Nickbeer/iStock Editorial by way of Getty Photos

Funding abstract

My advice for Watches of Switzerland Group (OTCPK:WOSGF) is a purchase ranking. Two main driving elements have precipitated the share worth to fall by 70% for the reason that current peak, and I consider the fairness worth has been over-punished. I don’t consider WOSGF’s place within the distribution chain has been disrupted in any respect, and the market ought to finally understand this. Whereas demand within the UK is weak, it’s probably as a result of sturdy progress in earlier years and the weak macroeconomic situations. Luxurious watch demand continues to be sturdy, as could be seen within the US market.

Enterprise Overview

WOSGF is a licensed vendor of luxurious watches, luxurious jewellery, and different trend merchandise. As of 9M24, the income cut up is 85%, 6.2%, and eight.7%, respectively, making luxurious watches an important section of the enterprise. The enterprise serves solely two areas: the US (43% of the overall) and Europe, together with the UK (57% of the overall). Rolex is the biggest revenue-contributing model for the enterprise (cited at ~60% of group income as of FY20, as per the 2FQ22 earnings call). The WOSGF share worth has taken a giant hit since August final 12 months, down 70% since, and I consider there are two driving elements: the Rolex acquisition of Bucherer and the weak 3Q24 efficiency. Under, I focus on each causes and why I believe that is an funding alternative.

Rolex acquisition of Bucherer doesn’t threaten WOSGF place

For background, Rolex introduced their acquisition of Bucherer final August, and this has led to many traders believing that Rolex goes into vertical integration (direct distribution), which is a giant menace to WOSGF enterprise as Rolex is a giant chunk of its enterprise. I believe this narrative has little or no benefit. Initially, if we take a look at the press launch, one paragraph stands out that means Rolex has no intention of going into direct distribution. If that isn’t sturdy sufficient proof, the press release by WSOGY after the deal ought to persuade traders.

“Bucherer will keep its name and continue to independently run its business. The Group’s management team will remain unchanged. Bucherer’s integration into the Rolex group will be effective once the competition authorities have approved the takeover transaction.”

“There will be no operational involvement by Rolex in the Bucherer business. Rolex will appoint non-executive Board members. There will be no change in the Rolex processes of product allocation or distribution developments as a consequence of this acquisition.”

So the query is, why did Rolex purchase Bucherer? Though the headline motive was that Jörg Bucherer was dying and had no succession plan, I consider there’s a greater image behind the scenes that makes strategic sense to Rolex. If Rolex didn’t purchase Bucherer, it will present Rolex’s rivals like Richemont or LVMH the chance to amass it, doubtlessly disrupting Rolex’s gross sales (Bucherer is the largest luxurious watch retailer on the planet). Therefore, the acquisition was completed.

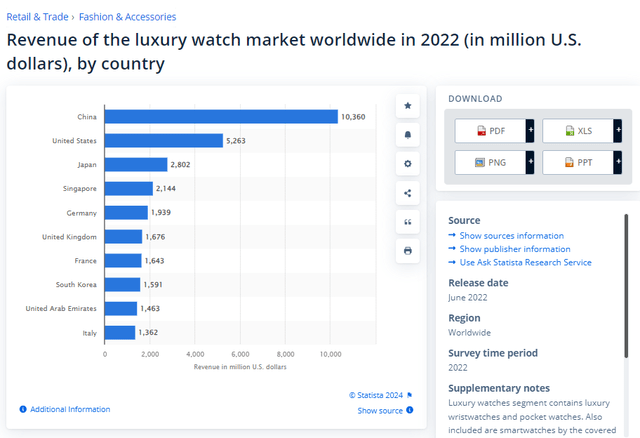

Furthermore, Rolex has traditionally relied on a fragmented community of third-party retailers for distribution. Bucherer, which occurs to be one of many main Rolex sellers globally, represents roughly 5% of Rolex’s revenue. Utilizing Rolex’s reported $11.5 billion in gross sales, this means ~$650 million in contribution to Rolex. Whereas for WOSGF, the enterprise contributes near a billion {dollars} in income (~60% of whole income) to Rolex, principally within the US and UK. For perspective, the US is the biggest spender of luxurious watches (exterior of China), and WOSGF has a bigger presence right here. As such, WOSGF nonetheless holds a vital constructive in Rolex’s distribution chain.

Even when Rolex does have intention for vertical integration, Rolex isn’t going to have the ability to accomplish that by simply buying a distribution channel that carries 5% of its income. The notable facet right here is that Rolex depends solely on brick-and-mortar retail and doesn’t allow on-line transactions, which additional complicates their potential to internalize distribution. It’s unlikely for them to vary this mannequin as a result of the shopper expertise whereas viewing the watches within the showroom is an important a part of the luxurious watch buy journey. The current retail areas of WSOGY are occupied by companions with long-term leases, which prevents Rolex from making a major entry into the market anytime quickly. It could take many years and billions of {dollars} to recreate this retail community, and Rolex could be taking an enormous operational danger that might injury its fame. Even when Rolex does wish to vertically combine, it must be good for WOSGF as a result of Rolex is extra more likely to simply purchase WOSGF than to attend out the leases and bid closely for these prime areas.

