Makiko Tanigawa

The last article that I published regarding Waste Management (NYSE:WM) came out in early June of this year. While that did touch somewhat on the company’s financial results, the primary focus involved what was then its just-announced acquisition of Stericycle (SRCL) in an all-cash transaction worth $7.15 billion. To see the last time that I analyzed the waste processing behemoth in a vacuum, you would need to go back to March of this year. At that time, I called the company boring. I also acknowledge that growth would be low. But because of the stability of the firm, management’s plans to grow, and how shares were priced relative to other businesses, I decided to rate it a ‘buy’.

Because of the amount of time that has passed and because the company has yet to complete its acquisition, I figured it would be a wise decision to look at the company again on a standalone basis. Doing this, I see continued growth, both on its top and bottom lines. On an absolute basis, I wouldn’t exactly call the stock cheap. But relative to similar firms, it is. Given this combination of factors, I don’t think it was wrong to rate the business a ‘buy’. And I would argue that it deserves to keep that rating at this time.

Still banking on trash

The purpose of this article is not to rehash or update details regarding Stericycle. Rather, it’s to assess the company on a standalone basis. I say this because I have been in this industry long enough to know that a deal is never done until it’s done. This is not to cast any doubt on the deal ultimately closing. It very likely will. Last Thursday, for instance, an important regulatory deadline expired that could see the company complete the transaction as early as this week. However, the current plan is for it to close in the final quarter of this year. The business has also received regulatory approval from other important parties. Examples include the governments of Portugal and the UK. Canada and Spain have also approved. The FTC has also given its approval. It would be shocking, if the transaction did not go through, given all of these approvals.

With that said, I think it would be healthy to dig into some of the most recent results of Waste Management as it stands. Take the most recent quarter, which would be the second quarter of the 2024 fiscal year, as an example. Revenue for this time came in at $5.40 billion. That’s an increase of 5.5% over the $5.12 billion the company generated one year earlier. Management attributed this to a higher yield on its trash collecting activities and to an increase in the value of recycled material. Digging a bit deeper, we see that the company has seen some improvements across most of its operations. Residential revenue, for instance, grew from $841 million to $863 million. Commercial revenue under the collection category popped from $1.26 billion to $1.33 billion. The company enjoyed an uptick in landfill revenue from $846 million to $873 million. Transfer revenue grew from $320 million to $348 million. And recycling processes and sales revenue expanded from $316 million to $405 million.

In one of my prior articles, which I already linked to above, I pointed out that an exciting part of the company to me involves its renewable energy operations. Long term, this is a part of the company that has some nice potential. But in the near term, I don’t see this contributing all that much to the top line. Its landfill gas to energy facilities operations did report a healthy 11.3% rise in revenue year over year in the second quarter. But that was from a very low base of $62 million to only $69 million. To put this in perspective, only 1.3% of the firm’s revenue currently comes from these activities. Certainly, this contribution will increase in the years to come. But this is a long-term play, not a short-term one.

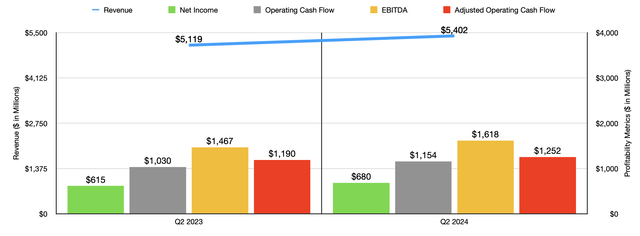

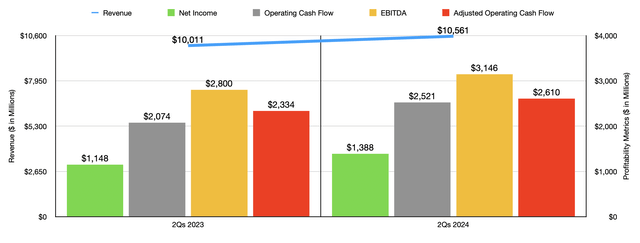

With revenue rising, profitability for the institution has also been growing. Net income jumped from $615 million last year to $680 million this year. Operating cash flow followed suit, growing from $1.03 billion to $1.15 billion. If we adjust for changes in working capital, we get a rise from $1.19 billion to $1.25 billion. And finally, EBITDA for Waste Management expanded from $1.47 billion to $1.62 billion. In the chart above, you can see financial performance for the first half of this year compared to the first half of 2023. As was the case in the second quarter on its own, revenue, profits, and cash flows, without exception, grew on a year-over-year basis.

