US CPI m/m

- MON: Swiss CPI

(Dec), EZ Retail Gross sales (Nov), Sentix (Jan), Japanese Tokyo CPI (Dec), Chinese language

Commerce Stability (Dec) - TUE: EIA STEO; German

Industrial Output (Nov), US NFIB (Dec). - WED: CNN

Republican Debate; Norwegian CPI (Dec), Chinese language CPI/PPI (Dec), Chinese language M2

(Dec). - THU: US CPI

(Dec), IJC (w/e fifth Jan), Japanese Present Account (Nov). - FRI: UK GDP

(Nov), US PPI Closing Demand (Dec), Canadian Housing Begins (Dec). - SAT: Taiwan

Presidential/Parliamentary Elections.

NOTE: Previews are listed in day order

Swiss CPI (Mon):

November’s launch was markedly cooler than

anticipated at 1.4% Y/Y (exp. 1.7%), even given the affect of the Rental Fee

improve from mid-2023. Nevertheless, the SNB’s December forecasts (supplied after

the November knowledge) search for inflation to tick as much as a mean of 1.8% throughout

Q1-2024. Although, crucially, inflation is seen throughout the 0-2% goal band for

the whole lot of 2024. December’s knowledge shall be assessed to see if the November

M/M lower at -0.2% continues, a decline that was pushed by decreased gas, resort

and vacation pricing with the majority of this stemming from imported merchandise.

Whereas the Rental Fee stays the headline level for these watching Swiss CPI,

the nation’s statistics workplace solely updates on this quarterly and is subsequent

scheduled for February’s CPI, due round two-weeks earlier than the March SNB coverage

announcement.

China Commerce (Mon):

There are presently no expectations for the

December Commerce Stability (prev. 35.39bln in USD phrases) and the Imports/Exports

breakdown (prev. -0.6% and +0.5% respectively). The information shall be eyed for a

prognosis of overseas and home demand. When it comes to the prior month’s

metrics, exports in November noticed a shock improve (in USD phrases) of 0.5% Y/Y

(exp. -1.1%), which ended a six-month streak of consecutive declines. The

surprising power in exports was attributed to China’s rising share in

the worldwide export market, regardless of general falling international commerce volumes. Key

elements embrace a shift in direction of EVs, though some desks counsel Chinese language

exporters face challenges comparable to decrease revenue margins and restricted scope for

additional value reductions, probably impacting export efficiency in 2024.

Imports final month remained weak and continued to lift issues surrounding

Chinese language home demand.

Norwegian CPI (Wed):

December’s print is anticipated to proceed the

incremental downward pattern within the Norges Financial institution’s principal measure of CPI-ATE

inflation, which printed at 5.8% Y/Y in November, a determine which matches the

January 2023 studying however was markedly beneath the 2023 peak of seven.0% from June.

December’s coverage announcement from the Norges Financial institution noticed a considerably surprising

hike to a probable 4.50% peak, although excessive inflation and NOK draw back have been cited

as potential drivers for additional tightening. For reference, the Financial institution’s This autumn-2023

CPI-ATE view is 5.83%, roughly in-line with November’s determine. When it comes to

December, SEB forecasts a Y/Y print of 5.6% writing that the anticipated modest

upward shock has not occurred within the collection.

China Inflation (Wed):

The prior month’s launch noticed inflation print

beneath expectations throughout the board, with CPI Y/Y at -0.5% (exp -0.1%), M/M at

-0.5% (exp -0.1%), and PPI Y/Y at -3.0% (exp -2.8%). The decline in shopper

value inflation was pushed by an additional lower in meals costs, from -4% to

-4.2% Y/Y, and a 0.5% M/M lower, after accounting for seasonality. Power

costs additionally fell by 2.7percentM/M, contributing to the deflation. Core inflation,

excluding meals and gas, remained regular at 0.6% in November. Analysts cited by

SCMP anticipate Chinese language inflation to stay low within the close to time period, however don’t

anticipate a deflationary spiral, and counsel core inflation is prone to

improve within the first half of 2024 on account of an increase in coverage assist, probably

boosting home demand and providers inflation. SCMP additionally posits that meals and

vitality value deflation is anticipated to minimize on account of altering base results, with

CPI inflation forecast to common 1% in 2024, up from 0.3% to this point this 12 months.

