Over the weekend,

the Chinese language Inflation information beat expectations by an enormous margin:

- CPI Y/Y 0.7% vs.

0.3% anticipated and -0.8% prior. - CPI M/M 1.0% vs.

0.7% anticipated and 0.3% prior. - Core CPI Y/Y 1.2%

vs. 0.4% prior. - Core CPI M/M 0.5% vs. 0.3% prior.

China Nationwide Bureau of

Statistics (NBS) on the CPI rise:

- “It was

primarily meals and repair costs that rose extra”. - “Through the

Spring Pageant interval, client demand for meals merchandise grew, in

addition to wet and snowy climate in some areas affecting provide”.

China Core CPI YoY

JiJi Press

reported that the BoJ was contemplating scrapping its Yield Curve Management (YCC)

program:

- The Financial institution of Japan is

contemplating scrapping its yield curve management program and as a substitute

indicating prematurely the quantity of presidency bonds it plans to buy,

Jiji Press reported, with out saying the place it obtained the data. - It should cease its

program to information benchmark 10-year authorities bond yields to round 0%, as

a part of its efforts to normalize financial coverage, in line with Jiji. - New framework would

goal the quantity of purchases, moderately than the yield, in line with Jiji. - The financial institution will resolve

on that and ending unfavorable rates of interest as quickly as the subsequent coverage

assembly concluding on March 19, the report mentioned.

JiJi Press

The Japanese Last

This autumn GDP invalidated the technical recession because the quantity was revised

considerably larger:

- Last This autumn GDP 0.1%

vs. 0.3% anticipated and -0.8% prior. - Annualised 0.4% vs.

-0.4% preliminary. - Non-public consumption

-0.3% vs. -0.2% preliminary (down for the third straight quarter). - Capex 2.0% vs. -0.1% preliminary.

Japan Last This autumn GDP

ECB’s Kazimir (hawk – voter) reaffirmed his desire

for a June price lower as he awaits extra information:

- Ought to wait till

June for first price lower. - Speeding the transfer is

not sensible nor helpful. - Upside dangers to inflation

are “alive and kicking”. - Want extra onerous

proof on inflation outlook. - Solely in June will we

attain the boldness threshold on that. - However discussions on

easing ought to prepared begin, will use the weeks forward for that.

ECB’s Kazimir

ECB’s Makhlouf (dove – non voter in April) helps a

gradual coverage easing:

- Gradual modifications are

finest moderately than a sudden determination. - Giant particular person

cuts “probably unlikely” as a result of “information isn’t that

definitive”.

ECB’s Makhlouf

BoE’s Mann (hawk – voter) reiterated that she nonetheless

sees an extended approach to go earlier than inflation normalises round their 2% goal:

- Our forecast on

service inflation appears aggressive. - We now have a good distance

to go for inflation pressures to be in line with 2% goal.

BoE’s Mann

RBA’s Hunter sees the economic system progressing as per their

forecasts:

- This autumn GDP largely in

line with forecasts. - Latest inflation

information additionally in line with forecasts. - Inflation the

largest drag on family consumption (“For some households, curiosity

price hikes are additionally difficult and troublesome, however inflation is the one

largest drag.”) - Households are

clearly struggling at current.

RBA’s Hunter

BoJ’s Ueda reaffirmed as soon as once more that wage progress is

of utmost significance for the central financial institution:

- Japan’s economic system is

recovering reasonably, though some weak information are seen. - Consumption is

bettering reasonably on easing cost-push strain, with hopes for larger

wages. - Some corporations seem to

be delaying funding, although capital expenditure plans stay agency. - We now have seen numerous

information since January, and extra information will come out this week. We are going to look

at these comprehensively in reaching an acceptable financial coverage

determination. - We’re specializing in

whether or not a optimistic wage-inflation cycle is kicking off, in judging whether or not

sustained, secure achievement of our worth goal is coming into sight. - When

achievement of two% inflation is stably and sustainably in sight, we are going to search

exit from unfavorable charges, yield curve management and different massive scale financial

easing steps. - As

for the order of phasing out these numerous instruments, it can depend upon the

financial, worth, and monetary situations on the time. - It

is feasible to manage short-term charges at acceptable stage by paying curiosity

on reserves parked with the BoJ. - If

inflation accelerates and warrants financial tightening, it’s attainable to take action

by elevating charges with out scaling again on BoJ bond holdings.

