Richard Drury/DigitalVision via Getty Images

Listen below or on the go via Apple Podcasts and Spotify

Joby Aviation (JOBY) shares soar after teaming up with Nvidia to advance autonomous flight tech. (00:25) Nvidia (NVDA) stock nears historic $5 trillion mark on upcoming Trump-Xi Blackwell chip talk. (01:17) No food stamps from next month as USDA says ‘the well has run dry.’ (01:55)

This is an abridged transcript.

Joby Aviation (NYSE:JOBY) is teaming up with NVIDIA (NASDAQ:NVDA) to advance the development of its “Superpilot” autonomous flight system. The partnership will use NVIDIA’s (NASDAQ:NVDA) new IGX Thor computer platform, powered by its advanced Blackwell AI chips.

The technology gives Joby’s (NYSE:JOBY) aircraft the ability to process huge amounts of data, make real-time flight decisions, and respond to weather, air traffic, or unexpected events — almost like a human pilot. It’ll even be able to predict maintenance needs before a problem occurs.

“The autonomous systems under development at Joby are poised to complement human intelligence by providing speed, precision, and stamina beyond what a person alone is capable of,” said Gregor Veble Mikić, Flight Research Lead at Joby.

Joby Aviation (NYSE:JOBY) is up 7 % in early trading.

Sticking with Nvidia…

Nvidia (NASDAQ:NVDA) shares have popped in premarket action, putting the chipmaker on track to surpass a $5 trillion market capitalization, a milestone no public company has ever reached.

As of the time of this recording, Nvidia is up 3.2% to $207.92.

The stock is lifted by President Trump’s remarks that he expects to speak with China’s Xi Jinping about Nvidia’s flagship Blackwell AI chip.

The stock has rallied nearly 50% year-to-date, adding about $1.6 trillion in market value.

As the government enters the 29th day of the ongoing shutdown, the U.S. Department of Agriculture announces no new benefits will be issued next month under the Supplemental Nutrition Assistance Program.

Starting November 1st, federal food aid will be suspended, impacting millions of Americans, about one in eight people nationwide.

The department says simply, “The well has run dry.”

Democratic officials in 25 states have filed suit against the Trump administration, arguing the government is legally required to tap a $6 billion contingency fund to keep benefits flowing. But the USDA says that money is reserved for emergencies like disaster relief, not routine payments.

This is now the second longest shutdown in U.S. history.

The Trump administration blames Democrats, who are pushing to extend Affordable Care Act subsidies.

What’s Trending on Seeking Alpha:

Starbucks Q4 preview: Analysts caution over declining same-store sales

SA analyst upgrades/downgrades: GOOG, INTC, AVGO, WBD

Thermo Fisher said to eye $10B takeover of clinical trial software firm Clario

Dow, S&P and Nasdaq futures are in mixed territory. Crude oil is down 0.3% at two cents shy of $60/barrel. Bitcoin is up 0.1% at $113,000. Gold is up 1.7% at $4,017.

The FTSE 100 is up 0.4% and the DAX is flat. And the market in Hong Kong was closed on Wednesday for a holiday.

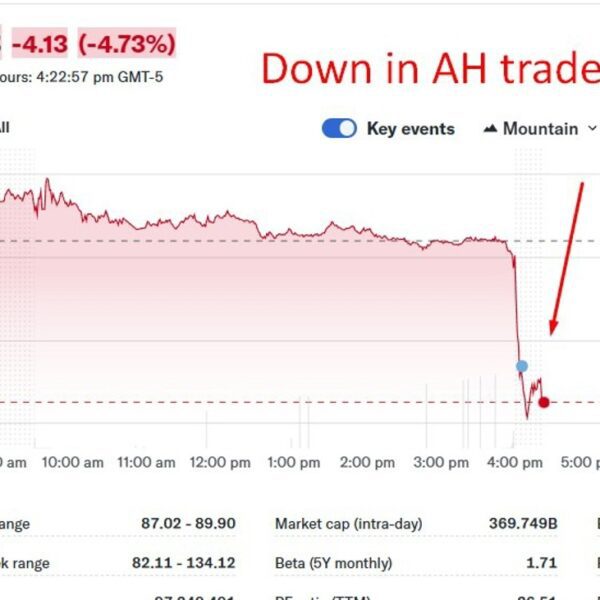

The biggest movers for the day premarket: Enphase Energy (NASDAQ:ENPH) -9% – Shares dropped after the solar inverter maker issued soft Q4 guidance and flagged tariff-related margin pressure.

On today’s economic calendar:

-

10:00 am Pending Home Sales Index

-

2:00 pm FOMC Announcement

-

2:30 pm Fed Chair Press Conference

We’ll have a special edition of Wall Street Lunch today after the FOMC announcement and press conference.