Chip designer Nvidia has emerged because the clear winner in not simply the early levels of the AI increase however, no less than up to now, in all of inventory market historical past. The $1.9 trillion AI large surged to a document excessive inventory value on Thursday, placing it on track so as to add over $230 billion to its market capitalization and shatter a one-day record only weeks old: Meta’s $197 billion acquire in early February.

It’s dominating the market, promoting over 70% of all AI chips, and startups are determined to spend tons of of 1000’s of {dollars} on Nvidia’s {hardware} techniques. Wall Road can’t get sufficient, both—Nvidia inventory rocketed up an astonishing 15% after the company smashed its lofty earnings goals last quarter, bringing its market cap to over $1.9 trillion on prime of its inventory worth tripling in the last year alone.

So … why? How is it that an organization based all the best way again in 1993 has displaced tech titans Alphabet and Amazon, leapfrogging them to develop into the third-most valuable company in the world? All of it comes right down to Nvidia’s main semiconductor chips to be used in synthetic intelligence.

The corporate that ‘got it’

Nvidia constructed up its benefit by enjoying the lengthy sport and investing in AI since years earlier than ChatGPT hit the market, and its chip designs are up to now forward of the competitors that analysts marvel if it’s even doable for anybody else to catch up. Designers reminiscent of Arm Holdings and Intel, as an illustration, haven’t but built-in {hardware} with AI-targeted software program in the best way Nvidia has.

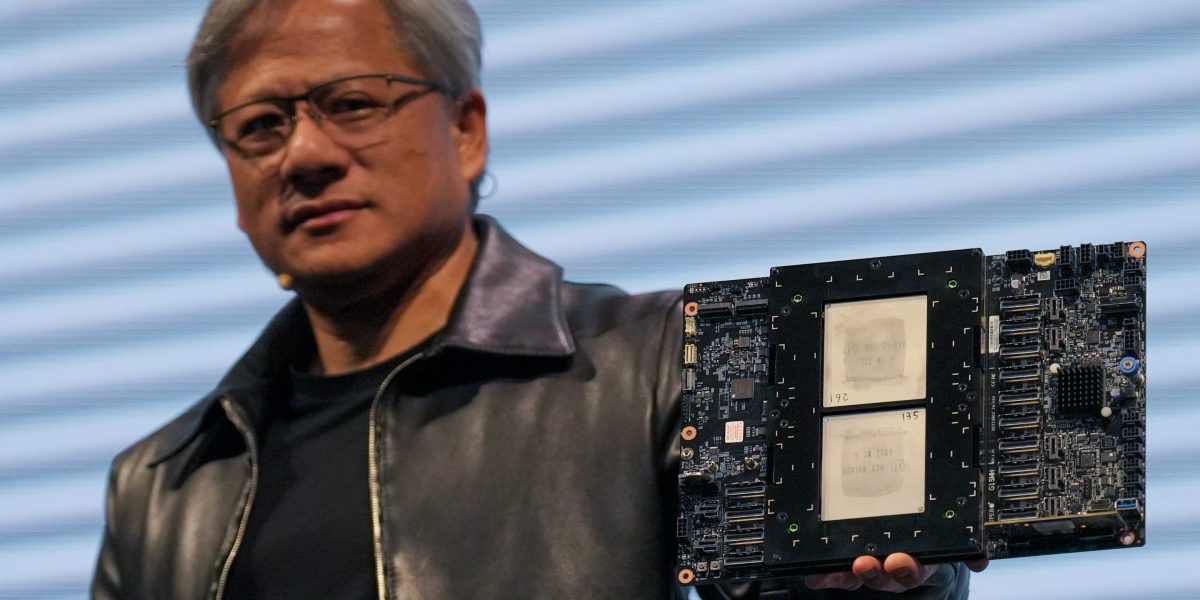

“This is one of the great observations that we made: we realized that deep learning and AI was not [just] a chip problem … Every aspect of computing has fundamentally changed,” mentioned Nvidia co-founder and CEO Jensen Huang on the New York Occasions’ DealBook summit final November. “We observed and realized that about a decade and a half ago. I think a lot of people are still trying to sort that out.” Jensen mentioned Nvidia simply “got it” earlier than anybody else did. “The reason why people say we’re practically the only company doing it is because we’re probably the only company that got it. And people are still trying to get it.”

Software program has been a key a part of that equation. Whereas rivals have centered their efforts on chip design, Nvidia has aggressively pushed its CUDA programming interface that runs on prime of its chips. That twin emphasis on software program and {hardware} has made Nvidia chips the must-have instrument for any developer trying to get into AI.

