ECB’s Knot (hawk –

voter) over the weekend reaffirmed the central financial institution’s give attention to wage development to

resolve when and by how a lot tweak their financial coverage:

- We now have a

credible prospect that inflation will return to 2% in 2025. - The one piece

that is lacking is the conviction that wage development will adapt to decrease

inflation. - As quickly as that

piece of the puzzle falls in place, we will decrease rates of interest

a bit.

ECB’s Knot

Over the weekend

three US troops received killed in Jordan in a drone assault. The US blamed

Iran-backed militias and later within the week Kataib Hezbollah, the group that

attacked the US base, stated that it’s going to droop navy and safety

operations in opposition to US forces. Crude Oil opened larger on Monday, however the beneficial properties

had been rapidly erased.

Drone Assault

ECB’s de Guindos

(impartial – voter) expressed his confidence in reaching their 2% goal as he

sees inflation dangers tilted to the draw back:

- We’ll reduce curiosity

charges once we are positive of assembly 2% inflation objective. - There’s excellent news

on inflation just lately. - Ultimately,

that can be mirrored in financial coverage. - Optimistic about

inflation dynamics, even on core inflation. - Inflation dangers are

to the draw back. - Newest financial institution lending

survey exhibits sure stabilization. - I believe the

disinflation course of can proceed. - China would not fear

US as a consequence of monetary contagion however via oblique influence on development. - I believe that

inflation can be barely decrease than we have now predicted. - Inflation

figures have principally introduced constructive surprises just lately. - Does

not need to put a determine on what “slightly lower” means. - Financial

coverage has performed its half in bringing inflation down. - Euro

space development prospects have deteriorated within the meantime. - Progress

may even be barely under 0.8%, as projected in December.

ECB’s de Guindos

ECB’s Centeno

(dove – voter) is among the most dovish members and he’s calling for sooner

than anticipated price cuts:

- Inflation is

reducing in a sustained method. - Virtually all components

that drove costs up have dissipated. - Ought to begin slicing

charges sooner moderately than later however keep away from abrupt strikes. - No want to attend for

wages knowledge in Could to make price selections. - There aren’t any seen

second-round results of wage hikes.

ECB’s Centeno

ECB’s Kazimir

(hawk – non voter in March) pushed again in opposition to the market’s pricing as he sees

the primary price reduce coming in June moderately than April:

- The following transfer will

be a price reduce and it’s inside our attain. - A price reduce in June

is extra possible than April, however actual timing is secondary to the

choice’s influence. - Endurance is

important earlier than making pivotal selections. - ECB is just not behind

the curve; it’s markets getting forward of the occasion. - Disinflation indicators

are constructive however not but sufficient to make a assured conclusion.

ECB’s Kazimir

SNB’s Jordan

expects inflation to rise a bit within the quick time period however nonetheless finish the yr under

their 2% goal:

- Our expectation is

that inflation will once more rise a little bit. - Concerning inflation,

the scenario has improved, it appears comparatively good. - Inflation needs to be

under 2% in 2024. - Inflation most likely accelerated January.

SNB’s Chairman Jordan

The US Treasury

launched its Q1 quarterly refunding estimates, and it was under the prior

forecast:

- Final yr, the

Treasury estimated Q1 borrowing wants at $816 billion, now expects to

borrow $760 billion. - Expects to borrow

$202 billion within the April-June quarter, assuming end-June money steadiness of

$750 billion. - Says it borrowed

$776 billion in This fall — according to estimates — and - Ended with money

steadiness of $769 billion, which was $19 billion larger than estimated due

to low cost on borrowing.

The Treasury stated that it

sees elevated internet fiscal flows and the next money steadiness.

US Treasury

The Japanese December

Unemployment Charge fell to 2.4% vs. 2.5% anticipated and a pair of.5% prior.

Japan Unemployment Charge

The Australian December

Retail Gross sales missed expectations by a giant margin:

- Retail Gross sales M/M -2.7%

vs. -0.9% anticipated and a pair of.0% prior. - Retail Gross sales Y/Y

0.8% vs. 2.20% prior.

