no prospects of stabilization at this point. To wit, the company has been enjoying a stable net margin in the range of 4~5% before 2020. However, due to the structural headwinds mentioned above, its margins suffered sharp declines. The breakout of the COVID-19 pandemic added to the volatility – in both the positive and negative directions. But overall, the trend starting from 2020 reflects a challenging environment for WBA, with its net margins tanking as low as -16% last quarter and hovering around only 0.95% currently.

WBA’s management has been largely responding, not controlling or fixing, these issues in my view judging by their recent moves. For example, the closure of its Rite Aid stores could help lessen near-term losses but won’t resolve the underlying issue. About one-quarter of its stores are currently losing money. I suspect the outlook for the remaining stores is quite gloomy too. As such, I don’t see store closures as a viable solution at all.

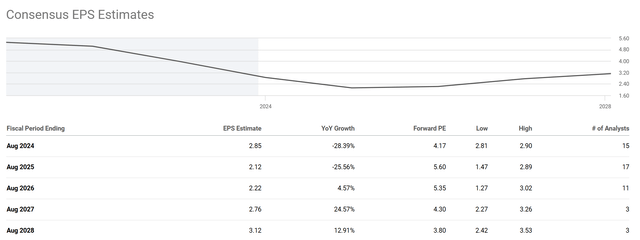

The gloomy outlook is quite reasonably captured by the current consensus EPS estimates, in my view. The chart below shows the consensus EPS estimates for WBA in the next 5 years between fiscal year 2024 to 2028. The EPS estimate for fiscal year 2024 is $2.85, representing a whooping YOY decline of more than 28%. Subsequently, the EPS estimate points to another year of 25% decline after that. According to consensus, its EPS won’t be able to recover to the 2024 level until 2028.

And such a timeframe leads to my next concern. A successful turnaround requires considerable resources, and I am not confident that WBA has them.

WBA stock: financial resources

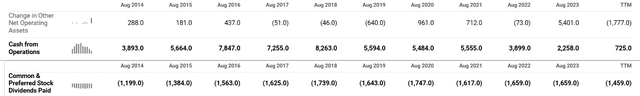

The company’s earnings have been deteriorating recently due to the above headwinds. More specifically, the chart below shows the cash from operations together with its dividends payouts. As seen, cash from operations generally increased from 2014 to 2018, reaching a peak of $8,263 million in 2018. Then it started declining rapidly. For FY 2023, the figure dwindled to $2,258 and further decreased to $725 million only for the trailing twelve months. The current cash flow is thus barely sufficient to cover its dividend payouts. As seen from the chart above, its dividend obligations for FY 2023 totaled $1,659 million and for 2024 TTM totaled $1,459 million.

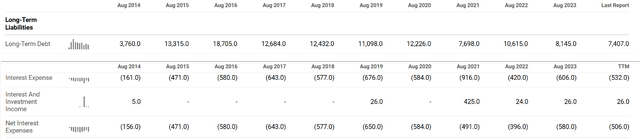

To compound the issue, the company also has a relatively heavy debt burden and the interest payments are quite substantial. More specifically, the chart below shows its long-term debt and interest expenses recently. As seen, the good news is that WBA has made good progress in deleveraging lately. Its long-term debt peaked at over $12 billion between 2018 and 2020. Since then, the company has paid down its debt to the current level of $7.4 billion.

Unfortunately, the borrowing rates have climbed considerably during the period. As a result, the interest expenses remained largely unchanged despite the sizable paydowns. To wit, net interest expense totaled $584 million in 2020 and only decreased mildly to $580 in 2023 and $506 million as of TTM. Thus, for the trailing 12 months, its dividend and interest obligations totaled $1,965 million, far exceeding its organic cash flow of $725 million.

Other risks and final thoughts

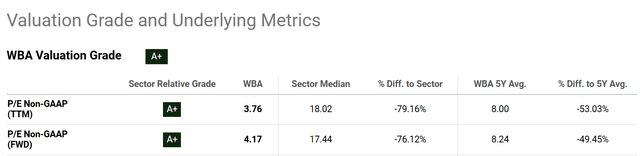

With profit headwinds persisting and the above tight (or even deficit) cash allocation, I do not see any good scenario for shareholders. To keep supporting its turnaround efforts, the company could reduce dividends again, which would trigger another sentiment deterioration and valuation compression, as the dividend is the main support for the stock now. The company could also consider issuing more shares, which is an unattractive idea given the beaten valuation multiples (current at 3~4x P/E as seen in the next chart below).

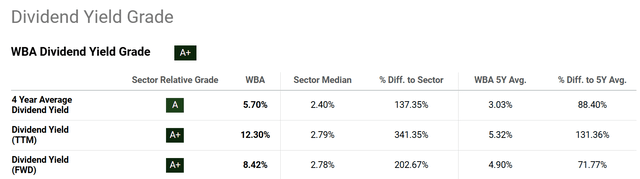

In terms of positives, the basement valuation and high dividend yields are the main draws here. More specifically, the next two charts below summarize its valuation and dividend grades. As seen in the first chart, the stock is currently trading at a P/E ratio of 3.76x only (on a TTM basis) and about 4.17x (on an FWD basis). The second chart shows that the stock offers a current dividend yield of 12.3% on a TTM basis and 8.42% on an FWD basis. Such a combination of low P/E and higher yield offers a good amount of downside protection against the earnings uncertainties analyzed above.

All told, I see an unfavorable return/risk profile here. The cheap P/E and high yield would be meaningful only if WBA can turn around the declining profits and stabilize its margins. But as experiences have taught me, two of the hallmarks of successful turnarounds are sound underlying economics and ample financial resources. I do not see either in the case of WBA under current conditions.

Finally, a word about my rating. I am rating Walgreens Boots Alliance, Inc. stock as a HOLD rather than a SELL due to my use of options as my exit strategy. The strategy is detailed in another article for readers interested in it. The essence is to keep writing slightly out-of-money covered-call options until the shares are called. Due to the use of this strategy, I am still holding the shares despite my attempt to sell them. Thus, I think a HOLD rating more accurately reflects my position.