The Chinese language

January Caixin Providers PMI missed expectations:

- Caixin Providers PMI

52.7 vs. 53.0 anticipated and 52.9 prior.

China Caixin Providers PMI

The Eurozone

December PPI got here according to expectations:

- PPI

M/M -0.8% vs. -0.8% anticipated and -0.3% prior. - PPI

Y/Y -10.6% vs. -10.5 anticipated and -8.8% prior.

Eurozone PPI YoY

Fed’s Kashkari

(hawk – non voter) debated whether or not the impartial charge within the US is larger than

anticipated and what that might imply for financial coverage:

- Probably

larger impartial charge means Fed can take extra time to evaluate upcoming knowledge earlier than

beginning charge cuts. - Greater impartial charge means financial coverage is probably not as tight as thought.

- That

will entail “less risk” to the financial restoration. - Core inflation making “rapid progress” in direction of Fed’s goal.

- However

financial knowledge not “unambiguously positive”. - There

are some indicators of weak point together with rising shopper delinquencies.

Fed’s Kashkari

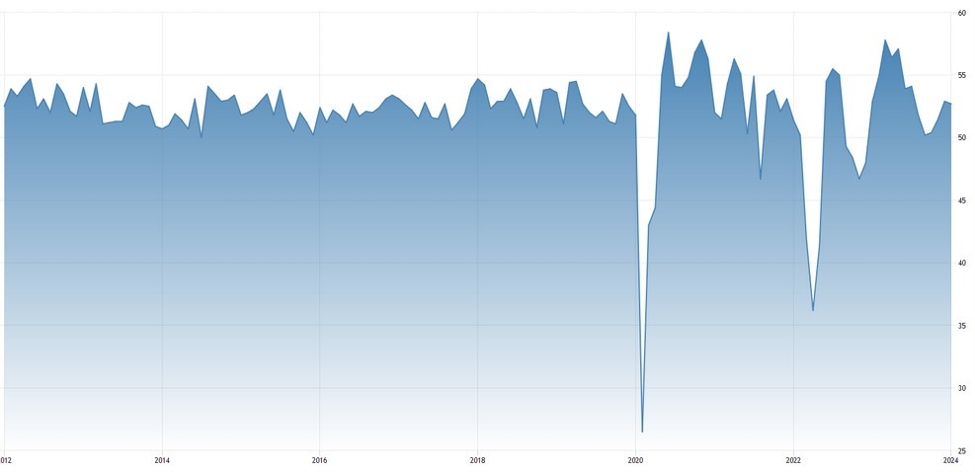

The US January ISM

Providers PMI beat expectations throughout the board with the employment part

leaping again into growth and the costs paid index spiking above 60:

- ISM Providers PMI

53.4 vs. 52.0 anticipated and 50.5 prior. - Enterprise exercise

55.8 vs. 55.8 prior. - Employment 50.5 vs. 43.8 prior.

- New orders 55.0 vs. 52.8 prior.

- Costs Paid 64.0 vs.

57.4 prior.

US ISM Providers PMI

Fed’s Goolsbee

(dove – non voter) stated {that a} March reduce was unlikely given the current financial

knowledge, however he didn’t need to rule it out both:

- March reduce is unlikely.

- Financial system has been

fairly robust. - If we hold getting

inflation taking place regardless of robust jobs in GDP progress, then we is perhaps

in a interval like mid-Nineties. - He doesn’t need to

rule out a March reduce however does need to see extra knowledge and never tie the Fed’s

palms. - Fed’s purpose is PCE measure

of two%. - Inverted yield

curve, as a rule of thumb, is just not relevant as a recession indicator. - Doesn’t see

widening issues within the regional banking system.

Fed’s Goolsbee

BoE’ Capsule (impartial

– voter) doesn’t see causes to chop charges in the intervening time:

- UK financial exercise

has been fairly weak. - Provide aspect

constraints are committing GDP progress. - The pickup in GDP is

not going to be dramatic. - It’s early days to

say that inflation has been suppressed. - Expects UK inflation

to fall near and even under its goal. - Charges could be

restrictive even after cuts. - Not but assured to

scale back charges. - Emphasize now could be on

when there isn’t any proof to chop charges, not reside.

BoE’s Capsule

Fed’s Bostic

(impartial – voter) didn’t touch upon the speed path outlook though he talked about

that wage progress is settling again into extra regular patterns.