Australia Retail Gross sales YoY

The Eurozone This fall Preliminary GDP barely beat

expectations:

- This fall GDP 0.0% vs.

-0.1% anticipated and -0.1% prior.

Eurozone This fall GDP

ECB’s Vujcic (hawk – voter) is open for a price reduce

both on April or June however he cautions in opposition to anticipating price cuts at each

assembly:

- April or June timing

for a price reduce is just not a giant distinction. - Charge cuts by 25 bps

quantity is preferable. - However it isn’t a

on condition that price cuts would occur at each assembly, pauses are doable. - GDP knowledge helps

view that Eurozone financial system is going through tender touchdown situation.

ECB’s Vujcic

The US December Job Openings beat expectations with an

upward revision to the prior determine:

- Job Openings 9.026M

vs. 8.750M anticipated and eight.925M prior (revised from 8.790M). - Quits price unchanged

at 2.2% - Hires price 3.6% vs.

3.5% prior.

US Job Openings

The US January Shopper Confidence got here in mainly

according to expectations however the Current Scenario index jumped above the 2021

stage and the labour market particulars improved significantly:

- Shopper Confidence 114.8 vs. 115.0 anticipated and

108.0 prior (revised from 110.7) - Current scenario index 161.3 vs. 148.5 prior.

- Expectations

83.8 vs. 81.9 prior. - 1 yr Inflation 5.2% vs. 5.6% prior – lowest

since 2020. - Jobs hard-to-get 9.8 vs. 13.2 prior.

US Shopper Confidence

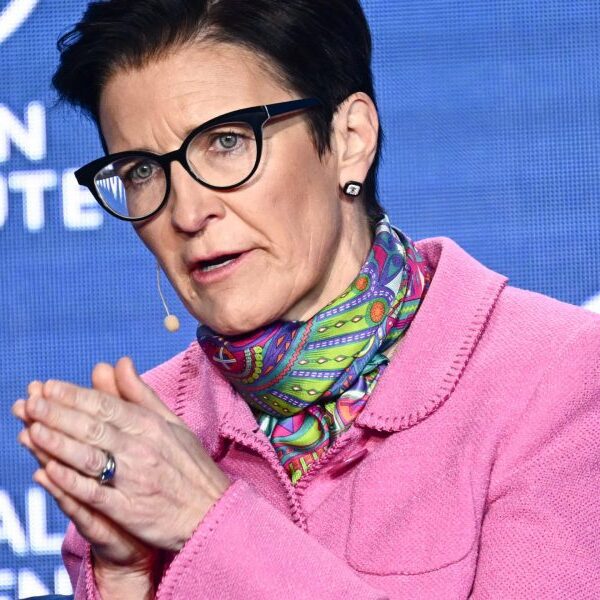

ECB’s Lagarde (impartial – voter) confused the

significance of wage development for his or her selections:

- We aren’t there

but’ on price cuts, want extra knowledge. - We have to be

additional into the disinflationary course of earlier than slicing charges. - The following transfer will

be a reduce. - Wage knowledge is

critically essential.

ECB’s President Lagarde

The Japanese December Industrial Manufacturing missed

expectations:

- Industrial

Manufacturing Y/Y -0.7% vs. -1.4% prior. - Industrial

Manufacturing M/M 1.8% vs. 2.4% anticipated and -0.9% prior.

Japan Industrial Manufacturing YoY

The Australian This fall CPI missed throughout the board:

- CPY Y/Y 4.1% vs. 4.3%

anticipated and 5.4% prior. - CPI Q/Q 0.6% vs.

0.8% anticipated and 1.2% prior. - Trimmed Imply CPI Y/Y

4.2% vs. 4.3% anticipated and 5.2% prior. - Trimmed Imply CPI Q/Q

0.8% vs. 0.9% anticipated and 1.2% prior.

