Treasury yields soared on Friday, with stable readings on each jobs and shopper sentiment bolstering hypothesis that bets on Federal Reserve price cuts subsequent yr could have gone too far.

Article content material

(Bloomberg) — Treasury yields soared on Friday, with stable readings on each jobs and shopper sentiment bolstering hypothesis that bets on Federal Reserve price cuts subsequent yr could have gone too far.

Throughout Wall Avenue, the prevailing view is: Whereas financial energy makes traders much less apprehensive a couple of recession, it additionally means the Fed may need to carry charges larger for longer. That comes as a disappointment to merchants who at one level had been betting the central financial institution would be capable of pivot as early as March. Swap contracts now present a 40% likelihood of that taking place — from over 50% previous to the report.

Commercial 2

Article content material

Article content material

Following a slew of figures underscoring a slowdown on the roles entrance, Friday’s studying confirmed an sudden employment pickup. Nonfarm payrolls elevated 199,000 final month, the unemployment price fell to three.7% and month-to-month wage progress topped estimates. A separate report confirmed US shopper sentiment rebounded sharply in early December — topping all forecasts — as households dialed again their year-ahead inflation expectations by probably the most in 22 years.

“The US economy continues to perform well,” stated John Leiper at Titan Asset Administration. “The aggressive decline in US Treasury yields we saw last month, which already looked a little overdone, is going into reverse with bond yields jumping. With markets pricing out rate cuts next year, higher-for-longer is back in vogue.”

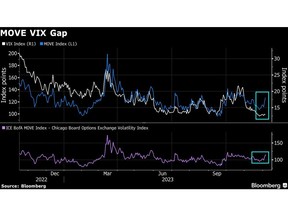

US two-year yields jumped 12 foundation factors to 4.72%. Issues additionally grew that technically “overbought” circumstances and bullish positioning left merchants uncovered to corrections. The S&P 500 edged larger. Wall Avenue’s “fear gauge” — the VIX — dropped to pre-pandemic ranges.

To Callie Cox at eToro, the robust jobs information could possibly be a “heat check for Wall Street” after markets rallied considerably on the rate-cut commerce. Hopes have gone somewhat too far, she famous.

Commercial 3

Article content material

“Just when you think the economy is finally softening, it continues to show signs of strength,” stated Chris Zaccarelli at Unbiased Advisor Alliance. “We remain bullish on the market because we are bullish on the economy.”

In truth, which may be one of many the explanation why the bond market cared much more in regards to the financial information than shares did.

“While these numbers may give the Fed pause that the economy isn’t slowing enough to reach 2% inflation in a timely fashion, recession fears are quickly evaporating,” stated Louis Navellier at Navellier & Associates.

Softening inflation and employment information prior to now month have satisfied traders that the Fed is completed elevating rates of interest and ignited bets that cuts of at the least 125 foundation factors of cuts had been in retailer over the following 12 months. Merchants scaled again these wagers to about 110 foundation factors of easing.

“People saying recession need to have their heads examined,” stated Neil Dutta at Renaissance Macro Analysis.

Merchants are making ready for one more busy week, with readings for the US shopper value index and retail gross sales, a compressed schedule of Treasury auctions — and the Fed’s remaining assembly of the yr on the docket.

Article content material

Commercial 4

Article content material

Fed officers are broadly anticipated to maintain borrowing prices on the highest degree in twenty years on Wednesday. Chair Jerome Powell has repeatedly pushed again in opposition to rising bets of price cuts early subsequent yr, stressing that policymakers will transfer cautiously however retain the choice to hike once more.

Whereas labor market energy implies fewer price cuts, traders ought to applaud the roles report because it suggests the Fed is delivering a “Goldilocks” situation of decrease inflation with out recession — which is the very best consequence for threat property, stated Ronald Temple at Lazard.

“The Fed has been stymied by better-than-expected data releases,” stated Quincy Krosby at LPL Monetary. “As long as inflation continues to edge lower, the Fed will likely remain on hold. But if today’s report is a harbinger of continued consumer spending, the Fed may have to issue a considerably more hawkish message and telegraph that they still cannot declare victory on their campaign to quell inflation.”

Former Treasury Secretary Lawrence Summers stated the Fed ought to maintain off on a shift towards decreasing rates of interest till there’s decisive proof displaying that inflation is again beneath management or that the financial system is coming into a stoop. Whereas a delicate touchdown, the place costs come beneath management and not using a recession, is wanting “more in play,” it’s not an consequence to be assured about at this level, he added.

Commercial 5

Article content material

To Brian Rose at UBS, provided that the market is already pricing in a number of price cuts in 2024, the Fed will probably keep away from sounding “overly dovish.”

The Fed is prone to hold coverage restrictive till mid-2024 — at which level inflation ought to have subsided sufficiently to warrant a modest easing cycle, based on Ronald Temple at Lazard.

