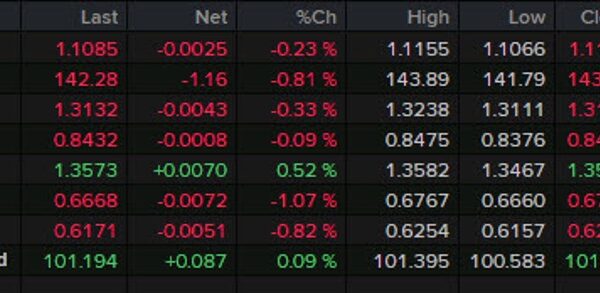

A wild week of trading on Wall Street ended with the S & P 500 back roughly where it started, but the lessons learned by whipsawed investors over those five days could determine what happens next. The S & P 500 had its worst day since 2022 on Monday, and then its best since 2022 on Thursday. The 10-year Treasury yield dropped below 3.7% on Monday before finishing around the 4% level. And Wall Street’s “fear gauge” — the Cboe Volatility Index — actually finished the week lower despite spiking to 65 on Monday, its highest level since 2020. But with the S & P 500 ending the week down less than 0.1% in a calm session on Friday, the market seems to have stabilized. “Currently with inflation under control globally and recession evidence in short supply, the recent volatility has produced correction weakness but lacks the characteristics of a bear market,” Tim Hayes, chief global investment strategist at Ned Davis Research, said in a note on Thursday. .SPX 5D mountain The S & P 500 finished the week nearly flat. Signs under the surface pointed to markets actually holding up decently well. For example, Bespoke Investment Group highlighted Friday that more than two-thirds of stocks in the S & P 500 were still trading above their 200-day moving average — a sign of strength for chart watchers. And in the bond market, the interest rate volatility didn’t seem to spook investors in high quality corporate debt. “Investment grade spreads held in,” Gennadiy Goldberg, head of U.S. rates strategy at TD Securities, told CNBC. “You had the single biggest daily VIX spike of all time, and yet IG credit didn’t really widen all that significantly. And I think that has to do with investors really being a little bit skeptical about some of this equity market volatility.” .VIX 5Y mountain Cboe Volatility index, 5 years Even in Japan — where there were huge moves in the local stock market and in the yen at the end of last week and the start of this one — there were signs of resilience. After suffering its worst day in decades on Monday, the Nikkei 225 Index finished the week down less than 3%. “It was a 1987-style crash, but it was one 15-basis point move from the Bank of Japan that doesn’t seem to have changed the real fundamental outlook for these companies,” Jeremy Schwartz, chief global investment strategist at WisdomTree, told CNBC, referring to an interest rate increase last week by the Japanese central bank . A basis point equals one one-hundredth of a percent (0.01%). Reasons to worry However, the recent weakness in the market culminating in Monday’s big drop suggests that some of the key drivers of this bull market are running low on fuel. “It is possible that the recovery will continue for another week or so, but ultimately, stocks will fall to fresh lows. … The storylines around both AI-linked tech stocks and the global economy are likely to get worse rather than better,” Peter Berezin, chief global strategist at BCA Research, said in a note to clients. Others are warning that the some of the issues that contributed to the initial drop, such as the unwind of the carry trade with the yen , aren’t done just yet. In the weeks ahead, those factors will be mixed together with a seasonally weak period for markets and the changing fortunes of the looming U.S. election. “Getting out of these sharp selloffs can itself be a process, as the recent action has made clear,” Wellington Shields technical analyst Frank Gretz said in a note to clients. “The process usually involves the so-called ‘test’ of the low or even a lower low. All of this could wreak a little havoc with the seasonal pattern, which itself is no prize.” Trading action throughout the week, such as several weak closes in the final hour or two of trading, raised eyebrows. Even the week’s counter rallies drew suspicion from some. RJ O’Brien & Associates’ managing director Tom Fitzpatrick said in a note to clients that Thursday’s rally following the often ignored weekly jobless claims report suggests that “markets are broken” and that the rebound won’t last. “The bias here is further short-term strength before likely renewed losses,” Fitzpatrick said.

Hot Topics

-

‘The Twilight Zone’ creator was plagued with PTSD after WWII: daughter

-

Current Bitcoin Correction Remains Within Historical Limits – The Impact Of An 11.7% Market Drawdown

-

Angry Panamanians Burn Flags Outside U.S. Embassy - Denounce Trump’s Canal Threat as ‘Imperial Delusion’ (VIDEO) | The Gateway Pundit

Subscribe to Updates

Get the latest tech, social media, politics, business, sports and many more news directly to your inbox.