BoJ Ueda

The UK February Jobs information missed expectations throughout the board:

- Unemployment price

3.9% vs. 3.8% anticipated and three.8% prior. - January employment

change -21K vs. 10K anticipated and 72K prior. - January common

weekly earnings 5.6% vs. 5.7% anticipated and 5.8% prior. - January common

weekly earnings (ex bonus) 6.1% vs. 6.2% anticipated and 6.2% prior. - February payrolls

change 20K vs. 15K prior (revised from 48K).

UK Unemployment Fee

The US NFIB Small Enterprise Optimism Index fell additional

in February:

- NFIB 89.4 vs. 90.7

anticipated and 89.9 prior.

“Twenty-three % of small

enterprise house owners reported that inflation was their single most essential

enterprise downside in working their enterprise, up three factors from final month

and changing labor high quality as the highest downside. Stories of labor high quality because the

single most essential downside for enterprise house owners decreased 5 factors to 16%,

the bottom studying since April 2020. “Whereas inflation pressures have eased

since peaking in 2021, small enterprise house owners are nonetheless managing the elevated

prices of upper costs and rates of interest. The labor market has additionally eased

barely as small enterprise house owners are having a better time attracting and

retaining workers”, mentioned NFIB Chief Economist Invoice Dunkelberg.

US NFIB Small Enterprise Optimism Index

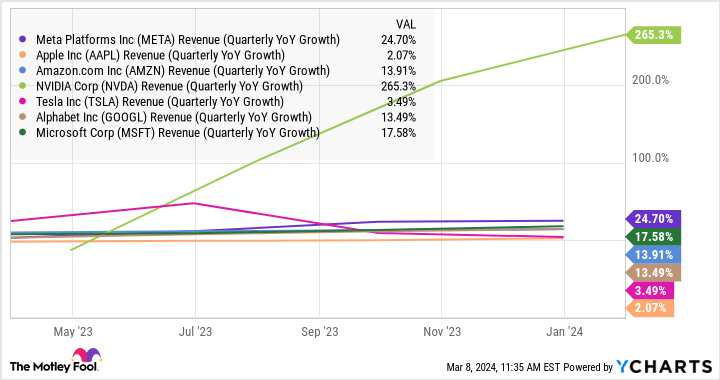

The US February CPI beat expectations throughout the

board:

- CPI Y/Y 3.2% vs. 3.1%

anticipated and three.1% prior. - CPI M/M 0.4% vs.

0.4% anticipated and 0.3% prior. - Core CPI Y/Y 3.8%

vs. 3.7% anticipated and three.9% prior. - Core CPI M/M 0.4%

vs. 0.3% anticipated and 0.4% prior. - Shelter M/M 0.4% vs. 0.6% prior.

- Shelter Y/Y 5.7% vs.

6.0% prior. - Providers much less lease

of shelter M/M 0.6% vs. 0.6% prior. - Actual weekly earnings

0.0% vs. -0.4% prior (revised from -0.3%). - Meals M/M 0.0% vs.

0.4% prior. - Meals Y/Y 2.2% vs.

2.6% prior. - Vitality M/M 2.3% vs.

-0.9% prior. - Vitality Y/Y -1.9% vs.

-4.6% prior. - Rents M/M 0.5% vs.

0.4% prior. - Proprietor’s equal

lease M/M 0.4% vs. 0.6% prior.

US Core CPI YoY

BoE’s Bailey (impartial –

voter) reiterated that the query policymakers are going through now’s for a way lengthy

they should hold charges on the present ranges:

- Query of coverage

restrictiveness is now key. - Query is now for

how lengthy can we have to be restrictive? - World stays extra

unsure place than we’ve been used to. - Financial coverage is

doing its job. - Inflation

expectations seem like properly anchored. - We now have seen restricted

proof to date of rising unemployment as a situation to scale back inflation. - Issues about

embedding of second-round results have been diminished.

BoE’s Governor Bailey

ECB’s Wunsch (hawk – non

voter in April) helps a price lower quickly regardless of the dangers of companies

inflation and wage progress:

- We’re going to have

to make a wager sooner or later. - Felt the Financial institution ought to

act “before so long”, with out specifying a month. - He mentioned the ECB was

getting to a degree the place it may react to inflation heading in the fitting

course. However it can stay a cautious transfer on the idea of what I do know

immediately due to the issue that has been commented repeatedly and

once more that service inflation and wage developments are nonetheless operating at

ranges which can be in the end not appropriate with our goal. - We aren’t going to

wait till we see wage growth at 3% earlier than we lower charges. I assume

we’ll do it earlier than and that is why I say it is essential we have to take a

wager.