Fed’s Bostic

The Federal

Reserve launched the Senior Mortgage Officer Opinion Survey (SLOOS) the place US banks

reported tighter lending requirements and weaker demand for C&I loans though

enhancing relative to the prior readings:

SLOOS

The Japanese

January Common Money Earnings missed expectations:

- Common Money

Earnings Y/Y 1.0% vs. 1.3% anticipated and 0.2% prior. - Spending M/M -0.9%

vs. 0.2% anticipated and -1.0% prior. - Additional time pay Y/Y

-0.7% vs. 0.9% prior.

Japan Common Money Earnings YoY

The RBA left the

Money Fee unchanged at 4.35% as anticipated and saved the tightening bias:

- Whereas current knowledge

point out that inflation is easing, it stays excessive. The Board expects that

will probably be a while but earlier than inflation is sustainably within the

goal vary. - Inflation continued

to ease within the December quarter. Regardless of this progress, inflation stays

excessive at 4.1 per cent. - Items value

inflation was decrease than the RBA’s November forecasts. - Providers value

inflation, nevertheless, declined at a extra gradual tempo according to the RBA’s

earlier forecasts and stays excessive. - Whereas there have

been beneficial indicators on items value inflation overseas, providers value

inflation has remained persistent and the identical may happen in Australia. - Wages progress has

picked up however is just not anticipated to extend a lot additional and stays

per the inflation goal. - The outlook continues to be

extremely unsure. - Whereas there are

encouraging indicators, the financial outlook is unsure, and the Board

stays extremely attentive to inflation dangers. - Providers value

inflation is anticipated to say no steadily as demand moderates and progress

in labour and non-labour prices eases. - The Board must

be assured that inflation is transferring sustainably in direction of the goal

vary. - Thus far, medium-term

inflation expectations have been per the inflation goal, and

it will be significant that this stays the case.

RBA

Transferring on to the

RBA Governor Bullock’s Press Convention:

- We nonetheless have gotten a

“little way to go” to get inflation down. - We aren’t ruling something

in or out on coverage. - We nonetheless suppose dangers

are balanced. - What we’re actually

on the lookout for is knowledge that assures that inflation is coming again to focus on. - We have had excellent news

thus far on inflation, but it surely nonetheless has a ‘4’ in entrance of the inflation charge. - We do not need

inflation expectations to rise. - Tax cuts are usually not a

materials situation for inflation and spending. - We have to be certain

we can’t must backtrack on inflation. - I really feel we’re

probably on the slender path to getting inflation again to focus on, cites

2.8% 2025 inflation forecast. - Says confidence

stage on getting there may be 5/10, extra knowledge wanted. - I am actually satisfied

we will convey inflation down with out an excessive amount of ache within the labour market. - We decide dangers to

inflation as pretty balanced. - Employment continues to be

rising and the board, I can assume you, may be very, very targeted on that. - We have got to be

assured that we’ll get to the midpoint of the goal to consider

rate of interest cuts.

RBA’s Bullock

The Eurozone

December Retail Gross sales missed expectations:

- Retail

Gross sales M/M -1.1% vs. -1.0% anticipated and 0.3% prior (revised from -0.3%). - Retail

Gross sales Y/Y -0.8% vs. -0.9% anticipated and -0.4% prior (revised from -1.1%).

Eurozone Retail Gross sales YoY

BoE’s Dhingra

(uber dove – voter) was the one member to vote for a charge reduce on the final

coverage assembly and she or he continues to help her view:

- I am not anxious

about chopping charges too early being the worst factor to do. - We took a very long time

to get charges up. - Couple that with the

transmission lags, we’re nonetheless a fairly restrictive interval of

financial coverage even after you begin the moderation. - Pretty satisfied

that falling costs are usually not solely pushed by power alone. - At this level, about

97% of annual CPI inflation gadgets have turned down. - Fall in retail gross sales

is fairly convincing and surprising. - Not totally satisfied

of sharp extra demand within the economic system from the consumption aspect. - Doesn’t see a

motive to commerce off weak consumption when inflation is on a sustainable

path at this level. - In case you do the best

coverage and should you even deviate for the best causes, individuals will

perceive.

BoE’s Dhingra

ECB’s Vujcic

(impartial – voter) continues to push again in opposition to untimely charge cuts:

- Shouldn’t rush

begin of charge chopping cycle. - Necessary for ECB’s credibility

to be proper with charge cuts. - Nonetheless various

resilience in providers inflation and wages. - The equilibrium

stage of rates of interest is more likely to be larger than it was some years in the past.