In its second quarter earnings release, the management team at the waste giant increased guidance for EBITDA and free cash flow by $100 million. The current expectation is for EBITDA to come in at between $6.375 billion and $6.525 billion. If we use the midpoint here for guidance, and assume that net profits will rise at the same rate, we should expect net income of about $2.52 billion. Meanwhile, the guidance provided by management suggests a midpoint for operating cash flow of about $5.125 billion. It is likely that this increase in guidance has been made possible by major continued investments, even in the face of this aforementioned acquisition. In fact, during its second quarter earnings release, the company said that it closed on over $750 million of solid waste acquisitions through the end of July. This places the company on track to capture about $1 billion worth of solid waste acquisitions by the end of the year.

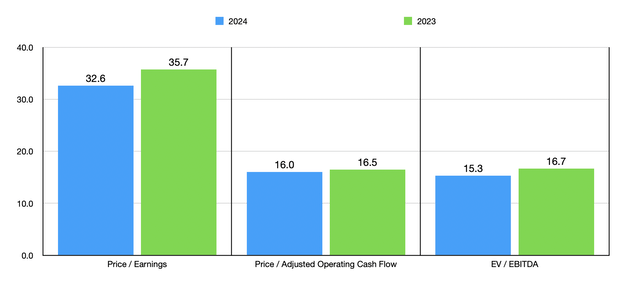

Using these estimates, as well as historical results for the 2023 fiscal year, I was able to value the company as shown in the chart above. Relative to earnings, the stock does look rather pricey. But again, we are talking about a high-quality business with stable cash flows that should continue to expand from here. When it comes to the other profitability metrics, the stock looks more or less fairly valued on an absolute basis. Having said that, relative to similar firms, our candidate is quite cheap. In the table below, you can see precisely what I mean. I compared Waste Management to three similar businesses. In each of the three valuation approaches, I found that it ended up being the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Waste Management | 32.6 | 16.0 | 15.3 |

| Republic Services (RSG) | 34.4 | 17.2 | 16.7 |

| Waste Connections (WCN) | 55.4 | 21.6 | 22.3 |

| GFL Environmental (GFL) | 1,194.8 | 17.5 | 23.8 |

Risks to be mindful of

At its core, Waste Management is a stable and solid business that should, in the long run, continue to expand. But there are certain risks for almost any business. And it’s no exception. The obvious risk that comes to my mind involves its acquisition of Stericycle. While acquiring the business offers the opportunity for additional revenue and cash flows, acquisitions have, from time to time, been botched. I can’t think of any specific examples or regarding this prospect. But the market is full of stories of acquisitions that have turned out poorly. I don’t think that this is highly probable, but it is a risk factor.

Other risks are more difficult to gauge. For instance, earlier in this article, I talked about the $750 million of management purchased in the solid waste space. The devil is always in the details. Overpaying for assets is a costly way to grow and can impair shareholder value. This kind of thinking extends into other investments the company might make as well. For instance, as I mentioned already, management is investing into renewable projects. This year, the company is on track to complete five such projects. It has another nine projects that are currently under construction.

Through 2026, Waste Management is budgeting as much as $2.9 billion toward renewable and recycling projects. And from 2022 through 2023, only $1.325 billion of this had been allocated. The current expectation is that the renewable projects that will come online are expected to contribute as much as $510 million of additional EBITDA, in the aggregate, through 2026. So they should be quite profitable. But project planning is never a guarantee, and economic conditions can change. Overinvestment in this space could prove costly, though again, I think the probability of that is quite low.

Takeaway

Fundamentally speaking, I would say that things are going very well for Waste Management and its investors. Obviously, the big thing is the aforementioned acquisition of Stericycle. But it is great to see that the company, on its own, is in top form. Management is making continued investments. In addition to this, they are being mindful of leverage. They expect a net leverage ratio of about 3.6 following the close of the purchase of Stericycle. But they expect to bring this down to between 2.75 and 3 within about 24 months following the close of the deal. This has pushed management to temporarily suspend their share buyback program. But considering how the stock is priced, I would say this is a net positive. Altogether, I do think the company still deserves a soft ‘buy’ rating at this time.