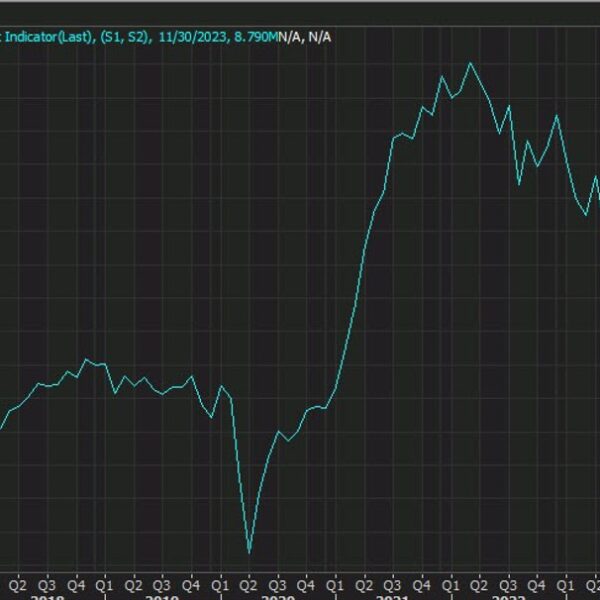

Berkshire Hathaway Inc. retreated on Monday after touching a report excessive that pushed the market worth of Warren Buffett’s conglomerate even nearer to $1 trillion.

The Omaha, Nebraska-based agency posted increased working earnings, which briefly boosted a inventory that’s been been crawling towards the trillion-dollar membership because it notched an all-time high final 12 months. Surpassing that degree would make Berkshire the primary US firm exterior of the expertise sector to achieve such a market capitalization.

The inventory closed decrease by 1.9%, after earlier gaining 3.1% in its largest one-day bounce since August. That briefly boosted Berkshire’s market capitalization above $925 billion.

“Extreme fiscal conservatism is a corporate pledge we make to those who have joined us in ownership of Berkshire,” Buffett wrote in his annual letter to shareholders. “Berkshire is built to last.”

The conglomerate reported fourth-quarter working earnings of $8.48 billion on Saturday, versus $6.63 billion for a similar interval a 12 months earlier, helped by a rise in insurance coverage underwriting earnings and funding earnings amid increased rates of interest and milder climate.

“Berkshire Hathaway’s earnings power should remain intact given its diverse units that can offset pockets of weakness — regardless of economic conditions,” Bloomberg Intelligence analyst Matthew Palazola wrote in a be aware.

Omaha-based Berkshire’s companies vary from insurance coverage to railroads and ice cream, a stark distinction to the tech giants that at present command such valuations. Its inventory trades in two courses — the extra closely traded Class B that now goes for greater than $400 per share, and its longer-standing Class A that modifications palms above $600,000.

Just a few US-based firms have ever attained market capitalizations above a trillion {dollars}.

Apple Inc. turned the first in 2018, whereas Microsoft Corp. not too long ago eclipsed the $3 trillion mark. Nvidia Corp. is flirting with a $2 trillion worth. Amazon.com Inc., Alphabet Inc. and Meta Platforms Inc. are additionally at present valued above $1 trillion, whereas Tesla Inc. as soon as crossed the mark however has since slumped.

Berkshire is the closest firm exterior of the tech giants, however that received’t essentially imply it’s the primary. Weight problems drugmaker Eli Lilly & Co. has prompted analyst questions of whether or not it could possibly be the primary $1 trillion biopharmaceutical inventory, as its market-capitalization quickly topped $700 billion.

Regardless of the inventory positive factors for Buffett’s conglomerate, its diversified companies and powerful insurance coverage outcomes maintain analysts optimistic.

Berkshire is “an attractive stock in an uncertain macro environment,” UBS analyst Brian Meredith wrote in a be aware. He holds a purchase ranking on shares.Play Video

In the meantime, Berkshire’s sheer dimension leaves significant deal-making tougher, as there “remain only a handful of companies in this country capable of truly moving the needle at Berkshire,” based on Buffett’s letter. Its money hoard has jumped to a report at $167.6 billion because the conglomerate struggled to search out transactions at enticing valuations.

“All in all, we have no possibility of eye-popping performance,” Buffett wrote.