UPCOMING EVENTS:

- Monday: Japan

Wage knowledge, Swiss Unemployment Fee. - Tuesday: US

NFIB Small Enterprise Optimism Index. - Wednesday: Japan

PPI, RBNZ Coverage Resolution, US CPI, BoC Coverage Resolution, FOMC Minutes. - Thursday: China

CPI, ECB Coverage Resolution, US PPI, US Jobless Claims. - Friday: New

Zealand Manufacturing PMI, New Zealand Retail Gross sales, UK GDP, UK Industrial

Manufacturing, US College of Michigan Client Sentiment.

Monday

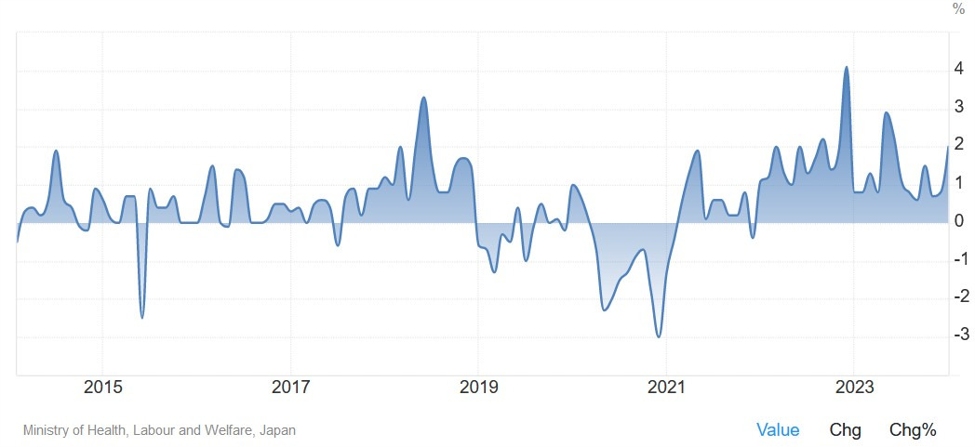

The Japanese Common Money Earnings Y/Y are

anticipated to rise to three.0% vs. 2.0% prior. The JPY would possibly get bid on a powerful

determine because the BoJ continues to see the achievement of their inflation goal

and talked about that one other charge hikeis dependent

on the data. The timing for such a

transfer stays unsure although with July and October being on the desk,

though the latter is probably the most possible one. General, even when we see a

beat, the market will seemingly wish to await the US CPI on Wednesday as that

is what’s going to seemingly resolve the USD pattern for the next days and weeks.

Japan Common Money Earnings YoY

Wednesday

The RBNZ is predicted to maintain the OCR

unchanged at 5.50%. As a reminder, the central financial institution dropped

the tightening bias within the final coverage

choice stating that rates of interest might want to stay at restrictive degree

for a sustained time frame. There’s nothing to anticipate from this week’s

choice because the RBNZ is trying to normalise coverage in 2025 whereas the

market sees the primary reduce coming in August.

RBNZ

The US CPI Y/Y is predicted at 3.4% vs.

3.2% prior, whereas the M/M measure is seen at 0.3% vs. 0.4% prior. The Core CPI

Y/Y is predicted at 3.7% vs. 3.8% prior, whereas the M/M studying is seen at 0.3%

vs. 0.4% prior. That is most likely one of the crucial essential inflation stories

of 2024 because the current knowledge has already hit the Fed’s confidence and one other

sizzling launch will seemingly set off a change within the near-term coverage outlook,

particularly following an excellent labour

market report on Friday.

Fed’s

Waller not too long ago stated that he needed to see

a few good stories to think about a charge reduce in June, so we simply want

this week’s report back to be sizzling to make the market to cost out the June reduce.

This may most probably have huge repercussions on the markets with Treasury

yields and the US Greenback rallying and the inventory market correcting decrease. On the

different hand, a chilly report ought to set off the alternative response with the inventory

market hitting new highs and the Treasury yields and the US Greenback coming below

strain because the risk-on sentiment ensues.

US Core CPI YoY

The BoC is predicted to maintain rates of interest

unchanged at 5.00%. Their coverage choice comes proper after a weak labour

market report on Friday the place we noticed

job losses and the unemployment charge leaping to six.1% from the prior 5.8%

determine. StatCan stated that the spike within the unemployment charge is tied to an

further 60,000 individuals in search of work or on momentary layoff in March as

the company reported not too long ago that inhabitants development hit its quickest charge since

1957.

The central financial institution can also be targeted on wage

development and sadly for them, the speed elevated once more to five.1% from the

prior positively revised 5.0% charge. On the optimistic facet, the most recent inflation

report missed expectations throughout the board

with notable easing within the underlying inflation measures. This places the central

financial institution in a troublesome place though they need to have sufficient causes to start out

leaning extra dovish. The market expects the primary charge reduce in June.

BoC

Thursday

The ECB is predicted to maintain rates of interest

unchanged at 4.00%. The central financial institution will seemingly set the stage for the June

charge reduce as policymakers have been touting such a transfer for fairly a while

and we even received the uber-hawk Holzmann becoming a member of the crew not too long ago. The newest Eurozone

inflation report missed expectations for

each the Headline and Core measures though the M/M readings had been each very

excessive and Providers inflation received caught at 4% since November 2023. Nonetheless,

the information earlier than the June choice may have the ultimate phrase because the ECB can also be

ready for the Q1 2024 wage knowledge to offer it a bit extra confidence.

ECB

The US PPI Y/Y is predicted at 2.3% vs.

1.6% prior, whereas the M/M measure is seen at 0.3% vs. 0.6% prior. The Core PPI

Y/Y is predicted at 2.3% vs. 2.0% prior, whereas the M/M studying is seen at 0.2%

vs. 0.3% prior. The info will come after the US CPI report, so it’s unlikely

to see it altering no matter pattern shall be set by the CPI launch.

US Core PPI YoY

The US Jobless Claims proceed to be one

of crucial releases each week because it’s a timelier indicator on the

state of the labour market. It’s because disinflation to the Fed’s goal is

extra seemingly with a weakening labour market. A resilient labour market although

may make the achievement of the goal harder. Preliminary Claims

carry on hovering round cycle lows, whereas Persevering with Claims stay agency round

the 1800K degree. Preliminary Claims are anticipated at 215K vs. 221K prior, whereas

there’s no consensus on the time of writing for Persevering with Claims though final

week we noticed a lower to 1791K vs. 1810K prior.

US Jobless Claims