ECB’s Vujcic

Fed’s Mester (hawk –

voter) gave some broad feedback on completely different matters and the TL;DR is that she

doesn’t see the necessity to reduce charges within the first half of the yr given the

power within the knowledge and the uncertainty across the final mile to the two% goal,

though she nonetheless count on 3 charge cuts in 2024:

- Financial coverage in

good place to evaluate what’s subsequent for charges. - Fed can decrease charges

later this yr if economic system performs as anticipated. - When Fed cuts charges

will doubtless be at gradual tempo. - If inflation does not

fall Fed can preserve present coverage. - Inflation should be

transferring sustainably decrease to open charge reduce door. - Expects to maneuver again

to 2% inflation over time. - Sees progress and

employment moderating this yr. - Have to be attentive to

threat labour market will cool faster-than-expected. - Current information on

inflation has been ‘encouraging’. - Cannot ensure final

stage of transfer to 2% inflation shall be swift. - To date Purple Sea

bother hasn’t rattled provide chains. - It might be a

mistake to chop charges prematurely. - Doable inflation

could also be extra persistent than anticipated. - Wage beneficial properties nonetheless too

excessive for attending to 2% inflation. - Greater productiveness

ranges could change wage-inflation calculus. - Doesn’t imagine us

is transferring to solely giant financial institution mannequin. - Fed won’t launch

Fed digital greenback until instructed to take action by elected officers. - Sees progress in

getting banks prepared to make use of low cost window. - Would not need to

provide timing on charge reduce. - Sees no rush to

decrease Fed charge goal. - Nonetheless leans towards

three charge cuts for 2024. - Needs extra knowledge

earlier than deciding on charges. - Expects to see charge

cuts later this yr. - Fed shouldn’t rule

out asset gross sales for stability sheet. - Expects stability

sheet run off to sluggish earlier than being stopped.

Fed’s Mester

Fed’s Kashkari

(hawk – non voter) gave some additional remarks on the present financial stance:

- Inflation has come

down in a short time. - Labor market may be very

robust. - It’s a conundrum.

- A recession is just not

my base case. - We don’t suppose

about politics, or the election, once we set rates of interest. - We aren’t fairly

there on yr over yr inflation knowledge, however 3-month and 6-month knowledge is

mainly there. - We aren’t completed but,

on inflation, however knowledge is wanting optimistic. - Many of the

disinflationary beneficial properties have come from supply-side. - The yield curve is

not a dependable indicator of recession, as a result of disinflation is not being

largely attributable to the Fed. - I really feel optimistic

in regards to the greenback’s position on the earth. - The greenback’s worth

in the long term is a set by financial competitiveness. - Family financial savings

are being spent down extra slowly than anticipated. - Delinquencies are

creeping up, although from very low ranges. - Financial coverage could

not be placing as a lot downward strain on demand as we predict. - If labour market

continues to be robust, we will dial again coverage charge fairly slowly. - At this second, 2-3 cuts

appear applicable. - If we will see a number of

extra months of fine inflation knowledge, will give confidence on approach again to 2%

inflation. - Most industrial actual

property sector, apart from workplace phase is doing effectively. - Financial system displaying to

be remarkably resilient. - To date knowledge has been

resoundingly optimistic. We’ll must see how the economic system

performs.

Fed’s Kashkari

BoC Governor Macklem stays

assured that the present stage of coverage setting is sufficient to convey inflation

again to focus on however he nonetheless desires to see some extra progress within the underlying

measures earlier than deciding when to begin chopping charges:

- Financial coverage is

working; it has slowed demand, rebalanced the economic system, and introduced down

inflation. - Shelter value

inflation is now the largest contributor to above-target inflation. - Years of provide

shortages and the current enhance in newcomers have meant home costs

have declined solely modestly with larger charges. - Housing

affordability is a major downside in Canada — however not one that may be

mounted by elevating or decreasing rates of interest. - Canada’s structural

scarcity of housing is just not one thing financial coverage can repair. - Extra time is required

to convey down inflation. - Volatility in world

oil and transportation prices associated to wars in Europe and the Center East

may add volatility to Canadian inflation. - The trail again to 2%

inflation is more likely to be sluggish and dangers stay. - Coverage rate of interest

at 5% is the extent we predict is required to take the remaining steam out of

inflation. - Dialogue about

future coverage is shifting from whether or not financial coverage is restrictive

sufficient to how lengthy to keep up the present stance. - We need to see

inflationary pressures proceed to ease and clear downward momentum in

underlying inflation. - BoC targets total

CPI inflation, however we can not ignore shelter prices. - Trying forward,

impartial rate of interest will most likely be a bit larger than the two% to three%

vary. - There shall be modest

enhance in housing costs this yr versus decreases final yr. - There may be definitely

appreciable uncertainty round what is going to occur to housing costs.

