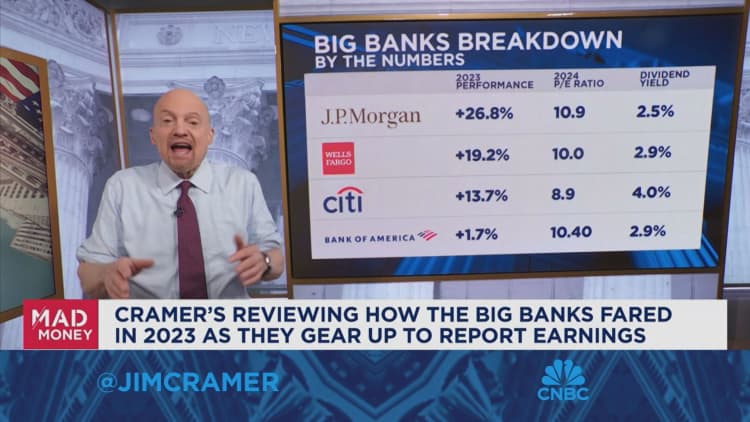

CNBC’s Jim Cramer analyzed a number of main banks’ performances on Wednesday, telling traders what to look out for when JPMorgan, Citigroup, Bank of America and Wells Fargo launch earnings reviews on Friday.

These reviews can set the tone for earnings season, he stated.

“If you believe, as I do, that interest rates have peaked and that our economy’s almost certainly in for a soft landing — thank you, [Fed Chair] Jay Powell — then the banks should be worth owning right now,” he stated. “But let’s see what happens when the four big money centers report on Friday.”

Cramer listed JPMorgan as one outfit that continues to be pretty well-liked on Wall Avenue, betting that its inventory “can grind higher” over time, however might not be a high choose for the yr. Financial institution of America and Citigroup want a couple of constructive quarters to earn traders’ belief, with the latter particularly having to show a comeback story after it introduced a serious restructuring effort in September, he stated.

Cramer stated he is most enthusiastic about Wells Fargo’s prospects, despite the fact that the inventory just lately noticed two analyst downgrades. He stated the corporate’s new administration is dedicated to slicing prices and enhancing know-how and prompt there could also be an imminent shopping for alternative.

In keeping with Cramer, traders ought to pay particular consideration to internet curiosity revenue and internet curiosity margin, which measure what banks earn from borrowing deposits after which lending these funds at increased charges. This knowledge can point out the efficiency of a financial institution’s core enterprise.

Buyers must also observe commentary carefully, particularly concerning the state of client and company credit score, Cramer stated. Banking shares may decline if credit score high quality proves to be poor, however sturdy credit score may result in increased earnings estimates for the remainder of the yr. As main bank card issuers, these outfits may additionally supply perception into client spending habits.

Lastly, Cramer suggested to keep watch over monetary establishments’ funding banking operations. He stated there may be optimism on Wall Avenue for a comeback this yr within the sector, spurred by a burgeoning preliminary public providing market and extra bond issuance.

“We’ve also seen a pickup in M&A, which is great for investment bankers — the advisory fees they get on these deals are phenomenal,” he stated. “An investment banking comeback could allow the financials to give us some excellent performance this year.”

JPSign up now for the CNBC Investing Membership to observe Jim Cramer’s each transfer available in the market.

Disclaimer The CNBC Investing Membership Charitable Belief holds shares of Wells Fargo.

Questions for Cramer?

Name Cramer: 1-800-743-CNBC

Wish to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram

Questions, feedback, solutions for the “Mad Money” web site? [email protected]