“Nvidia has done just a masterful job of making it easier to run on CUDA than to run on anything else,” mentioned Edward Wilford, an analyst at tech consultancy Omdia. “CUDA is hands-down the jewel in Nvidia’s crown. It’s the thing that’s gotten them this far. And I think it’s going to carry them for a while longer.”

AI wants computing energy—lots of computing energy. AI chatbots reminiscent of ChatGPT are skilled by inhaling huge portions of knowledge sourced from the web—up to a trillion distinct items of data. That information is fed right into a neural community that catalogs the associations between numerous phrases and phrases, which, after human coaching, can be utilized to provide responses to consumer queries in pure language. All these trillions of knowledge factors require enormous quantities of {hardware} capability, and {hardware} demand is simply anticipated to extend because the AI subject continues to develop. That’s put Nvidia, the sector’s greatest vendor, in a fantastic place to profit.

Huang sounded the same tune on his triumphant earnings call on Wednesday. Highlighting the shift from general-purpose computing to what he known as “accelerated computing” at information facilities, he argued that it’s “a whole new way of doing computing”—and even topped it “a whole new industry.”

In early on the AI increase

Nvidia has been on the forefront of AI {hardware} from the beginning. When large-scale AI analysis from startups reminiscent of OpenAI began ramping up within the mid-2010s, Nvidia—via a mix of luck and good bets—was in the fitting place on the proper time.

Nvidia had lengthy been recognized for its progressive GPUs, a sort of chip well-liked for gaming purposes. Most traditional laptop chips, known as CPUs, excel at performing difficult calculations in sequence, separately. However GPUs can carry out many easy calculations directly, making them wonderful at supporting the complicated graphics processing that video video games demand. Because it turned out, Nvidia’s GPUs had been an ideal match for the kind of computing techniques AI builders wanted to construct and prepare LLMs.

“To some extent, you could say they’ve been extremely lucky. But I think that diminishes it—they have capitalized perfectly on every instance of luck on every opportunity they were given,” mentioned Wilford. “If you go back five or 10 years, you see this ramp-up in console gaming. They rode that, and then when they felt that wave cresting, they got into cryptocurrency mining, and they rode that. And then just as that wave crested, AI started to take off.”

In reality, Nvidia had been quietly creating AI-targeted {hardware} for years. Way back to 2012, Nvidia chips were the technical foundation of AlexNet, the groundbreaking early neural community developed partly by OpenAI cofounder and former Chief Scientist Ilya Sutskever, who just lately left the nonprofit after attempting to oust CEO Sam Altman. That first mover benefit has given Nvidia a giant leg up over its rivals.

“They were visionaries … for Jensen, that goes back to his days at Stanford,” mentioned Wilford. “He’s been waiting for this opportunity the whole time. And he’s kept Nvidia in a position to jump on it whenever the chance came. What we’ve seen in the last few years is that that strategy executed to perfection. I can’t imagine someone doing better with it than Nvidia has.”

Since its early AI investments over a decade in the past, Nvidia has poured tens of millions right into a massively worthwhile AI {hardware} enterprise. The corporate sells its flagship Hopper GPU for 1 / 4 of 1,000,000 {dollars} per unit. It’s a 70-pound supercomputer, constructed from 35,000 particular person items—and the waiting list for customers to get their hands on one is months long. Determined AI builders are turning to organizations just like the San Francisco Compute Group, which rents out computing energy by the hour from their assortment of Nvidia chips. (As of this text’s publication, they’re booked out for nearly a month.)

Nvidia’s AI chip juggernaut is poised to develop much more if AI development meets analysts’ expectations.

“Nvidia delivered against what was seemingly a very high bar,” wrote Goldman Sachs in its Nvidia earnings evaluation. “We expect not only sustained growth in Gen AI infrastructure spending by the large CSPs and consumer internet companies, but also increased development and adoption of AI across enterprise customers representing various industry verticals and, increasingly, sovereign states.”

There are some potential threats to Nvidia’s market domination. For one, buyers famous within the firm’s most up-to-date earnings that restrictions on exports to China dinged enterprise, and a possible enhance in competitors from Chinese language chip designers may put stress on Nvidia’s world market share. And Nvidia can also be depending on Taiwanese chip foundry TSMC to really manufacture lots of the chips it designs. The Biden administration has been pushing for extra funding in home manufacturing via the CHIPS act, however Jensen himself said will probably be no less than a decade earlier than American foundries might be absolutely operational.

“[Nvidia is] highly dependent on TSMC in Taiwan, and there are regional complications [associated with that], there are political complications,” mentioned Wilford. “[And] the Chinese government is investing very heavily in developing their own AI capabilities as a result of some of those same tensions.”