Surprise jitters

More than $420 billion. That’s how much value Bloomberg estimates chip stocks globally have shed after their Dutch peer ASML Holdings (ASML) lowered its forecasts for 2025 and revealed that it booked about half the orders Wall Street expected in the third quarter. While ASML’s shares tanked about 17%, the news also took down other semiconductor stocks: Nvidia (NVDA), AMD (AMD), Taiwan Semiconductor (TSM), Broadcom (AVGO), Intel (INTC), Applied Materials (AMAT), and Lam Research (LRCX).

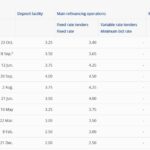

Zoom in: On Tuesday, chip equipment supplier ASML slashed its net sales forecast to €30B – €35B ($32.7B – $38.1B) from previous expectations of €30B to €40B. The guidance came in about 15% to 20% below expectations. For Q3, ASML’s net orders were €2.6B compared to the consensus of €5.39B. Meanwhile, quarterly net sales were €7.47B, beating estimates of €7.17B. CEO Christophe Fouquet mentioned that while development in artificial intelligence remains robust, other market segments like logic and memory were taking longer to recover, and this trend would likely continue into 2025.

Export curbs at play? For ASML, a larger worry is the business they are losing in China due to current U.S. and Dutch export restrictions set in place to curb China’s AI capabilities. “So we expect China to come in at around 20% of our total revenue for next year. Which would also be in line with its representation in our backlog,” ASML CFO Roger Dassen said. This means a massive reduction, as revenue from China accounted for 49% of ASML’s revenue in the previous quarter. Separately, a recent Bloomberg report mentioned that U.S. officials have also been in talks to set a cap on export licenses for certain nations in the interest of national security.

SA commentary: “With a primary growth driver, China, gone, it could be a while before investor sentiment on ASML Holding N.V. stock turns around. I don’t think shareholders need to sell, but we could be range-bound for the foreseeable future,” said Kumquat Research in ASML: Export Restrictions Kill Key Growth Driver. Expecting ASML’s revenue growth to be driven by high numerical aperture EUV products, Hunter Wolf Research said, “I think the headwinds are fully priced in their current stock price. I am buying the dip today.”