Editor’s notice: Looking for Alpha is proud to welcome Kenio Fontes as a brand new contributor. It is simple to develop into a Looking for Alpha contributor and earn cash on your finest funding concepts. Energetic contributors additionally get free entry to SA Premium. Click here to find out more »

Jacek_Sopotnicki

In recent times, Warner Bros. (NASDAQ:WBD) has confronted notable challenges throughout the quickly evolving media and leisure sector, with elements corresponding to poor decision-making and different elements (just like the SAG-AFTRA strikes and pay-tv disruption) contributing to substantial losses.

Nevertheless, regardless of the adversities, there are causes for some optimism concerning the corporate’s worth potential, given its excessive asymmetry on the time of writing. On this article, we’ll delve right into a little bit of the corporate’s valuation, as regardless of the powerful situation, from my standpoint, it’s additionally too undervalued.

Outlook For Warner Bros. Discovery

Warner Bros. Discovery operates in three primary segments: Networks, Studios, and Direct-to-Shopper (DTC). Within the Networks phase, the corporate faces challenges stemming from the disruption of the “pay-TV” mannequin, which negatively impacts income development, contemplating that in 2023, Networks accounted for about 51% of whole income, regardless of experiencing an 8% contraction throughout the 12 months.

Subsequently, in my projections, I assume a continuation of income declines within the Networks phase (whose primary traces are “distribution” and “advertising”). Nevertheless, it’s cheap to forecast that the corporate can regain its Studios income and speed up the expansion (and profitability) of the DTC division by way of international enlargement and different initiatives.

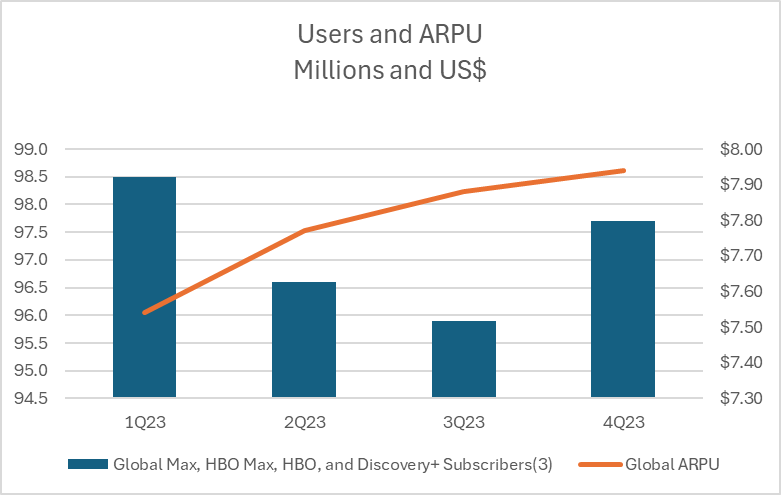

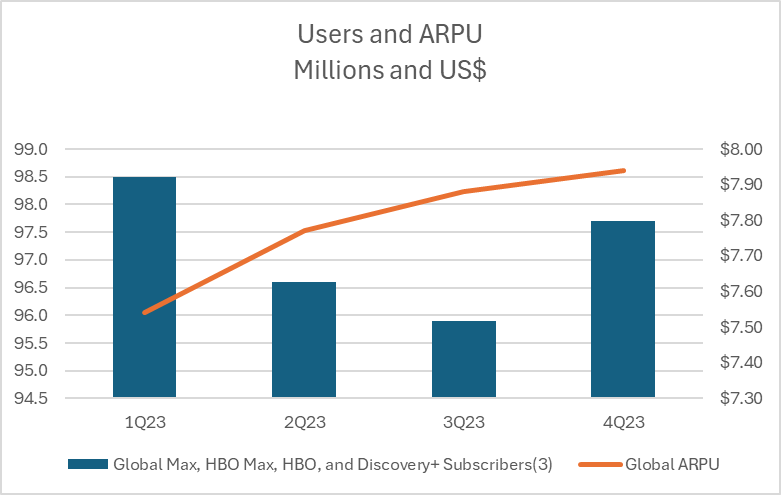

On this phase DTC, though the corporate is just not exhibiting accelerated subscriber development, its profitability initiatives are paying off, with ARPU (Annual Income Per Consumer) reaching 7.94 {dollars}, in comparison with 7.54 {dollars} at first of 2023. As well as, as an optionality, it’s attainable to say the partnership between Disney (DIS), Warner Bros. Discovery, and Fox, which intention to create a sports activities streaming service, which analysts project will cost between $40 and $50/m.