ECB’s Wunsch

BoJ’s Ueda delivered some

imprecise feedback and repeated that coverage tweaking will come as soon as their

situations fall into place:

- Says will contemplate

coverage modifications as soon as achievement of worth goal is in sight. - We should scrutinise

whether or not optimistic wage-inflation cycle emerges. - That can decide

whether or not situations for phasing out stimulus are falling into place. - This yr’s wage

talks is essential in deciding timing on exit from stimulus. - We are going to scrutinise

wage talks consequence in addition to different information in making determination. - Will contemplate

tweaking unfavorable charges, YCC and different financial easing instruments if sustained

achievement of worth goal comes into sight.

BoJ Governor Ueda

Bloomberg reported that

the BoJ was contemplating scrapping ETF purchases with inflation goal in sight.

The report says that the Japanese central financial institution is mulling such a transfer as

policymakers see little must hold shopping for ETFs to restrict threat premiums in a

market that’s wanting moderately frothy.

BoJ

ECB’s Villeroy (impartial –

non voter in April) locations larger probabilities on a June price lower though he retains

a door open for an earlier transfer:

- It’s extra doubtless a

price lower will occur in June than in April. - A spring price lower stays

possible. - We stay vigilant

on the inflation entrance however victory is within reach. - We’re profitable the

battle in opposition to inflation.

ECB’s Villeroy

The UK January GDP got here

consistent with expectations:

- January GDP M/M 0.2%

vs. 0.2% anticipated and -0.1% prior. - GDP 3M/3M -0.1% vs.

-0.1% anticipated and -0.3% prior. - Providers M/M 0.2%

vs. 0.2% anticipated and -0.1% prior. - Industrial output

M/M -0.2% vs. 0.0% anticipated and 0.6% prior. - Manufacturing output

M/M 0.0% vs. 0.0% anticipated and 0.8% prior. - Development output

M/M 1.1% vs. -0.1% anticipated and -0.5% prior.

UK GDP

The Eurozone January

Industrial Manufacturing missed expectations by an enormous margin:

- Industrial Manufacturing M/M -3.2% vs. -1.5%

anticipated and 1.6% prior (revised from 2.6%). - Industrial Manufacturing Y/Y -6.7% vs. -2.9%

anticipated and 0.2% prior (revised from 1.2%).

Eurozone Industrial Manufacturing YoY

ECB’s Stournaras (dove –

voter) referred to as for the beginning in price cuts quickly and added that he sees 4 price

cuts in complete as affordable this yr:

- We have to begin

price cuts quickly. - Mustn’t

exaggerate the chance of a wage-price spiral. - Doesn’t purchase the

argument that the ECB can not lower charges earlier than the Fed. - 4 price cuts in

2024 appear affordable. - We now have to chop charges

twice earlier than the summer season break.

ECB’s Stournaras

ECB’s Knot (hawk – voter)

expressed his desire for a June price lower as most of different ECB members

already did:

- Anticipate first lower in

June. - Additional cuts most

doubtless in September and December. - Interim conferences

would even be accessible for price cuts if incoming information tells us we must always

do extra.

ECB’s Knot

The US February PPI beat

expectations throughout the board:

- PPI M/M 0.6% vs.

0.3% anticipated and 0.3% prior. - PPI Y/Y 1.6% vs.

1.1% anticipated and 1.0% prior (revised from 0.9%). - Core PPI M/M 0.3%

vs. 0.2% anticipated and 0.5% prior. - Core PPI Y/Y 2.0%

vs. 1.9% anticipated and a couple of.0% prior.

US Core PPI YoY

The US February Retail

Gross sales missed expectations throughout the board with unfavorable revisions to the prior

figures:

- Retail Gross sales M/M

0.6% vs. 0.8% anticipated and -1.1% prior (revised from -0.8%). - Retail Gross sales Y/Y

1.5% vs. 0.0% prior (revised from 0.6%). - Ex-autos M/M 0.3%

vs. 0.5% anticipated and -0.8% prior (revised from -0.6%). - Management group M/M 0.0%

vs. 0.4% anticipated and -0.3% prior (revised from -0.4%). - Retail gross sales ex fuel

and autos M/M 0.3% vs. -0.5% prior.

US Retail Gross sales YoY

The US Jobless Claims

beat expectations with an enormous optimistic revision to the Persevering with Claims

figures following the annual BLS revisions and a brand new mannequin to seasonally alter

the info:

- Preliminary Claims 209K

vs. 218K anticipated and 210K prior (revised from 217K). - Persevering with Claims

1811K vs. 1900K anticipated and 1794K prior (revised from 1906K).

