The office-leasing enterprise declared chapter this week, two years after lastly going public minus its notorious co-founder. It has $19 billion of liabilities and $15 billion of belongings. Longtime traders, together with Softbank Group Corp. and the Imaginative and prescient Fund, will add to the enormous losses they’ve already taken on the enterprise.

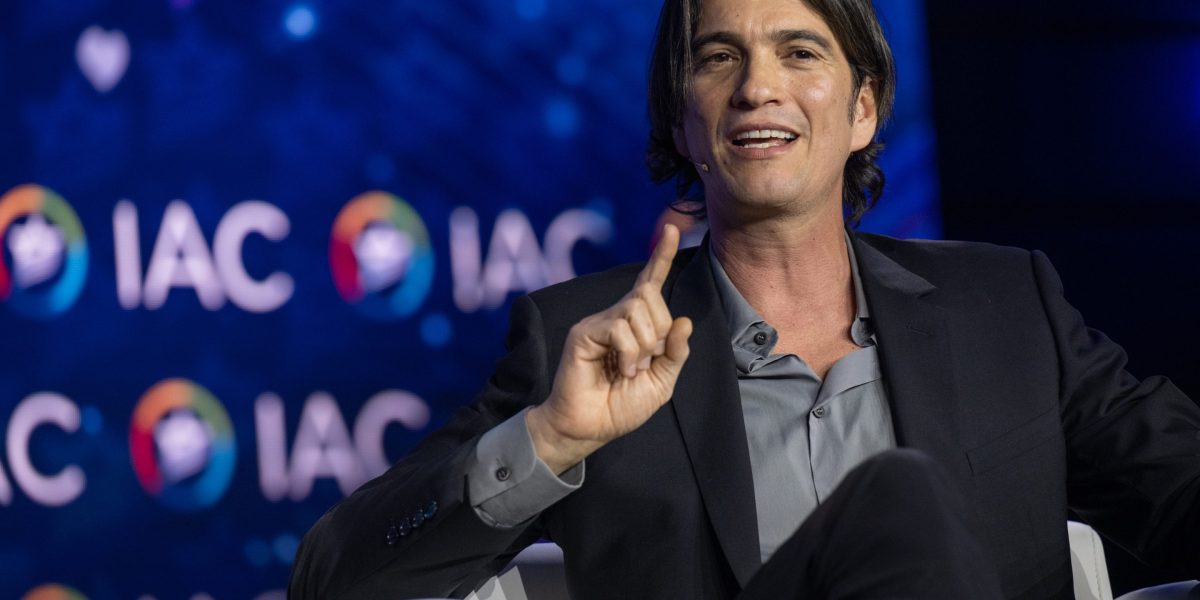

“It has been difficult for me to observe from the sidelines as WeWork has did not make the most of a product that’s extra related right this moment than ever earlier than,” Neumann, 44, mentioned in a press release.

However part of Neumann could be grateful he was pressured out in 2019 following the corporate’s disastrous first try at an preliminary public providing. Whereas battering his status, the exit left him with loads of liquidity, and he’s nonetheless price $1.7 billion, in response to the Bloomberg Billionaires Index.

To make certain, WeWork’s failure damage Neumann’s wealth. When it went public in a merger with a particular objective acquisition firm in 2021, Neumann had a fortune of $2.3 billion, in response to the index, with practically one-third in WeWork shares. They’ve since fallen greater than 99%.

However the deal additionally revealed how he managed to extract large quantities of money from WeWork in higher occasions. The ex-CEO’s title was talked about 197 occasions in a merger submitting alongside eye-watering payouts, together with a $185 million non-compete settlement, $106 million settlement fee and $578 million obtained for shares offered by Neumann’s We Holdings to SoftBank.

It additionally outlined a $432 million mortgage from the Japanese agency to Neumann, secured by a few of his now nearly nugatory WeWork stake.

WeWork’s chapter is costing SoftBank, based and led by billionaire Masayoshi Son, an estimated $11.5 billion in fairness losses with one other $2.2 billion in debt nonetheless on the road.

The chapter course of is predicted to take months and can determine how collectors divide the stays of the corporate. Up to now, courtroom papers present that billions of {dollars} of the agency’s debt can be transformed into fairness, whereas practically all shareholders and house owners of low-ranking bonds can be worn out.

New Enterprise

Today Neumann is busy with a brand new startup, Stream, which obtained a $350 million funding from enterprise capital agency Andreessen Horowitz at a $1 billion valuation in August of 2022 earlier than even starting operations. Stream will function multifamily residential properties that goal to foster a sense of possession and neighborhood.

A minimum of among the residential properties have been already owned by Neumann. As a result of his personal funding into the corporate couldn’t be decided, Stream hasn’t been factored into Neumann’s fortune, that means he could possibly be even wealthier than Bloomberg’s determine.

Not all of his investments outdoors of WeWork have been going so properly. His household workplace fell behind on curiosity funds on a $31 million mortgage tied to a San Jose, California, workplace constructing, in response to an October mortgage submitting. Neumann famously invested in workplace buildings, a few of which have been rented again to WeWork, one of many conflicts of curiosity that sunk the primary IPO.

Neumann no longer rents any buildings to WeWork, in response to filings, that means he received’t be one of many landlords coping with lease renegotiations throughout its chapter.

His connections to WeWork may not be utterly completed. Neumann, who now not has a non-compete with the corporate, has been approached about the potential for getting concerned within the enterprise post-bankruptcy, in response to an individual accustomed to the discussions, who requested to not be recognized as a result of the knowledge is personal. His assertion even hinted on the risk.

“With the proper technique and crew, a reorganization will allow WeWork to emerge efficiently,” Neumann mentioned.