Geopolitical flare ups are helping to temper venture capital’s decades-long love affair with software and spark a greater interest in defense technology, according to several startup investors.

The wars in Ukraine and Israel have spurred venture capitalists to open their pocketbooks for so-called defense tech, the equipment and systems used to defend national interests, according to a report from AIN Ventures. Between 2021 and 2023, investors funneled $108 billion into defense tech companies, the Washington Post reported in February, citing PitchBook data.

For years, private equity and venture capital firms have made big money by investing in software. Video conferencing service Zoom, workplace messaging service Slack, and mortgage software maker Ellie Mae are just a few examples of companies that have delivered huge returns for investors through initial public offerings or acquisitions.

But the rush to fund software startups will eventually cool, warned Jenny Xiao, a partner at Leonis Capital, during a July 17 panel at Fortune’s Brainstorm Tech conference in Park City, Utah. The reason: AI will reduce the cost of creating software to nearly zero, making it a difficult business in which to make money because of competition, she said.

“Software is no longer going to be as good of a business in the next 20 or 30 years. Mostly because of AI—because AI makes it so easy to build software,” Xiao predicted.

Instead, hardware, a sector that is a sort of ugly duckling in tech because of the high costs required to get off the ground and to manufacture, will undergo a metamorphosis, she argued. That’s why defense tech is primed to be a good investment. “You almost always have to have some sort of hardware and have some sort of hard technology,” Xiao said.

Of course, defense tech isn’t a new sector, as startups have played an important role creating new defense technology for more than 20 years, consulting firm McKinsey said in a February report. Moreover, a small number of tech companies are already making a splash in defense tech including aerospace business SpaceX, data mining company Palantir, and defense tech startup Anduril.

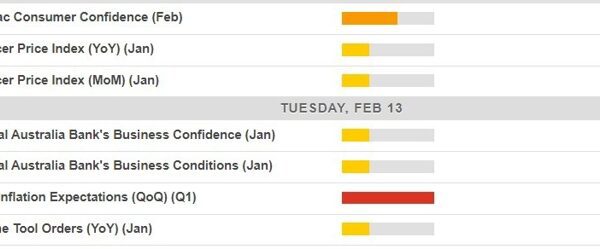

As it is, venture capital funding of defense tech varies greatly between years. A large funding round for a handful of startups can create huge fluctuations in industry-wide investing numbers over time.

For example, through mid-May this year, venture investing in defense startups had dropped 62% compared to the same point in 2023, according to Crunchbase. A big part of the decline was attributed to large funding rounds last year for robot maker Gecko Robotics, defense startup Shield AI, and aerospace company True Anomaly.

Marcus Ryu, a partner at Battery Ventures, agreed that tech sectors outside of software will likely do well in the coming years. “There is a general awakening to the possibility that there is enterprise value creation in other areas besides SaaS software, which is a good thing,” he said, referring to cloud-based software that has dominated venture capital investing over the past decade.

Nathan Poon, cofounder and CEO of medical drone delivery service Avol Aerospace, predicted that the tense relationship between the U.S. and China could be a boon for some businesses. He expects the U.S. government to crack down on products from China and U.S. companies that rely on Chinese components, as the federal government has already done with high-end semiconductors. “What we’ll see is a lot of homegrown U.S.-based drone companies become extremely profitable,” Poon said.

Currently military conflicts, like the Ukraine war, can also serve as a test bed for the technologies companies are developing, Poon said. Businesses don’t have to pay for pilots, they can “just send drones to Ukraine to test the latest firmware,” he said, referring to the software embedded in drone hardware.