WBD Trending-Schedules

As well as, the corporate talked about on the This autumn earnings name that DTC could possibly be one of many drivers of promoting development:

We presently see the tempo of D2C promoting income accelerating off this tempo in Q1 and anticipate this to be an impactful phase driver for 2024 general. – Gunnar Wiedenfels, Warner’s CFO.

The Studios phase is already exhibiting constructive indicators, with movies like Dune, Wonka, and Barbie attaining important success. Moreover, the Hogwarts Legacy sport’s profitable launch signifies Warner Bros.’s means (and can) to leverage its IPs throughout varied leisure platforms.

Then again, as Oppenheimer dominates in Oscars, it’s value noting that, not like different Nolan films, this one wasn’t distributed by Warner., with the director ending the connection by saying that Warner has the worst streaming service. This, amongst others information, such because the delay of Batman half II, could also be an indicator of wrestle within the Studio division.

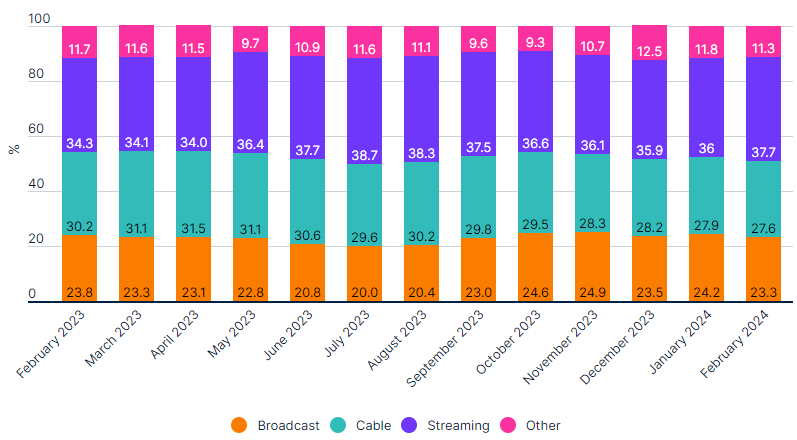

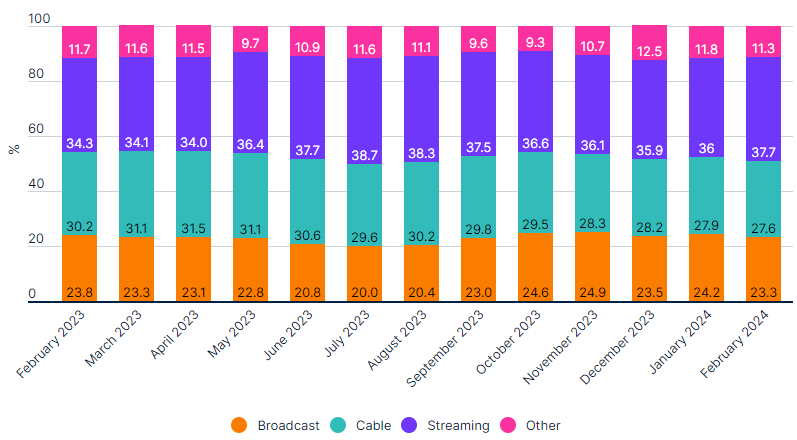

Talking of the streaming platform’s prospects, right here, though the outlook for development and profitability is optimistic, the situation is just not so pleasant both, given the sturdy aggressive surroundings. Even so, in response to Nielsen data, Max has remained in a secure trending place, representing round 1.3% of the time watched.

Utilizing information from the identical supply, though legacy (Networks) operations are exhibiting a decline, Broadcast and Cable TV nonetheless account for more often than not watched. As well as, the sports activities style stays one of many primary applications on cable TV, with TNT’s (Warner) broadcast of the NBA All-Star Recreation 2024 taking first place.