BoC’s Macklem

Fed’s Harker (impartial – non

voter) sees the US on observe for a gentle touchdown:

- Sees ‘actual progress’

on getting inflation again to 2%. - Fed choice to carry

charges was the proper choice. - Information exhibits inflation

falling and labour market in higher stability. - Shopper spending

has been resilient. - Financial system on observe for

a gentle touchdown.

Fed’s Harker

The New Zealand This fall labour

market report beat expectations:

- Unemployment Fee

4.0% vs. 4.2% anticipated and three.9% prior. - Job progress 0.4% vs.

0.3% anticipated and -0.2% prior. - Participation charge

71.9% vs. 72.0% anticipated and 72% prior. - Labour price index Q/Q

1.0% vs. 0.8% anticipated and 0.8% prior. - Labour price index

Y/Y 3.9% vs. 3.8% anticipated and 4.1% prior.

New Zealand Unemployment Fee

BoE’s Breeden (impartial –

voter) is assured that the present stage of charges is sufficient to convey

inflation again to focus on and she or he’s simply patiently ready for some extra

progress earlier than chopping charges:

- I’ve grow to be much less

involved that charges would possibly have to be tightened additional. - Want extra proof

to be assured that UK economic system is progressing as per forecast. - My focus has shifted

to fascinated about how lengthy charges want to stay at present stage. - Will have a look at how pay

progress and demand are influencing companies’ pricing selections.

BoE’s Breeden

ECB’s Schnabel (hawk –

voter) stays cautious about dangers of a reacceleration in inflation as a consequence of

untimely charge cuts, so she continues to be affected person ready for extra progress

earlier than leaning in direction of charge cuts:

- The final mile in

bringing inflation down stands out as the most tough one. - We see sticky

providers inflation, resilient labour market. - There’s a loosening

of economic situations as markets aggressively priced in charge cuts. - Current occasions within the

Purple Sea additionally spark fears of renewed provide chain disruptions. - Taken collectively, this

cautions in opposition to adjusting coverage stance too quickly. - We now have made

substantial progress on inflation, however we’re not there but. - We should be affected person,

cautious as inflation can flare up once more.

ECB’s Schnabel

Fed’s Kugler (impartial –

voter) gave a complete speech on the state of the economic system and financial

coverage:

- Happy with ‘nice

progress’ on inflation. Optimistic it’s going to proceed. - Fed’s job on

inflation ‘not completed but’. - Will stay targeted

on Fed’s inflation purpose till assured inflation is returning durably to

2% goal. - Dangers to our twin

mandate ‘roughly balanced’. - Our coverage stance is

restrictive. - In some unspecified time in the future,

cooling inflation and labour markets could make charge reduce applicable. - If disinflation

progress stalls, could also be applicable to carry coverage charge regular for longer. - Sees ’causes for

optimism’ on providers inflation, the place there was much less progress. - Core-services

ex-housing ‘nonetheless elevated,’ however count on enchancment. - Continued moderation

of wage progress, normalization of price-setting, anchored inflation

expectations ‘more likely to contribute’ to continued disinflation. - Happy that cooling

of labour demand has not led to rise in layoffs. - How spending

momentum will evolve this yr an open query’ affecting disinflationary

course of. - Expects shopper

spending to develop extra slowly this yr. Ought to

assist with disinflation. - Some measures of

monetary situations have eased however stay comparatively tight and are

per continued progress on inflation. - Paying shut

consideration to upside inflation dangers from geopolitics. - Disinflation was

fast within the second half of 2023. - Inflation on

3–6-month foundation as moved to 2% stage. - Wage progress

moderation is vital. - Providers ex-housing

is without doubt one of the parts to be watched for continued declines. - Housing inflation

