On-chain information reveals stablecoins have recorded greater than $4 billion in inflows previously month. Right here’s why this may very well be related for Bitcoin.

Stablecoin Market Cap Has Loved Some Notable Progress Just lately

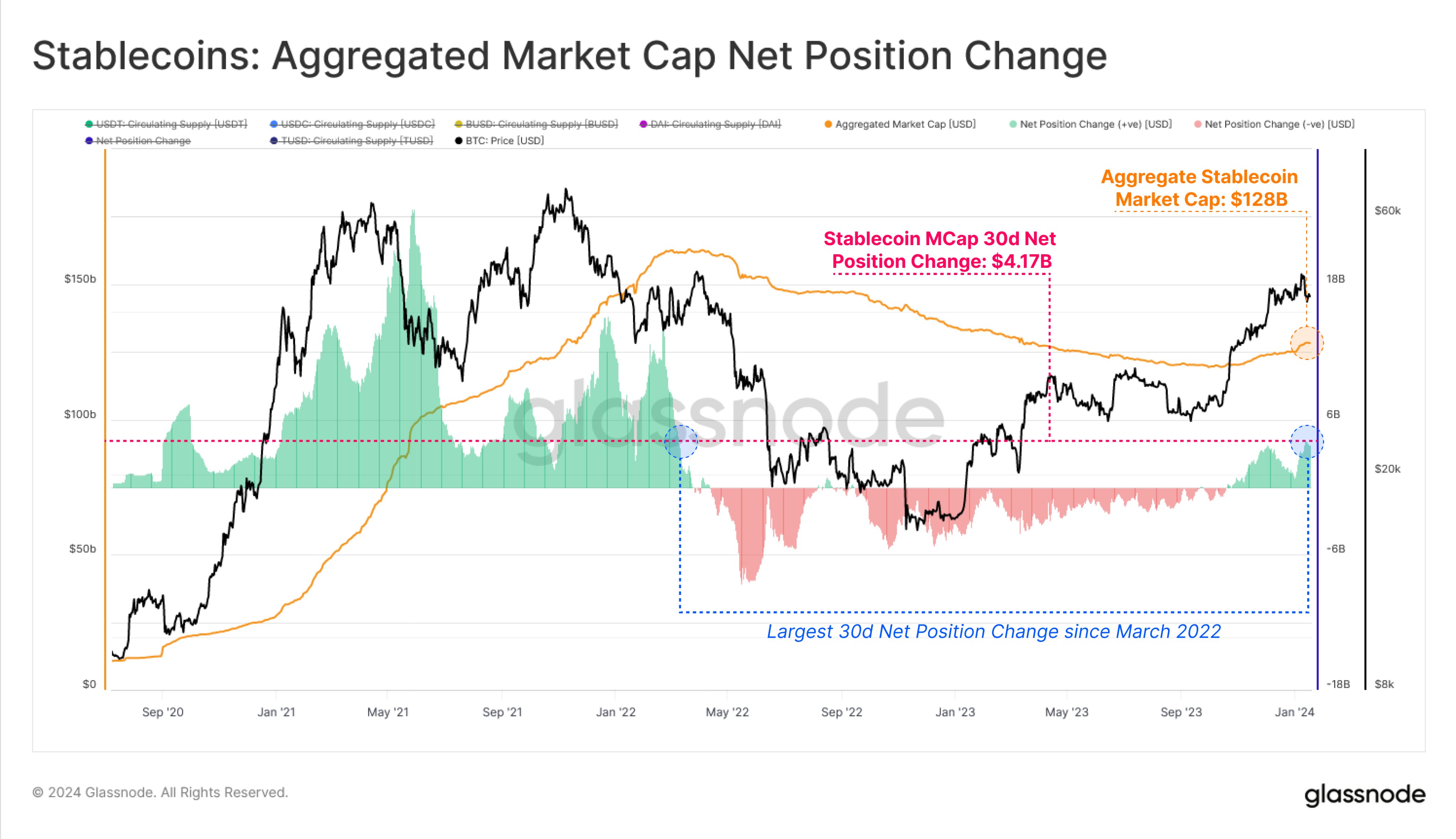

In response to information from the on-chain analytics agency Glassnode, the combination provide of stablecoins has been going by way of an enlargement since October of final 12 months.

The related indicator right here is the “aggregated market cap net position change,” which retains observe of the month-to-month modifications taking place within the whole stablecoin provide (or market cap, as they’re equal within the case of those property tied to the USD).

When the worth of this metric is constructive, it implies that the provision of the stables has gone up over the last 30 days. However, destructive values suggest a decline has occurred on this house.

Glassnode has solely included the foremost stablecoins within the information for this indicator. To be extra particular, Tether (USDT), USD Coin (USDC), Binance USD (BUSD), Dai (DAI), and TrueUSD (TUSD) are the property of curiosity.

Now, here’s a chart that reveals the development within the aggregated market cap web place change for these stablecoins over the previous few years:

The worth of the metric seems to have been inexperienced in current weeks | Supply: Glassnode on X

As displayed within the above graph, the stablecoin market cap has loved web inflows over the past couple of months, as the web place change has been constructive.

The 30-day web place change has not too long ago hit the $4.17 billion mark, which suggests the market cap of those stables has simply witnessed its largest improve since March 2022. Following these newest inflows, these fiat-tied tokens now make up for an combination market cap of round $128 billion.

Now, what does this improve imply for the broader cryptocurrency sector? Typically, there could be two the reason why the provision of the stablecoins would go up. First is a rotation of capital from Bitcoin and different property.

When the buyers need to escape the volatility related to these different cash out there, they might search safe-haven in these stables, that are solely as unstable because the USD. Thus, holders promoting these cash in favor of the stables can result in a rise of their provide.

The opposite purpose behind an increase out there cap of those property is of course a contemporary capital inflow. The previous issue could be bearish for the costs of the opposite property, not less than within the short-term, however this latter purpose is at all times a bullish improvement.

The current spike within the stablecoin web place change, although, has come as Bitcoin has plunged, probably implying that whereas some contemporary capital might have are available, a rotation from BTC and others has undoubtedly appeared to have occurred.

In both case, although, the long-term consequence of the stablecoin provide going up ought to nonetheless stay bullish, as capital locked in these fiat-tied cash normally tends to seek out its means again to the unstable facet as soon as buyers really feel it’s time to purchase into Bitcoin and others.

BTC Value

Bitcoin has noticed a plunge over the previous day, through which the coin briefly went down in direction of $40,700m however has since made some restoration again to $41,400.

Seems to be like the value of the coin has plunged not too long ago | Supply: BTCUSD on TradingView

Featured picture from CoinWire Japan on Unsplash.com, charts from TradingView.com, Glassnode.com