Share of TV Trended (Nielsen)

Assumptions, Forecast, and Valuation

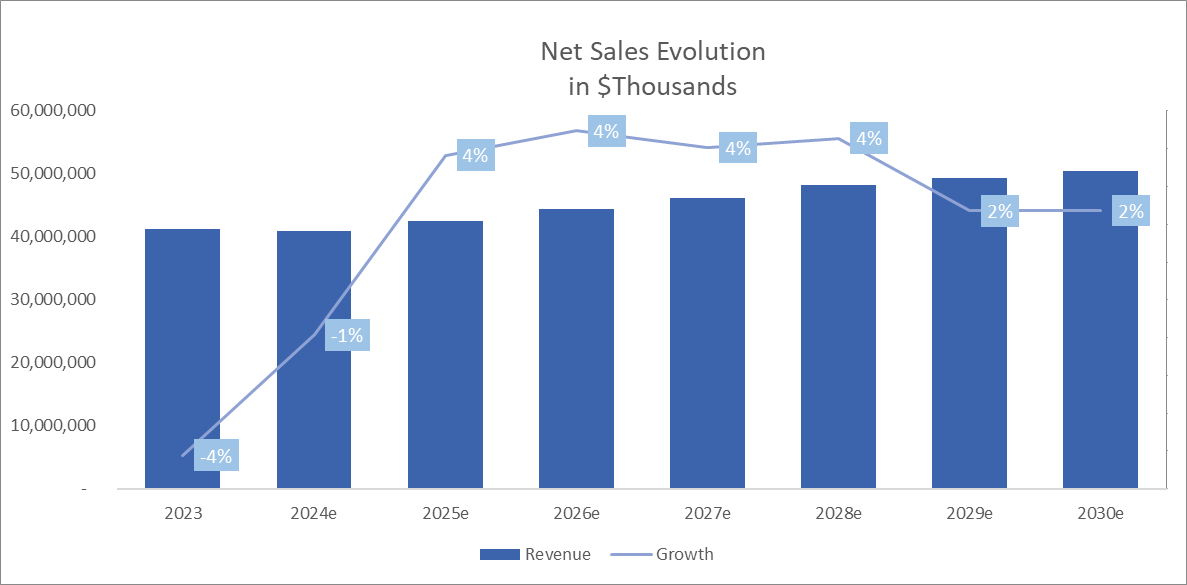

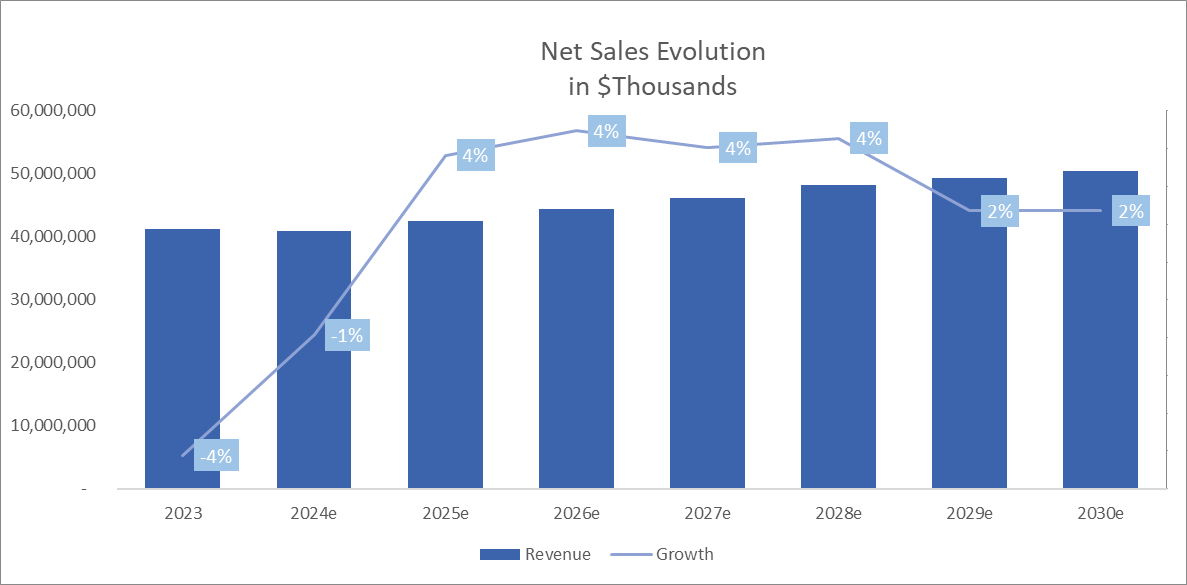

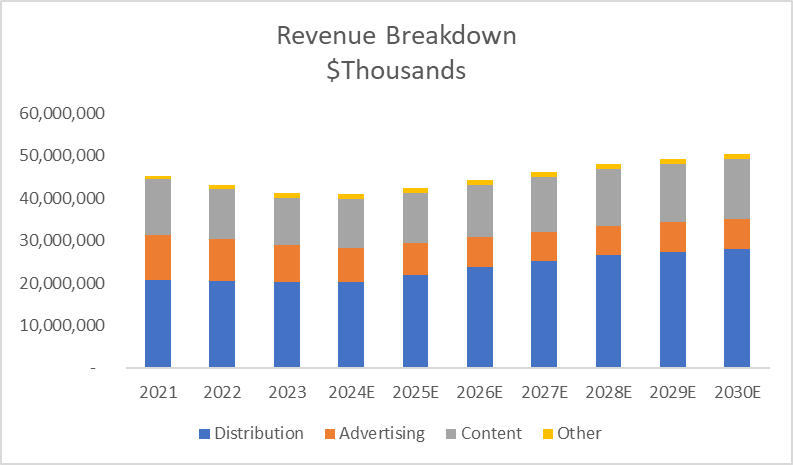

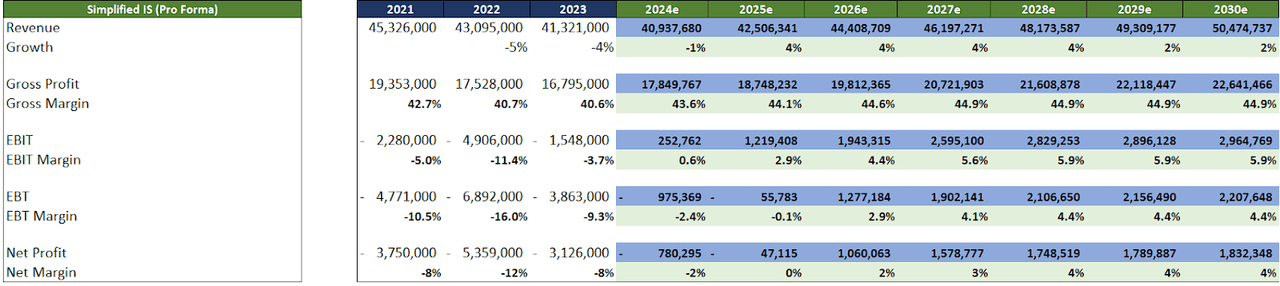

With these views, contemplating a decline in Networks over the subsequent few years, modest development in Studios (restoration), and barely accelerated development in DTC, we’ve got the next evolution of Internet Gross sales:

Supply: Creator and WBD Trending-Schedules