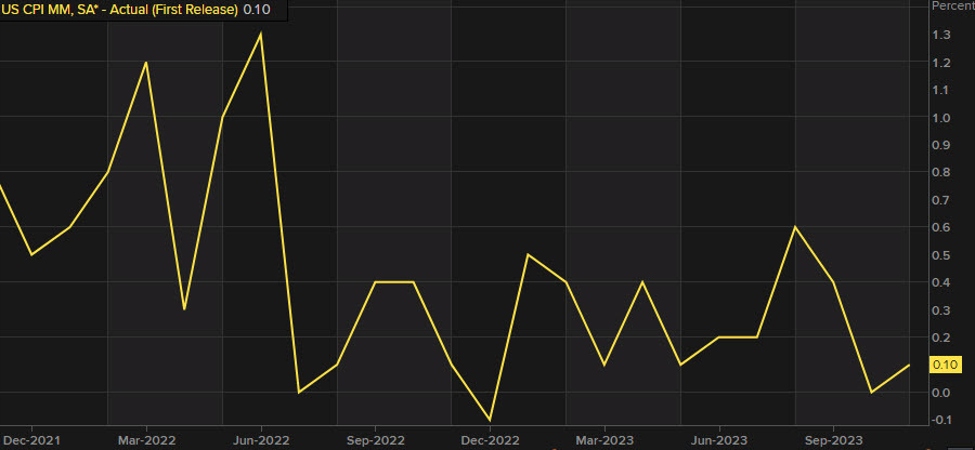

US CPI (Thu):

US headline CPI is anticipated to rise +0.2% M/M in

December (prev. +0.1%), whereas the core price is seen rising +0.3% M/M, matching

the speed seen in November. Merchants shall be trying to see if there’s any

resurgence in value pressures that might knock the market’s dovish view of the

Fed’s price trajectory (presently, the market has priced six 25bps price cuts in

2024, however the FOMC’s December projections sees solely three). November’s report

noticed headline inflation persevering with to fall, although analysts at JPM famous that

core inflation stays sticky at a stage larger than what the Federal Reserve

needs, as elevated wages within the providers sector proceed so as to add a component of

stickiness; after that November knowledge, JPM stated that it appeared much less doubtless

that the Fed will implement a price lower within the upcoming March 2024 assembly. This

week’s version of The Economist notes that the latest fall in inflation would possibly

be a “false signal”; it notes that whereas items costs have declined,

providers costs proceed to edge up, with many rising extra shortly than the

pre-pandemic pattern, whereas even home costs noticed a rebounded in 2023 (as

mortgage charges now fall again, it leaves dangers that home costs might pick-up

additional), whereas an easing in monetary situations because the Fed cuts charges would additionally

feed into renewed value pressures. “If inflation rebounds the Fed would

have little selection however to maintain rates of interest elevated, maybe reviving the

fears of a recession which have all however vanished,” The Economist said.

US Company Earnings (Fri):

Based on FactSet, This autumn earnings development for the

S&P 500 is estimated to be +2.4%, which might mark the second straight

quarter of Y/Y development for the index. It additionally notes that these estimates have

been falling as we method This autumn reporting: in September, analysts anticipated the

S&P 500 earnings development price to be +8.1% Y/Y. Forward of earnings season,

FactSet’s knowledge exhibits 72 S&P 500 firms issued damaging EPS steerage, 39

issued optimistic EPS steerage. Trying forward, a longer-term ballot from Reuters

finds that analysts anticipate US company earnings to enhance at a stronger price

this 12 months as inflation and rates of interest fall, although issues surrounding

slower financial development cloud the outlook. The Reuters ballot says that analysts

anticipate S&P 500 earnings to rise +11.1% this 12 months after +3.1% in 2023. However

analysts need to see stable earnings development to assist lofty fairness valuations,

that are presently round 19.8x ahead 12-month earnings estimates for the

S&P 500, considerably above the long-term common of round 15.6x.

“The market buying and selling the place it’s at present ranges calls for earnings to point out

sturdy development subsequent 12 months,” Wells Fargo stated. Accordingly, analysts shall be eyeing the This autumn earnings report for indicators on how larger charges are impacting the

economic system and company earnings. It’s going to even be fascinating to see how

analysts’ views evolve after This autumn earnings, as some predict Q1 earnings will

weaken at a fast tempo.

UK GDP (Fri):

Expectations are for GDP to rise +0.1% M/M in

November (vs. the 0.3% contraction seen in October, regardless of consensus anticipating

an unchanged end result, the discharge reported falls in each sector, with providers

sector the principle contributor for the declines. This, mixed with the damaging

Q3 GDP print has stoked some issues over a possible H2 2023 recession. For

the November launch, analysts at Investec observe that their forecast of +0.2%

can be “too small to prevent a technical recession,” albeit, such a recession

can be “as mild as they come.” When it comes to the drivers for a rebound in

manufacturing, the desk cites sturdy retail gross sales quantity development, lack of NHS

strike motion and cooler climate prompting a rise in heating wants. That

stated, upside might be capped through the stress on households and corporations from

larger rates of interest. Past the upcoming launch, Investec expects lacklustre

exercise to proceed into Q1 earlier than recovering later as inflation declines.

From a financial coverage perspective, the upcoming launch will doubtless have

little sway on market pricing for the BoE, with the MPC extra involved about

providers inflation and wage development. Nevertheless, a very tender launch might

see markets convey ahead present expectations of the primary BoE price lower from

June to Could. As a reference level, markets presently value round 120bps of

cuts by year-end.

For extra like this, try Newsquawk.