An worker works on the manufacturing line of pharmaceutical firm Zentiva in Prague, Czech Republic, Could 6, 2021.

David W. Cerny | Reuters

The health-care sector has worn out a lot of its losses for the 12 months throughout the December market rally. Crushed-down biotech and medical machine makers have seen the largest rebound this month, and analysts see that momentum persevering with within the new 12 months.

Nonetheless, analysts and strategists have a blended outlook for the sector in 2024.

“We’re entering the year as an underweight,” mentioned Sam Stovall, chief funding strategist at CFRA. “There’s a lot of overhead resistance, and they have to work through that overhead resistance because a lot of investors might say, ‘let me get out and move on to something that has better growth potential.'”

The second week of January might carry some huge strikes for health-care names, when firms current at this 12 months’s JPMorgan health-care convention in San Francisco. It is likely one of the 12 months’s largest health-care gatherings of main business CEOs, and firms typically present updates on earnings steerage and scientific trial analysis throughout the convention.

The political calendar might pose one of many largest challenges. The S&P 500 health-care sector has lagged the S&P 500 in 4 of the final six presidential cycles. Elevated regulatory give attention to drug costs might end in one other 12 months of underperformance.

The S&P 500 health-care sector stays on tempo for a second straight annual loss, dragged down by Covid vaccine makers Moderna and Pfizer, which have fallen greater than 40% for the 12 months. Eli Lilly, up greater than 55% for the 12 months, is the sector’s largest gainer, fueled by demand for its diabetes and weight problems medication.

This is a have a look at which components of the well being business analysts see going through continued stress in 2024, which is able to get some aid, and which beaten-down names are getting buyers’ votes for a rebound subsequent 12 months:

Huge Pharma: Worth negotiations

Novartis scientist in lab packing supplies for transportation.

Supply: Novartis

In 2024, Inflation Discount Act drug worth negotiations will likely be entrance and middle. Medicare officers will make their preliminary affords on the primary 10 medication chosen for discussions Feb. 1.

“This law was passed, and we want to implement it in the most thoughtful manner possible,” mentioned Dr. Meena Seshamani, deputy administrator and director of the federal Heart for Medicare, “to really create a robust conversation in our health system in a sense that, how can we ensure access to innovative therapies that people need?”

The drugmakers have sued the administration however have chosen to proceed with discussions, whereas complaining that negotiations on this nation will likely be completely different from these they’ve had with different nations. They argue that U.S. well being insurers and pharmacy profit managers could not go on full reductions to sufferers.

“In a European market, when you negotiate a price, that medicine is readily available to patients, there’s no prior authorizations,” mentioned Victor Bulto, president of Novartis’ U.S. operations.

Novartis‘ coronary heart medicine Entresto is among the many first medication chosen for negotiation. Accepted by the FDA in 2015, the negotiated Medicare low cost on the drug will go into impact in 2026.

Bulto argues the IRA’s timeline, making drugs eligible for negotiations after 9 years available on the market, will end in much less analysis for brand spanking new indications on medication like most cancers remedies.

“We normally start investigating in the sickest patients, where you establish the benefit risk of your molecule, and then you want to start bringing data earlier,” he mentioned, “to see if you can impact the cause of cancer early. But that takes time and money and a lot of investment.”

The large query for buyers is how steep a reduction the Biden administration will ask of producers. Worth discussions are anticipated to stay non-public till the Facilities for Medicare & Medicaid Companies reveals its last worth subsequent September – until the drugmakers resolve to go public.

“We are not intending to go out there publicly because we’re going to be part of a back-and-forth negotiation with each individual manufacturer,” mentioned Seshamani. However, she added, if the businesses do go public, Medicare might doubtlessly accomplish that as properly.

Well being insurers: Profit administration dangers cool

A CVS location in New York, US, on Thursday, Feb. 9, 2023.

Stephanie Keith | Bloomberg | Getty Photos

Insurers’ pharmacy advantages administration divisions, often known as PBMs, are underneath growing regulatory stress. CVS Health’s CVS Caremark, Cigna‘s Specific Scripts and UnitedHealth Group‘s OptumRx collectively account for practically 80% of market share within the enterprise of administering pharmacy advantages.

Greater than two dozen bipartisan payments had been proposed in Congress this 12 months, aimed toward creating larger PBM worth transparency. But, given Home management struggles, not one of the measures gathered sufficient momentum to realize approval by each chambers of Congress.

“As we move into 2024, history has told us that you tend not to have the major regulatory reform events in health care necessarily play out in the election year,” mentioned Scott Fidel, health-care analyst at Stephens.

Analysts at Financial institution of America see enhancing fundamentals for well being insurers subsequent 12 months. They named Humana their high decide for 2024, saying the Medicare insurer is greatest positioned for robust beneficial properties.

“The reported M&A discussion between Cigna and Humana have raised questions about whether Humana itself is concerned about its own growth outlook,” BofA analysts wrote in a word to purchasers. “We see Humana walking away from a deal as validation of the core growth story ahead.”

