The European Session is uninteresting right this moment as now we have the Labour Day’s Vacation. Issues will get rather more fascinating within the US Session as we get some key US financial information after which we end the day with the FOMC fee resolution. Let’s break down the upcoming information releases and see what could possibly be the doubtless market influence.

-

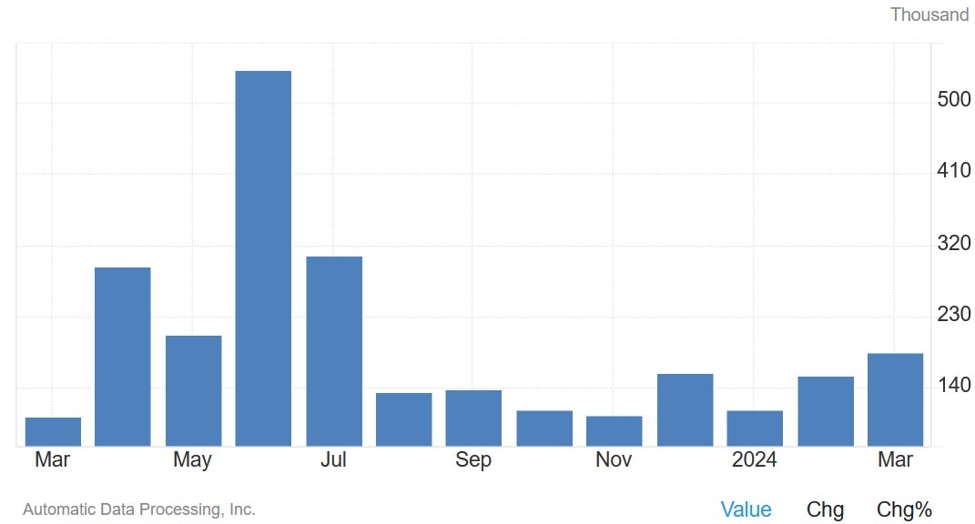

US ADP 12:15 GMT (08:15 ET)

US ADP

The US ADP is predicted at 175K vs. 184K prior. Last month, the info shocked to the upside with the most important enhance in hiring in eight months. The worrying half was the change in annual pay which confirmed an unchanged 5.1% fee for job stayers and a giant bounce to 10.1% vs. 7.6% prior for job changers. The issue right here is {that a} resilient labour market with rising wage development couldn’t solely cease the disinflationary pattern however even reverse it. That is one thing that the Fed will need to keep away from. Due to this fact, be careful for the pay positive factors information right this moment as an upside shock may gasoline one other hawkish response from the market with extra shopping for momentum for the USD throughout the board and extra draw back for bonds, shares and gold.

-

US ISM Manufacturing PMI 14:00 GMT (10:00 ET)

US ISM Manufacturing PMI

The US ISM Manufacturing PMI is predicted

to tick decrease to 50.1 vs. 50.3 prior. Last

month, the index jumped into enlargement for

the primary time after 16 consecutive months in contraction with typically upbeat

commentary. The most recent S&P

Global US Manufacturing PMI returned again

into contraction after the Q1 2024 enlargement. The commentary this time has

been fairly bleak with even mentions of sturdy layoff exercise, though there

was additionally excellent news on the inflation entrance. The ISM report is mostly

thought of extra necessary by the market, so will probably be used to verify or

deny the S&P International end result.

If the info surprises to the upside, it would doubtless set off a hawkish response because the market will brush off utterly some latent worries from the S&P International survey and result in extra bids for the USD and presents for bonds, shares and gold. Conversely, if the info surprises to the draw back, the market may reverse a few of the strikes seen in the previous few days.

-

US Job Openings 14:00 GMT (10:00 ET)

US Job Openings

The US Job Openings is predicted at 8.680M

vs. 8.756M prior. This would be the first main US labour market report of

the week and, though it’s previous (March information), it’s typically a market

shifting launch. The last

report we bought a slight beat with unfavourable

revisions to the prior readings highlighting a resilient though normalising

labour market. The market may even deal with the hiring and stop charges as they

each fell beneath the pre-pandemic pattern currently. This report can be overshadowed by the ISM Manufacturing PMI however be careful for large surprises as they may exacerbate and even reverse the strikes from the ISM launch.