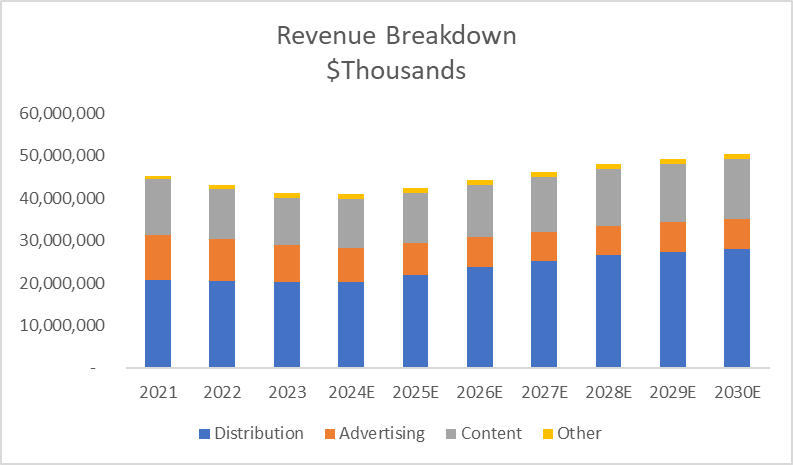

Notice that even imagining DTC’s evolution may offset the decline in Networks, these assumptions nonetheless produce conservative outcomes. Internet income is projected to advance by 4% till 2028, adopted by a modest 2% development thereafter. The income breakdown is as follows, with a higher slowdown in promoting because of Networks (even with some offset of DTC promoting), Content material (studios) secure, and distribution gaining illustration because of DTC:

Supply: Creator and WBD Trending-Schedules

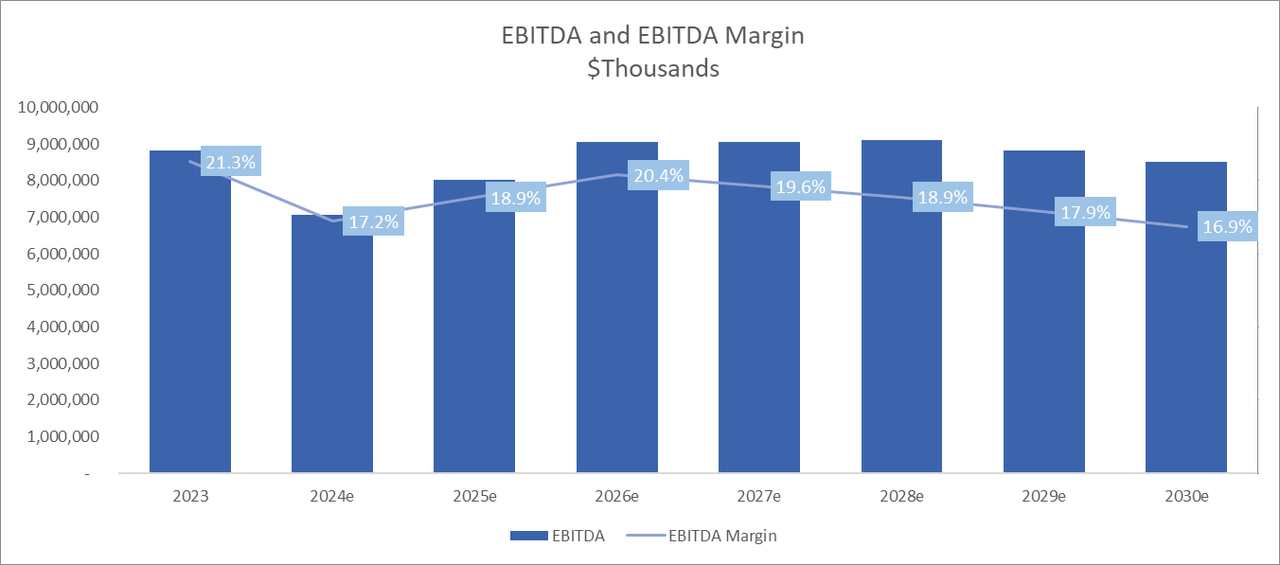

Shifting on to profitability assumptions, right here, though partly conservative, it’s a necessity to consider that their inner initiatives (a minimum of partly) will probably be efficient over time, together with capturing synergies and making the DTC channel worthwhile (which in flip had an ADJ EBITDA of $100 million in 2023 and has a steerage of $1 billion for 2025).

Thus, contemplating some evolution in prices and bills relative to the corporate’s internet income, in addition to depreciation nonetheless at related ranges (though properly beneath 2023 and step by step declining), we’ve got an EBITDA margin reaching 20.4% in 2026.

Creator and WBD Trending-Schedules

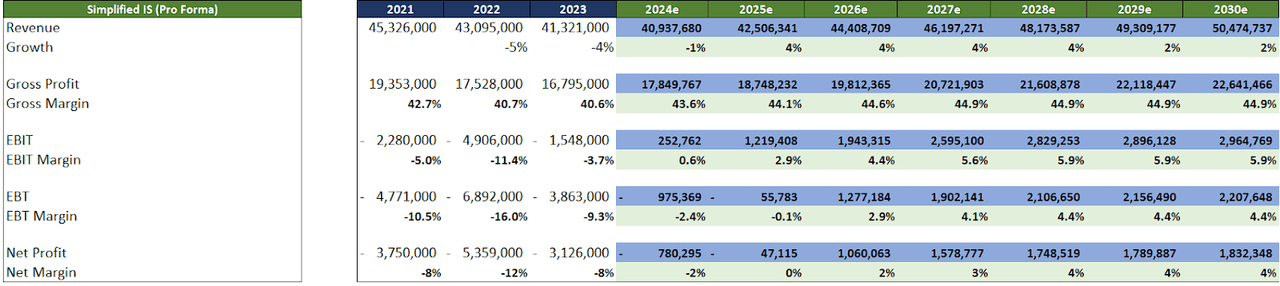

In the meantime, working margins stay flat after 2028, with the EBIT margin reaching 5.9% and the EBT margin at 4.4%. Thus, regardless of this situation with conservative assumptions, which lead to decrease income and EBITDA than projected by the market, it’s also a situation through which initiatives to monetize operations will happen, and the working margins present some modifications. For illustration functions, the consensus of 16 analysts tasks a income of $43.4b in 2026 and an EBITDA of $10.42b.