We’re the most important, the oldest retailer in Rolex. We have got the best visibility in initiatives that we have ever had going ahead, so we have got a really thrilling few years forward general with Rolex. 2Q24 earnings call

Demand outlook

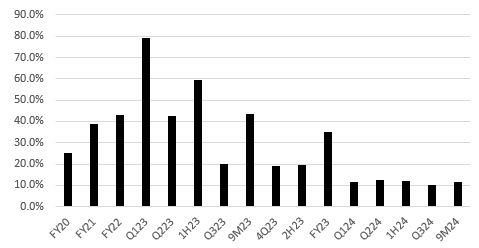

US income underlying y/y progress (Redfox Capital Concepts)

In 3Q24, WOSGF reported a 7% fixed forex income decline in Europe, together with the UK, at GBP222 million, and confirmed that they’re seeing a difficult buying and selling surroundings. This precipitated one other main sell-off within the inventory. Whereas Europe/UK is weak, keep in mind that the U.S. enterprise continues to help double-digit income progress (11.4% underlying progress in 3Q24), and that is the biggest luxurious watch market on the planet. I ought to additional level out that FY23 was a really powerful 12 months for WOSGF. The UK enterprise grew 11.4% in FY23 on high of the 29.6% progress in FY22. As such, I consider the {industry} wants a while to digest all of the purchases. Given the macro headwinds within the UK, luxurious discretionary spending is unlikely to see a serious pick-up in the meanwhile. However I see this as a brief difficulty, on condition that the demand for luxurious watches has not been structurally impaired (take a look at WOSGF’s US progress for proof).

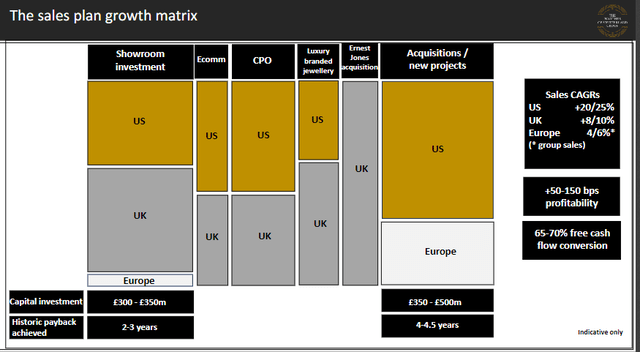

Throughout the latest Investor Day, administration introduced their intention to allocate GBP300-$500 million in M&A and new initiatives to consolidate the US market and develop in Europe. These investments have traditionally generated very enticing payback intervals of two–3 years (20+% ROI). As WOS continues to develop its footprint, mixed with the bettering macroeconomic situations forward, I consider general progress can simply choose as much as no less than mid-single digits, in keeping with industry expectations.

Valuation

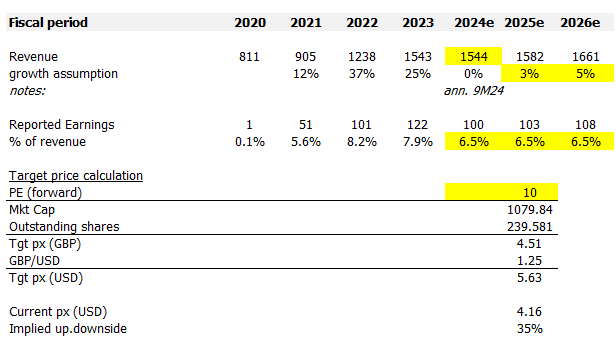

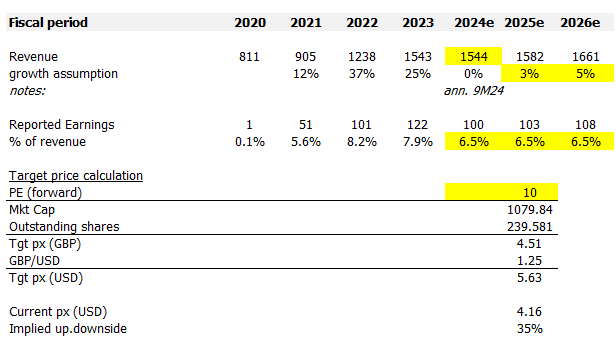

Redfox Capital Concepts

I mannequin WOSGF utilizing a ahead PE strategy, and utilizing my assumptions, I consider WOSGF is value $5.63. My assumption is that progress will finally recuperate to an industry-like progress fee over the subsequent 2 years, with the assumption that macroeconomic situations will ease by then. FY24 progress is more likely to be muted (I annualized from the 9M24 outcomes) given the previous 3 years noticed extraordinary progress and the {industry} most likely wants time to digest this. I don’t count on margin enchancment right here, as administration goes to proceed increasing its presence within the US and Europe, which suggests prices are going to go up. The most important upside driver in my mannequin is that PE a number of ought to commerce as much as 10x, which is a reduction to the extent earlier than Rolex introduced the acquisition (at 12x ahead PE). As I acknowledged above, I don’t assume the acquisition ought to have any valuation influence on WOSG given the explanations acknowledged, however a reduction is warranted as progress is way slower at the moment. Between the present 7.5x and the earlier 12.5x, I used the midpoint as a reference level.

Danger

If Rolex have been to amass extra retailers and resolve to enter direct distribution, this might be a serious recreation changer for WOSGF in that the fairness worth and enterprise place may very well be completely impaired.

Conclusion

My view for WOSGF is a purchase ranking regardless of its current share worth decline. The bearish sentiment surrounding the Rolex acquisition of Bucherer and weak European efficiency is overblown. WOSGF stays a vital companion for Rolex, particularly within the profitable US market. The UK slowdown is probably going non permanent as a consequence of previous years extraordinary progress and weak macro situations. Wanting forward, I’m constructive about WOSGF deliberate investments, which have traditionally completed properly and will simply help industry-like progress forward.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please pay attention to the dangers related to these shares.