Darren415

Funding has lagged behind different elements of the financial system

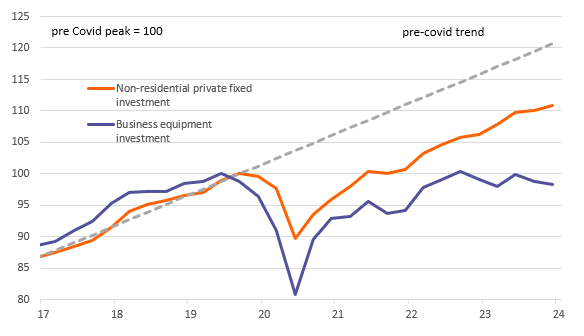

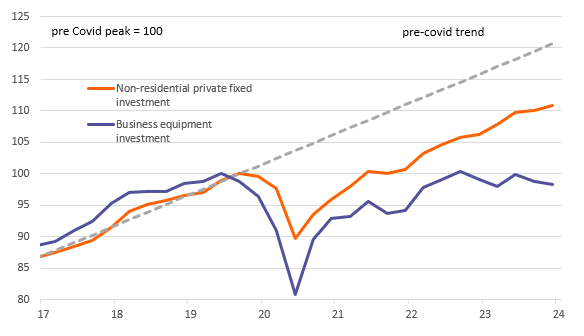

The US financial system beat expectations all through 2023, thanks primarily to the power of shopper and authorities spending development whereas internet commerce additionally made a constructive contribution. The primary disappointment was enterprise funding. Personal non-residential fastened funding is barely up 11% on its pre-Covid peak, however extra considerably, because the chart under reveals, is monitoring round 8 share factors under the place the pre-Covid pattern suggests it needs to be. Enterprise gear funding has carried out much more poorly with the extent of spending really down on 2019 ranges when adjusted for inflation.

Degree of actual enterprise funding (pre-Covid peak = 100)

Supply: Macrobond, ING

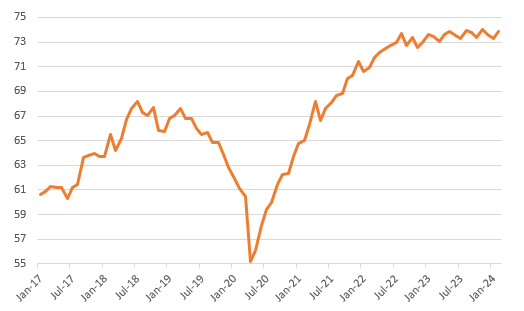

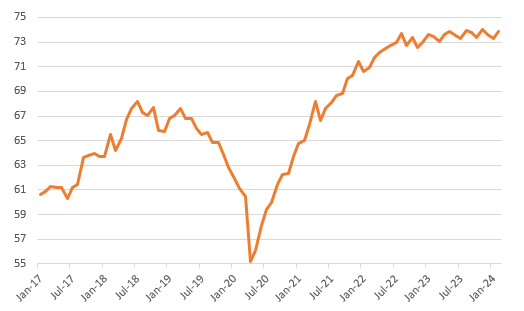

Sadly, right this moment’s sturdy items report offers no sign of an imminent turnaround on this scenario. Whole orders rose 1.4%, led by a 24.6% achieve in non-defence plane orders, with Boeing (BA) having obtained 15 new jet orders, up from simply three in January. Nonetheless, the January determine was revised right down to -6.9% from -6.2%. In any case, we desire to give attention to core orders – non-defence capital items orders ex plane – that are much less risky and have lead high quality for enterprise funding. It confirmed development of 0.7% month-on-month versus the 0.1% consensus, however once more, there have been sizeable downward revisions to the historical past.

Trying in greenback worth phrases, this vital metric has been range-bound between $72.5bn and $74bn ever since Could 2022, so when adjusted for inflation, the amount of orders is definitely falling over the interval. Traditionally, this has been the perfect lead indicator for enterprise capex and means that regardless of robust financial development and rising fairness markets, company America stays very reluctant to take a position.

Non-defence capital items orders ex plane ($bn)

Supply: Macrobond, ING

Shopper stays the main target for development, however challenges are mounting

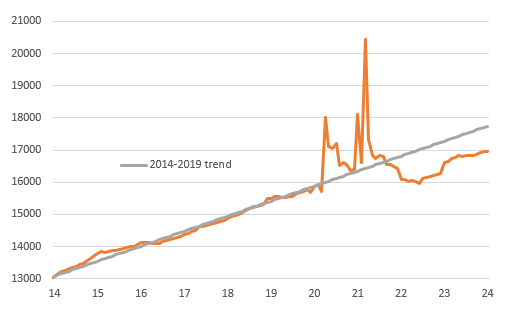

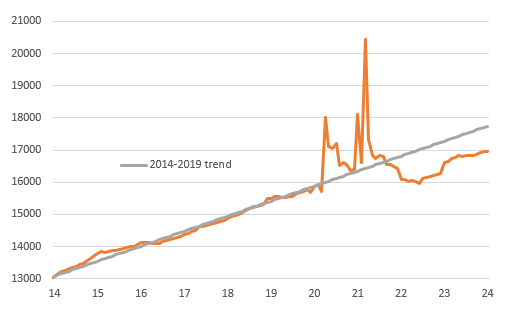

In that regard, we will probably be intently watching Friday’s private revenue and spending report. Shopper spending accounts for almost 70% of GDP and there are 4 essential methods to finance that spending – revenue, financial savings (both save much less every month or run down your inventory of financial savings), borrow extra, equivalent to utilizing bank cards or fourthly, promote property. Actual family disposable revenue is often the principle issue, however because the chart under reveals, it hasn’t moved a lot over the previous twelve months and the extent is effectively under the pre-pandemic pattern. We anticipate one other flat end result on Friday.

Actual Family Disposable Revenue ($bn) versus pre-Covid pattern

Supply: Macrobond, ING

This has meant financial savings and borrowing has been used as a key issue to take care of spending momentum and right here too there may be warning given bank card borrowing prices are at 50-year highs and auto mortgage rates of interest are the best in additional than 20 years. The San Francisco Federal Reserve Financial institution then estimates that of $2.1tn of pandemic-era accrued financial savings generated by revenue good points and decreased spending, solely round $110bn or so is left. This means that neither financial savings nor borrowing will present the identical quantity of help for spending that they did in 2022 and 2023.

This leads us to anticipate a slowdown in shopper spending and with authorities spending additionally prone to reasonable and funding doing comparatively little, a weakening development backdrop ought to assist to dampen value pressures. In flip, this could supply the Federal Reserve the room it seeks to start out transferring financial coverage from restrictive territory to a extra impartial stage from June onwards.

Content material Disclaimer

This publication has been ready by ING solely for info functions regardless of a specific consumer’s means, monetary scenario or funding aims. The knowledge doesn’t represent funding advice, and neither is it funding, authorized or tax recommendation or a suggestion or solicitation to buy or promote any monetary instrument. Read more