Supply: Creator and WBD Trending-Schedules

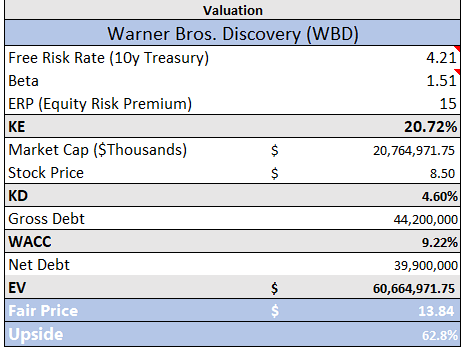

On this situation, I opted to make use of a DCF (Discounted Money Movement) mannequin to discover a truthful value for Warner Bros. Discovery shares, contemplating it a great way to worth an organization with sturdy money technology.

Different DCF premises embrace:

-

CapEx~-3% of Income. Barely increased than 2023 over the subsequent 2 years, considering the necessity for funding for development and profitability (tools, software program, streaming, video games, and AI), reaching -3% within the medium time period after which falling to -2.5% after 2030 (increased maturity achieved).

-

It is value noting, that Gunnar Wiedenfels, Warner CFO, stated that CapEx goes to come back down, and the main focus will proceed to be on capital effectivity. For 2024, he additionally stated that CapEx will “likely to be slightly lower”

-

-

Perpetuity Progress of 1% (virtually secure, beneath inflation, given the excessive maturity achieved).

-

WACC of 9.22% (harassed assumption, as may be seen within the 15% ERP within the picture beneath. It must be about 7% contemplating the low debt value).

With these assumptions, discounting the projected money movement it was attainable to discover a truthful value of $13.84 for WBD Shares, indicating an upside of roughly 60%.

Creator; Koyfin (Beta); CNBC (U.S. 10y Treasury)

This situation is merely an train (and consequently, the truthful value will range because the outlook modifications and Warner strikes ahead with its methods), and the corporate can shock each positively and negatively, however I consider it is already a robust indicator of undervaluation (i.e. could possibly be used to assist the ‘buy rating’), contemplating that the projection is a baseline situation the place the corporate achieves gentle development together with implementing sure initiatives.

On the identical time, predicting that the corporate won’t solely be capable to obtain a sure degree of profitability, but additionally perpetuate such money technology comes with built-in dangers, particularly contemplating that Legacy Operations might decelerate extra strongly, or the corporate might not be capable to consolidate itself amid of a aggressive streaming market. In different phrases, there’s asymmetry, however the degree of danger can also be excessive.

Worth Play or Worth Entice?

Regardless of the obvious low cost in shares, it is essential to acknowledge the challenges Warner Bros. faces. Whereas the corporate’s substantial debt, presently round $44 billion, raises issues and could possibly be an issue in some situations, its money technology is already ample to cowl these obligations, even with out main operational developments — and the debt prices are comparatively low. In 2023 alone, the company repaid $5.4 billion of debt, reducing net debt to $39.9 billion.

Moreover, the execution of its technique and the latest historical past of uneven efficiency are areas that require consideration. One of many primary elements that would improve worth destruction is an extra (or lasting) decline within the Networks phase, particularly if mixed with a failure to attain margin beneficial properties within the coming years.

Furthermore, regardless of exhibiting an attention-grabbing money technology, in latest intervals the corporate has demonstrated important losses, with a detrimental EBIT margin in 2023 and 2022.

