It is crucial after we strategy huge ticket occasions like US CPI to look below the hood at market expectations.

Realizing the median expectations is in fact crucial, however understanding how expectations may be skewed below the hood can present actually insightful info.

Let’s check out the 4 key measures, beginning with headline YY:

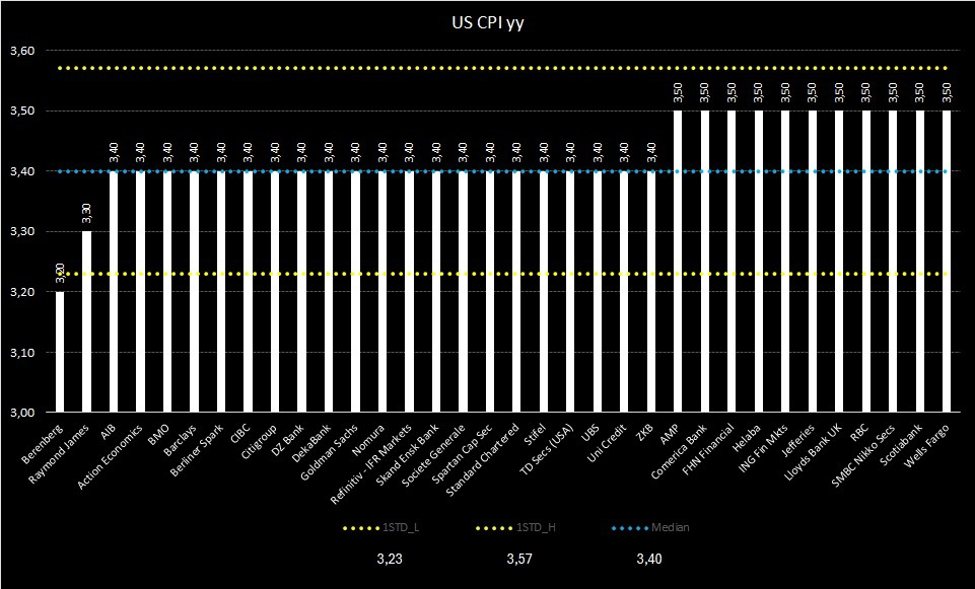

US CPI YY Forecast Distribution (10 April 2024)

We’ve just a few outliers on the draw back at 3.2% and three.3%. However we are able to see {that a} deviation of simply -0.1% or +0.1% will already shock the majority of market contributors.

Right here is Core CPI YY:

US Core CPI YY Forecast Distribution (10 April 2024)

Right here we’ve a really comparable story with only some contributors on the outer edges of expectations. Which as soon as once more signifies that a small deviation of -0.1% or +0.1% ought to already be sufficient to shock virtually all contributors polled for as we speak’s occasion.

We are able to see an identical story for the headline MM:

US CPI MM Forecast Distribution (10 April 2024)

On the headline MM there’s a barely larger skew on the upside at 0.4%, however a print at 0.4% will nonetheless shock the largest share of contributors.

Lastly we’ve the Core MM measure:

US Core CPI MM Forecast Distribution (10 April 2024)

In all probability the clearest one of all of them, with a really apparent shock issue on both a -0.1% or a +0.1% deviation.

Thus, a miss or a beat throughout the board of -0.1% or +0.1% has the potential to shock the overwhelming majority of market contributors and will see some very punchy strikes throughout the board.