US Jobless Claims

JiJi Press reported that

the BoJ was arranging to finish unfavorable rates of interest coverage on the subsequent week’s

assembly. After a quick spike, the JPY gave again all of the positive aspects given the sturdy

US information and the truth that the market has already priced in a March exit.

BoJ

ECB’s de Guindos (impartial

– voter) reaffirmed that the central financial institution may have extra information in June for a

price lower and expressed some concern in regards to the excessive monetary belongings valuations:

- I see Europe’s

economic system selecting up in H2 2024. - In June we’ll have

adequate stage of information to make choices on financial coverage. - Monetary asset

valuations are very excessive.

ECB’s de Guindos

The PBoC left its MLF

price unchanged at 2.50% as anticipated.

- MLF

2.50% vs. 2.50% anticipated and a couple of.50% prior. - Injects

money by way of MLF for the sixteenth month in a row. - Provides

CNY 387bn vs. the 500bn yuan maturing.

PBoC

The New Zealand

Manufacturing PMI improved in February though the index stays in

contraction:

- Manufacturing PMI 49.3

vs. 47.3 prior.

BNZ’s Catherine Beard:

- Improved February

end result confirmed indicators of a gradual turnaround within the sector. - The important thing sub-index of

Manufacturing (49.1) was at its highest stage since January 2023, whereas

Deliveries (51.4) was at its highest level since March 2023. Nevertheless, New

Orders (47.8) has now remained in contraction for 9 consecutive months

and sure must get a lot nearer to the 50-point mark to edge the

sector again into growth.

BNZ’s Stephen Toplis:

- New Zealand’s

manufacturing sector continues to be in recession, however this month’s PMI signifies

there may be mild on the finish of the tunnel. The 49.3 studying is inside a

smidgen of “breakeven” and the brand new orders to stock differential

gives help for a rise in manufacturing. Furthermore, New Zealand’s

underperformance in opposition to the remainder of the world is narrowing shortly.

New Zealand Manufacturing PMI

Japan’s Rengo, the

largest commerce union, mentioned that preliminary information confirmed a mean of 5.28% of

wage hike this yr. That compares with the three.80% seen in fiscal yr 2023. And

for added context, the above represents the most important pay hike in additional than 30

years. With this information the situations for the BoJ to exit the NIRP have been met.

Japan Rengo

ECB’s Rehn (impartial – non

voter in April) mentioned that the central financial institution already began to debate price cuts

however the inflation information shall be key for the timing:

- Began dialogue

about lowering the restrictive dimension of financial coverage. - Speak pertains to when

it’s acceptable to begin slicing rates of interest. - If inflation

continues to fall, can slowly begin easing the foot off the brake pedal of

financial coverage.

ECB’s Rehn

The US February

Industrial Manufacturing beat expectations with unfavorable revisions to the prior

figures:

- Industrial

Manufacturing M/M 0.1% vs. 0.0% anticipated and -0.5% prior (revised from -0.1%). - Industrial Manufacturing

Y/Y -0.2 vs. -0.3 prior (revised from 0.0%). - Manufacturing

manufacturing M/M 0.8% vs. 0.3% anticipated and -1.1% prior (revised from

-0.5%). - Manufacturing manufacturing

Y/Y -0.7% vs. -1.1% prior (revised from -0.9%). - Capability utilization

78.3% vs. 78.5% anticipated and 78.3% prior (revised from 78.5%).

US Capability Utilization

The US February

College of Michigan Shopper Sentiment survey got here principally consistent with

expectations throughout the board:

- Shopper Sentiment 76.5

vs. 76.9 anticipated and 76.9 prior. - Present situations

79.4 vs. 79.2 anticipated and 79.4 prior. - Expectations 74.6 vs.

75.1 anticipated and 75.2 prior. - One-year inflation

3.0% vs. 3.0% prior. - 5-year inflation

2.9% vs. 2.9% prior.

College of Michigan Shopper Sentiment

The

highlights for subsequent week shall be:

- Monday: China Retail Gross sales and

Industrial Manufacturing, Canada PPI, US NAHB Housing Market Index. - Tuesday: BoJ Coverage Resolution,

RBA Coverage Resolution, Eurozone Wage information, Eurozone ZEW, Canada CPI, US Housing

Begins and Constructing Permits. - Wednesday: PBoC LPR, UK CPI, FOMC

Coverage Resolution, New Zealand GDP. - Thursday:

Australia/Japan/Eurozone/UK/US Flash PMIs, Australia Labour Market report, SNB

Coverage Resolution, BoE Coverage Resolution, US Jobless Claims. - Friday: Japan CPI, UK Retail

Gross sales, Canada Retail Gross sales.

That’s all people. Have a

good weekend!