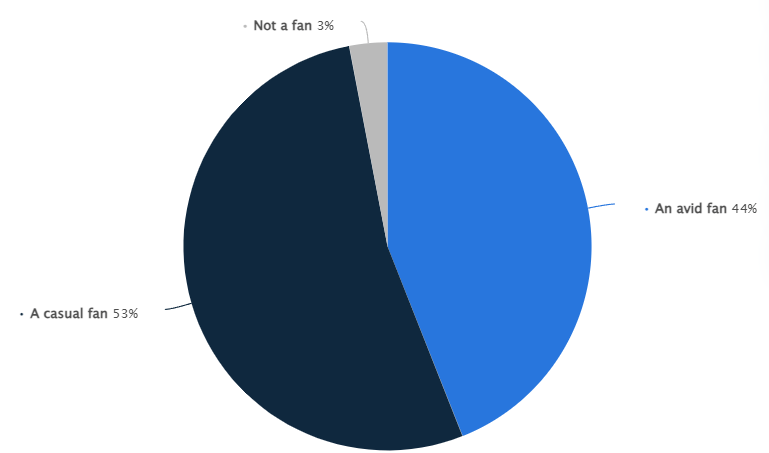

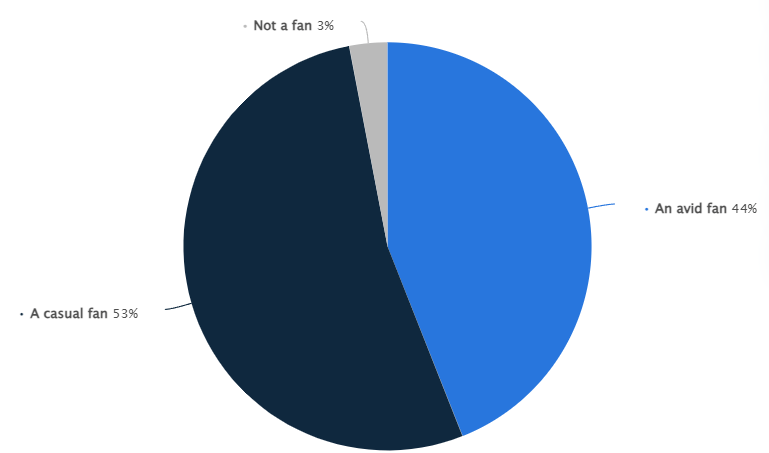

Nevertheless, the alternatives appear to outweigh the challenges: The standard of Warner Bros.’ IPs seems to be a big aggressive benefit, and the corporate is well-positioned to seize streaming and Studio market development, signaling its intention to discover its present content material, corresponding to Harry Potter (which is big, see the graph below) and DC. One other level to remember is that, even with its nice IPs, the corporate typically misses the mark. For instance, within the final earnings name, it was talked about that the Suicide Squad sport “has fallen short of our expectations”.

Share of adults who think about themselves followers of the Harry Potter films in the US in 2023: (Statista)

Additionally, it is attainable to say as an optionality, some operational beneficial properties that will come up not solely from the initiatives they’re already enterprise but additionally from different areas corresponding to synthetic intelligence (AI). It is nonetheless in its infancy and one thing to contemplate for the long run, however I consider that using AI for movie, sequence, and sport manufacturing will probably be an much more related subject within the media trade quickly, which may improve the corporate’s effectivity, both by producing content material extra shortly or at a decrease value, to not point out different facets associated to consumer expertise.

As a disclaimer, I am not asserting that Warner Bros. Discovery is an “AI company,” nevertheless it would not appear to me like an organization that has something to lose from technological development, however moderately one thing to achieve.

In brief, WBD’s thesis has important dangers, since despite the fact that its enterprise mannequin is powerful, it additionally faces challenges from disruption and competitors, which has led to weak income development and pressured margins.

Then again, there’s an effort with inner initiatives to regain profitability, and even with important debt, the corporate is already in a position to generate a big money mountain, which brings the multiples down and makes the shares extra enticing. These elements justify my bullish view.

It must be talked about that because of the increased degree of danger, there’s a want to observe the thesis extra intently (and in addition to be cautious concerning the measurement of this place within the portfolio). Some elements, such because the quicker deceleration of Networks, decrease DTC development, and low margin evolution, may simply alter the notion of the thesis’ worth.

The Backside Line

Warner Bros. faces important obstacles that improve the extent of danger, nevertheless it additionally has important alternatives forward. With a sturdy portfolio of IPs, a renewed deal with high-quality content material, and a worldwide enlargement technique, the corporate is well-positioned to remain related within the evolving media and leisure panorama.

Taking all this under consideration, the low multiples (each present and forecasted, corresponding to an EV/EBITDA NTM of 6.6x primarily based on market consensus on Koyfin) point out important undervaluation to me. Regardless of the corporate’s challenges, I view it not as a price entice however moderately as a inventory with elevated danger but a wonderful asymmetry.