Summary:

-

West Virginia bill would allow up to 10% of treasury assets into metals and digital assets

-

Only bitcoin currently meets the bill’s $750bn market-cap requirement

-

Stablecoins would require explicit regulatory approval

-

Similar proposals have emerged across the U.S., with limited success so far

-

Political support for the bill remains uncertain

West Virginia bill opens door to state investment in bitcoin and precious metals. What could possibly go wrong?

A U.S. state lawmaker has proposed legislation that would allow West Virginia’s treasury to allocate a portion of its reserves into precious metals and select digital assets, adding to a growing but still limited push by state governments to gain exposure to alternative stores of value.

Under a bill introduced this week by Chris Rose, West Virginia’s Board of Treasury would be permitted to invest up to 10% of its holdings in precious metals, qualifying digital assets and approved stablecoins. The proposal, titled the Inflation Protection Act, is framed as a hedge against inflation and currency debasement rather than a wholesale shift in treasury management strategy.

The bill specifies that any eligible digital asset must have recorded a market capitalisation above $750 billion in the prior calendar year. As of January, that threshold would limit exposure to Bitcoin alone, effectively excluding smaller cryptocurrencies and reinforcing the bill’s emphasis on liquidity and scale.

According to the draft legislation, digital assets held by the state could be custodied through a qualified third-party custodian, an exchange-traded product, or another secure custody solution. Stablecoins would face tighter constraints, requiring explicit regulatory approval from either the U.S. federal government or individual states before being eligible for treasury investment.

West Virginia would not be alone in exploring such an approach. Several U.S. states have debated similar measures over the past year, though legislative success has been uneven. While numerous bills were introduced in 2025, only a small number of states — including Texas, Arizona and New Hampshire — have ultimately passed laws allowing for some form of state-level crypto reserve or investment framework.

At this stage, the political outlook for the West Virginia proposal remains uncertain. The bill has been referred to the legislature’s Committee on Banking and Insurance, where it will face scrutiny over risk management, volatility and fiduciary responsibility. There is no clear indication yet that it has sufficient support to advance to a full vote.

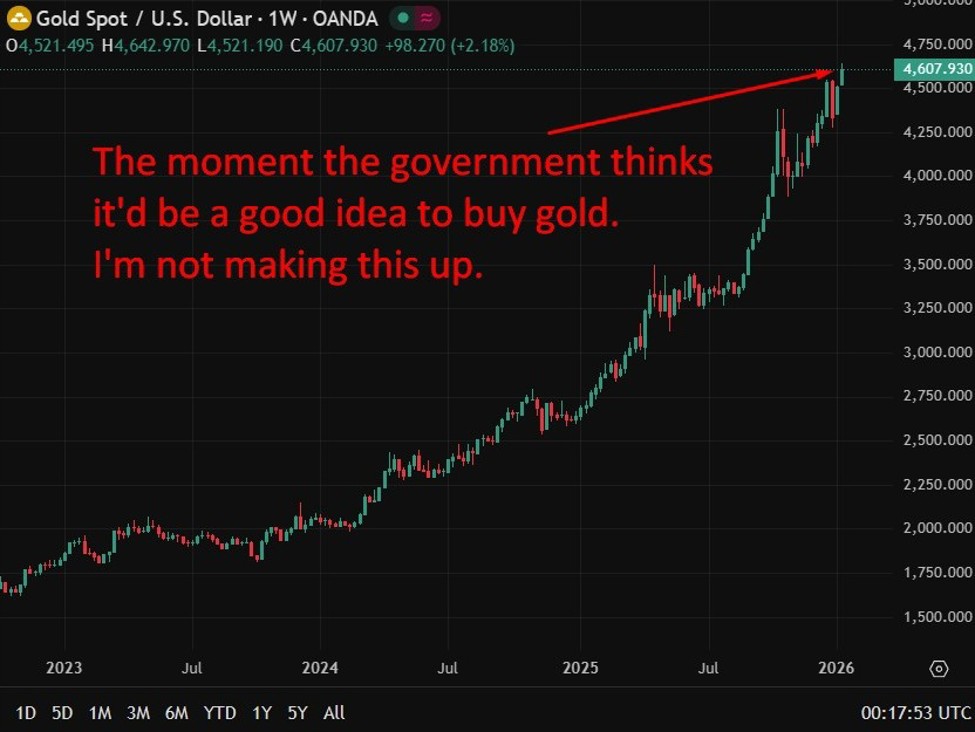

For markets, the proposal highlights a broader trend of governments beginning to acknowledge alternative assets, often after significant price appreciation has already occurred. While such moves may add to the narrative legitimacy of bitcoin and precious metals, they also risk being late-cycle signals rather than catalysts for sustained upside.

—

For bitcoin, the bill reinforces its positioning as a macro hedge and reserve-style asset rather than a speculative token. However, given bitcoin’s strong performance in recent years, incremental government interest is unlikely to be a major upside catalyst on its own and may instead signal growing mainstream saturation.

For precious metals, particularly gold and silver, the proposal aligns with their traditional role as inflation hedges. Yet, similar to crypto, official-sector interest typically emerges after prolonged rallies, suggesting demand validation rather than fresh momentum.

Overall, while such legislation supports the long-term legitimacy of alternative assets, it may also argue for caution on near-term price expectations.

Buy some gold they say. It’ll be fun, they say.