Kevin Dietsch

Pay attention beneath or on the go on Apple Podcasts and Spotify

DOJ set to sue Apple for antitrust violations associated to iPhone. (0:14) Reddit to debut after pricing IPO at high of vary. (0:48) Apollo offers $11 billion for Paramount’s movie and TV enterprise. (1:52)

The next is an abridged transcript:

The U.S. Division of Justice plans to sue Apple (NASDAQ:AAPL) for violating antitrust legal guidelines as quickly as in the present day, based on revealed studies.

The go well with alleges that Apple blocked rivals from accessing {hardware} and software program options on its ever-popular iPhone.

That is the third time the DOJ has sued Apple for alleged antitrust violations.

The DOJ is already suing Alphabet’s Google (GOOG) (GOOGL) for alleged monopolization in its promoting enterprise.

Apple rose 1.5% on Wednesday amid the market’s risk-on transfer, however the inventory is down about the identical quantity premarket. Shares have underperformed this yr, down greater than 7%.

Reddit (RDDT) is set to debut on the New York Inventory Change in the present day with indicators of strong demand. The corporate raised $748 million Wednesday evening, pricing its IPO of twenty-two million shares at $34 apiece, the highest of its vary.

About 15.3 million shares are being bought by the corporate and about 6.7 million shares are being bought by sure stockholders. Final week, Reuters reported that the message board website’s IPO was between 4 and 5 occasions oversubscribed.

Reddit provided lively customers, together with moderators and customers with excessive karma, an opportunity to purchase shares in its IPO utilizing a tier system to allocate shares. The primary tier together with “certain users and moderators identified by us who have meaningfully contributed to Reddit community programs.” Subsequent in line had been customers with not less than 200,000 karma and not less than 5,000 moderator actions.

Customers that take part in Reddit’s IPO won’t be topic to a lock-up interval.

Shares will commerce underneath the image “RDDT.” Morgan Stanley, Goldman Sachs, J.P. Morgan and BofA Securities are appearing as lead book-running managers for the providing.

Paramount International (PARA) (PARAA) rallied on Wednesday afternoon after the Wall Avenue Journal reported that Apollo International Administration (APO) made an $11 billion offer to purchase the corporate’s movie and tv studio.

That is the newest in a long-simmering story of a possible acquisition of the venerable Hollywood identify. It comes alongside an present supply from Skydance Media to purchase Paramount mum or dad Nationwide Amusements and merge with the corporate as an entire.

And it lands amid reluctance from controlling shareholder Shari Redstone, amongst others, to promoting the corporate solely partially moderately than in complete.

Nonetheless, the supply considerably tops Paramount’s general market cap of $7.7 billion.

The inventory rose greater than 11% on Wednesday and is up greater than 1.5% in earlier than the bell.

Different articles to look out for on Searching for Alpha

Micron soars as Q2 results and guidance blow past expectations

Astera Labs rallies post-IPO as chip enthusiasm stays strong

And Disney teams up with Google and Trade Desk on an ad platform update

On our catalyst look ahead to the day:

- CSP (CSPI) will begin buying and selling on a split-adjusted foundation following the corporate’s two-for-one inventory break up.

- Arthur J. Gallagher & Co. (AJG) can be internet hosting its often scheduled quarterly administration assembly.

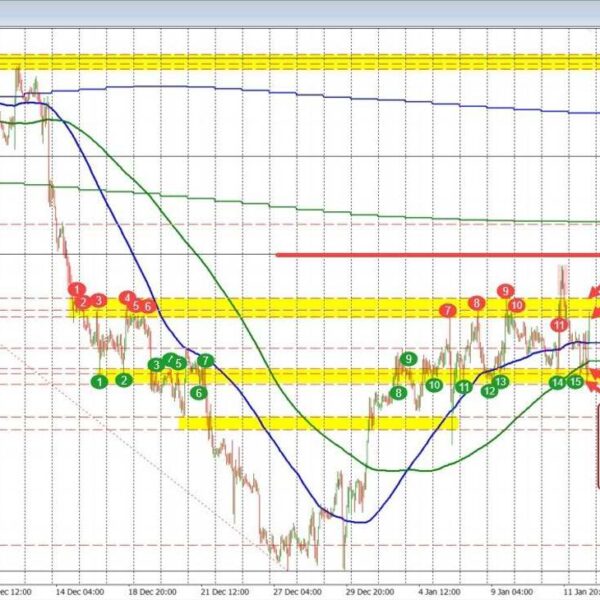

It was a giant day for the bulls on Wednesday because the S&P 500 (SP500) set a brand new closing document following what was seen as a dovish Fed dot plot and press convention from Chairman Jerome Powell.

The S&P rose rather less then +1%, ending above 5,200. The Nasdaq (COMP.IND) gained +1.25% and the Dow (DJI) rose +1%. Treasury yields fell

Merchants focuses on the FOMC conserving its dot-plot projection for 2024 at three charge cuts for the yr, though the members boosted their forecasts for actual development and core inflation, whereas slicing unemployment forecasts. So, even with a stronger economic system they nonetheless assume three cuts are acceptable. You may get extra particulars on that in Wednesday’s Fed edition of Wall Street Lunch.

This morning, the risk-on transfer continues. Index futures are within the inexperienced, led by Nasdaq 100 futures (NDX:IND).

Charges proceed to slip following the Swiss Nationwide Financial institution reduce charges for the primary time in 9 yr. It lowered its benchmark charge to 1.5% from 1.75% and slashed forecasts for inflation. The ten-year Treasury yield (US10Y) is again beneath 4.25%.

Amongst premarket movers, Broadcom (AVGO) is up following the corporate’s announcement of its newest synthetic intelligence infrastructure choices at an investor assembly. Executives emphasised the necessity for a network-centric platform based mostly on open options to deal with the rising demand for generative AI clusters.

And Li Auto (LI) is underneath strain after the corporate revised its 1Q24 supply outlook attributable to lower-than-expected order consumption. It now expects automobile deliveries to be between 76,000 and 78,000, down from the earlier estimate of between 100,000 and 103,000.

We wrap up with in the present day’s financial calendar

- 8:30am Preliminary Jobless Claims and March Philly Fed

- 9:45am PMI Composite Flash for March

- 10:00am February Present Dwelling Gross sales and February index of Main Indicators