Australia Trimmed Imply CPI YoY

The Chinese language January PMIs got here according to

expectations:

- Manufacturing PMI

49.2 vs. 49.2 anticipated and 49.0 prior. - Companies PMI 50.7

vs. 50.6 anticipated and 50.4 prior.

China Manufacturing PMI

ECB’s Lane (dove – voter) echoed his colleagues by

reaffirming that they need to see extra proof that inflation is heading again

to their 2% goal.

ECB’s Lane

The US January ADP missed expectations:

- ADP 107K vs. 145K anticipated and 158K prior (revised

from164K).

The median change in annual

pay:

- Job stayers 5.2% vs. 5.4% final month.

- Job changers 7.2% vs. 8.0% final month.

US ADP

The US Treasury introduced its quarterly refunding borrowing:

- 2 yr $63b vs. $63

billion anticipated. - 3-year $54b vs.

$53-$54 billion anticipated. - 5-year $64b vs. $64

billion anticipated. - 7-year vs. $40 billion anticipated.

- 10-year $42b vs. $42

billion anticipated. - 20-year $16b vs. $16

billion anticipated. - 30-year $25b vs. $25

billion anticipated. - Provide for subsequent week

$121b vs. $121 billion anticipated. - Given present fiscal

forecasts, Treasury expects to keep up invoice public sale sizes at present

ranges into late-March.

Refunding

The Canadian November GDP beat expectations:

- November GDP

0.2% vs. 0.1% anticipated. - Service producing industries 0.1% vs. 0.1% prior.

- Items producing industries 0.6% vs. 0.0% prior.

- December

advance studying 0.3%. - Preliminary

This fall estimate 0.3%. - Preliminary

2023 estimate 1.5%.

Canada GDP

The US This fall Employment Value Index missed expectations:

- ECI This fall 0.9% vs. 1.0%

anticipated and 1.1% prior. - Wages This fall 0.9% vs.

1.2% final quarter. - Advantages This fall 0.7% vs.

0.9% final quarter.

US Employment Value Index

The Federal Reserve left rates of interest unchanged at

5.25-5.50% as anticipated:

- Latest indicators

recommend that financial exercise has been increasing at a strong tempo. - Removes reference to

‘extra coverage firming’. - The Committee does

not count on it is going to be acceptable to scale back the goal vary till it has

gained better confidence that inflation is shifting sustainably towards 2

p.c. - Inflation has eased

over the previous yr however stays elevated. - Complete paragraph

about banking system and tighter monetary situations eliminated. - Says dangers to

employment and inflation objectives are “moving into better balance”.

Federal Reserve

Transferring on to Fed Chair

Powell’s Press Convention:

- It’ll seemingly be

acceptable to chop sooner or later this yr. - The financial system has made

‘good progress’ in direction of twin mandate. - Payroll development over previous

three months is averaging 165K, which remains to be wholesome however nicely under a

yr in the past. - Inflation stays

above longer run objective of two%. - Decrease inflation in

H2 2023 had been welcome however we might want to see persevering with proof to get

confidence that inflation shifting to focus on. - Longer-term

inflation expectations seem nicely anchored. - FOMC extremely

attentive to dangers inflation poses to each side of mandate. - Our coverage price is

seemingly at its peak. - Decreasing coverage too

quickly or too late poses dangers. - We proceed to make

choice meeting-by-meeting. - We need to see a

continuation of fine inflation knowledge to realize confidence. - Six month knowledge on

inflation is sweet sufficient however we have now to believe it is going to proceed. - We had very sturdy

development final yr. - Lots of the

enchancment in knowledge has been from items, finally that can stage out

and we’ll must see extra from providers. - We have to see extra

proof that confirms what we predict we’re seeing. - “We need to see

extra good knowledge… not searching for higher knowledge… extra good knowledge…” - Virtually each

participant on the committee does consider it is going to be acceptable to decrease

charges. - An sudden drop

in employment would ‘completely’ argue for slicing sooner. - There was no

proposal to chop charges immediately. There is a large disparity about when to chop. - The roles market is

rebalancing, it is going to most likely take a pair years for wages to normalize. - We’re not trying

for inflation to anchor under 2%. - We need to end

the job on inflation whereas preserving the labour market sturdy. - Total, it is a

fairly good image on the financial system. - I do not suppose it is

seemingly we may have sufficient confidence to chop in March, I do not suppose

that is the bottom case. - We cannot preserve it a

secret when we have now confidence on inflation. - I actually like

anecdotal knowledge, and in chats with enterprise there are indicators of

re-acceleration. - I am not so fearful

that development is simply too sturdy, and inflation may come again. - Continued declines

in inflation are what we’re .