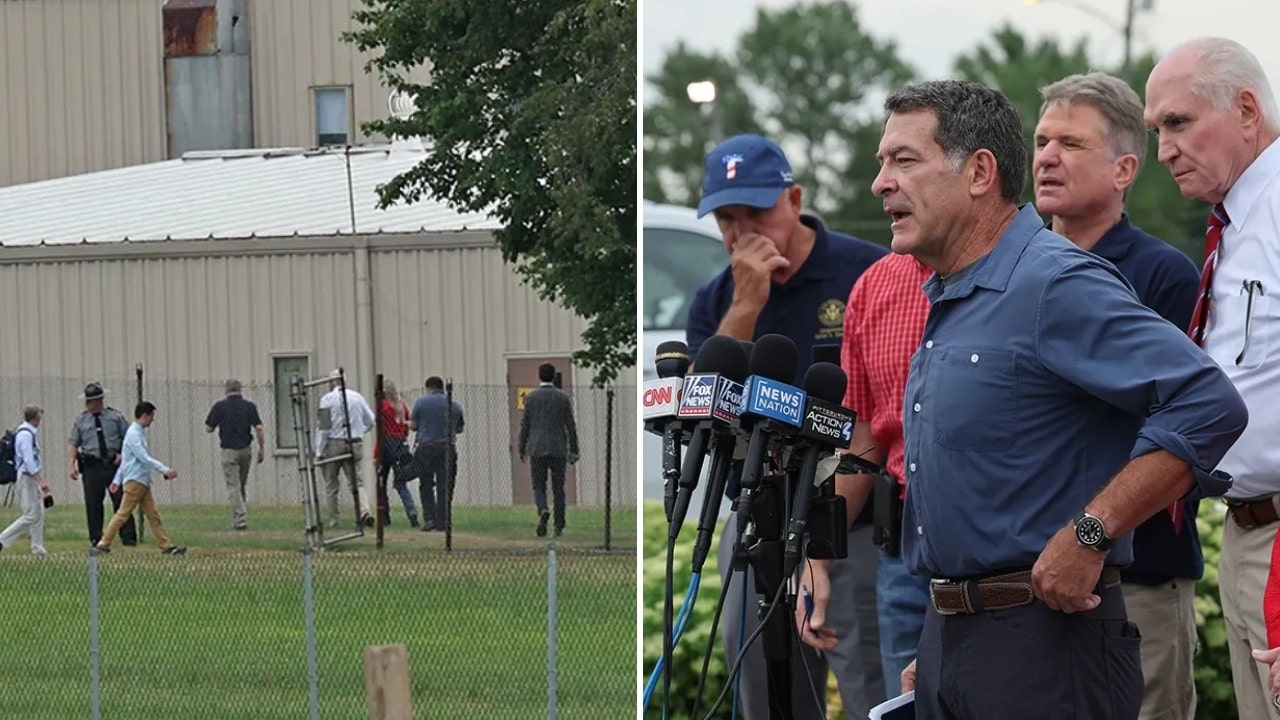

Panelists also discussed the rise in U.S. nationalism and the growing conservatism in Silicon Valley. Earlier this month, former- President Donald Trump formally accepted the GOP presidential nomination at the Republican National Convention and picked Sen. J.D. Vance (R-Ohio) as his running mate. Vance is a former venture capitalist who worked at Peter Thiel’s Mithril Capital, and Steve Case’s Revolution, before launching his own investment firm.

Until recently, many tech companies avoided working with the U.S. government on defense-related tech. In 2018, Google decided to not renew a contract with the Pentagon for technology that could be used for lethal purposes after Google employees objected.

More recently, however, that aversion has changed. Xiao, of Leonis Capital, noted a trend toward conservatism globally and that made working on defense-related startups and investing in them more popular. The shift in thinking is partly reflected by Silicon Valley billionaires increasingly supporting conservative candidates. Earlier this month, Ben Horowitz and Marc Andreessen, cofounders of venture firm Andreessen Horowitz, endorsed Trump for president, while Elon Musk promised to contribute $45 million monthly to a pro-Trump political action committee.

“Definitely we’re seeing a trend towards conservatism, and I think this is one of the reasons why investing in defense technology is no longer taboo,” Xiao said.