has been persistent however is anticipated to return down. - Layoffs in US are

spotty and never displaying up in mixture knowledge. - Immigration is

helped in some sectors together with building. - We’d like additional

moderation in wage knowledge particularly the service sector, however it’s

moderating and this filtering via to costs. - Wage moderation

must proceed, although stage that’s per inflation goal

depends upon elements like productiveness. - Too early to evaluate

AI’s potential on productiveness. - Progress on

inflation has been aided by each Fed coverage affect on demand and therapeutic

of the supply-side. - There may be nonetheless room

for therapeutic on the supply-side assist decrease inflation. - 20% of corporations are

nonetheless seeing scarcity of products provides. - There may be a lot

uncertainty across the impartial charge of curiosity. - On the coverage

rate of interest will rely on efficiency of inflation. - Conscious that

unemployment charge can transfer quick when it begins to vary. - Watching industrial

actual property for supply of economic stress. - Holding an in depth eye

on regional financial institution publicity. - Could also be some upward

strain approaching items costs given world delivery, different threat. - Each assembly is

‘reside’ from right here and transferring ahead.

Fed’s Kugler

Fed’s Collins (impartial –

non voter) echoed his colleagues as she continues to count on “gradual and

methodical” charge cuts later this yr:

- Prone to reduce charges

later this yr if the economic system meets expectations. - Financial coverage is

effectively positioned for present outlook. - Progress again to 2%

inflation might be uneven and bumpy. - When cuts begin,

they need to be gradual and methodical. - Supported FOMC

choice to maintain charges regular final week. - Wants extra knowledge

earlier than supporting charge reduce. - Sturdy January jobs

knowledge exhibits why warning warranted. - Financial system must

reasonable to get to 2% inflation. - Must see wage

beneficial properties reasonable to assist transfer to 2% inflation. - Current knowledge exhibits

financial resilience, demand to take time to reasonable. - Financial dangers have

come into higher stability. - Necessary for Fed to

ensure it is on path to decrease inflation. - Fed does not have to

go all the way in which again to 2% inflation to ease. - Sees limits to

provide chain enchancment aiding decrease inflation. - Jury is out when it

involves impartial charge stage. - It is attainable future

rate of interest is perhaps larger than pre-pandemic ranges. - In future deflation

dangers doubtless decrease relative to earlier than pandemic. - Current knowledge has been

fairly risky.

Fed’s Collins

Fed’s Barkin (impartial –

voter) preached endurance on coverage charge path as he desires to see some extra

“broad-based” progress on inflation:

- Is smart to be

affected person on charge cuts. - In all honesty my

forecast is unsure. That is why it is necessary to be affected person on charge

cuts. - Inflation has been

coming down properly during the last seven months. - Involved that items

costs coming down is perhaps a head faux and will transfer again the upside in

coming months. - I haven’t got a charge

path focus. Have an economic system focus. - If inflation continues

to settle down, and if it begins to broaden out in lots of classes, that is a

sort of sign I’m on the lookout for to begin chopping charges. - Nonetheless a decent labour

market. - Problem on

inflation coming down is that it isn’t that broad. - Providers and lease

inflation have stayed extra elevated. - We now have to see if it

nonetheless extra inflationary strain to calm. - Corporations nonetheless really feel

like they’ve just a little extra value energy than they used to. - I’m very supportive

of being affected person to get to the place we have to get on inflation. - I’m ready to see

if disinflation turns into extra broad-based. - I did not count on the

power of the final jobs report. - I’m in no

explicit hurry on coverage charge.

Fed’s Barkin

The BoC launched the

Minutes of its January Financial Coverage Assembly:

- Financial institution of Canada was

‘notably involved about persistent inflation and decreasing charges

‘prematurely’ in January policy-setting conferences. - Governing council

mentioned threat that financial coverage may have better than anticipated

affect on shopper spending, requiring decrease charges earlier and extra

rapidly. - Governing council

noticed threat of inflation being extra persistent than anticipated, requiring charge to

keep restrictive for longer. - Governing council

mentioned threat that housing market would rebound greater than anticipated and

hold inflation above goal whilst different value pressures wane. - Governing council

noticed blended image of underlying inflation, the necessity for extra time for

previous charge hikes to sink in. - Governing council

acknowledged ‘it was tough to foresee when it will be applicable to

start chopping charges’. - Governing council

count on wage progress to reasonable steadily. - Governing council

agreed almost definitely clarification for rise in in a single day repo rate of interest

above coverage charge was enhance in demand for presidency bonds. - Governing council

agreed want for in a single day repo operations was operational situation associated to

implementing financial coverage.