Fed Chair Powell

The Chinese language January

Caixin Manufacturing PMI beat expectations:

- Caixin Manufacturing

PMI 50.8 vs. 50.6 anticipated and 50.8 prior.

Key

findings highlighted within the report:

- Manufacturing continues

to develop modestly, however complete gross sales development softens. - New export enterprise

rises for first time in seven months. - Enterprise confidence

improves to nine-month excessive.

China Caixin Manufacturing PMI

The Switzerland January

Manufacturing PMI missed expectations:

- Manufacturing PMI 43.1

vs. 44.5 anticipated and 43.0 prior.

Switzerland Manufacturing PMI

The Eurozone January CPI got here according to

expectations though the M/M measures had been each deeply unfavorable:

- CPI Y/Y 2.8% vs. 2.8%

anticipated and a pair of.9% prior. - CPI -0.4% vs. 0.2%

prior. - Core CPI Y/Y 3.3% vs.

3.2% anticipated and three.4% prior. - Core CPI M/M -0.9% vs. 0.5% prior.

Eurozone Core CPI YoY

The BoE left the Financial institution Charge unchanged at 5.25% as

anticipated dropping the tightening bias:

- Financial institution

price vote 6-2-1 vs. 8-1-0 anticipated (Haskel, Mann voted for 25 bps price hike;

Dhingra voted for 25 bps price reduce). - Financial

coverage might want to stay restrictive for sufficiently lengthy. - Ready

to regulate financial coverage as warranted by financial knowledge to return inflation to

2% goal sustainably. - Labour

market has continued to ease however stays tight by historic requirements. - GDP

development is predicted to choose up regularly. - Dangers

to inflation are extra balanced. - Dangers

round CPI inflation projection is skewed to the upside. - Though

providers worth inflation and wage development have fallen by considerably greater than

anticipated, key indicators of inflation persistence stay elevated. - The Committee will preserve below assessment for the way lengthy Financial institution Charge needs to be

maintained at its present stage.

BoE

Transferring on to BoE Governor Bailey’s Press Convention:

- We aren’t but at a

level the place we will decrease charges. - The extent of financial institution

price stays acceptable. - It is not as easy

as seeing inflation return to focus on within the spring and calling the job

executed. - However issues are

shifting in the best course. - We’ve got to maintain

financial coverage sufficiently restrictive for sufficiently lengthy. - How lengthy that can

be and the way excessive charges have to remain depends upon incoming knowledge. - We

must see proof of essentially the most persistent parts of inflation, providers

inflation particularly, easing again. - In

phrases of policy-setting, we have to look previous short-term traits. - Companies

inflation is likely to be a lot stickier within the months forward. - Hopes

decrease inflation will affect expectations in the actual financial system. - However

we have to see extra proof of that. - Inflation shifting again to round 2.7% is just not an appropriate stage as a

resting level. - Needing to get inflation again to 2% mark is the very best factor for

households. - We

won’t preserve coverage stance any longer than we have to. - If we observe market

path inflation could be above goal for 3 years. - Excellent news on financial system

has taken away want for warning that charges may rise once more. - Do not agree with the

concept that we have executed straightforward bit on bringing wage development down. - We need not see

inflation again at goal to chop charges, we have to see proof that it is

heading there.

BoE’s Governor Bailey

The US Challenger Job Cuts confirmed plans to chop 82.31K

jobs in January vs. 34.82K in December:

Excluding final January, that is the very best variety of

job cuts introduced in January since January 2009. Generally, firms

level to cost-cutting as the principle driver for layoffs.