Cantor Fitzgerald analyst Sarah James thinks well being insurers are properly positioned to navigate challenges like increased affected person medical prices and Medicare reimbursement adjustments subsequent 12 months. She additionally sees a shopping for alternative if there are pullbacks amid heated election 12 months rhetoric about medical health insurance.

“When you see the multiple compression around election cycles is when you want to put incremental investments or money to work in the sector, because it’s very rare that anything they talk about during their stump speeches, actually pans out,” mentioned James.

Medical gadgets: GLP-1 stress lifts

A pharmacist shows packing containers of Ozempic, a semaglutide injection drug used for treating kind 2 diabetes made by Novo Nordisk, at Rock Canyon Pharmacy in Provo, Utah, U.S. March 29, 2023.

George Frey | Reuters

Shares of medical machine makers had been among the many largest losers this 12 months, as buyers predicted the surge in recognition of weight problems drugs, often known as GLP-1 receptor agonists, would reduce demand for issues like diabetes administration, knee replacements and bariatric surgical procedure, mentioned E-Squared well being portfolio supervisor Les Funtleyder.

“Just because there was a lot of concern that GLPs are going to, you know, eliminate all procedures all the time. And that’s not going to happen. That’ll be proven next year,” mentioned Funtleyder. “I think medical devices do best next year.”

There are indicators the sector could have bottomed in October. The iShares Medical Devices ETF has surged greater than 15% over the past two months. Two of the sector’s largest gainers had been insulin pump maker Insulet and Dexcom, which makes steady glucose monitoring gadgets often known as CGMs.

Whereas each shares have gained greater than 40% in two months, analysts at Leerink Companions raised their worth goal on Insulet to $270 from $231 and boosted their goal on Dexcom to $144 from $128. Prescriptions for diabetes gadgets stay robust, Leerink mentioned in a word to purchasers.

The diabetes gamers even have new merchandise on the horizon which might gas recent beneficial properties subsequent 12 months, mentioned BTIG analyst Marie Thibault.

“We think investors are already looking toward the anticipated launch of a 15-day sensor for type 2 diabetes non-insulin patients in Summer 2024,” Thibault wrote in a analysis word, including that rival CGM maker Abbott Laboratories can be anticipated to realize approval for its new glucose wearable within the new 12 months.

Aid for biotech and life science instruments

Eli Lilly and Firm, Pharmaceutical firm headquarters in Alcobendas, Madrid, Spain.

Cristina Arias | Cowl | Getty Photos

The beaten-down biotech sector has worn out its losses for the 12 months throughout this month’s rally, with the SPDR S&P Biotech ETF rebounding greater than 28% from its October low.

RBC analyst Brian Abrahams sees the momentum persevering with in 2024, fueled partially by the run-up within the GLP-1 drugmakers like Eli Lilly and Novo Nordisk, which has left them flush with money.

“The biotech sector may benefit more and be less overshadowed in the coming year as we potentially see GLP-1 cash flows catalyze more M&A, and biotech efforts to improve upon some of the shortcomings of the leading GLP-1 agents emerge,” Abrahams wrote in a shopper word.

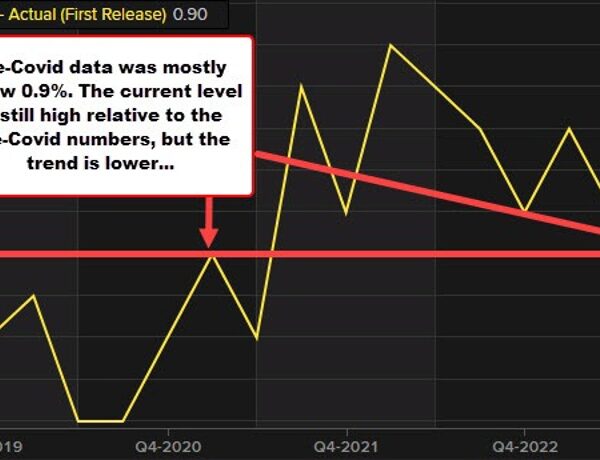

Smaller biotech companies confronted a money crunch because the Federal Reserve raised rates of interest over the past 12 months, making it harder for them to entry funding and spend money on capital expenditures. That had a damaging affect on life science instruments, however a variety of buyers see the image enhancing subsequent 12 months.

“We don’t think rates are going to go much higher if at all from here, and that eases the pressure on high-valuation growth stocks going forward,” Advisor Capital Administration portfolio supervisor JoAnne Feeney informed CNBC. “And we think it takes the pressure off a lot of life sciences tools companies that were really hurt by the funding challenges of high interest rates. We think that starts to ease.”

Analysts at Goldman Sachs see life science instruments posting stronger beneficial properties than the general well being sector subsequent 12 months, after two years of declining gross sales progress. “We look for a stabilization and ultimately a resumption of an upward revenue and earnings revision cycle which should allow the sector to show absolute outperformance vs the market,” they wrote in a word to purchasers.

Goldman’s high instruments picks for 2024 are Thermo Fisher, Avantor and Qiagen.