BoC

The Atlanta Fed Wage

Progress tracker fell to five.0% vs. 5.2% prior within the newest studying.

Atlanta Fed Wage Progress Tracker

The Chinese language January CPI

missed expectations with even the Core Y/Y measure now approaching deflationary

territory:

- CPI M/M 0.3% vs. 0.4%

anticipated and 0.1% prior. - CPI Y/Y -0.8% vs.

-0.5% anticipated and -0.3% prior. - Core CPI M/M 0.3% vs. 0.1% prior.

- Core CPI Y/Y 0.4%

vs. 0.6% prior. - PPI Y/Y -2.5% vs.

-2.6% anticipated and -2.7% prior.

China Core CPI YoY

BoJ’s Uchida slammed

hawks’ expectations as he downplayed an eventual charge hike:

- BoJ will not

aggressively hike charges even after ending adverse charge. - Japan’s actual

rate of interest is in deep adverse territory, financial situations are very

accommodative. - We do not count on this

to vary in a giant approach. - Uncertainty over

outlook stay excessive, however chance of sustainably reaching our value

goal steadily heightening. - We count on Japan’s

financial restoration to proceed, optimistic wage-inflation cycle to strengthen. - Shopper inflation

has exceeded 2% however that is primarily as a consequence of cost-push elements. - If sustained,

sustainable achievement of value goal comes into sight, position of huge

stimulus may have been met and we are going to take into account reviewing it. - No matter when

we tweak coverage, we see have to take steps in communication, market

operations to make sure there isn’t any disruptive strikes in monetary markets. - Earlier than we launched

adverse charges, B0J utilized a 0.1% curiosity on extra reserves, in a single day

name charge moved in a spread of 0-0.1%. - If we have been to maneuver

again to that scenario, it will be equal to a 0.1% rate of interest

hike.

- What’s extra

necessary is the long run short-term charge path, which shall be set at

applicable stage, so shopper inflation strikes round BoJ’s 2% goal. - YCC and BoJ’s bond

shopping for administration are intertwined. - After we finish or tweak

YCC, we are going to take into consideration how we’d talk our bond shopping for

operation.

- Tweak to YCC would

imply permitting yields to maneuver extra freely however we are going to guarantee this doesn’t

result in massive change in our bond shopping for quantity, sharp rise in yields. - It might be pure

to finish ETF, J-REIT shopping for if achievement of two% inflation will be foreseen. - Even when we have been to

finish ETF, J-REIT shopping for, affect on markets will not be massive. - What to do with our

very large ETF, J-REIT holding is a unique downside, that is one thing we

want to contemplate taking time.

- We want to

preserve steady, accommodative financial atmosphere. - Expects service

costs to rise alongside wage will increase. - Authorities, BoJ

share widespread understanding in guiding coverage. - Inflation will not

sustainably hit 2% until accompanied by wage progress. - We are going to guarantee to

help the economic system as a way to obtain that.

BoJ’s Uchida

ECB’s Wunsch (hawk – non

voter in March) desires to see a normalisation in wage progress to provide him some

extra conviction for charge cuts:

- There may be worth in

ready to get extra comforting wage knowledge. - Wage rises are

holding up charge cuts. - However have some

indications, not robust ones, that wage progress is softening.

ECB’s Wunsch

The US Jobless Claims

beat expectations:

- Preliminary Claims 218K

vs. 220K anticipated and 227K prior (revised from 224K). - Persevering with Claims

1871K vs. 1878K anticipated and 1894K prior (revised from 1898K).

US Jobless Claims

ECB’s Lane (dove – voter)

expanded on the central financial institution’s concentrate on wage progress as they need to ensure

that the disinflation again to their goal is sustainable:

- When it comes to an

total analysis of our coverage trajectory, we have to be additional

alongside within the disinflation course of earlier than we will be sufficiently

assured that inflation will hit the goal in a well timed method and settle

at goal sustainably. - The incoming knowledge

recommend that the method of disinflation within the close to time period the truth is could run

sooner than beforehand anticipated, though the implications for

medium-term inflation are much less clear. - Financial coverage

must rigorously stability the chance of overtightening by holding charges too

excessive for too lengthy in opposition to the chance of prematurely transferring away from the

hold-steady place that we have now been in since September. - Many wage agreements

shall be renewed within the early months of 2024, and updates to the wage

trackers will present important info in projecting wage dynamics. - The accessible survey

indicators are broadly per the reducing wage profile

foreseen within the newest Eurosystem workers projections. - In keeping with our

most up-to-date discussions with giant European non-financial companies,

the wage progress expectations of this set of corporations for 2024 are 4.4

% on common, which is a marked easing in comparison with the common 2023

wage progress of 5.3 per cent.