US Challenger Job Cuts

The US Jobless Claims missed expectations for the

second consecutive week:

- Preliminary Claims 224K vs. 212K anticipated and 215K

prior (revised from 214K). - Persevering with Claims 1898K vs. 1840K anticipated and

1828K prior (revised from 1833K).

US Jobless Claims

The Canadian Manufacturing PMI improved in January

though it stays in contractionary territory:

- Manufacturing PMI 48.3 vs. 45.4 prior.

- Manufacturing was

sub-50 for a sixth month in a row throughout January. - Confidence within the

future improved in January, hitting its highest stage in six months.

Canada Manufacturing PMI

The US January ISM Manufacturing PMI beat expectations

by a giant margin with the New Orders index leaping again into enlargement:

- ISM Manufacturing

PMI 49.1 vs. 47.0 anticipated and 47.4 prior.

Particulars:

- Costs paid 52.9 vs. 45.2 prior.

- Employment 47.1 vs 48.1 prior.

- New orders 52.5 vs. 47.1 prior.

- Inventories 46.2 vs 44.3 prior.

- Manufacturing 50.4 vs 50.3 prior.

US ISM Manufacturing PMI

Al Jazeera reported on a ceasefire in Gaza sending

Crude Oil worth decrease, however later deleted the tweet with the market erasing the

losses. In a while, Reuters reported {that a} Qatari official advised them there is no such thing as a

ceasefire deal but for Gaza and Crude Oil began to float decrease once more. The

official stated that Hamas ‘obtained the proposal positively’ but it surely has not

responded but.A Hamas official advised Reuters they’ve obtained the

truce proposal however have not given response to any events and it’s nonetheless being

studied. They added ‘we can not say present state of negotiations is zero and at

the identical time, we can not say that we have now reached an settlement’.

WTI Crude Oil

The Australian This fall PPI slowed though the Y/Y measure

remained elevated:

- PPI Y/Y 4.1% vs.

3.8% prior. - PPI Q/Q 0.9% vs. 1.8% prior.

Australia PPI YoY

BoE’s Capsule (impartial – voter) reaffirmed his affected person

method on the subject of price cuts:

- The time when price

cuts can be doable is a way off for me. - Totally different votes on

MPC is symptomatic of a wholesome dialogue. - Want for restrictive

coverage does not imply charges want to remain at present ranges indefinitely. - Must look via

any short-term achievement of inflation goal within the coming months.

BoE’s Capsule

The US NFP beat expectations by a giant margin:

- NFP 353K vs. 180K anticipated and 333K prior

(revised from 216K). - November revised to 173K from 164K.

- Two-month internet revision 126K vs. -71K prior.

- Unemployment price 3.7% vs. 3.8% anticipated and three.7%

prior. - Participation

price 62.5% vs. 62.5% prior. - U6 underemployment price 7.2% vs. 7.1% prior.

- Common hourly earnings M/M 0.6% vs. 0.3%

anticipated. - Common hourly earnings Y/Y 4.5% vs. 4.1%

anticipated. - Common weekly hours 34.1 vs. 34.3 anticipated.

- Change in personal payrolls 317K vs. 164K anticipated.

- Change in manufacturing payrolls 23K vs. 5K

anticipated. - Family survey -31K vs. -683K prior.

- Beginning-death adjustment -121K vs. -52K prior.

US Unemployment Charge

The highlights for subsequent week

can be:

- Monday: China Caixin Companies PMI, Eurozone PPI, Canada

Companies PMI, US ISM Companies PMI. - Tuesday: Japan Wage knowledge, RBA Coverage Choice, Eurozone

Retail Gross sales, New Zealand Jobs knowledge. - Wednesday: Switzerland Unemployment Charge.

- Thursday: China Inflation knowledge, US Jobless Claims.

- Friday: Canada Jobs knowledge.

That’s all of us. Have a pleasant weekend!