“While labor market strength implies fewer rate cuts, investors should applaud the report as it suggests the Fed is delivering a ‘goldilocks’ scenario of lower inflation without recession — which is the best outcome for risk assets,” he famous.

A key gauge of stock-market fear will climb in 2024 after tumbling this yr to the bottom since earlier than the pandemic struck, and the magnitude relies on the energy of the financial system, based on JPMorgan Chase & Co. strategists.

The Cboe Volatility Index will “generally trade higher in 2024 than in 2023, and the extent of the increase depends on the timing and severity of an eventual recession” and potential wider swings that might curb promoting of short-term volatility, the financial institution’s Americas fairness derivatives strategists, led by Bram Kaplan, wrote in a notice Friday.

Commercial 6

Article content material

Inventory markets will endure within the first quarter of 2024 as a rally in bonds would sign sputtering financial progress, based on Financial institution of America Corp.’s Michael Hartnett.

The narrative of “lower yields = higher stocks” would flip to “lower yields = lower stocks,” Hartnett wrote.

Sentiment indicators are additionally now not supportive of additional positive aspects in threat property, Hartnett stated. BofA’s customized bull-and-bear sign surged to three.8 from 2.7 within the week via Dec. 6, its greatest weekly leap since February 2012. A studying beneath 2 is usually thought of to be a contrarian purchase sign.

Cash-market funds attracted their largest inflows since March, whereas US equities had an eighth straight week of inflows, BofA stated, citing EPFR International information.

David Bailin, Citi International Wealth’s chief funding officer and head of investments, says shares are ripe for additional positive aspects in 2024 as inflation traits decrease, the financial system stays resilient and earnings rebound — growing the chance value for traders nonetheless sitting on the sidelines, clinging to their money.

“I’m not sure what investors are waiting for,” he stated. “The US economy is going to stay strong and, eventually, money-market rates are going to come down, so why are people not buying core 60/40 portfolios?”

Commercial 7

Article content material

Elsewhere, oil rebounded as technical ranges supplied assist and the US sought to refill its Strategic Petroleum Reserve, however nonetheless remained heading in the right direction for the longest weekly shedding streak since 2018 on issues a couple of world glut.

Company Highlights:

- Endeavor Vitality, the biggest closely-held oil and gasoline firm within the Permian basin, is exploring a sale that might worth it between $25 billion and $30 billion, based on Reuters.

- Honeywell Worldwide Inc. agreed to accumulate the safety enterprise of Service International Corp. for an enterprise worth of about $5 billion, which marks the largest deal since 2015 for the maker of jet engines and gasoline detectors.

- Starbucks Corp. stated it reached out to the union representing tons of of its shops, a possible step towards ending an deadlock that has frayed the espresso big’s relationship with a few of its frontline staff.

- Alphabet Inc.’s Google stated that the European Union’s risk to interrupt up its worthwhile advert tech arm was “flawed” because it formally took intention on the bloc’s allegations of anticompetitive conduct.

- Broadcom Inc., a chip provider for Apple Inc. and different massive tech corporations, expects the fast growth of synthetic intelligence computing to assist offset its worst slowdown since 2020.

- Lululemon Athletica Inc.’s fourth-quarter income steerage trailed Wall Avenue estimates, a uncommon miss for the retailer whose efficiency routinely exceeds investor expectations.

- Microsoft Corp. and OpenAI Inc.’s partnership, which just lately went via a governance meltdown, is going through but extra scrutiny after the UK antitrust watchdog stated it’s contemplating if it must be known as in for a full blown investigation.

- Commodity buying and selling big Trafigura Group paid $5.9 billion in annual dividends to its worker shareholders, greater than triple a yr earlier, after churning out one other report revenue within the 12 months via September.

- Anglo American Plc unveiled plans to drastically minimize manufacturing in a bid to scale back prices amid logistical and operational snarls.

Commercial 8

Article content material

A number of the foremost strikes in markets:

Shares

- The S&P 500 rose 0.3% as of two:15 p.m. New York time

- The Nasdaq 100 rose 0.3%

- The Dow Jones Industrial Common rose 0.3%

- The MSCI World index rose 0.2%

Currencies

- The Bloomberg Greenback Spot Index rose 0.2%

- The euro fell 0.3% to $1.0761

- The British pound fell 0.3% to $1.2555

- The Japanese yen fell 0.5% to 144.85 per greenback

Cryptocurrencies

- Bitcoin rose 1% to $43,832.26

- Ether fell 0.9% to $2,349.88

Bonds

- The yield on 10-year Treasuries superior eight foundation factors to 4.23%

- Germany’s 10-year yield superior 9 foundation factors to 2.28%

- Britain’s 10-year yield superior seven foundation factors to 4.04%

Commodities

- West Texas Intermediate crude rose 2.7% to $71.20 a barrel

- Spot gold fell 1.4% to $2,000.68 an oz

This story was produced with the help of Bloomberg Automation.

—With help from Edward Bolingbroke, Sagarika Jaisinghani, Michael Mackenzie and Carly Wanna.

Article content material