ECB’s Lane

BoE’s Mann (uber hawk –

voter) stays agency on her views that the central financial institution ought to at very least

stay on maintain for longer as she nonetheless sees dangers round inflation momentum and

persistence:

- My vote to hike was

a “finely balanced” choice. - Sees threat of

continued inflation momentum and embedded persistence. - Labour market nonetheless

“relatively tight”. - Monetary situations

have eased considerably; have eased ‘an excessive amount of’. - Headline inflation

strikes are usually not a superb measure of inflation. - A drop in providers

inflation may persuade me to vote to carry. - It is unclear what

may persuade me to vote to chop charges.

BoE’s Mann

ECB’s Holzmann (uber hawk

– voter) is probably the most hawkish member of the central financial institution and he sees an opportunity

that the ECB won’t reduce charges in any respect this yr:

- There’s a sure

probability that the ECB won’t reduce charges this yr. - Have to be certain

inflation is in test earlier than first reduce. - Excessive wage offers will

present up in inflation ultimately.

ECB’s Holzmann

RBA Bullock delivered her

remarks to Parliament:

- RBA Board is targeted

on bringing inflation down. - Stay acutely conscious

that the price of residing is rising a lot sooner than it has over current

a long time. - Current developments

in inflation are encouraging. - We now have some option to

go to fulfill our goal. - Even when the economic system

evolves alongside the central path, inflation will nonetheless have been exterior the

goal vary for 4 years. - Whereas there are some

encouraging indicators, Australia’s inflation problem is just not over. - The longer inflation

stays excessive and out of doors the goal vary, the better is the chance that

inflation expectations of households and companies regulate larger. - At this stage, the

board hasn’t dominated out an additional enhance in rates of interest however neither

has it dominated it in. - Given the

substantial prices to the economic system and the Australian individuals of continued

excessive inflation, the board is dedicated to bringing inflation again to

goal in an affordable time-frame. - Attempting to convey

inflation again to focus on with out slowing the economic system greater than mandatory

on the one hand or risking excessive inflation for longer. - Inflation doesn’t

have to be in 2-3% band for us to consider charge cuts. - If consumption slows

extra rapidly than anticipated shall be alternative to chop charges. - We thought-about vary

of coverage eventualities at February assembly.

RBA Governor Bullock

The Canadian January Labour

Market report beat expectations though we noticed a fall in wage progress and full-time

jobs:

- Employment change

37.3K vs. 15K anticipated and 12.3K prior (revised from 0.1K). - Unemployment charge

5.7% vs. 5.9% anticipated and 5.8% prior. - Full time employment

-11.6K vs. -23.5K final month. - Half-time employment

48.9K vs. 23.6 final month. - Common hourly wages

everlasting staff Y/Y 5.3% vs. 5.7% final month. - Participation charge

65.3% vs. 65.4% final month.

Canada Unemployment Fee

The BLS launched the revisions

for the prior CPI readings:

- December CPI 0.2%

vs. 0.3% prior. - December CPI ex-food

and power unrevised at 0.3%. - November 0.2% vs. 0.1%.

- October 0.1% from unchanged.

- This fall core CPI

unrevised at a 3.3% annualized enhance. - Core six-month

annualized CPI down to three.0% from 3.3%.

US CPI Revisions

The

highlights for subsequent week shall be:

- Tuesday: Japan PPI,

UK Labour Market report, Switzerland CPI, German ZEW, US NFIB Small Enterprise

Optimism Index, US CPI. - Wednesday: UK CPI,

Eurozone Industrial Manufacturing. - Thursday: Japan

GDP, Australia Labour Market report, UK GDP, UK Industrial Manufacturing,

Switzerland PPI, US Retail Gross sales, US Jobless Claims, US Industrial Manufacturing,

US NAHB Housing Market Index, New Zealand Manufacturing PMI, PBoC MLF. - Friday: UK Retail Gross sales,

Switzerland Industrial Manufacturing, US PPI, US Housing Begins and Constructing

Permits, US College of Michigan Shopper Sentiment.

That’s all people. Have a

good weekend!